Tax preparation software has transformed the way individuals and businesses handle their tax filings. With the increasing complexity of tax regulations and the growing number of financial instruments like cryptocurrencies and forex, many taxpayers are turning to software solutions to simplify their tax preparation process. This article explores the advantages and disadvantages of using tax preparation software, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Cost-effective compared to hiring a tax professional | May not accommodate complex tax situations effectively |

| User-friendly interfaces streamline the filing process | Potential for hidden fees with advanced features |

| Real-time calculations reduce errors | Limited personalized support compared to professionals |

| Accessible from anywhere with an internet connection | Security risks associated with online data submission |

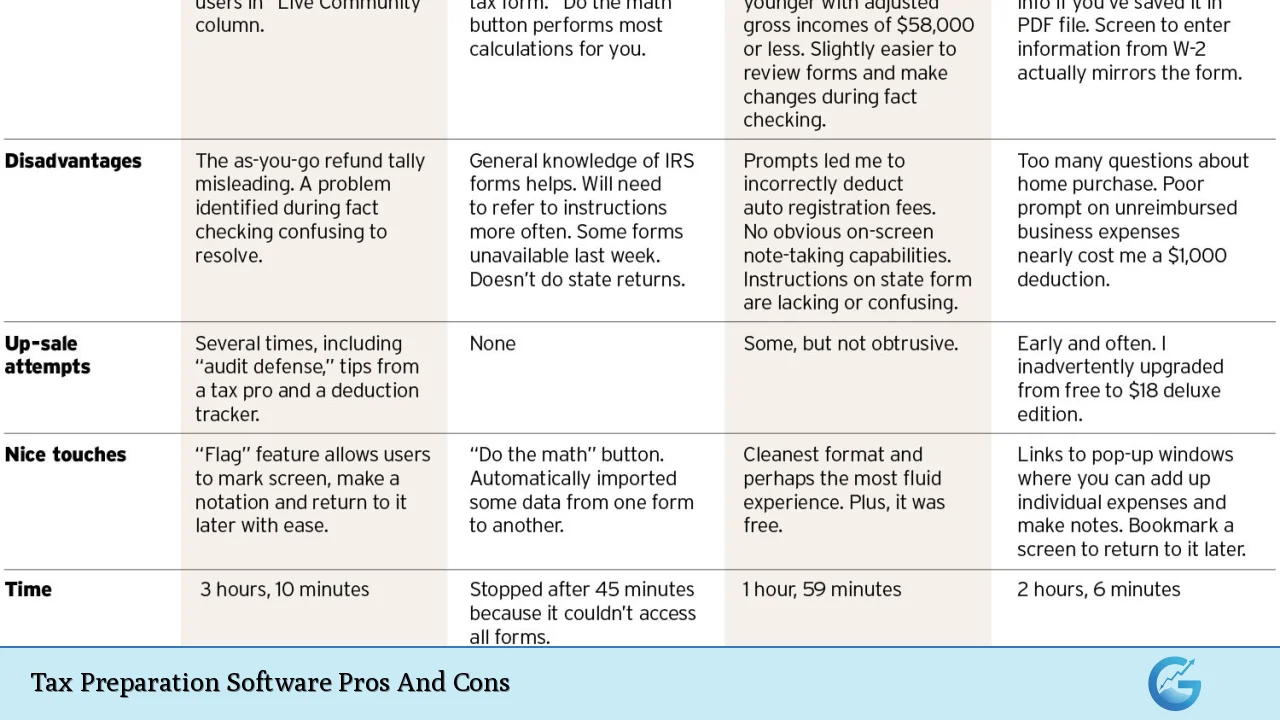

| Automatic updates ensure compliance with current tax laws | Some software may upsell unnecessary features |

| Ability to import financial data from various sources | Learning curve for new users unfamiliar with tax laws |

| Convenient tracking of refunds and payments | May miss deductions without thorough user knowledge |

Cost-Effective Compared to Hiring a Tax Professional

One of the most significant advantages of using tax preparation software is its cost-effectiveness. Hiring a certified public accountant (CPA) or a tax professional can be expensive, especially for individuals with straightforward tax situations.

- Affordability: Many software options offer free basic services or low-cost plans that cater to simple tax returns.

- Variety of Pricing Tiers: Most providers have multiple pricing tiers based on the complexity of your return, allowing users to select a plan that fits their needs without overspending.

However, it’s essential to consider that while the initial costs are lower, users with more complex financial situations may find themselves needing to pay for additional features or higher-tier plans.

User-Friendly Interfaces Streamline the Filing Process

Tax preparation software is designed with user-friendliness in mind. Most programs utilize an interview-style format that guides users through the filing process step-by-step.

- Intuitive Design: Users can easily navigate through various sections, inputting information as prompted.

- Data Entry Automation: Many programs allow users to import data directly from financial institutions, reducing manual entry errors.

Despite these conveniences, individuals unfamiliar with technology may still experience challenges navigating the software effectively.

Real-Time Calculations Reduce Errors

Another notable benefit is the real-time calculation feature that many tax preparation tools offer. This capability helps ensure accuracy throughout the filing process.

- Immediate Feedback: As users enter information, they can see how it affects their overall tax liability or refund amount.

- Error Detection: Most software includes built-in checks that flag potential errors before submission.

However, reliance on automated calculations can lead some users to overlook nuances in their financial situations that could affect their taxes.

Accessible from Anywhere with an Internet Connection

The rise of cloud-based tax preparation software allows users to access their accounts from anywhere at any time.

- Flexibility: Users can work on their taxes from home, work, or even while traveling, provided they have internet access.

- Multiple Device Compatibility: Many platforms are compatible across devices, including smartphones and tablets.

On the downside, this accessibility raises concerns about data security and privacy when using public Wi-Fi networks.

Automatic Updates Ensure Compliance with Current Tax Laws

Tax laws are subject to frequent changes, and keeping up can be challenging. Tax preparation software typically includes automatic updates that ensure users are compliant with the latest regulations.

- Peace of Mind: Users can file their taxes knowing they are adhering to current laws without needing to research changes manually.

- Year-Round Support: Many providers offer resources and updates throughout the year to assist users beyond just tax season.

However, not all updates may be communicated effectively to users, potentially leading to misunderstandings about new features or requirements.

Ability to Import Financial Data from Various Sources

Modern tax preparation software often allows users to import financial data directly from banks and investment platforms.

- Efficiency: This feature saves time by minimizing manual data entry and reducing errors associated with transcribing numbers.

- Comprehensive Overview: Users can see all their financial information in one place, making it easier to understand their overall tax situation.

Nevertheless, this feature may not be available for all types of transactions or financial institutions, which can limit its usefulness for some users.

Convenient Tracking of Refunds and Payments

Many tax preparation platforms provide tools for tracking refunds and payments throughout the filing process.

- Transparency: Users can monitor the status of their returns and refunds in real-time.

- Alerts: Some software sends notifications regarding important deadlines or changes in status.

However, relying too heavily on these tools may lead some users to overlook critical actions they need to take regarding their filings.

May Not Accommodate Complex Tax Situations Effectively

While many individuals benefit from using tax preparation software, those with complex financial situations may find limitations in these tools.

- Complex Returns: Individuals who own businesses or have multiple income streams may require more personalized assistance than what software can provide.

- Limited Customization: Some programs may not offer sufficient flexibility for unique circumstances that require tailored solutions.

In such cases, consulting a professional might be more beneficial despite the higher cost involved.

Potential for Hidden Fees with Advanced Features

Many tax preparation software options advertise low starting prices but may include hidden fees for additional features or services.

- Upselling Tactics: Users might find themselves prompted to purchase add-ons they do not need during the filing process.

- Unexpected Costs: As users progress through their returns, they may encounter charges for e-filing or accessing specific forms not included in basic packages.

This unpredictability can lead to frustration and dissatisfaction among users who thought they were opting for a budget-friendly solution.

Limited Personalized Support Compared to Professionals

While many tax preparation platforms offer customer support via chat or email, it often lacks the personalized touch provided by human professionals.

- Automated Assistance: Some platforms rely heavily on AI-driven support systems that might not understand nuanced questions.

- Response Times: Users may experience delays in receiving help during peak filing seasons when demand is high.

For those who prefer direct interaction or have specific questions about their finances, this limitation can be a significant drawback.

Security Risks Associated with Online Data Submission

Submitting sensitive financial information online carries inherent risks.

- Data Breaches: Cybersecurity threats can compromise personal information if proper safeguards are not in place.

- Phishing Scams: Users must be vigilant against fraudulent websites posing as legitimate tax prep services.

To mitigate these risks, it’s crucial for users to choose reputable providers that prioritize security measures such as encryption and two-factor authentication.

Some Software May Upsell Unnecessary Features

As mentioned earlier, many software programs use upselling techniques that can lead users into purchasing features they do not need.

- Confusing Options: The variety of plans and add-ons can overwhelm new users who might not fully understand what they require.

- Pressure Tactics: Some platforms might encourage upgrades at critical points in the filing process when users feel pressured to complete their returns quickly.

This practice can detract from an otherwise positive user experience if individuals feel misled about what they need versus what they are being sold.

Learning Curve for New Users Unfamiliar with Tax Laws

For individuals who are new to filing taxes or unfamiliar with specific regulations, there is often a learning curve associated with using tax preparation software.

- Educational Resources: Many platforms offer tutorials and guides; however, these resources might not cover every user’s unique situation comprehensively.

- Complex Terminology: The language used within the software may confuse those without prior knowledge of tax-related terms or concepts.

This challenge highlights the importance of ensuring that users take time to familiarize themselves with both the software interface and relevant tax laws before beginning their filings.

May Miss Deductions Without Thorough User Knowledge

Tax preparation software is only as effective as its user’s understanding of their financial situation.

- Knowledge Gaps: Users unfamiliar with potential deductions might overlook opportunities for savings simply because they do not know what questions to answer correctly.

- Generic Questions: While many programs prompt users about common deductions, they cannot account for every individual circumstance that could yield savings.

Thus, individuals should approach using these tools as a supplement rather than a substitute for understanding their own finances thoroughly.

In conclusion, while tax preparation software offers numerous advantages such as cost savings, user-friendly interfaces, and real-time calculations, it also presents significant challenges including limitations on handling complex situations effectively and potential security risks. Understanding both sides will help taxpayers make informed decisions about whether these tools align with their unique needs during tax season.

Frequently Asked Questions About Tax Preparation Software

- What is tax preparation software?

Tax preparation software is a digital tool designed to help individuals prepare and file their taxes by guiding them through various questions related to income and deductions. - Is it cheaper than hiring a professional?

Generally yes; most tax prep software options are more affordable than hiring a CPA or professional service. - Can I use it for complex taxes?

While some advanced programs cater to complex situations, many standard options may struggle with intricate returns. - Are my financial details safe?

The safety of your data depends on the provider’s security measures; always choose reputable services. - Do I get support when using these programs?

Support varies by provider; while many offer customer service options, it may not match the personalized assistance from a professional. - Can I file my taxes for free?

Yes; several platforms provide free versions for simple returns based on income levels. - What happens if I make an error using the software?

If you make an error after filing electronically through software, you typically need to file an amended return. - How do I choose the right software?

Select based on your specific needs—consider factors like complexity of your return, required features, and budget.