The Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores, or CNMV) plays a crucial role in regulating the financial markets in Spain. For those interested in forex, finance, and cryptocurrency markets, understanding the CNMV broker license is essential. This comprehensive guide will delve into the intricacies of obtaining and maintaining a CNMV broker license, its importance, and what it means for investors and traders.

| License Type | Key Features | Requirements |

|---|---|---|

| Investment Services Entity (ESI) License | – Allows wide range of investment services – Includes receiving and transmitting orders, executing client orders, portfolio management, and investment advice | – Detailed organizational structure – Robust risk management procedures – Suitable officers and shareholders |

| Securities Dealer License | – Authorizes intermediary activities – Permits receiving and transmitting orders – Allows execution of buy/sell orders in financial markets | – Compliance with capital requirements – Adequate internal controls – Experienced management team |

| Collective Investment Scheme Management Company (SGIIC) License | – Enables management of collective investment schemes – Allows creation and administration of investment funds | – Specialized knowledge in fund management – Strict compliance with investor protection rules – Robust risk assessment methodologies |

Obtaining a CNMV Broker License

Securing a CNMV broker license is a rigorous process designed to ensure that only qualified and trustworthy entities operate in the Spanish financial markets.

Application Process:

The journey begins with submitting a comprehensive application to the CNMV. This application must include:

- Detailed information on the company’s organizational structure

- A thorough business plan outlining proposed activities

- Financial projections and capital adequacy assessments

Suitability Assessment:

The CNMV conducts an in-depth evaluation of the company’s key personnel, including:

- Shareholders

- Directors

- Senior management

This assessment aims to verify that these individuals possess the necessary experience, knowledge, and integrity to operate in the financial sector effectively.

Capital and Solvency Requirements:

Entities seeking a CNMV license must demonstrate their financial robustness by meeting strict capital and solvency requirements. These typically include:

- Minimum initial capital thresholds

- Ongoing solvency ratios

- Liquidity maintenance standards

Organizational Structure and Internal Procedures:

The CNMV scrutinizes the applicant’s internal framework, focusing on:

- Risk management systems

- Compliance mechanisms

- Corporate governance structures

These elements must align with regulatory expectations and industry best practices.

User Experience:

Many applicants find the process challenging but ultimately rewarding. One forex broker commented, “The CNMV’s thoroughness gave us confidence in our own systems and helped us refine our operations.”

Recommendations:

- Engage legal experts familiar with Spanish financial regulations

- Prepare a detailed and realistic business plan

- Ensure all key personnel have verifiable credentials and experience

Maintaining a CNMV Broker License

Obtaining the license is just the beginning. Maintaining it requires ongoing commitment and compliance.

Continuous Supervision:

The CNMV employs a proactive approach to supervision, which includes:

- Regular audits and inspections

- Monitoring of financial reports and key performance indicators

- Assessment of compliance with evolving regulations

Reporting Requirements:

Licensed entities must adhere to strict reporting schedules, including:

- Annual financial statements

- Quarterly operational reports

- Immediate notification of significant events or changes

Consumer Protection Measures:

The CNMV places a strong emphasis on investor protection. Brokers must:

- Implement clear and fair client communication practices

- Maintain robust complaint handling procedures

- Ensure transparency in product offerings and pricing

Technical Considerations:

Brokers must maintain state-of-the-art technological infrastructure to:

- Ensure secure and efficient trading platforms

- Protect client data and prevent cybersecurity breaches

- Facilitate accurate and timely reporting to the CNMV

User Insights:

A compliance officer at a CNMV-regulated firm shared, “Staying compliant is an ongoing process. We’ve found that investing in strong compliance and risk management teams pays dividends in maintaining our license and reputation.”

Best Practices:

- Implement a dedicated compliance monitoring system

- Regularly train staff on regulatory updates and compliance procedures

- Conduct internal audits to identify and address potential issues proactively

Benefits of CNMV Regulation for Investors

The CNMV’s rigorous oversight provides numerous advantages for investors operating in the Spanish financial markets.

Enhanced Investor Protection:

CNMV regulation ensures:

- Segregation of client funds from company assets

- Participation in investor compensation schemes

- Adherence to strict conflict of interest policies

Market Integrity:

The CNMV’s oversight promotes:

- Fair and transparent pricing

- Equitable market access for all participants

- Swift action against market manipulation and insider trading

Dispute Resolution:

Investors benefit from:

- Formal complaint procedures overseen by the CNMV

- Access to mediation and arbitration services

- Legal recourse backed by regulatory framework

Technical Safeguards:

CNMV-regulated brokers must implement:

- Advanced encryption and security protocols

- Regular system audits and stress tests

- Disaster recovery and business continuity plans

Investor Testimonial:

One retail investor noted, “Knowing my broker is CNMV-regulated gives me peace of mind. The transparency and protection it offers are invaluable.”

Tips for Investors:

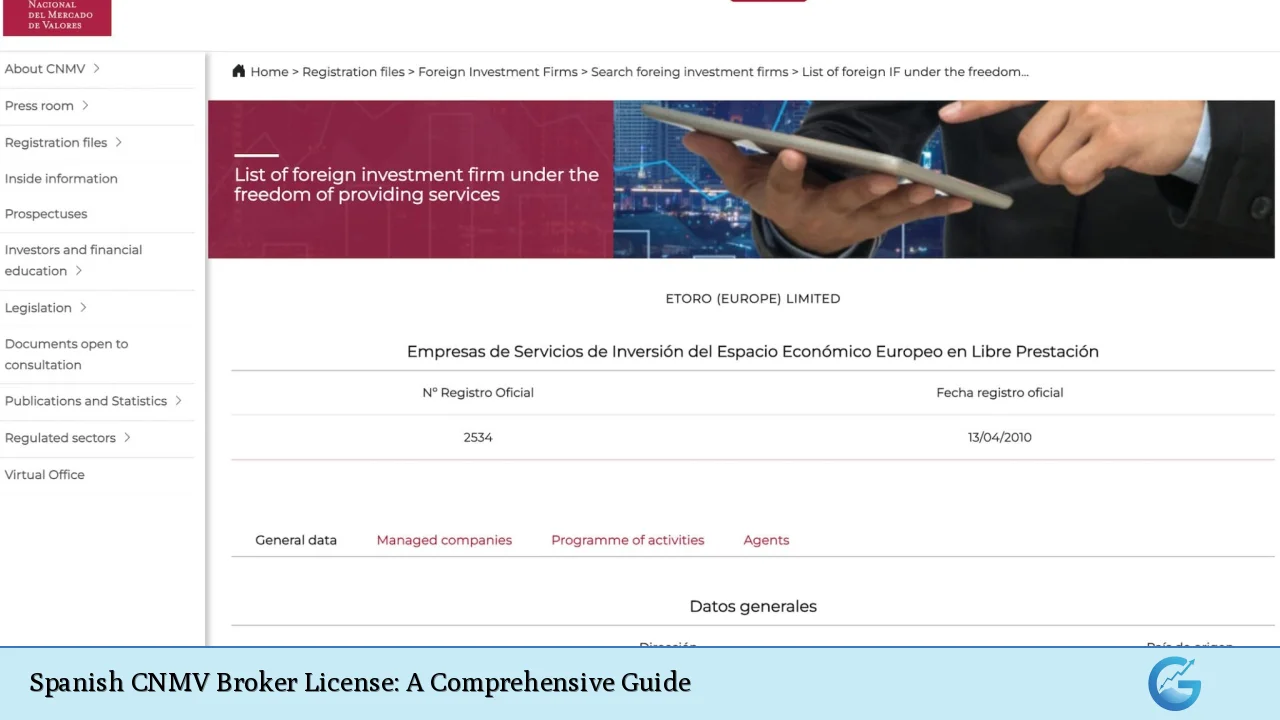

- Always verify a broker’s CNMV license status before investing

- Familiarize yourself with the protections and rights afforded by CNMV regulation

- Stay informed about any regulatory warnings or actions against brokers

Challenges and Future Outlook

While the CNMV broker license is highly regarded, the regulatory landscape continues to evolve.

Emerging Technologies:

The CNMV is adapting its framework to address:

- Cryptocurrency and blockchain-based financial products

- Artificial intelligence and algorithmic trading

- Open banking and API-driven financial services

Cross-Border Considerations:

With increasing global financial integration, the CNMV is focusing on:

- Harmonization with EU-wide regulations like MiFID II

- Cooperation agreements with international regulatory bodies

- Addressing challenges posed by Brexit and other geopolitical shifts

Regulatory Technology (RegTech):

The CNMV is encouraging the adoption of:

- Automated compliance reporting systems

- AI-powered risk assessment tools

- Blockchain for transparent audit trails

Industry Perspective:

A fintech startup CEO remarked, “The CNMV’s openness to innovation, while maintaining strict standards, positions Spain as an attractive market for financial technology firms.”

Future Considerations:

- Stay abreast of CNMV consultations and proposed regulatory changes

- Invest in flexible compliance systems that can adapt to evolving requirements

- Engage in industry forums and dialogues with the CNMV to shape future regulations

In conclusion, the Spanish CNMV Broker License represents a gold standard in financial regulation, offering robust protection for investors while fostering a dynamic and innovative financial ecosystem. As the financial landscape continues to evolve, the CNMV’s adaptive approach ensures that Spain remains at the forefront of secure and forward-thinking financial markets.

FAQs

- How long does it typically take to obtain a CNMV broker license?

The process usually takes 6-12 months, depending on the complexity of the application and the responsiveness of the applicant. - Can non-Spanish companies obtain a CNMV broker license?

Yes, non-Spanish companies can apply, but they must establish a legal entity in Spain and meet all regulatory requirements. - What are the minimum capital requirements for a CNMV broker license?

Capital requirements vary by license type, ranging from €50,000 to €730,000, depending on the services offered. - How often does the CNMV conduct audits on licensed brokers?

The CNMV conducts regular audits, typically annually, but may perform more frequent inspections based on risk assessments or specific concerns. - Can a CNMV-licensed broker operate in other EU countries?

Yes, under EU passporting rules, CNMV-licensed brokers can operate in other EU countries, subject to notification procedures.