In today’s digital age, tax-preparation software has become an increasingly popular tool for individuals and businesses alike to manage their tax obligations. This comprehensive guide will explore the advantages and disadvantages of using tax-preparation software, providing insights for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Cost-effective | Limited personalization |

| Time-saving | Potential for errors |

| User-friendly interface | Lack of human expertise |

| Automatic updates | Security concerns |

| Access to multiple tax forms | Upselling of premium features |

| Integration with financial accounts | Complexity for unusual tax situations |

| Built-in error checking | Overreliance on software |

| Educational resources | Limited audit support |

Cost-effectiveness

One of the primary advantages of tax-preparation software is its cost-effectiveness compared to hiring a professional tax preparer. This aspect is particularly appealing to individual investors and small business owners who want to maximize their returns while minimizing expenses.

- Lower costs compared to professional tax preparers

- Free versions available for simple tax situations

- Tiered pricing options to suit different needs

For investors in cryptocurrency and forex markets, the cost savings can be significant, especially when dealing with multiple transactions and complex calculations. Many tax-preparation software options offer specialized features for these markets, allowing users to import transaction data directly from exchanges and calculate capital gains accurately.

Time-saving

In the fast-paced world of finance and investing, time is a valuable commodity. Tax-preparation software offers a significant advantage in this regard, streamlining the tax filing process and reducing the time spent on paperwork.

- Automated data entry from previous years

- Quick import of financial information from various sources

- Guided interview process for efficient information gathering

For traders and investors who deal with high-frequency transactions, the time-saving aspect of tax-preparation software can be particularly beneficial. Automated import features can save hours of manual data entry, allowing more time for market analysis and trading activities.

User-friendly Interface

Most tax-preparation software is designed with user experience in mind, offering intuitive interfaces that guide users through the tax filing process step by step. This feature is especially valuable for those who may not have extensive knowledge of tax laws or accounting principles.

- Clear, step-by-step instructions

- Visual representations of tax data

- Progress tracking throughout the filing process

The user-friendly nature of these software solutions makes them accessible to a wide range of users, from novice investors to experienced traders. This accessibility can empower individuals to take control of their tax obligations without relying on expensive professional services.

Automatic Updates

Tax laws and regulations are constantly evolving, particularly in emerging areas such as cryptocurrency taxation. Tax-preparation software offers the advantage of automatic updates to reflect these changes, ensuring users have access to the most current information.

- Real-time updates to tax forms and calculations

- Incorporation of new tax laws and regulations

- Alerts for relevant tax changes affecting the user’s situation

For those involved in international forex trading or investing in global markets, staying compliant with changing tax regulations across different jurisdictions can be challenging. Automatic updates in tax-preparation software can help mitigate this risk by providing up-to-date information and guidance.

Access to Multiple Tax Forms

Tax-preparation software typically provides access to a wide range of tax forms, catering to various financial situations and investment activities. This comprehensive coverage is particularly valuable for those with diverse investment portfolios or multiple income streams.

- Availability of forms for different types of income and deductions

- Specialized forms for cryptocurrency and forex trading

- State-specific tax forms for multi-state filers

For investors dealing with complex financial instruments or engaging in cross-border transactions, having access to the right tax forms is crucial for accurate reporting and compliance. Tax-preparation software can simplify this process by automatically selecting and populating the necessary forms based on the user’s input.

Integration with Financial Accounts

Many tax-preparation software solutions offer integration capabilities with various financial accounts, including bank accounts, investment platforms, and cryptocurrency exchanges. This feature streamlines the data collection process and improves accuracy.

- Direct import of financial data from banks and brokerages

- Automatic categorization of income and expenses

- Real-time synchronization with financial accounts

For active traders and investors, this integration can significantly reduce the time and effort required to compile tax-relevant information, especially when dealing with high-volume transactions in forex or cryptocurrency markets.

Built-in Error Checking

One of the key advantages of tax-preparation software is its ability to perform automatic error checks throughout the filing process. This feature helps identify potential mistakes or inconsistencies that could lead to issues with tax authorities.

- Real-time flagging of potential errors or discrepancies

- Consistency checks across different sections of the tax return

- Alerts for missing information or unusual entries

For investors dealing with complex financial transactions or multiple income sources, the built-in error checking can provide an additional layer of assurance and help avoid costly mistakes or potential audits.

Educational Resources

Many tax-preparation software packages include educational resources to help users understand tax concepts and make informed decisions. This can be particularly valuable for those new to investing or dealing with unfamiliar tax situations.

- In-depth explanations of tax terms and concepts

- Guidance on maximizing deductions and credits

- Updates on tax law changes relevant to investors

These educational resources can empower users to make more informed financial decisions and develop a better understanding of the tax implications of their investment activities.

Limited Personalization

Despite the many advantages, tax-preparation software has its limitations. One significant drawback is the limited ability to personalize the tax filing process for unique or complex situations.

- Difficulty in addressing unusual tax scenarios

- Limited flexibility for creative tax planning strategies

- Potential for missed deductions or credits in complex cases

For high-net-worth individuals or those with intricate investment structures, the lack of personalization in tax-preparation software may result in suboptimal tax outcomes. In such cases, consulting with a tax professional may be necessary to ensure all aspects of the tax situation are properly addressed.

Potential for Errors

While tax-preparation software includes error-checking features, there is still potential for mistakes, especially when users input incorrect information or misinterpret questions.

- Risk of data entry errors

- Misinterpretation of tax rules or software prompts

- Overlooking relevant information due to software limitations

For investors dealing with complex financial instruments or engaging in sophisticated trading strategies, the risk of errors may be higher due to the software’s potential limitations in handling nuanced tax situations.

Lack of Human Expertise

One of the most significant disadvantages of tax-preparation software is the absence of personalized advice from a tax professional. This can be particularly problematic for those with complex financial situations or unique tax challenges.

- Limited ability to provide strategic tax planning advice

- Lack of context-specific interpretation of tax laws

- Inability to address nuanced questions or concerns

For investors in emerging markets like cryptocurrency or those engaged in complex forex trading strategies, the lack of human expertise can be a significant drawback, as these areas often require specialized knowledge and interpretation of evolving tax regulations.

Security Concerns

As with any digital tool handling sensitive financial information, tax-preparation software comes with inherent security risks. Users must be vigilant about protecting their personal and financial data.

- Risk of data breaches or unauthorized access

- Potential for identity theft or financial fraud

- Concerns about data storage and retention policies

For investors dealing with large sums or sensitive financial information, the security risks associated with tax-preparation software may outweigh the convenience, necessitating additional precautions or alternative filing methods.

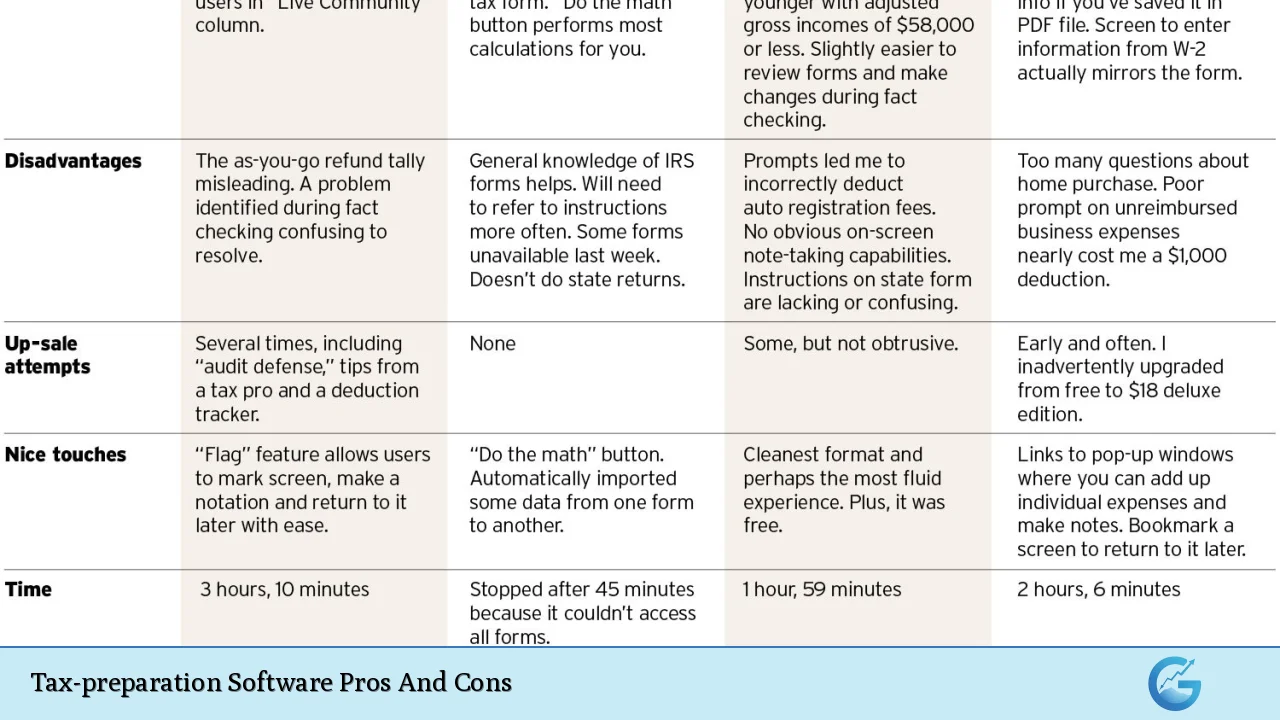

Upselling of Premium Features

Many tax-preparation software providers offer basic versions for free or at low cost, but often upsell premium features or additional services. This can lead to unexpected costs and frustration for users.

- Pressure to upgrade to more expensive versions

- Hidden fees for certain forms or features

- Aggressive marketing of add-on services

Investors should be cautious of these upselling tactics and carefully evaluate whether premium features are necessary for their specific tax situation.

Complexity for Unusual Tax Situations

While tax-preparation software can handle most common tax scenarios, it may struggle with unusual or highly complex situations. This limitation can be particularly problematic for investors with diverse portfolios or unique financial arrangements.

- Difficulty in handling complex investment structures

- Limited support for international tax issues

- Challenges in addressing industry-specific tax rules

For investors involved in cutting-edge financial products or operating in multiple jurisdictions, the complexity of their tax situation may exceed the capabilities of standard tax-preparation software.

Overreliance on Software

There’s a risk that users may become overly dependent on tax-preparation software, potentially leading to a lack of understanding of their tax situation or missed opportunities for tax planning.

- Reduced engagement with personal tax knowledge

- Potential for missed tax-saving opportunities

- Difficulty in identifying software errors or limitations

Investors should strive to maintain a basic understanding of tax principles and actively engage in the tax preparation process, even when using software, to ensure optimal financial outcomes.

Limited Audit Support

While many tax-preparation software packages offer some level of audit support, it is often limited compared to the assistance provided by a professional tax preparer.

- Restricted representation in case of an audit

- Limited guidance on responding to IRS inquiries

- Potential additional costs for comprehensive audit support

For investors in high-risk sectors or those with complex financial arrangements, the limited audit support provided by tax-preparation software may be insufficient to address potential scrutiny from tax authorities.

In conclusion, tax-preparation software offers numerous advantages for investors and financial professionals, including cost-effectiveness, time savings, and user-friendly interfaces. However, it also comes with limitations such as reduced personalization, potential for errors, and limited expertise in complex situations. When deciding whether to use tax-preparation software, individuals should carefully consider their specific financial circumstances, the complexity of their investments, and their comfort level with managing their own tax obligations. For those with straightforward tax situations, the benefits of tax-preparation software often outweigh the drawbacks. However, investors with complex portfolios, international holdings, or unique tax challenges may find that a combination of software and professional advice yields the best results.

Frequently Asked Questions About Tax-preparation Software Pros And Cons

- Is tax-preparation software suitable for cryptocurrency investors?

Yes, many tax-preparation software options now include features specifically for cryptocurrency transactions. However, complex situations may require additional expertise. - Can tax-preparation software handle international investments?

Most software can handle basic international investments, but complex cross-border transactions or foreign tax credit calculations may require professional assistance. - How secure is my financial data when using tax-preparation software?

Reputable tax-preparation software uses encryption and security measures to protect user data. However, users should also take precautions like using strong passwords and secure networks. - Does tax-preparation software guarantee accuracy?

While most software offers accuracy guarantees, they typically only cover calculation errors, not errors resulting from incorrect user input or misinterpretation of tax laws. - Can I use tax-preparation software for both personal and business taxes?

Many tax-preparation software packages offer versions for both personal and business taxes, but separate products may be required for more complex business structures. - How does tax-preparation software handle state-specific tax laws?

Most software includes state-specific modules that account for different tax laws and forms across various jurisdictions. - Is it possible to import data from previous years when switching to a new tax-preparation software?

Many software options allow for importing data from previous years, even from different providers, but the process may vary in complexity and completeness. - What level of customer support can I expect from tax-preparation software providers?

Support levels vary by provider and package, ranging from basic email support to live chat and phone assistance. Premium versions often offer more comprehensive support options.