Obtaining a trading license in Slovakia is a crucial step for entrepreneurs and businesses looking to establish themselves in the country’s financial markets. This comprehensive guide will provide you with all the necessary information to navigate the process successfully, whether you’re interested in forex, finance, or cryptocurrency trading.

| License Type | Requirements | Processing Time |

|---|---|---|

| Free Trade License | – 18 years of age – Legal capacity – Clean criminal record – Completed application form – Proof of address | 3-5 business days |

| Regulated Trade License | – All Free Trade License requirements – Proof of professional qualifications – Industry-specific certifications | 7-10 business days |

| Craft Trade License | – All Free Trade License requirements – Proof of apprenticeship or relevant experience – Professional certification | 5-7 business days |

Understanding the Slovakia Trading License

The Slovakia Trading License, also known as a Trade License or Živnostenské oprávnenie in Slovak, is a legal requirement for individuals and businesses wishing to conduct trade activities in Slovakia. This includes various financial services such as forex trading, cryptocurrency exchanges, and other financial market operations.

Types of Trade Licenses

There are three main types of trade licenses in Slovakia:

- Free Trade License: This is the most common and easiest to obtain. It covers a wide range of business activities that don’t require specific qualifications.

- Regulated Trade License: This type is required for activities that demand specific professional qualifications or experience, such as financial advisory services.

- Craft Trade License: This license is necessary for trades that require specialized skills and training, typically not applicable to financial trading but important to be aware of.

Requirements for Obtaining a Trading License

To obtain a trading license in Slovakia, you must meet the following general conditions:

- Be at least 18 years old

- Have full legal capacity

- Possess a clean criminal record

- Provide proof of address in Slovakia (for certain types of licenses)

For regulated trades, additional requirements include:

- Proof of professional qualifications

- Relevant work experience

- Industry-specific certifications

Application Process for a Slovakia Trading License

The process of obtaining a trading license in Slovakia has been streamlined in recent years, making it more accessible for both locals and foreigners.

Step-by-Step Guide

- Choose your trade activity: Determine which type of license you need based on your intended business activities.

- Prepare required documents: Gather all necessary paperwork, including identification, proof of address, and any required qualifications.

- Visit the Trade Licensing Office: You can apply in person at the local Trade Licensing Office or use the online portal at www.slovensko.sk.

- Submit your application: Fill out the required forms and submit them along with your documents.

- Pay the administrative fee: Fees vary depending on the type of license, ranging from €5 to €50.

- Receive your license: If approved, you’ll receive your trade license, typically within 3-10 business days.

Technical Considerations

When applying for a trading license for financial activities, consider the following technical aspects:

- Online trading platforms: Ensure your chosen platform complies with Slovak financial regulations.

- Data protection: Implement robust security measures to protect client information.

- Reporting requirements: Familiarize yourself with the financial reporting obligations in Slovakia.

User Experiences

Many forex and cryptocurrency traders have reported a relatively smooth process when obtaining their trading licenses in Slovakia. However, some have noted challenges in meeting the specific requirements for regulated financial activities.

One user shared: “The free trade license was straightforward to obtain, but when I expanded into forex advisory services, I needed to provide additional certifications, which took some time to acquire.”

Recommendations

- Start with a free trade license if you’re new to the Slovak market.

- Consider hiring a local legal consultant to navigate the process, especially for regulated trades.

- Keep all your documentation organized and up-to-date to facilitate renewals and potential audits.

Legal and Regulatory Compliance

Compliance with Slovak and EU regulations is crucial for maintaining your trading license and operating legally in the financial markets.

Key Regulations

- Act No. 455/1991 Coll. on Trade Licensing: This is the primary legislation governing trade licenses in Slovakia.

- Act No. 566/2001 Coll. on Securities and Investment Services: Relevant for those engaging in securities trading or investment advisory.

- Anti-Money Laundering (AML) regulations: Strict compliance is required, especially for forex and cryptocurrency businesses.

Ongoing Obligations

- Annual tax filings

- Regular financial audits

- Continuous professional development for regulated trades

- Adherence to consumer protection laws

Penalties for Non-Compliance

Failure to comply with regulations can result in:

- Fines up to €3,300 for minor infractions

- Suspension or revocation of your trading license

- Legal proceedings and potential criminal charges for serious violations

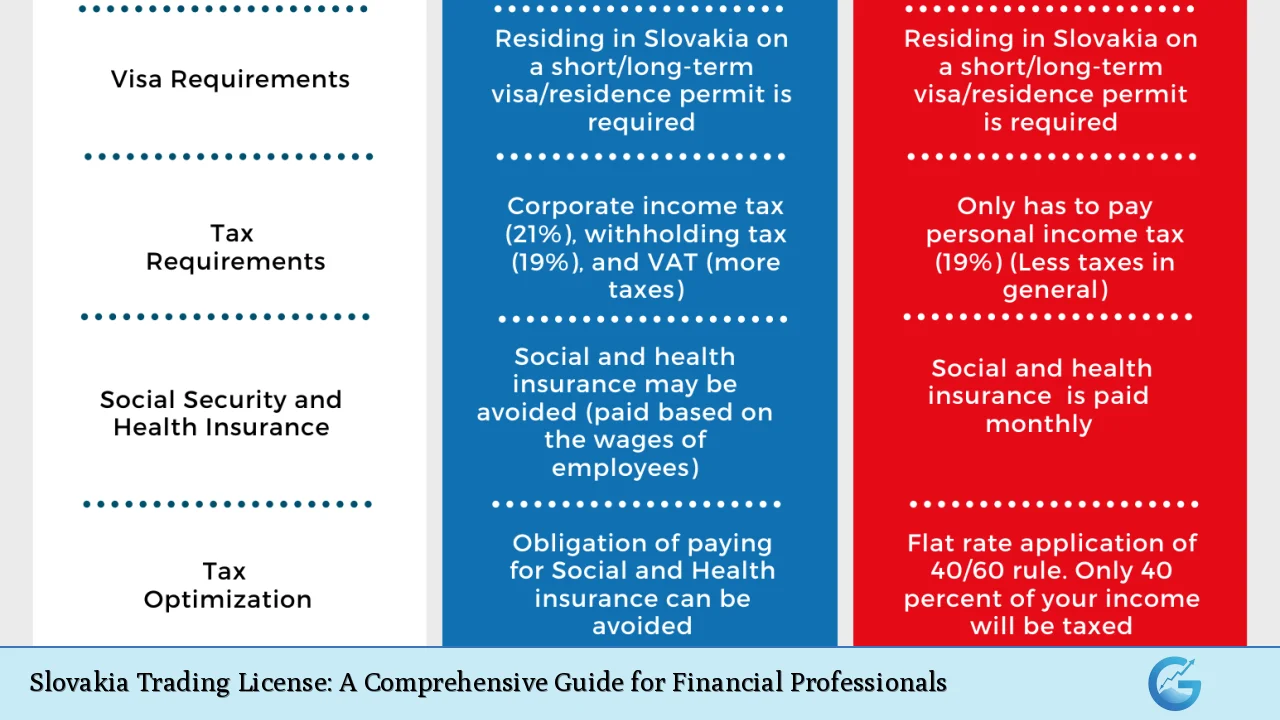

Taxation and Financial Considerations

Understanding the tax implications of your trading activities is essential for long-term success in the Slovak market.

Tax Rates and Obligations

- Corporate Income Tax: 21% flat rate

- Personal Income Tax: Progressive rate up to 25%

- Value Added Tax (VAT): Standard rate of 20%

Financial Reporting

- Maintain accurate financial records

- Submit annual tax returns

- Consider hiring a local accountant familiar with Slovak tax laws

Banking and Currency Considerations

- Open a Slovak business bank account

- Be aware of currency exchange regulations, especially for forex trading

- Consider the implications of dealing with cryptocurrencies under Slovak law

Expanding Your Trading Business in Slovakia

Once you’ve established your trading business with a valid license, consider these growth strategies:

- Diversify your trading portfolio: Explore opportunities in stocks, bonds, and commodities.

- Network with local financial professionals: Join industry associations and attend financial conferences.

- Explore EU-wide opportunities: Use Slovakia as a base to access other EU markets.

Conclusion

Obtaining a Slovakia Trading License is a crucial step for anyone looking to enter the country’s financial markets. While the process can be complex, especially for regulated activities, the potential benefits of operating in this strategically located EU member state are significant. By following the guidelines outlined in this comprehensive guide and staying compliant with local regulations, you can establish a strong foundation for your trading business in Slovakia.

FAQs

- Can foreigners obtain a trading license in Slovakia?

Yes, foreigners can obtain a trading license in Slovakia, subject to meeting the same requirements as Slovak citizens. - How long does it take to get a trading license in Slovakia?

The process typically takes 3-10 business days, depending on the type of license and completeness of your application. - Do I need a physical office in Slovakia to get a trading license?

For most licenses, you need a registered address in Slovakia, which can be a virtual office in some cases. - Is it mandatory to register for VAT when obtaining a trading license?

VAT registration is not mandatory when obtaining a license but may be required depending on your turnover and business activities. - Can I use my Slovakia trading license to operate in other EU countries?

While the license is valid for Slovakia, it may facilitate easier entry into other EU markets, subject to each country’s specific requirements.