The Financial Services Board (FSB) license in South Africa is a crucial requirement for entities looking to operate in the country’s financial services sector. This comprehensive guide will provide you with detailed information about obtaining and maintaining an FSB license, now known as the Financial Sector Conduct Authority (FSCA) license, in South Africa.

| License Type | Requirements | Benefits |

|---|---|---|

| Category I | – Minimum capital: R2 million – Fit and proper requirements – Operational ability – Financial soundness | – Ability to provide financial advice – Intermediary services – Lower compliance burden |

| Category II | – Minimum capital: R3 million – Higher fit and proper requirements – Enhanced operational ability – Stricter financial soundness criteria | – Discretionary investment management – Broader range of financial products – Higher client trust |

| Category IIA | – Minimum capital: R5 million – Highest fit and proper requirements – Advanced operational systems – Stringent financial soundness measures | – Hedge fund management – Complex financial instruments – Institutional client focus |

Understanding the FSB/FSCA License

The Financial Services Board (FSB) was replaced by the Financial Sector Conduct Authority (FSCA) in April 2018. This regulatory body oversees the non-banking financial services industry in South Africa, including forex brokers, investment firms, and cryptocurrency exchanges.

Key Points:

- The FSCA license is mandatory for financial service providers in South Africa

- It ensures compliance with local regulations and protects consumers

- Different categories of licenses are available based on the nature of financial services offered

Application Process for FSCA License

Obtaining an FSCA license involves a rigorous application process designed to ensure that only qualified and trustworthy entities enter the financial services market.

Steps to Apply:

- Determine the appropriate license category for your business

- Prepare all required documentation, including business plans and compliance policies

- Submit the application through the FSCA’s online portal

- Pay the applicable application fees

- Undergo a thorough vetting process by the FSCA

Technical Requirements:

- Robust IT infrastructure to support operations

- Secure data management systems

- Compliance with cybersecurity standards

User Experience:

Many applicants find the process time-consuming and complex. It’s advisable to seek professional assistance to navigate the regulatory landscape effectively.

Recommendations:

- Start the application process well in advance of your planned operational launch

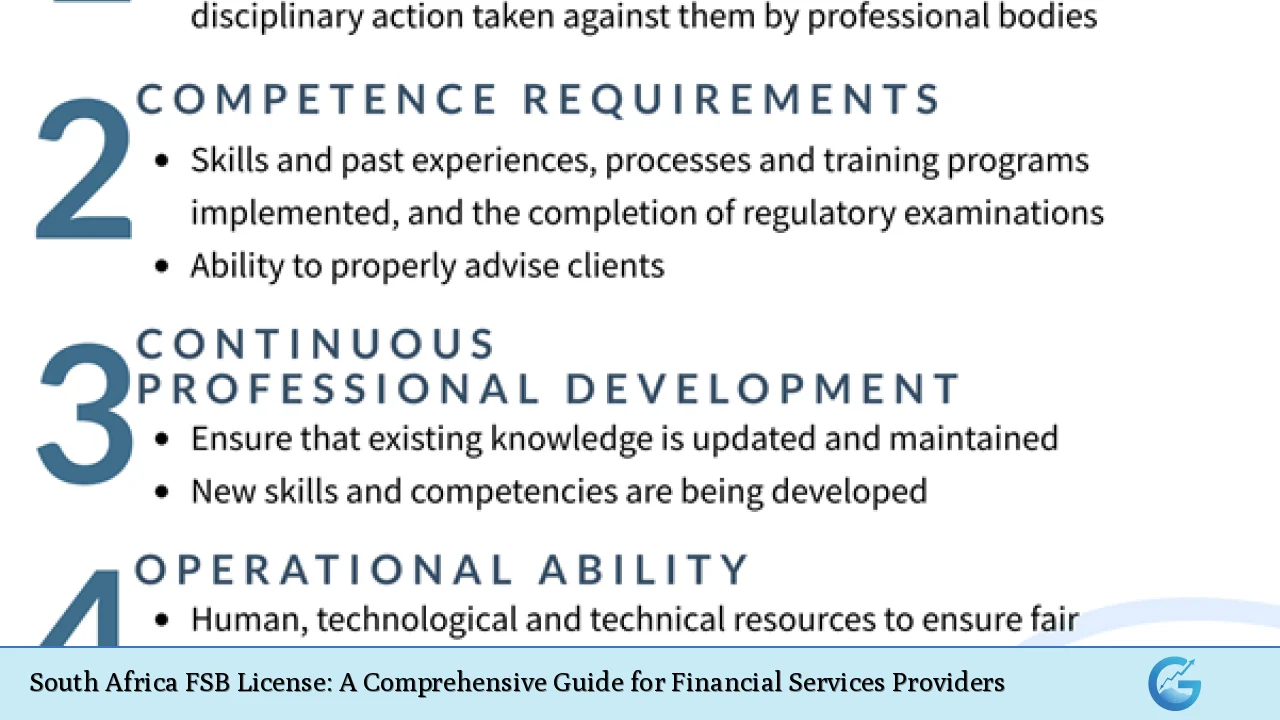

- Ensure all key individuals meet the fit and proper requirements

- Develop a comprehensive compliance framework before applying

Capital Requirements and Financial Soundness

The FSCA imposes strict capital requirements to ensure the financial stability of licensed entities.

Key Considerations:

- Minimum capital requirements vary by license category

- Ongoing financial reporting is mandatory

- Audited financial statements must be submitted annually

Technical Details:

- Category I: R2 million minimum capital

- Category II: R3 million minimum capital

- Category IIA: R5 million minimum capital

User Insights:

Maintaining the required capital can be challenging, especially for startups. Some firms opt for lower categories initially and upgrade as they grow.

Recommendations:

- Maintain a capital buffer above the minimum requirements

- Implement robust financial management systems

- Consider partnering with established financial institutions for capital support

Compliance and Reporting Obligations

FSCA licensees must adhere to strict compliance and reporting standards to maintain their license.

Key Obligations:

- Regular submission of compliance reports

- Maintaining proper records of all financial transactions

- Adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations

- Continuous professional development for key individuals

Technical Aspects:

- Implementation of automated compliance monitoring systems

- Regular internal audits to ensure adherence to regulations

User Experiences:

Many licensees find the compliance burden significant but acknowledge its importance in maintaining market integrity.

Recommendations:

- Invest in compliance management software

- Engage with compliance consultants for ongoing support

- Stay updated with regulatory changes through FSCA notifications

Operational Requirements and Risk Management

FSCA licensees must demonstrate robust operational capabilities and effective risk management practices.

Operational Considerations:

- Adequate staffing with qualified personnel

- Clear segregation of duties to prevent conflicts of interest

- Comprehensive risk management framework

Technical Implementation:

- Advanced trading platforms for forex and cryptocurrency operations

- Real-time risk monitoring systems

- Disaster recovery and business continuity plans

User Perspectives:

Operators appreciate the FSCA’s focus on operational resilience, as it helps build trust with clients and partners.

Best Practices:

- Conduct regular risk assessments

- Implement multi-layer security measures for online operations

- Provide ongoing training for staff on operational procedures and risk management

Client Protection and Dispute Resolution

The FSCA places a strong emphasis on client protection, requiring licensees to have robust mechanisms for handling client complaints and resolving disputes.

Key Requirements:

- Clear and transparent communication of product risks to clients

- Segregation of client funds from company assets

- Membership in an approved ombudsman scheme

Technical Implementations:

- Automated client onboarding systems with built-in risk profiling

- Secure client fund management platforms

- Integration with external dispute resolution bodies

User Feedback:

Clients of FSCA-licensed entities generally report higher confidence in their financial service providers due to these protections.

Recommendations:

- Develop a comprehensive client education program

- Implement a user-friendly complaint management system

- Regularly review and improve client communication channels

In conclusion, obtaining and maintaining an FSCA license in South Africa is a complex but crucial process for financial service providers. It requires significant investment in compliance, technology, and human resources. However, the benefits of operating within a well-regulated environment, including increased client trust and market stability, make it a worthwhile endeavor for serious players in the financial services industry.

FAQs

- How long does it take to obtain an FSCA license in South Africa?

The process typically takes 6-12 months, depending on the complexity of the application and the responsiveness of the applicant. - Can foreign companies apply for an FSCA license?

Yes, foreign companies can apply, but they must establish a local presence and meet all regulatory requirements. - What are the ongoing costs associated with maintaining an FSCA license?

Costs include annual levies, compliance expenses, and professional fees for audits and legal services. - Is an FSCA license required for cryptocurrency exchanges in South Africa?

As of 2024, cryptocurrency exchanges are required to obtain FSCA licensing to operate legally in South Africa. - Can an FSCA license be revoked, and under what circumstances?

Yes, licenses can be revoked for serious compliance breaches, financial misconduct, or failure to meet ongoing regulatory requirements.