Secured Guaranteed Retirement Accounts (SGRAs) are innovative financial products designed to provide individuals with a stable and predictable income stream during their retirement years. These accounts aim to address the growing concern of retirement income security in an era where traditional pension plans are becoming increasingly rare. SGRAs combine elements of both defined benefit and defined contribution plans, offering a unique approach to retirement savings and income generation.

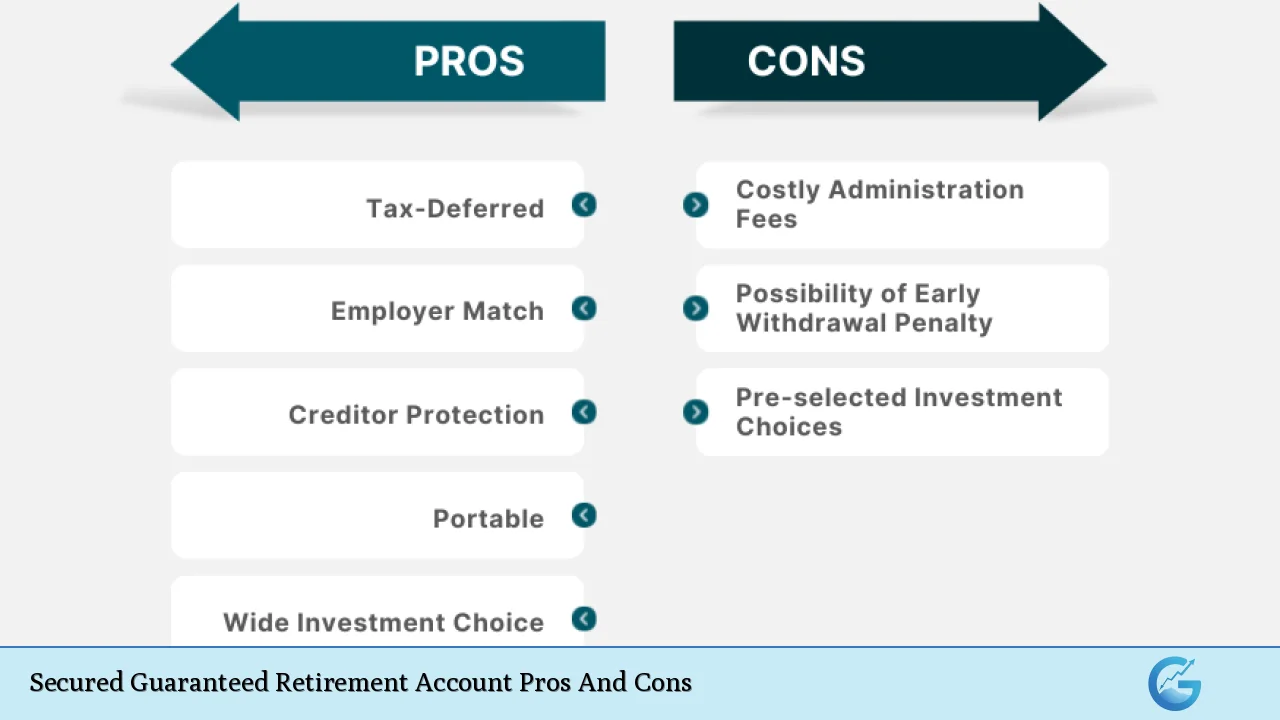

| Pros | Cons |

|---|---|

| Guaranteed lifetime income | Limited investment flexibility |

| Protection against market volatility | Potential for lower returns |

| Tax advantages | Reduced liquidity |

| Employer contributions | Complexity of plan structure |

| Portability between jobs | Inflation risk |

| Professional fund management | Limited control over investments |

| Potential for higher savings rates | Dependency on government guarantees |

| Simplified retirement planning | Potential for regulatory changes |

Advantages of Secured Guaranteed Retirement Accounts

Guaranteed Lifetime Income

One of the most significant benefits of SGRAs is the promise of a guaranteed income stream that lasts throughout retirement. This feature addresses one of the primary concerns many individuals face when planning for retirement: the fear of outliving their savings. With an SGRA, retirees can enjoy peace of mind knowing that they will receive a steady paycheck for life, regardless of how long they live.

- Eliminates longevity risk

- Provides financial security in later years

- Allows for better budgeting and financial planning in retirement

Protection Against Market Volatility

SGRAs offer a buffer against the unpredictability of financial markets. Unlike traditional 401(k) plans or IRAs, where account balances can fluctuate dramatically based on market performance, SGRAs provide a more stable value proposition.

- Shields retirement savings from market downturns

- Reduces stress and anxiety associated with market fluctuations

- Ensures a consistent income regardless of economic conditions

Tax Advantages

Similar to other qualified retirement plans, SGRAs come with tax benefits that can help individuals save more effectively for retirement.

- Contributions may be made with pre-tax dollars, reducing current taxable income

- Tax-deferred growth on investments within the account

- Potential for lower tax rates in retirement when withdrawals are made

Employer Contributions

Many SGRA plans include employer matching or contributions, similar to traditional 401(k) plans. This feature essentially provides “free money” to boost retirement savings.

- Increases overall retirement savings

- Encourages higher employee participation rates

- Can be a valuable part of an employee’s total compensation package

Portability Between Jobs

Unlike traditional pension plans that may be tied to a specific employer, SGRAs are designed to be portable. This means that workers can take their account with them when they change jobs, ensuring continuity in their retirement savings strategy.

- Facilitates job mobility without sacrificing retirement benefits

- Allows for consistent saving throughout one’s career

- Reduces the risk of leaving behind or cashing out retirement savings when changing employers

Professional Fund Management

SGRAs are typically managed by professional investment managers, which can lead to better long-term performance compared to self-directed retirement accounts.

- Access to sophisticated investment strategies

- Potential for improved risk-adjusted returns

- Reduces the burden on individuals to make complex investment decisions

Potential for Higher Savings Rates

The structure of SGRAs, with their guaranteed income feature, may encourage individuals to save more for retirement than they would with traditional defined contribution plans.

- Clearer connection between savings and future income

- Psychological benefit of seeing projected monthly retirement income

- May motivate individuals to increase contributions to secure a higher guaranteed income

Simplified Retirement Planning

SGRAs can simplify the retirement planning process by providing a clear picture of future income, reducing the complexity of managing multiple investment accounts and withdrawal strategies.

- Easier to estimate and plan for retirement expenses

- Reduces the need for complex withdrawal calculations in retirement

- Provides a straightforward way to ensure basic income needs are met

Disadvantages of Secured Guaranteed Retirement Accounts

Limited Investment Flexibility

One of the primary drawbacks of SGRAs is the lack of investment choice and control offered to account holders. Unlike self-directed retirement accounts, SGRAs typically have a predetermined investment strategy.

- Inability to adjust investments based on personal risk tolerance or market views

- May not be suitable for individuals who prefer active management of their retirement funds

- Potential opportunity cost if other investment strategies outperform the SGRA’s returns

Potential for Lower Returns

The guaranteed nature of SGRAs often comes at the cost of potentially lower overall returns compared to more aggressive investment strategies. This trade-off between security and growth potential is a significant consideration for many investors.

- Conservative investment approach may underperform in bull markets

- Opportunity cost of not participating fully in market upswings

- May result in a lower total retirement nest egg compared to more aggressive strategies

Reduced Liquidity

SGRAs are designed primarily as retirement vehicles, which means access to funds before retirement age may be limited or subject to penalties.

- Difficulty in accessing funds for emergencies or major expenses before retirement

- Potential penalties for early withdrawals

- Less flexibility in managing short-term financial needs

Complexity of Plan Structure

The mechanics behind SGRAs can be complex, involving actuarial calculations, government guarantees, and intricate rules regarding contributions and distributions.

- May be challenging for some individuals to fully understand

- Requires careful consideration and potentially professional advice

- Complexity could lead to suboptimal decision-making if not properly understood

Inflation Risk

While SGRAs provide a guaranteed income, not all plans automatically adjust for inflation. This means the purchasing power of the guaranteed income may decrease over time.

- Fixed income payments may lose value in real terms

- May require additional savings or investments to maintain lifestyle in retirement

- Inflation-adjusted options, if available, may come at a higher cost or lower initial payout

Limited Control Over Investments

Participants in SGRAs typically have little to no say in how their contributions are invested, which can be frustrating for those who prefer to have more control over their financial future.

- No ability to tailor investments to personal beliefs or preferences (e.g., socially responsible investing)

- Cannot capitalize on personal investment knowledge or expertise

- May feel disconnected from the growth of retirement savings

Dependency on Government Guarantees

The security of SGRAs often relies on government backing or guarantees, which introduces political and fiscal risks.

- Potential for changes in government policy affecting the guarantees

- Risk of underfunding if government faces fiscal challenges

- Dependency on long-term solvency of government programs

Potential for Regulatory Changes

As with any retirement vehicle, SGRAs are subject to changes in laws and regulations, which could impact their benefits or structure over time.

- Future legislative changes could alter the tax treatment or other advantages of SGRAs

- Modifications to contribution limits or distribution rules could affect retirement planning

- Changes in Social Security or other government programs could influence the overall effectiveness of SGRAs

In conclusion, Secured Guaranteed Retirement Accounts offer a compelling solution for individuals seeking a stable and predictable retirement income. They provide peace of mind through guaranteed lifetime payments and protection against market volatility. However, these benefits come with trade-offs, including potentially lower returns, reduced flexibility, and complexity in plan structure. Prospective retirees should carefully weigh these pros and cons against their personal financial goals, risk tolerance, and overall retirement strategy before deciding if an SGRA is the right choice for their future.

As the retirement landscape continues to evolve, SGRAs represent an innovative approach to addressing the challenges of longevity risk and retirement income security. While they may not be the perfect solution for everyone, they offer a valuable option in the toolkit of retirement planning, particularly for those who prioritize income stability and are willing to forgo some potential upside in exchange for guaranteed benefits.

Frequently Asked Questions About Secured Guaranteed Retirement Accounts

- What is the minimum contribution required for a Secured Guaranteed Retirement Account?

Minimum contributions vary by plan, but typically range from 1% to 3% of an employee’s salary. Some plans may have a fixed dollar amount as the minimum contribution. - Can I withdraw money from my SGRA before retirement age?

Early withdrawals are generally discouraged and may be subject to penalties. Some plans may allow hardship withdrawals under specific circumstances, but this can reduce your future guaranteed income. - How is the guaranteed income calculated in an SGRA?

The guaranteed income is typically calculated based on your total contributions, any employer matches, investment returns, and actuarial factors such as your age at retirement. The specific formula can vary by plan provider. - Are SGRAs insured by the government?

The level of government insurance or guarantee for SGRAs can vary. Some may be backed by state or federal guarantees, while others rely on the financial strength of the insurance company providing the guarantee. - Can I choose how my SGRA funds are invested?

Generally, SGRAs offer limited or no investment choices to participants. The funds are typically managed by professional investment managers following a predetermined, conservative investment strategy. - What happens to my SGRA if I change jobs?

SGRAs are designed to be portable. You can usually keep your account and continue contributing to it even if you change employers, as long as your new employer participates in the SGRA program. - Can I leave my SGRA to my heirs?

This depends on the specific plan. Some SGRAs offer survivor benefits or allow you to designate beneficiaries, while others may terminate upon the account holder’s death. - How do SGRAs compare to traditional pension plans?

SGRAs combine features of both defined benefit and defined contribution plans. They offer guaranteed income like pensions, but with individual accounts and potentially more portability.