When planning for retirement, choosing the right Individual Retirement Account (IRA) is crucial. The two most popular types of IRAs are the Roth IRA and the Traditional IRA. Each has its unique advantages and disadvantages, making them suitable for different financial situations and retirement goals. Understanding these pros and cons can help investors make informed decisions that align with their long-term financial strategies.

Pros and Cons Overview

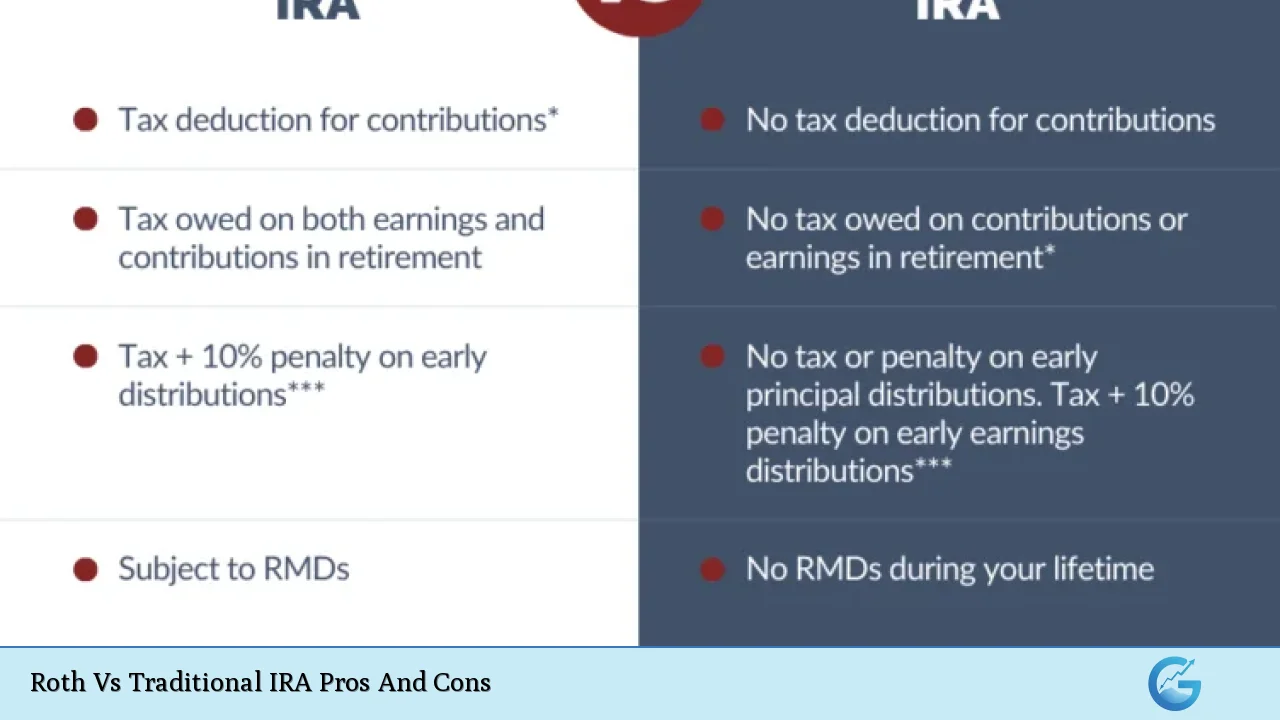

| Pros | Cons |

|---|---|

| Tax-free withdrawals in retirement. | No immediate tax deduction for contributions. |

| No required minimum distributions (RMDs). | Income limits restrict eligibility for contributions. |

| Contributions can be withdrawn at any time without penalties. | Earnings cannot be withdrawn tax-free until certain conditions are met. |

| Potential for tax-free growth if you expect to be in a higher tax bracket in retirement. | Lower contribution limits compared to other retirement accounts. |

| Flexibility in estate planning due to no RMDs. | Early withdrawal penalties on earnings before age 59½. |

Tax-Free Withdrawals in Retirement

One of the most significant advantages of a Roth IRA is that all qualified withdrawals, including both contributions and earnings, are tax-free during retirement. This can lead to substantial savings, especially for individuals who anticipate being in a higher tax bracket when they retire. The ability to withdraw funds without incurring taxes allows retirees to manage their income effectively, preserving more wealth for personal use or legacy planning.

Key Points:

- Tax-free growth: Earnings grow without being taxed.

- No tax on withdrawals: Both contributions and earnings can be accessed without tax implications after meeting specific criteria.

No Required Minimum Distributions (RMDs)

Unlike Traditional IRAs, Roth IRAs do not require account holders to begin withdrawing funds at a certain age. This feature allows individuals to keep their money invested for longer periods, potentially increasing their overall retirement savings through compounded growth.

Key Points:

- Control over withdrawals: Investors can choose when or if to withdraw funds.

- Legacy benefits: Funds can be passed on to heirs without forced distributions during the account holder’s lifetime.

Contributions Can Be Withdrawn Anytime Without Penalties

Roth IRAs allow account holders to withdraw their contributions at any time without facing taxes or penalties. This feature provides flexibility and access to funds in case of emergencies or unexpected expenses, making it an attractive option for younger investors who may need liquidity.

Key Points:

- Emergency access: Contributions can serve as a backup fund.

- No penalties: Unlike Traditional IRAs, which impose penalties on early withdrawals, Roth IRAs offer more leniency.

Potential for Tax-Free Growth

If an investor expects their income tax rate to increase in the future, contributing to a Roth IRA may be advantageous. Since contributions are made with after-tax dollars, any growth within the account is not subject to future taxes, which can lead to significant financial benefits over time.

Key Points:

- Long-term growth strategy: Ideal for younger investors or those anticipating higher future earnings.

- Tax strategy alignment: Aligns with those expecting higher tax brackets upon retirement.

Flexibility in Estate Planning

The absence of RMDs makes Roth IRAs particularly appealing for estate planning. Account holders can leave their investments untouched, allowing them to grow indefinitely. This flexibility is beneficial for those looking to pass on wealth to heirs or charitable organizations.

Key Points:

- Wealth preservation: Funds can grow without mandatory withdrawals.

- Tax-efficient inheritance: Beneficiaries can receive funds without immediate tax liabilities.

No Immediate Tax Deduction for Contributions

A significant disadvantage of Roth IRAs is that contributions are made with after-tax dollars, meaning investors do not receive an immediate tax deduction. For individuals seeking to reduce their taxable income now, this can be a drawback compared to Traditional IRAs.

Key Points:

- Higher upfront costs: Investors must pay taxes on contributions upfront.

- Less cash flow flexibility: Immediate cash flow may be limited due to upfront tax payments.

Income Limits Restrict Eligibility

Roth IRAs have income limits that determine eligibility for contributions. High earners may find themselves phased out of the ability to contribute directly to a Roth IRA, limiting its accessibility as a retirement savings vehicle.

Key Points:

- Contribution phase-out: Individuals with modified adjusted gross incomes above certain thresholds may not qualify.

- Alternative options needed: High earners may need to consider backdoor Roth conversions or other retirement accounts.

Earnings Cannot Be Withdrawn Tax-Free Until Conditions Are Met

While contributions can be withdrawn penalty-free at any time, earnings from a Roth IRA cannot be accessed without taxes until the account holder reaches age 59½ and has held the account for at least five years. This limitation can deter those who might need access to their investment gains sooner.

Key Points:

- Five-year rule: Earnings are subject to restrictions that may delay access.

- Planning required: Investors must plan withdrawals carefully around this rule.

Lower Contribution Limits Compared to Other Retirement Accounts

Roth IRAs have lower annual contribution limits compared to other retirement accounts like 401(k)s. For 2024, individuals under 50 can contribute up to $7,000 annually ($8,000 if over 50), which may not be sufficient for some investors aiming for aggressive retirement savings goals.

Key Points:

- Limited growth potential: Lower contribution limits may hinder aggressive savers.

- Need for additional accounts: Investors may need multiple accounts to meet retirement savings goals effectively.

Early Withdrawal Penalties on Earnings Before Age 59½

Withdrawals of earnings from a Roth IRA before age 59½ typically incur a 10% penalty along with income taxes unless specific exceptions apply. This restriction may discourage younger investors from utilizing their savings when needed most.

Key Points:

- Penalties apply: Early access comes with financial consequences.

- Exceptions limited: Only specific circumstances allow penalty-free access to earnings.

In conclusion, both Roth and Traditional IRAs offer unique benefits and drawbacks that cater to different financial situations and retirement strategies. The choice between these two types of accounts should consider factors such as current income levels, expected future income levels, and individual retirement goals.

Frequently Asked Questions About Roth Vs Traditional IRA Pros And Cons

- What is the main difference between Roth and Traditional IRAs?

The primary difference lies in taxation; Roth IRAs use after-tax dollars with tax-free withdrawals in retirement, while Traditional IRAs use pre-tax dollars with taxes paid upon withdrawal. - Can I convert my Traditional IRA into a Roth IRA?

Yes, you can convert your Traditional IRA into a Roth IRA; however, you will owe taxes on any pre-tax contributions and earnings at the time of conversion. - Are there age restrictions for contributing to a Roth IRA?

No, there are no age restrictions; as long as you have earned income within the income limits, you can contribute at any age. - What happens if I exceed the contribution limits?

If you exceed the contribution limits for either type of IRA, you may face penalties unless corrected within a specified timeframe. - Can I withdraw my contributions from a Roth IRA anytime?

Yes, you can withdraw your original contributions anytime without penalties or taxes since they were made with after-tax dollars. - What are the income limits for contributing to a Roth IRA?

The ability to contribute phases out based on your modified adjusted gross income; in 2024, single filers start phasing out at $138,000 and married couples at $218,000. - Is it better to contribute to a Roth or Traditional IRA?

The best choice depends on your current tax situation versus expected future tax rates; generally, younger investors expecting higher future incomes benefit more from Roth IRAs. - What happens if I need money from my Traditional IRA before retirement?

If you withdraw funds before age 59½ from a Traditional IRA, you will typically incur both income taxes and a 10% early withdrawal penalty unless specific exceptions apply.

Choosing between a Roth and Traditional IRA requires careful consideration of individual financial circumstances and long-term goals. Each option has distinct advantages that cater differently depending on current financial needs and future expectations regarding taxation and income levels.