Target funds, also known as target date funds (TDFs), are investment vehicles designed to simplify the process of saving for retirement or other long-term financial goals. These funds automatically adjust their asset allocation over time, becoming more conservative as the target date approaches. This feature makes them particularly appealing to investors who prefer a hands-off approach to managing their portfolios. However, while target funds offer several advantages, they also come with notable drawbacks that potential investors should consider.

Overview of Target Funds

Target funds are structured to provide a diversified investment strategy that aligns with a specific retirement date or financial goal. They typically invest in a mix of stocks, bonds, and other assets, adjusting the allocation based on the investor’s age and proximity to the target date. This automatic rebalancing is intended to reduce risk as the investor nears their retirement or goal date.

Key Features of Target Funds

- Automatic Rebalancing: The fund’s asset allocation shifts from higher-risk investments (like stocks) to lower-risk investments (like bonds) as the target date approaches.

- Diversification: Target funds invest in various asset classes, which helps spread risk and can enhance overall returns.

- Simplicity: Investors can choose a fund based on their expected retirement date without needing to manage individual investments actively.

Target Audience

Target funds are particularly suitable for individuals who may not have extensive investment knowledge or experience. They cater to those looking for a straightforward investment solution that requires minimal ongoing management.

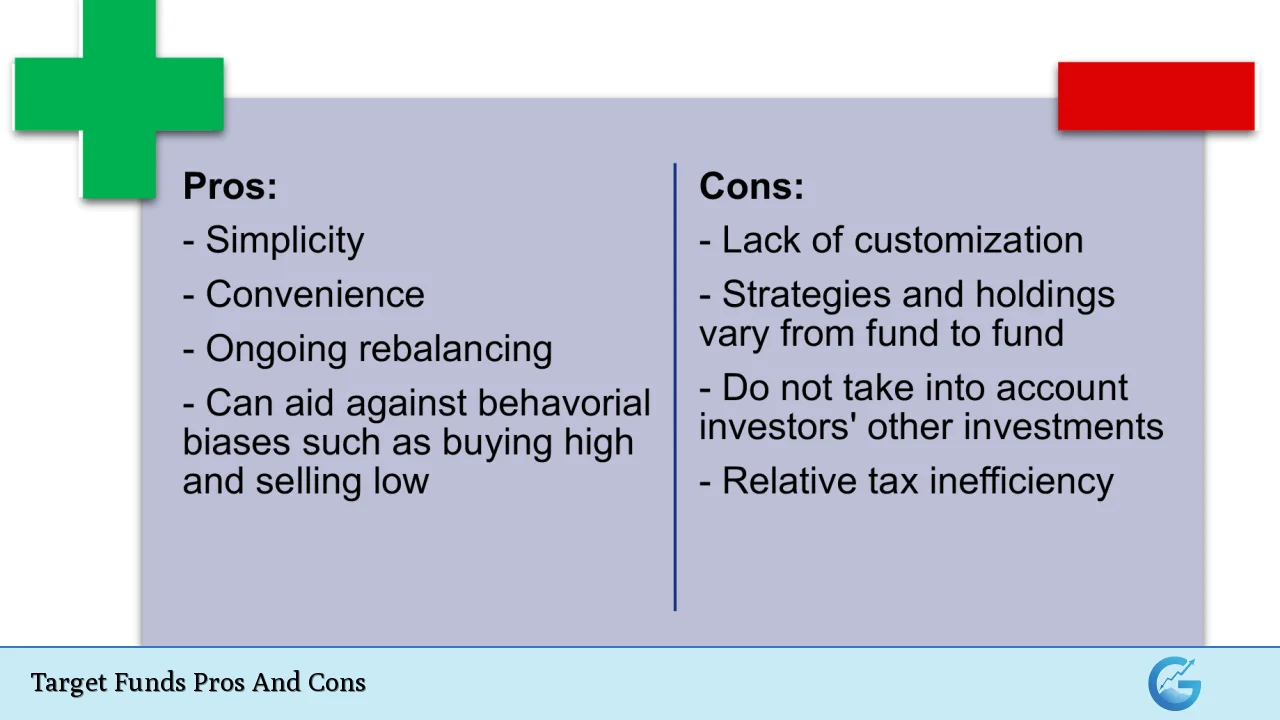

| Pros | Cons |

|---|---|

| Automatic adjustments based on target date | Limited customization options |

| Diversification across various asset classes | Potentially high fees and expenses |

| Simplicity and ease of use | No guaranteed returns |

| Professional management of investments | Risk of becoming too conservative too quickly |

| Helps avoid common investment mistakes | Lack of control over investment decisions |

Advantages of Target Funds

Automatic Adjustments Based on Target Date

One of the most significant advantages of target funds is their automatic adjustment feature. As investors approach their target date—typically retirement—the fund gradually reallocates its assets from higher-risk investments like equities to lower-risk options such as bonds. This strategy aims to protect accumulated wealth as the investor nears the time when they will need to access their funds.

- Benefit: This automatic adjustment reduces the burden on investors to constantly monitor and rebalance their portfolios as they age.

- Example: A 2060 target fund might start with an allocation of 90% in stocks and 10% in bonds, gradually shifting to 40% in stocks and 60% in bonds by 2060.

Diversification Across Various Asset Classes

Target funds typically invest in a broad range of asset classes, including domestic and international stocks, bonds, and cash equivalents. This diversification helps mitigate risks associated with poor performance in any single asset class.

- Benefit: By spreading investments across different asset types, target funds can potentially enhance returns while reducing volatility.

- Example: A well-diversified target fund may include investments in U.S. large-cap stocks, international equities, corporate bonds, and government securities.

Simplicity and Ease of Use

For many investors, especially those new to investing or those who prefer a hands-off approach, target funds offer a simple solution. Investors can select a fund based on their expected retirement year without needing to understand complex investment strategies.

- Benefit: This simplicity makes it easier for individuals to start investing without feeling overwhelmed by choices.

- Example: An investor planning to retire in 2035 can choose a 2035 target fund that automatically adjusts its allocations over time.

Professional Management of Investments

Target funds are managed by professional portfolio managers who make decisions about asset allocation and investment selection based on market conditions and economic forecasts.

- Benefit: Investors benefit from expert management without needing to actively manage their investments themselves.

- Example: Fund managers regularly review and adjust the fund’s holdings to align with its investment strategy and market conditions.

Helps Avoid Common Investment Mistakes

Target funds are designed to help investors avoid common pitfalls associated with retirement planning, such as extreme asset allocations or emotional decision-making during market fluctuations.

- Benefit: The structured approach encourages consistent investing behaviors and reduces the likelihood of making impulsive decisions based on market volatility.

- Example: Research indicates that many young investors tend to be overly conservative or overly aggressive; target funds help mitigate these extremes by following a predetermined glide path.

Disadvantages of Target Funds

Limited Customization Options

While target funds offer a one-size-fits-all solution, this can be a disadvantage for investors with unique financial goals or risk tolerances. The standardized approach may not align perfectly with every investor’s needs.

- Drawback: Investors who prefer specific asset allocations or have particular financial situations may find target funds inadequate.

- Example: An investor nearing retirement who wants a more aggressive portfolio may be restricted by the conservative nature of their chosen target fund as it approaches its target date.

Potentially High Fees and Expenses

Target funds often come with management fees that can vary significantly between different providers. Additionally, since many target funds invest in other mutual funds or ETFs (known as “funds of funds”), investors may incur multiple layers of fees.

- Drawback: High fees can erode overall returns over time, especially if investors could achieve similar results through lower-cost index funds or self-managed portfolios.

- Example: A target fund with an expense ratio of 1% may not seem significant initially but can lead to substantial differences in returns over decades compared to a fund with an expense ratio of 0.2%.

No Guaranteed Returns

Like all investments, target funds carry risks and do not guarantee specific returns. Market fluctuations can impact performance significantly, particularly during economic downturns.

- Drawback: Investors must accept that their retirement savings could decrease in value at any time due to market conditions.

- Example: In times of economic stress, such as during a recession, even conservative-targeted funds can experience significant declines in value.

Risk of Becoming Too Conservative Too Quickly

As a target fund approaches its target date, it reallocates assets toward safer investments like bonds. However, this shift could occur too rapidly for some investors’ preferences or needs for growth during retirement years.

- Drawback: If the fund becomes overly conservative before the investor has fully accessed their savings, it could limit potential growth needed for long-term financial stability.

- Example: An investor retiring at age 65 might find that their fund has shifted too much into bonds by age 62, potentially missing out on equity gains that could enhance their portfolio’s value during retirement years when longevity risk is a concern.

Lack of Control Over Investment Decisions

Investing in a target fund means relinquishing control over specific investment decisions to portfolio managers. For some investors who prefer an active role in managing their portfolios, this lack of control can be frustrating.

- Drawback: Investors may feel disconnected from their investments if they cannot influence how assets are allocated or which securities are selected within the fund.

- Example: An investor concerned about environmental issues may prefer not to invest in certain industries but has no say over the fund’s holdings if they choose a standard target fund without socially responsible investing criteria.

Closing Thoughts

Target funds offer numerous benefits for investors seeking simplicity and professional management while planning for retirement or long-term financial goals. Their automatic adjustments and diversification strategies make them appealing options for many individuals. However, potential drawbacks such as limited customization, fees, and risks associated with market fluctuations must be carefully considered before committing significant assets.

Investors should evaluate their personal circumstances and preferences when deciding whether target funds align with their financial objectives. Overall, while they serve as valuable tools for many investors, understanding both the strengths and weaknesses is crucial for making informed investment choices.

Frequently Asked Questions About Target Funds

- What are target date funds?

Target date funds are mutual funds designed to automatically adjust asset allocations based on an investor’s expected retirement date. - How do I choose a target date fund?

Select a fund whose target date aligns closely with your anticipated retirement year or when you plan to access your savings. - Are there risks associated with target date funds?

Yes, like all investments, they carry risks including market volatility which can impact returns. - Can I customize my investment within a target date fund?

No, these funds follow predetermined asset allocation strategies which limit customization options. - What fees should I expect with target date funds?

Fees vary by provider but typically include management fees; it’s important to compare expense ratios before investing. - Do target date funds guarantee returns?

No investment guarantees returns; performance can vary based on market conditions. - How often do target date funds rebalance?

They rebalance periodically according to the fund’s strategy as it approaches its designated target date. - Should I invest in multiple target date funds?

Generally not recommended; investing in multiple TDFs can complicate your overall asset allocation strategy.