A Simplified Employee Pension Individual Retirement Account (SEP IRA) is a retirement savings plan designed primarily for self-employed individuals and small business owners. It allows employers to make contributions to their employees’ retirement savings, including their own, while offering higher contribution limits than traditional IRAs. This flexibility makes the SEP IRA an attractive option for many, but it also comes with specific drawbacks that potential users should consider. This article will explore the advantages and disadvantages of a SEP IRA in detail, helping you make an informed decision about whether this retirement plan is right for you.

| Pros | Cons |

|---|---|

| High contribution limits compared to traditional IRAs | No employee contributions allowed |

| Tax-deductible contributions for employers | Must contribute equally for all eligible employees |

| Flexible annual contributions based on business performance | No catch-up contributions for those aged 50 or older |

| Easy to set up and maintain with minimal paperwork | Early withdrawal penalties apply before age 59½ |

| Immediate vesting for employees | Required minimum distributions (RMDs) starting at age 73 |

| Tax-deferred growth on investments | Limited investment options compared to other plans |

| Can be used alongside other retirement accounts | Potentially costly for businesses with many employees due to mandatory contributions |

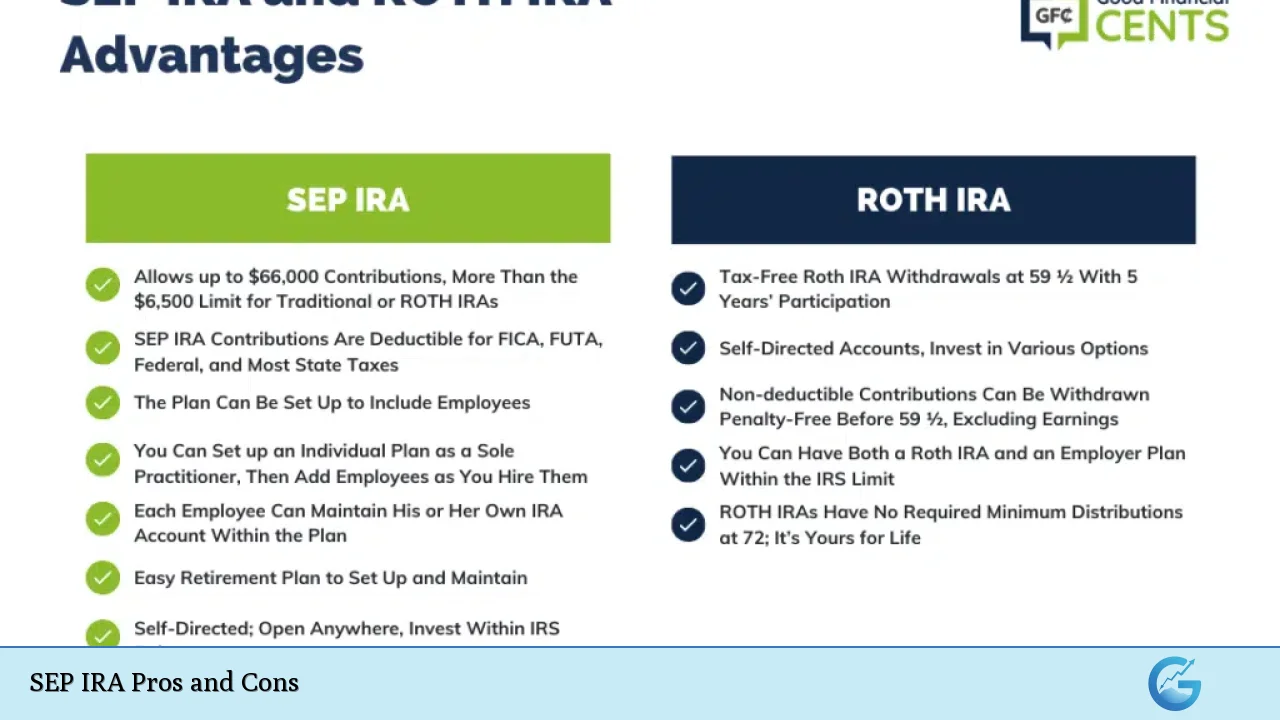

High Contribution Limits Compared to Traditional IRAs

One of the most significant advantages of a SEP IRA is its high contribution limits. For 2024, the maximum contribution is the lesser of 25% of an employee’s compensation or $69,000. This limit is substantially higher than that of traditional and Roth IRAs, which allows self-employed individuals and small business owners to save more for retirement in a tax-advantaged manner.

- Higher savings potential: The ability to contribute significantly more than traditional IRAs enables better preparation for retirement.

- Flexible contribution percentages: Employers can adjust their contribution rates annually based on business performance, making it easier to manage cash flow.

No Employee Contributions Allowed

While SEP IRAs allow employer contributions, they do not permit employee contributions. This means that employees cannot add their own funds to the account, which can be a disadvantage for those who wish to supplement their retirement savings.

- Employer-only contributions: Only employers can fund the account, limiting employee participation in their retirement planning.

- Potential dissatisfaction among employees: Employees may feel less engaged with their retirement savings if they cannot contribute directly.

Tax-Deductible Contributions for Employers

Contributions made by employers to a SEP IRA are tax-deductible, which can help reduce taxable income. This feature makes SEP IRAs particularly appealing for small business owners looking to lower their tax burden while providing retirement benefits.

- Immediate tax benefits: Tax deductions can lead to significant savings during tax season.

- Encourages employer contributions: The tax incentives may motivate employers to contribute more generously to their employees’ retirement plans.

Must Contribute Equally for All Eligible Employees

A notable drawback of the SEP IRA is that if an employer decides to contribute, they must do so at the same percentage rate for all eligible employees, including themselves. This requirement can be challenging for businesses with many employees or varying salaries.

- Equity requirement: Employers must ensure that all eligible employees receive equal percentage contributions based on their compensation.

- Financial strain: For businesses with fluctuating incomes or many employees, this could become financially burdensome.

Flexible Annual Contributions Based on Business Performance

SEP IRAs offer flexibility in terms of annual contributions. Employers are not required to contribute every year, which allows them to skip contributions during lean years without penalty.

- Adaptability: Business owners can adjust their contributions based on profitability, providing financial relief during tough times.

- Encourages saving in good years: In profitable years, employers can maximize contributions without being locked into a fixed amount annually.

No Catch-Up Contributions for Those Aged 50 or Older

Unlike other retirement accounts such as 401(k)s or traditional IRAs, SEP IRAs do not allow catch-up contributions for individuals aged 50 or older. This means that older workers cannot make additional contributions beyond the standard limit as they approach retirement age.

- Limited options for older savers: Older individuals may miss out on opportunities to boost their retirement savings as they near retirement.

- Potential disadvantage compared to other accounts: For those looking to maximize savings before retiring, this limitation can be frustrating.

Easy to Set Up and Maintain with Minimal Paperwork

Setting up a SEP IRA is relatively straightforward compared to other retirement plans. It requires minimal paperwork and no annual filing requirements with the IRS, making it an appealing choice for busy business owners.

- Quick setup process: Business owners can establish a SEP IRA quickly by completing one IRS form and choosing a financial institution.

- Low administrative burden: The simplicity of maintenance means less time spent on paperwork and compliance issues.

Early Withdrawal Penalties Apply Before Age 59½

Withdrawals from a SEP IRA before reaching age 59½ are subject to income tax and an additional 10% penalty. This rule applies similarly to traditional IRAs and may deter some individuals from accessing their funds in emergencies.

- Financial penalties: Early withdrawals can significantly reduce the amount available during retirement due to taxes and penalties.

- Discourages premature access: The penalties encourage individuals to leave the funds untouched until retirement age.

Immediate Vesting for Employees

One significant advantage of a SEP IRA is that all contributions made by employers are immediately vested. This means that employees have full ownership of the funds as soon as they are deposited into their accounts.

- Employee satisfaction: Immediate vesting enhances employee morale and loyalty since they know they will not lose employer contributions if they leave the company quickly.

- Simplified management: Employers do not have to manage vesting schedules, reducing administrative complexity.

Required Minimum Distributions (RMDs) Starting at Age 73

Like traditional IRAs, SEP IRAs require account holders to begin taking minimum distributions once they reach age 73. This requirement can impact financial planning strategies as retirees must account for these mandatory withdrawals in their income calculations.

- Planning considerations: Retirees need to factor RMDs into their overall income strategy during retirement years.

- Tax implications: Withdrawals are taxed as ordinary income, which may affect overall tax liability in retirement.

Tax-Deferred Growth on Investments

Funds within a SEP IRA grow tax-deferred until withdrawn during retirement. This feature allows investments to compound without immediate tax implications, potentially leading to greater growth over time compared to taxable accounts.

- Long-term growth potential: Tax-deferred growth can significantly enhance overall returns over decades of investment accumulation.

- Retirement readiness: The ability to grow investments without immediate taxation helps individuals prepare better financially for retirement needs.

Limited Investment Options Compared to Other Plans

While SEP IRAs allow various investment choices similar to traditional IRAs (stocks, bonds, mutual funds), some plans may offer fewer options than other types of employer-sponsored plans like 401(k)s.

- Investment flexibility concerns: Business owners may find that certain investment vehicles are not available within a SEP IRA framework compared to other plans.

- Potentially lower returns: Limited investment choices could hinder growth potential if suitable investment options are unavailable within the plan structure.

Potentially Costly for Businesses with Many Employees Due to Mandatory Contributions

For businesses with numerous employees or fluctuating revenues, mandatory equal percentage contributions can become expensive. If profits decline but obligations remain constant, this could strain finances significantly.

- Financial burden on small businesses: Companies may struggle financially if required contributions become too high relative to income levels during challenging economic periods.

- Consideration of alternatives: Business owners might explore other retirement plan options that offer more manageable contribution requirements based on individual circumstances.

In conclusion, while a SEP IRA offers significant advantages such as high contribution limits and tax-deductible employer contributions, it also presents challenges like mandatory equal contributions and early withdrawal penalties. Understanding both sides is crucial for self-employed individuals and small business owners considering this retirement plan. Careful consideration of your business’s specific needs and financial situation will help determine if a SEP IRA aligns with your long-term financial goals.

Frequently Asked Questions About SEP IRA

- What is a SEP IRA?

A Simplified Employee Pension (SEP) IRA is a type of retirement plan designed primarily for self-employed individuals and small business owners that allows higher contribution limits than traditional IRAs. - Who can contribute to a SEP IRA?

Only employers can contribute; employees cannot make personal contributions into their SEP IRA accounts. - What are the contribution limits?

The maximum contribution limit is the lesser of 25% of an employee’s compensation or $69,000 in 2024. - Are there any penalties for early withdrawal?

Yes, withdrawals taken before age 59½ incur ordinary income taxes plus an additional 10% penalty. - Do I have to contribute every year?

No, employers are not required to make annual contributions; however, if they choose to contribute in a given year, they must do so equally across all eligible employees. - What happens when I reach age 73?

You must begin taking required minimum distributions (RMDs) from your account once you reach age 73. - Can I have other retirement accounts alongside my SEP IRA?

Yes, you can maintain other types of retirement accounts such as traditional or Roth IRAs while having a SEP IRA. - Is there immediate vesting with a SEP IRA?

Yes, all employer contributions are immediately vested in the employee’s account.