Student loan consolidation is a financial strategy that allows borrowers to combine multiple student loans into a single loan, simplifying repayment and potentially altering the terms of the debt. This approach can be particularly appealing for those overwhelmed by multiple payments, varying interest rates, and the complexities of managing different loan servicers. However, while consolidation can offer several benefits, it also comes with significant drawbacks that borrowers must carefully consider. This article explores the advantages and disadvantages of student loan consolidation in detail, providing insights for individuals interested in finance and investment.

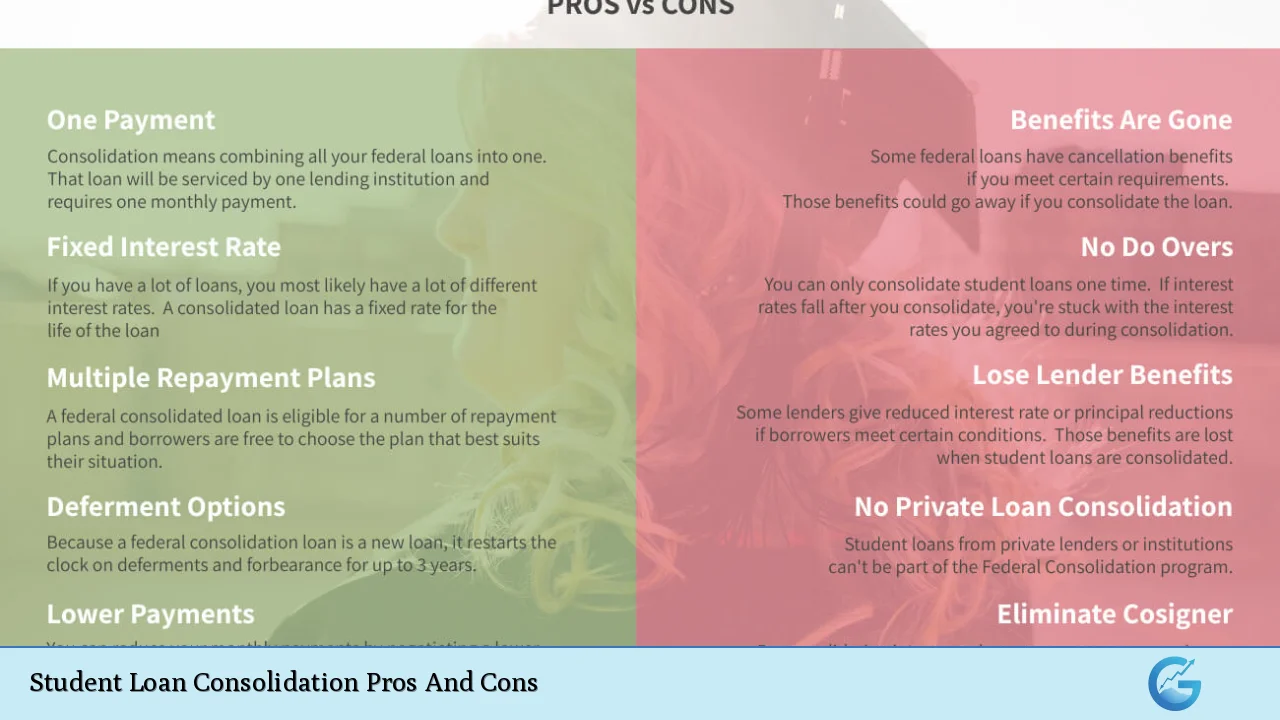

| Pros | Cons |

|---|---|

| Simplifies repayment with one monthly payment | May lead to higher total interest paid |

| Potentially lower monthly payments | Loss of borrower benefits from original loans |

| Access to flexible repayment options | Longer repayment period may extend debt duration |

| Fixed interest rate can provide stability | Resetting progress towards forgiveness programs |

| Helps in managing multiple loans effectively | Unpaid interest may be capitalized into the new loan |

| Can assist in avoiding default status | Not all loans can be consolidated together |

Simplifies Repayment with One Monthly Payment

One of the most significant advantages of student loan consolidation is the simplification of the repayment process. By merging multiple loans into a single loan, borrowers only need to manage one monthly payment instead of several. This can reduce stress and make it easier to keep track of payments, which is crucial for maintaining a good credit score.

- Reduced administrative burden: Managing multiple loans can be cumbersome; consolidation streamlines this process.

- Improved budgeting: With only one payment to track, borrowers can more easily budget their finances.

Potentially Lower Monthly Payments

Consolidation often results in lower monthly payments due to extended repayment terms. While this can make immediate financial management easier, it is essential to understand the long-term implications.

- Extended repayment terms: Borrowers may opt for a repayment period of up to 30 years, significantly lowering monthly obligations.

- Increased affordability: Lower payments can free up cash flow for other expenses or investments.

Access to Flexible Repayment Options

Consolidating federal student loans opens up access to various repayment plans that can be tailored to individual financial situations.

- Income-driven repayment plans: These plans adjust monthly payments based on income levels, making them more manageable during financial hardships.

- Graduated repayment plans: Payments start low and increase over time, which can be beneficial for borrowers expecting future income growth.

Fixed Interest Rate Can Provide Stability

When consolidating federal loans, borrowers receive a fixed interest rate based on the weighted average of their existing loans. This stability can be advantageous in fluctuating interest rate environments.

- Protection from rising rates: A fixed rate shields borrowers from potential increases in market rates over time.

- Predictable payments: Fixed rates allow for easier financial planning since monthly payments remain consistent.

Helps in Managing Multiple Loans Effectively

For borrowers juggling various loans from different lenders, consolidation offers a way to consolidate their debts under one lender.

- Single point of contact: Dealing with one lender simplifies communication and reduces confusion regarding payment schedules.

- Easier access to information: All loan information is centralized, making it simpler to track progress and manage repayments.

Can Assist in Avoiding Default Status

For borrowers who are struggling with payments and at risk of defaulting on their loans, consolidation can serve as a lifeline.

- Immediate relief: By consolidating, borrowers can avoid default and regain control over their financial situation.

- Access to deferment options: Consolidation may provide access to deferment or forbearance options that were not previously available.

May Lead to Higher Total Interest Paid

Despite the benefits, one significant drawback of consolidation is the potential for increased overall interest costs.

- Longer repayment terms mean more interest: Extending the repayment period generally results in paying more interest over time.

- Higher total cost of borrowing: While monthly payments may decrease, the total amount paid across the life of the loan could increase significantly.

Loss of Borrower Benefits from Original Loans

Consolidation may result in losing certain borrower benefits associated with original loans, particularly federal ones.

- Loss of interest rate discounts: Some lenders offer discounts that are forfeited upon consolidation.

- Impact on additional perks: Borrowers might lose access to specific benefits like principal reductions or rebates tied to their original loans.

Longer Repayment Period May Extend Debt Duration

While extending the repayment term can lower monthly payments, it also prolongs the duration of debt.

- Increased time in debt: Borrowers may find themselves repaying loans for decades longer than anticipated.

- Financial freedom delayed: A longer repayment period could hinder opportunities such as home ownership or investment in other assets.

Resetting Progress Towards Forgiveness Programs

For those enrolled in forgiveness programs like Public Service Loan Forgiveness (PSLF), consolidating loans may reset progress toward forgiveness.

- Loss of qualifying payments: Payments made prior to consolidation may not count toward forgiveness under new consolidated loans.

- Critical decision-making required: Borrowers must weigh the benefits of consolidation against potential setbacks in their path toward forgiveness.

Unpaid Interest May Be Capitalized into the New Loan

Any unpaid interest on existing loans will typically be added to the principal balance when consolidating.

- Higher principal balance increases costs: This capitalization means that future interest will accrue on a larger amount.

- Compounding effect on debt: Over time, this can significantly increase the total amount owed if not managed carefully.

Not All Loans Can Be Consolidated Together

Borrowers should note that not all types of student loans are eligible for consolidation under federal programs.

- Private vs. federal loans: Federal student loan consolidation does not allow for private loans to be included.

- Strategic planning necessary: Borrowers with mixed loan types must strategize about which loans to consolidate and which to keep separate based on their unique circumstances.

In conclusion, student loan consolidation presents both advantages and disadvantages that require careful consideration. While it offers simplification in managing multiple debts and potential lower monthly payments, it also poses risks such as increased overall interest costs and loss of borrower benefits.

Ultimately, individuals should evaluate their unique financial situations and long-term goals before deciding whether consolidation is the right choice for them. Consulting with a financial advisor or using online resources can provide additional clarity and help borrowers make informed decisions regarding their student loan management strategies.

Frequently Asked Questions About Student Loan Consolidation

- What is student loan consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan with one monthly payment. - Can I consolidate both federal and private student loans?

No, federal student loan consolidation does not allow for private loans to be included; they must be consolidated separately. - Will my interest rate change after consolidating?

Your new interest rate will be a weighted average of your existing rates rounded up slightly; it may not necessarily be lower. - What happens if I have unpaid interest before consolidating?

If you have unpaid interest on your current loans, that amount will typically be added to your principal balance upon consolidation. - Will I lose any benefits by consolidating my federal loans?

Yes, you may lose certain borrower benefits associated with your original federal loans when you consolidate. - How does consolidation affect my progress toward forgiveness programs?

If you consolidate your loans while enrolled in forgiveness programs like PSLF, you may reset your qualifying payment count. - Is there a downside to extending my repayment term through consolidation?

Yes, extending your repayment term can lead to paying more total interest over time and remaining in debt longer. - Can I consolidate my student loans multiple times?

You can only consolidate once unless you include additional eligible loans in a new consolidation.