A Roth Individual Retirement Account (IRA) is a popular retirement savings vehicle that offers unique tax advantages and flexibility for investors. Unlike traditional IRAs, Roth IRAs are funded with after-tax dollars, allowing for tax-free growth and withdrawals in retirement. This distinctive feature has made Roth IRAs an attractive option for many individuals planning for their financial future. However, like any investment tool, Roth IRAs come with their own set of advantages and disadvantages that potential investors should carefully consider.

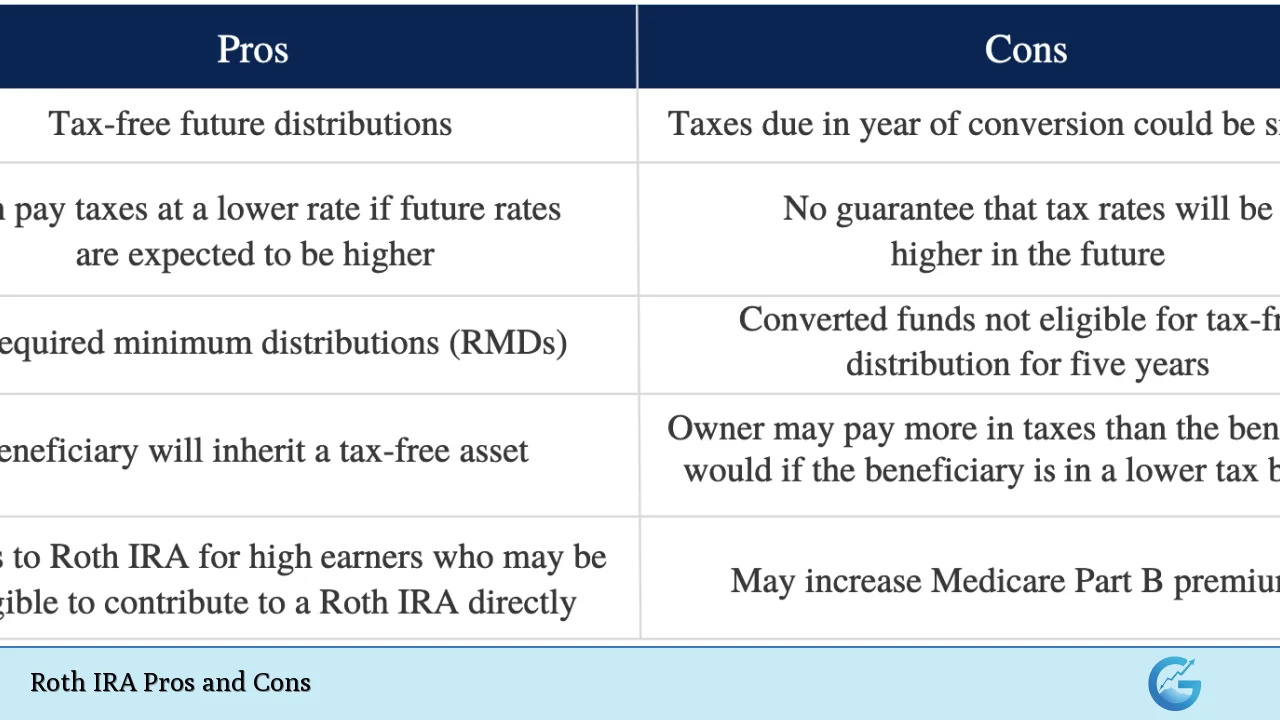

| Pros | Cons |

|---|---|

| Tax-free withdrawals in retirement | No immediate tax deduction on contributions |

| No required minimum distributions (RMDs) | Income limits for contributions |

| Flexible withdrawal rules for contributions | Lower contribution limits compared to some employer plans |

| Tax-free growth potential | Five-year rule for earnings withdrawals |

| Estate planning benefits | No loan options |

| Backdoor Roth IRA conversion option | Potential for legislative changes |

Tax-Free Withdrawals in Retirement

One of the most significant advantages of a Roth IRA is the ability to make tax-free withdrawals in retirement. This feature can provide substantial benefits for investors, especially those who anticipate being in a higher tax bracket during their retirement years.

- Long-term tax savings: By paying taxes on contributions upfront, investors can potentially save a considerable amount on taxes in the future when their account has grown significantly.

- Predictable retirement income: Tax-free withdrawals allow for more accurate retirement income planning, as there’s no need to factor in future tax liabilities.

- Hedge against future tax rate increases: If tax rates rise in the future, Roth IRA holders will be insulated from these increases on their retirement savings.

It’s important to note that to qualify for tax-free withdrawals, the account must be open for at least five years, and the account holder must be at least 59½ years old.

This rule ensures that the account is used for its intended purpose of long-term retirement savings.

No Required Minimum Distributions (RMDs)

Unlike traditional IRAs and many other retirement accounts, Roth IRAs do not mandate required minimum distributions (RMDs) during the owner’s lifetime. This feature provides several advantages:

- Extended tax-free growth: Without RMDs, funds can remain in the account indefinitely, continuing to grow tax-free.

- Greater control over retirement income: Account holders can withdraw funds as needed, rather than being forced to take distributions they may not require.

- Enhanced estate planning: The absence of RMDs allows for more efficient wealth transfer to heirs, as the account can be passed on with its tax benefits intact.

The lack of RMDs makes Roth IRAs particularly attractive for individuals who don’t anticipate needing all of their retirement savings during their lifetime and wish to leave a tax-advantaged inheritance to their beneficiaries.

Flexible Withdrawal Rules for Contributions

Roth IRAs offer a unique level of flexibility when it comes to accessing contributed funds. Unlike many other retirement accounts, Roth IRAs allow for the withdrawal of contributions at any time without penalties or taxes.

- Emergency fund alternative: The ability to withdraw contributions penalty-free provides a safety net for unexpected expenses.

- Financial flexibility: This feature allows investors to contribute to their retirement savings with the knowledge that they can access the funds if absolutely necessary.

- No early withdrawal penalties on contributions: While early withdrawals of earnings may be subject to penalties, contributed amounts can be withdrawn at any time without incurring the 10% early withdrawal penalty.

It’s crucial to understand that while contributions can be withdrawn freely, earnings are subject to different rules and may incur taxes and penalties if withdrawn early.

This distinction underscores the importance of keeping accurate records of contributions and earnings.

Tax-Free Growth Potential

One of the most compelling advantages of a Roth IRA is the potential for tax-free growth. This feature can significantly enhance the long-term value of your retirement savings.

- Compound growth without tax drag: All earnings within the account, including capital gains, dividends, and interest, grow tax-free.

- Maximized returns: The absence of annual tax obligations on investment gains allows for more efficient compounding over time.

- Diversification opportunities: Investors can pursue a wide range of investment strategies without concern for tax implications within the account.

The power of tax-free growth becomes increasingly significant over longer investment horizons, making Roth IRAs particularly attractive for younger investors or those with a long time until retirement.

Estate Planning Benefits

Roth IRAs offer several advantages from an estate planning perspective, making them a valuable tool for individuals looking to efficiently transfer wealth to their heirs.

- Tax-free inheritance: Beneficiaries can inherit Roth IRA funds without incurring income tax on distributions.

- Stretch IRA potential: While recent legislation has limited the “stretch IRA” strategy, non-spouse beneficiaries can still spread distributions over a 10-year period, potentially maximizing tax-free growth.

- No impact on estate tax exemption: Roth IRA contributions are made with after-tax dollars, so they don’t affect the account owner’s estate tax exemption.

It’s important to note that while Roth IRAs offer significant estate planning benefits, they are still subject to estate taxes if the total estate value exceeds federal or state exemption limits.

Backdoor Roth IRA Conversion Option

For high-income earners who exceed the Roth IRA income limits, the backdoor Roth IRA conversion provides a potential workaround to contribute to a Roth IRA indirectly.

- Access for high earners: Allows individuals above the income threshold to benefit from Roth IRA advantages.

- Tax planning opportunity: Can be used strategically in years when income is lower or tax deductions are higher.

- Long-term tax diversification: Enables building a tax-free retirement account even when direct contributions are not allowed.

While the backdoor Roth IRA strategy can be beneficial, it’s important to be aware of potential tax implications, especially if you have existing traditional IRA balances, and to consult with a tax professional before proceeding.

No Immediate Tax Deduction on Contributions

One of the primary drawbacks of a Roth IRA is the lack of an immediate tax deduction for contributions, unlike traditional IRAs.

- Higher current tax liability: Contributions are made with after-tax dollars, potentially resulting in a higher tax bill in the contribution year.

- Reduced current cash flow: The absence of a tax deduction means less immediate tax savings that could be used for other financial goals.

- Potential opportunity cost: The lack of upfront tax savings means less money available for immediate investment or debt reduction.

This disadvantage can be particularly significant for individuals in high tax brackets who could benefit more from the immediate tax deduction offered by traditional IRAs or 401(k) plans.

Income Limits for Contributions

Roth IRAs have income limits that can restrict or eliminate the ability of high earners to contribute directly to these accounts.

- Reduced contribution amounts: As income approaches the upper limit, the allowable contribution amount phases out.

- Complexity in financial planning: Income fluctuations near the threshold can complicate contribution strategies from year to year.

- Potential for excess contributions: Inadvertently exceeding income limits can result in penalties if not corrected promptly.

For 2024, single filers with modified adjusted gross income (MAGI) above $161,000 and married couples filing jointly with MAGI above $240,000 are ineligible to contribute directly to a Roth IRA.

These limits are subject to annual adjustments for inflation.

Lower Contribution Limits Compared to Some Employer Plans

While Roth IRAs offer valuable benefits, they have lower contribution limits compared to many employer-sponsored retirement plans like 401(k)s.

- Restricted savings potential: The annual contribution limit for Roth IRAs in 2024 is $7,000 ($8,000 for those 50 and older), significantly less than the $23,000 limit for 401(k) plans.

- Limited catch-up contributions: The additional catch-up contribution for those 50 and older is only $1,000 for Roth IRAs, compared to $7,500 for 401(k) plans.

- Potential need for multiple accounts: Investors may need to utilize both Roth IRAs and other retirement accounts to maximize their savings.

These lower limits may necessitate a more diverse retirement savings strategy, potentially incorporating both Roth IRAs and other types of retirement accounts to meet savings goals.

Five-Year Rule for Earnings Withdrawals

The five-year rule for Roth IRAs adds a layer of complexity to withdrawal strategies and can limit short-term flexibility.

- Restricted access to earnings: Earnings withdrawn before the account is five years old may be subject to taxes and penalties, even if the account holder is over 59½.

- Complexity in tracking multiple accounts: Each Roth IRA conversion has its own five-year clock, potentially complicating withdrawal planning.

- Impact on early retirement plans: The five-year rule can affect strategies for those planning to retire early and access their Roth IRA funds.

Understanding and navigating the five-year rule is crucial for Roth IRA holders to avoid unexpected taxes and penalties on withdrawals.

No Loan Options

Unlike some employer-sponsored retirement plans, Roth IRAs do not offer loan provisions, which can limit financial flexibility in certain situations.

- Reduced access to funds: Inability to borrow against the account balance for short-term needs without incurring taxes or penalties.

- Limited options in financial emergencies: Account holders may need to turn to other, potentially less favorable, sources of funds in times of need.

- Potential for early withdrawal penalties: Without a loan option, some individuals might be tempted to take early withdrawals, incurring taxes and penalties on earnings.

The absence of a loan option underscores the importance of maintaining separate emergency funds and considering the role of Roth IRAs primarily as long-term retirement savings vehicles.

Potential for Legislative Changes

As with any tax-advantaged account, Roth IRAs are subject to potential changes in tax laws and regulations, which could affect their benefits in the future.

- Uncertainty in long-term planning: Future legislative changes could alter the tax treatment or rules governing Roth IRAs.

- Potential for reduced benefits: Changes in tax policy could diminish the advantages of Roth IRAs relative to other retirement savings options.

- Need for ongoing strategy adjustments: Investors may need to adapt their retirement savings approach in response to evolving regulations.

While the potential for legislative changes exists, it’s important to note that historically, changes to retirement account rules have often been implemented with grandfathering provisions or phase-in periods to minimize disruption to existing account holders.

In conclusion, Roth IRAs offer a unique set of advantages that make them an attractive option for many investors, particularly those who anticipate being in a higher tax bracket in retirement or who value the flexibility and estate planning benefits these accounts provide. The tax-free growth and withdrawal features, combined with the absence of required minimum distributions, can significantly enhance long-term retirement savings strategies.

However, the lack of immediate tax deductions, income limits on contributions, and lower contribution caps compared to some employer-sponsored plans are important considerations. Additionally, the complexity introduced by rules such as the five-year holding period for tax-free earnings withdrawals requires careful planning and understanding.

Ultimately, the decision to invest in a Roth IRA should be based on an individual’s specific financial situation, retirement goals, and overall tax strategy. For many investors, a diversified approach that includes both Roth and traditional retirement accounts may provide the best balance of current tax benefits and future financial flexibility. As with any significant financial decision, consulting with a qualified financial advisor or tax professional can help ensure that a Roth IRA aligns with your broader financial objectives and retirement planning strategy.

Frequently Asked Questions About Roth IRA Pros and Cons

- How does a Roth IRA differ from a traditional IRA in terms of tax treatment?

A Roth IRA is funded with after-tax dollars, allowing for tax-free withdrawals in retirement, while a traditional IRA offers tax-deductible contributions but taxable withdrawals. This key difference affects both current and future tax situations for the account holder. - Can high-income earners contribute to a Roth IRA?

High-income earners may be restricted or ineligible to contribute directly to a Roth IRA due to income limits. However, they might be able to use the backdoor Roth IRA strategy, which involves converting a traditional IRA to a Roth IRA. - What are the penalties for early withdrawal from a Roth IRA?

Contributions to a Roth IRA can be withdrawn at any time without penalty. However, earnings withdrawn before age 59½ and before the account is five years old may be subject to taxes and a 10% early withdrawal penalty, with some exceptions. - How does the five-year rule affect Roth IRA withdrawals?

The five-year rule stipulates that to withdraw earnings tax-free, a Roth IRA must be open for at least five tax years and the account holder must be at least 59½ years old. This rule applies separately to each Roth IRA conversion. - Can I contribute to both a Roth IRA and a 401(k)?

Yes, you can contribute to both a Roth IRA and a 401(k) in the same year, subject to the contribution limits and income restrictions of each account type. This strategy can provide tax diversification in retirement savings. - What happens to my Roth IRA when I die?

Upon death, a Roth IRA can be passed to beneficiaries. Spouses have the option to treat the inherited Roth IRA as their own, while non-spouse beneficiaries must generally withdraw the entire balance within 10 years, maintaining the tax-free status of qualified distributions. - How do Roth IRA contribution limits compare to other retirement accounts?

Roth IRA contribution limits are generally lower than those for employer-sponsored plans like 401(k)s. For 2024, the Roth IRA limit is $7,000 ($8,000 if 50 or older), while 401(k) limits are $23,000 ($30,500 if 50 or older). - Can I convert my traditional IRA to a Roth IRA, and what are the tax implications?

Yes, you can convert a traditional IRA to a Roth IRA through a process called Roth conversion. The converted amount