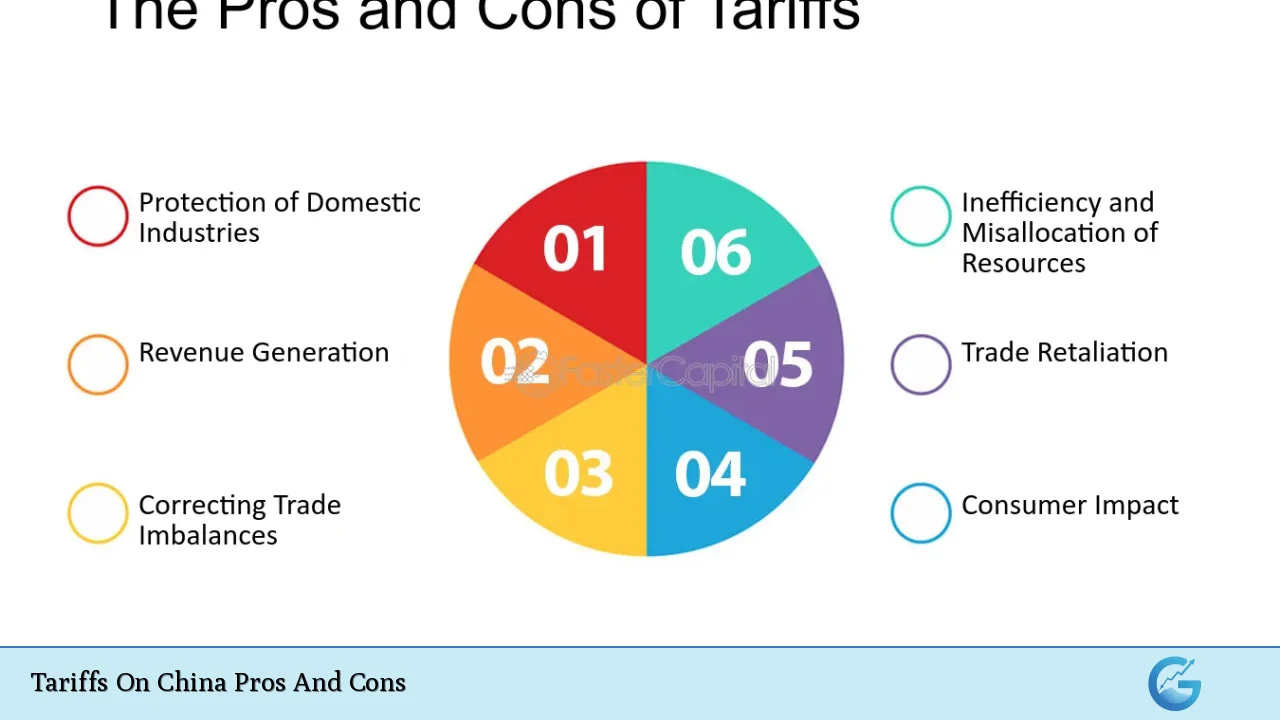

The debate surrounding tariffs on Chinese imports has intensified in recent years, particularly with the prospect of renewed trade tensions under a potential second Trump administration. These trade measures, designed to protect domestic industries and address trade imbalances, have far-reaching implications for the global economy, financial markets, and individual consumers. As investors and financial professionals navigate this complex landscape, it’s crucial to understand both the potential benefits and drawbacks of imposing tariffs on Chinese goods.

| Pros | Cons |

|---|---|

| Protection of domestic industries | Higher consumer prices |

| Increased government revenue | Potential for retaliatory measures |

| Encouragement of domestic manufacturing | Supply chain disruptions |

| Addressing trade imbalances | Economic slowdown |

| Leverage in trade negotiations | Inflationary pressures |

| National security considerations | Reduced market access for U.S. exports |

Protection of Domestic Industries

One of the primary arguments in favor of tariffs on Chinese imports is the protection they offer to domestic industries. By increasing the cost of foreign goods, tariffs can make American-made products more competitive in the domestic market.

- Job preservation: Tariffs can help maintain employment in sectors vulnerable to foreign competition.

- Industrial capacity: Protecting key industries ensures the U.S. maintains critical manufacturing capabilities.

- Reduced dependence: Lessening reliance on Chinese imports can strengthen national economic resilience.

However, this protection may come at the cost of economic efficiency and innovation, potentially leading to higher prices for consumers and reduced competitiveness in global markets.

Higher Consumer Prices

The most immediate and tangible impact of tariffs on Chinese goods is often an increase in prices for American consumers. As importers face higher costs, these are typically passed on to end-users.

- Everyday goods: Products ranging from electronics to clothing may become more expensive.

- Input costs: Higher prices for raw materials and components can increase production costs across various industries.

- Reduced purchasing power: As prices rise, consumers may find their disposable income effectively diminished.

The inflationary effect of tariffs can be particularly challenging in an environment where central banks are already grappling with price stability concerns.

Increased Government Revenue

Tariffs serve as a source of revenue for the federal government, potentially providing funds for various initiatives or deficit reduction.

- Direct income: Duties collected on imported goods contribute to the national treasury.

- Fiscal flexibility: Additional revenue can offer policymakers more options in budgeting and spending decisions.

- Reduced reliance on other taxes: In theory, tariff revenue could offset the need for other forms of taxation.

However, the net fiscal impact of tariffs can be complex, as potential economic slowdowns may reduce other forms of tax revenue.

Potential for Retaliatory Measures

One of the most significant risks associated with imposing tariffs on Chinese goods is the likelihood of retaliatory actions from China and other trading partners.

- Tit-for-tat tariffs: China may respond with its own tariffs on U.S. exports, harming American businesses.

- Escalating trade tensions: Retaliatory measures can lead to a broader trade war, affecting global economic stability.

- Non-tariff barriers: China might employ other means to restrict U.S. business activities, such as regulatory hurdles or licensing restrictions.

The potential for escalation in trade disputes introduces significant uncertainty into global markets, affecting investment decisions and economic forecasts.

Encouragement of Domestic Manufacturing

Proponents argue that tariffs can incentivize companies to relocate production to the United States, boosting domestic manufacturing.

- Reshoring: Higher costs of imports may make domestic production more attractive for some industries.

- Investment in U.S. facilities: Companies may choose to expand or establish new manufacturing operations within the country.

- Supply chain localization: Reduced reliance on foreign suppliers can lead to more resilient domestic supply chains.

While this shift can create jobs and stimulate local economies, it may also lead to higher production costs and reduced global competitiveness for U.S. companies.

Supply Chain Disruptions

The imposition of tariffs can cause significant disruptions to established global supply chains, affecting businesses across various sectors.

- Sourcing challenges: Companies may struggle to find alternative suppliers or face higher costs in doing so.

- Production delays: Adjusting supply chains can lead to temporary shortages and production bottlenecks.

- Inventory management: Uncertainty around tariffs can complicate inventory planning and lead to inefficiencies.

These disruptions can have cascading effects throughout the economy, potentially leading to reduced productivity and economic output.

Addressing Trade Imbalances

Tariffs are often presented as a tool to address persistent trade deficits with China and promote more balanced trade relationships.

- Reduced trade deficit: Higher costs for Chinese imports may decrease the overall trade imbalance.

- Negotiating leverage: Tariffs can serve as a bargaining chip in trade negotiations, potentially leading to more favorable terms.

- Market access: The threat of tariffs may encourage China to open its markets further to U.S. goods and services.

However, economists debate the effectiveness of tariffs in addressing structural trade imbalances, which are influenced by a complex array of factors beyond just pricing.

Economic Slowdown

The broader economic impact of tariffs can include a slowdown in overall economic growth, affecting both the U.S. and global economies.

- Reduced consumer spending: Higher prices can lead to decreased consumption, a key driver of economic growth.

- Business uncertainty: Trade tensions can cause businesses to delay investments and expansion plans.

- Global ripple effects: As two of the world’s largest economies, U.S.-China trade disputes can have far-reaching consequences for global growth.

The potential for tariffs to trigger a broader economic slowdown is a significant concern for investors and policymakers alike.

Leverage in Trade Negotiations

Tariffs can serve as a strategic tool in trade negotiations, providing the U.S. with leverage to address various economic and geopolitical issues with China.

- Intellectual property protection: Tariffs may pressure China to strengthen its IP laws and enforcement.

- Market access: The U.S. can use tariffs to negotiate for greater access to Chinese markets for American companies.

- Geopolitical influence: Trade measures can be used to address broader strategic concerns beyond purely economic issues.

While tariffs can be an effective negotiating tool, they also risk escalating tensions and potentially leading to less cooperative outcomes in the long term.

Inflationary Pressures

The implementation of tariffs on a wide range of Chinese goods can contribute to inflationary pressures in the U.S. economy.

- Cost-push inflation: Higher input costs for businesses can lead to increased prices across various sectors.

- Wage pressures: As the cost of living rises, workers may demand higher wages, further fueling inflation.

- Monetary policy challenges: Increased inflation may prompt the Federal Reserve to adopt a more hawkish stance, potentially slowing economic growth.

The inflationary impact of tariffs can be particularly challenging in an environment where central banks are already grappling with price stability concerns.

National Security Considerations

Proponents of tariffs often cite national security concerns, particularly in relation to critical industries and technologies.

- Strategic industries: Tariffs can help maintain domestic capabilities in sectors deemed crucial for national security.

- Technological independence: Reducing reliance on Chinese technology may mitigate potential security risks.

- Economic security: A strong domestic industrial base is often viewed as essential for overall national security.

However, critics argue that the national security justification for broad tariffs can be overstated and may lead to inefficient economic outcomes.

Reduced Market Access for U.S. Exports

As trade tensions escalate, U.S. companies may face reduced access to the Chinese market, one of the world’s largest and fastest-growing economies.

- Retaliatory tariffs: Chinese tariffs on U.S. goods can make American products less competitive in China.

- Non-tariff barriers: China may implement other measures to restrict U.S. business activities.

- Lost opportunities: U.S. companies may miss out on growth opportunities in the Chinese market.

The potential loss of market share in China can have significant long-term implications for U.S. businesses and the overall economy.

In conclusion, the imposition of tariffs on Chinese imports presents a complex set of trade-offs for policymakers, businesses, and investors. While tariffs may offer short-term protection for certain industries and provide leverage in trade negotiations, they also carry significant risks in terms of economic disruption, inflationary pressures, and potential retaliation. As the global economic landscape continues to evolve, stakeholders in financial markets must carefully weigh these pros and cons, considering both the immediate impacts and long-term strategic implications of trade policies. The ongoing debate surrounding tariffs underscores the intricate relationship between trade, economic growth, and geopolitical dynamics in our increasingly interconnected world.

Frequently Asked Questions About Tariffs On China Pros And Cons

- How do tariffs on Chinese goods affect U.S. stock markets?

Tariffs can create market volatility due to uncertainty about their economic impact. Sectors heavily reliant on Chinese imports or exports to China may see more significant stock price fluctuations. - Can tariffs lead to job creation in the United States?

While tariffs may protect some jobs in import-competing industries, they can also lead to job losses in sectors that rely on Chinese inputs or export to China. The net effect on employment is often debated among economists. - How might tariffs impact the U.S. dollar’s value?

Tariffs can have mixed effects on the dollar. They may strengthen it if they reduce the trade deficit, but could weaken it if they lead to slower economic growth or reduced foreign investment in the U.S. - What industries are most affected by tariffs on Chinese goods?

Industries such as electronics, textiles, and manufacturing are often significantly impacted. However, the effects can ripple through the entire economy, affecting various sectors indirectly. - How do tariffs influence inflation and interest rates?

Tariffs can contribute to inflationary pressures by increasing the cost of goods. This may lead the Federal Reserve to raise interest rates to combat inflation, affecting borrowing costs across the economy. - Can individual investors benefit from tariffs on Chinese goods?

Some investors may find opportunities in domestic companies that benefit from reduced Chinese competition. However, the overall market impact of tariffs is often negative due to increased economic uncertainty. - How do tariffs affect global supply chains?

Tariffs can disrupt established supply chains, forcing companies to seek alternative suppliers or relocate production. This can lead to increased costs and operational challenges for businesses. - What are the long-term economic consequences of sustained tariffs on China?

Prolonged tariffs can lead to reduced economic efficiency, slower technological progress, and potential fragmentation of the global economy. They may also strain diplomatic relations and hinder international cooperation on other issues.