Roth conversions have gained significant attention in the financial planning community, particularly as individuals seek to optimize their retirement savings strategies. A Roth conversion involves transferring funds from a traditional IRA or other tax-deferred retirement accounts into a Roth IRA, which allows for tax-free withdrawals in retirement. This strategy can be particularly appealing for those anticipating higher tax rates in the future or seeking greater flexibility in their retirement income. However, like any financial strategy, it comes with its own set of advantages and disadvantages that must be carefully considered.

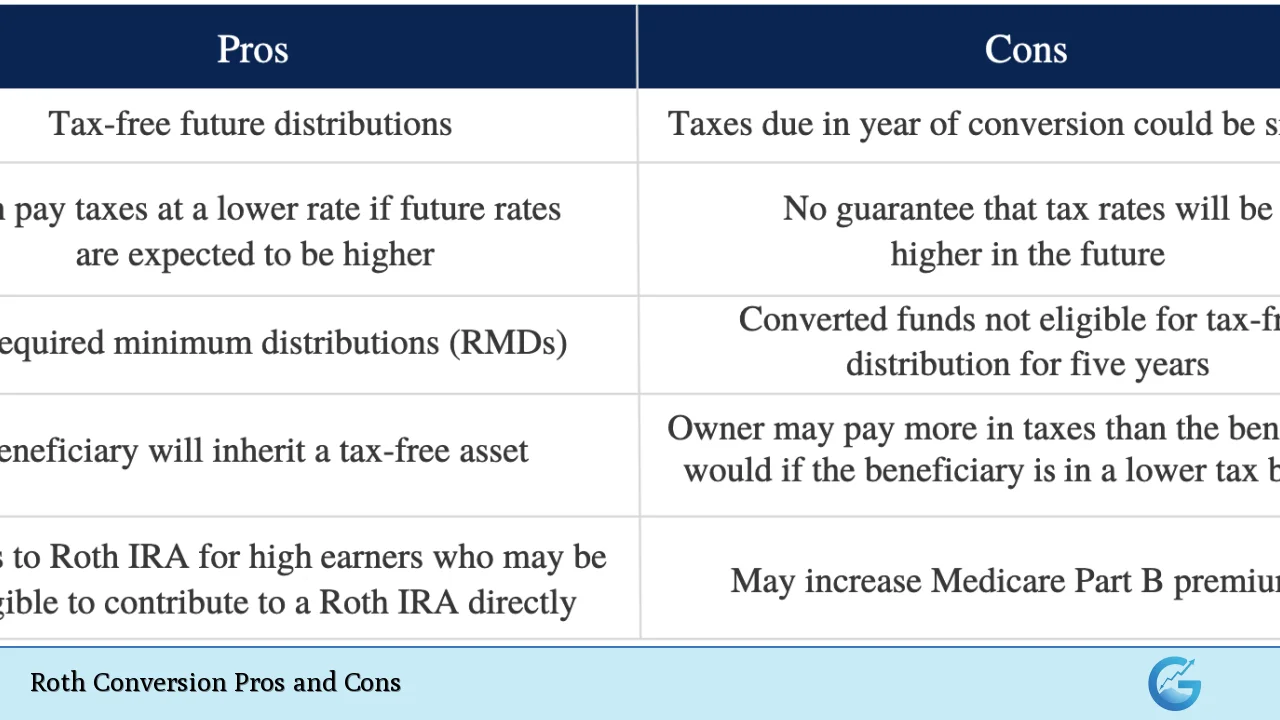

| Pros | Cons |

|---|---|

| Tax-free withdrawals in retirement | Immediate tax liability on converted amount |

| No required minimum distributions (RMDs) | Potentially higher taxable income in conversion year |

| Tax diversification for retirement income | Risk of being pushed into a higher tax bracket |

| Access to contributions at any time without penalty | Five-year waiting period for converted funds to avoid penalties |

| Beneficial if tax rates increase in the future | Complexity in tax calculations and planning |

| Can benefit from market downturns during conversion | May not be advantageous if you expect lower taxes in retirement |

Tax-Free Withdrawals in Retirement

One of the most significant advantages of a Roth conversion is the ability to withdraw funds tax-free during retirement. Once you pay taxes on the converted amount, all future growth and withdrawals from the Roth IRA are exempt from taxation, provided certain conditions are met.

- Long-term growth potential: Since the money grows tax-free, it can significantly enhance your retirement portfolio over time.

- Flexibility: You can withdraw contributions (but not earnings) at any time without penalty, providing access to funds if needed.

No Required Minimum Distributions (RMDs)

Unlike traditional IRAs, Roth IRAs do not require account holders to take minimum distributions starting at age 73. This feature allows for greater control over your retirement funds.

- Increased control over withdrawals: You can decide when and how much to withdraw, allowing for strategic tax planning.

- Estate planning benefits: If you leave your Roth IRA to heirs, they can benefit from tax-free growth without RMDs during your lifetime.

Tax Diversification for Retirement Income

A Roth conversion adds an element of tax diversification to your retirement strategy. Having both traditional and Roth accounts allows you to manage your taxable income more effectively during retirement.

- Strategic withdrawals: You can choose which account to withdraw from based on your current tax situation, potentially minimizing your overall tax burden.

- Flexibility in managing taxable income: This can be particularly advantageous if you expect fluctuating income needs or changes in tax rates.

Access to Contributions at Any Time Without Penalty

Another appealing aspect of a Roth IRA is that you can withdraw your contributions at any time without incurring taxes or penalties. This flexibility can be beneficial for individuals who may need access to their funds before retirement.

- Emergency fund potential: The ability to access contributions provides a safety net without the penalties associated with early withdrawals from traditional IRAs.

Beneficial If Tax Rates Increase in the Future

Converting to a Roth IRA may be particularly advantageous if you anticipate that tax rates will rise during your retirement years. By paying taxes now at potentially lower rates, you could save significantly in the long run.

- Locking in lower rates: If you convert while in a lower tax bracket, you can avoid higher rates later on when withdrawing funds from traditional accounts.

Can Benefit from Market Downturns During Conversion

Timing your conversion during a market downturn can reduce the immediate tax impact of converting assets. When the value of your investments is lower, you pay taxes on a smaller amount.

- Tax efficiency: This strategy allows for more assets to grow tax-free once they are converted, enhancing long-term growth potential.

Immediate Tax Liability on Converted Amount

The most significant disadvantage of a Roth conversion is the immediate tax liability incurred on the amount converted. This can lead to substantial upfront costs that must be planned for carefully.

- Cash flow considerations: You need sufficient liquid assets to cover this tax bill without dipping into your retirement savings.

Potentially Higher Taxable Income in Conversion Year

Converting assets increases your taxable income for the year, which could have various implications depending on your overall financial situation.

- Impact on other benefits: Higher income may affect eligibility for certain benefits such as subsidies for healthcare or student financial aid.

Risk of Being Pushed into a Higher Tax Bracket

Depending on the amount converted, you may find yourself pushed into a higher tax bracket due to increased taxable income. This could negate some of the benefits of converting.

- Long-term planning is essential: It’s crucial to assess how much you convert each year to avoid unnecessary tax burdens.

Five-Year Waiting Period for Converted Funds to Avoid Penalties

When converting funds from a traditional IRA to a Roth IRA, there is a five-year waiting period before you can withdraw converted amounts without incurring penalties. This rule applies separately to each conversion made.

- Planning for liquidity needs: If you anticipate needing access to these funds within five years, it may not be wise to convert large amounts at once.

Complexity in Tax Calculations and Planning

The mechanics of Roth conversions can be complex and may require careful planning and consultation with financial advisors or tax professionals.

- Navigating IRS rules: Understanding how conversions affect your overall tax situation requires diligence and expertise.

May Not Be Advantageous If You Expect Lower Taxes in Retirement

If you anticipate being in a lower tax bracket during retirement than during the conversion year, it might make more sense financially not to convert at all.

- Evaluating personal circumstances: Each individual’s situation is unique; thorough analysis is necessary before making decisions regarding conversions.

In conclusion, while Roth conversions offer numerous advantages—such as tax-free withdrawals and increased control over retirement assets—they also come with significant drawbacks that must be weighed carefully. The decision should hinge on individual financial circumstances, anticipated future income levels, and overall retirement goals. Consulting with financial advisors can provide personalized insights tailored to one’s specific situation and help navigate this complex area of retirement planning effectively.

Frequently Asked Questions About Roth Conversion Pros and Cons

- What is a Roth conversion?

A Roth conversion involves transferring funds from a traditional IRA or other pre-tax accounts into a Roth IRA, allowing future withdrawals to be made tax-free. - What are the primary benefits of converting to a Roth IRA?

The main benefits include tax-free withdrawals in retirement, no required minimum distributions (RMDs), and greater flexibility regarding withdrawal timing. - What are the risks associated with Roth conversions?

The primary risks include immediate taxation on converted amounts and potential increases in taxable income that could affect other benefits. - Is there an ideal time for making a Roth conversion?

The best time is often when market values are low or when an individual is temporarily in a lower income bracket. - Can I undo a Roth conversion?

No, under current laws established by the Tax Cuts and Jobs Act of 2017, once you convert funds into a Roth IRA, you cannot recharacterize them back into a traditional IRA. - How does my age affect my decision about converting?

Your age impacts factors like RMDs and how long your investments have until withdrawal; younger individuals might benefit more from longer growth periods. - What happens if I need access to my converted funds before five years?

You can withdraw contributions anytime without penalty; however, converted amounts are subject to penalties if withdrawn within five years. - Should I consult with a financial advisor about my decision?

Yes, consulting with an advisor can help tailor strategies based on personal financial situations and long-term goals.