Tax yield investing, particularly through mechanisms like tax lien certificates, offers a unique approach to generating income while navigating the complexities of taxation. This investment strategy involves purchasing liens placed on properties due to unpaid taxes, allowing investors to earn interest on the owed amounts or potentially acquire the property itself if the debt remains unpaid. Understanding the advantages and disadvantages of tax yield investing is crucial for anyone looking to incorporate this strategy into their financial portfolio.

| Pros | Cons |

|---|---|

| High potential returns | Risk of property devaluation |

| Low initial investment | Complex legal landscape |

| Predictable income stream | Time-consuming research required |

| Diversification opportunities | Potential for foreclosure complications |

| Support for local governments | Limited liquidity in some cases |

| Tax advantages in certain scenarios | Market volatility impacts returns |

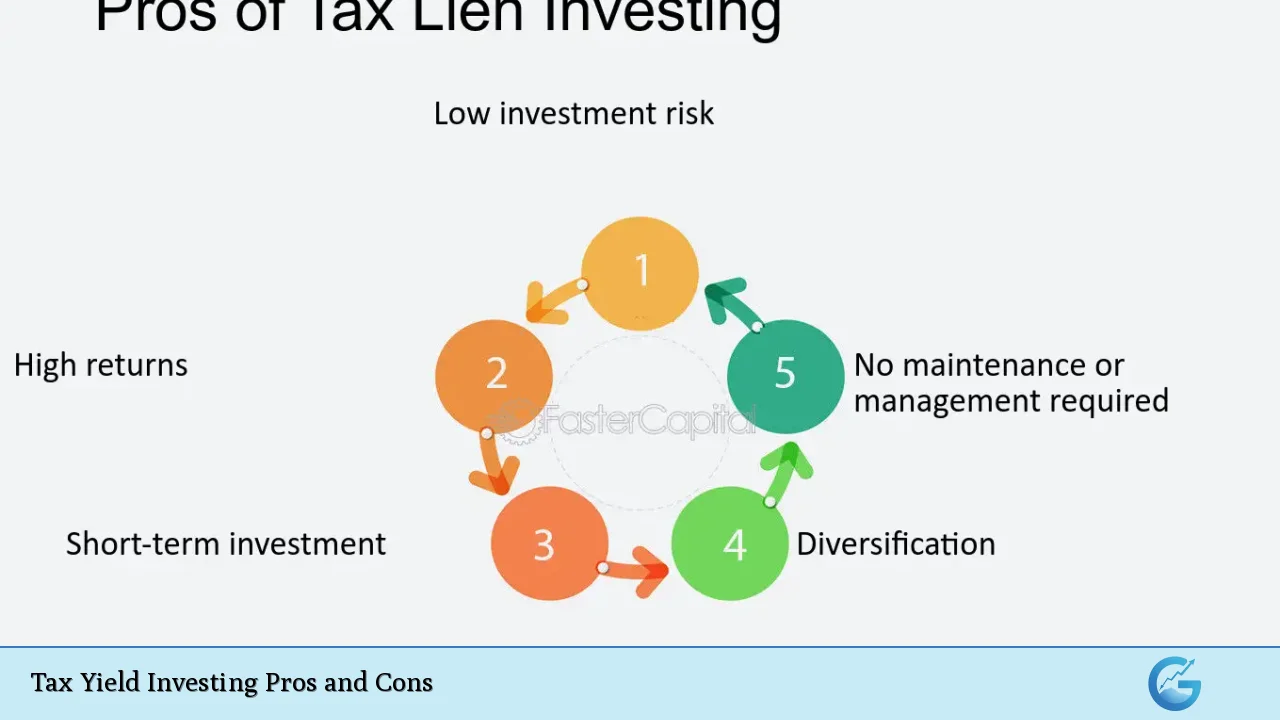

High Potential Returns

One of the most attractive aspects of tax yield investing is the potential for high returns.

- Interest rates on tax liens can range from 5% to as high as 24%, depending on state laws.

- Investors can earn returns that significantly outpace traditional investments like savings accounts or even some stocks.

- The predictability of these returns can be appealing, as investors know in advance what interest they will earn if the lien is paid.

Low Initial Investment

Tax lien certificates often require a relatively low initial investment compared to other real estate investments.

- Many tax liens can be purchased for a few hundred dollars, making them accessible to a broader range of investors.

- This low barrier to entry allows investors to diversify their portfolios without committing substantial capital upfront.

- It also enables new investors to gain experience in real estate investing without significant financial risk.

Predictable Income Stream

Tax yield investments can provide a reliable income stream.

- The interest rates are typically fixed, allowing investors to forecast their earnings accurately.

- This predictability can assist in financial planning and budgeting, as investors can anticipate when they will receive payments.

- In some cases, if the property owner fails to pay their taxes, investors may eventually acquire the property, leading to further potential gains.

Diversification Opportunities

Investing in tax liens allows for diversification within an investment portfolio.

- Investors can purchase liens from various jurisdictions, spreading their risk across different markets and properties.

- This diversification can help mitigate risks associated with economic downturns affecting specific regions or property types.

- By diversifying, investors can enhance their overall portfolio stability and performance.

Support for Local Governments

Investing in tax liens contributes positively to local communities.

- When investors purchase tax liens, they help local governments collect overdue taxes that fund essential services such as education, infrastructure, and public safety.

- This investment strategy not only benefits the investor but also supports community development and maintenance.

- By participating in this market, investors play a role in promoting fiscal responsibility among property owners.

Tax Advantages in Certain Scenarios

Certain tax yield investments may offer unique tax benefits.

- Depending on the investor’s jurisdiction and specific circumstances, there may be opportunities for tax deductions related to investment expenses or losses.

- Understanding local tax laws can help investors maximize their after-tax returns through strategic planning.

- Tax-exempt municipal bonds are another form of tax yield investment that can provide income without federal taxation.

Risk of Property Devaluation

Despite the potential benefits, there are significant risks associated with tax yield investing.

- The value of properties tied to unpaid taxes can fluctuate dramatically based on market conditions.

- If a property is devalued significantly before an investor can collect on a lien or acquire it through foreclosure, they may face substantial financial losses.

- Investors must conduct thorough due diligence on properties before purchasing liens to mitigate this risk.

Complex Legal Landscape

The legal framework governing tax lien investing can be complicated and varies by state.

- Each jurisdiction has its own rules regarding how liens are sold and redeemed, which can create confusion for inexperienced investors.

- Failure to understand these laws could result in lost investments or legal complications during the redemption process.

- Engaging with legal professionals or experienced investors is often necessary to navigate this landscape effectively.

Time-consuming Research Required

Successful tax yield investing demands extensive research and due diligence.

- Investors need to evaluate properties thoroughly before purchasing liens, including understanding their condition and market value.

- This research process can be time-consuming and requires access to reliable data sources about local real estate markets.

- Without proper research, investors may inadvertently purchase liens on properties that are unlikely to yield returns or are encumbered by additional debts.

Potential for Foreclosure Complications

While acquiring property through foreclosure may seem appealing, it comes with its own set of challenges.

- If a lienholder must foreclose on a property due to non-payment of taxes, they may encounter complications such as existing mortgages or other liens that take precedence over their claim.

- The foreclosure process can be lengthy and costly, potentially eroding any profits from the initial investment.

- Investors must be prepared for the possibility that they might not gain clear title to a property even after successfully foreclosing on it.

Limited Liquidity in Some Cases

Tax lien investments may not offer immediate liquidity compared to other asset classes.

- Unlike stocks or bonds that can be sold quickly on exchanges, selling tax lien certificates often requires finding a buyer willing to purchase them at an acceptable price.

- This lack of liquidity means that investors might have their capital tied up for extended periods while waiting for interest payments or redemption from property owners.

- Investors should consider their liquidity needs before committing significant funds to this type of investment.

Market Volatility Impacts Returns

The real estate market is inherently volatile, which can affect tax yield investments.

- Economic downturns may lead to increased rates of property tax delinquency as homeowners struggle financially.

- While this could present more opportunities for purchasing liens at lower prices, it also increases the risk that many properties will not be redeemed due to ongoing economic challenges.

- Investors must remain vigilant about market trends and adjust their strategies accordingly.

In conclusion, tax yield investing offers both significant opportunities and considerable risks. While the potential for high returns and low initial investments makes it an attractive option for many investors, understanding the complexities involved is crucial. Thorough research, awareness of legal implications, and careful consideration of market conditions are essential steps in successfully navigating this investment strategy. As with any investment decision, weighing these pros and cons carefully will help individuals make informed choices aligned with their financial goals.

Frequently Asked Questions About Tax Yield Investing

- What is tax yield investing?

Tax yield investing involves purchasing tax liens placed on properties due to unpaid taxes. Investors earn interest on these debts or potentially acquire properties if owners fail to pay. - How do I start investing in tax liens?

To start investing in tax liens, research local laws regarding tax lien sales and auctions. Attend auctions or use online platforms where municipalities sell these certificates. - What are typical returns from tax lien investments?

Returns vary by state but typically range from 5% to 24%, depending on local regulations and bidding processes. - Are there risks associated with tax lien investing?

Yes, risks include potential property devaluation, complex legal issues, and challenges related to foreclosure processes. - Can I lose money with tax lien investments?

It is possible to lose money if you invest in liens tied to properties that decline in value or face other encumbrances. - How long do I have to wait for returns?

The time frame varies; some properties may redeem quickly while others could take years before yielding returns. - Do I need special knowledge or training?

While not mandatory, having knowledge about real estate markets and local laws significantly enhances your chances of success. - Is it possible to sell my tax lien certificates?

You can sell your certificates; however, finding buyers may take time due to limited liquidity compared to other investments.