Treasury bonds (T-bonds) are long-term debt securities issued by the U.S. Department of the Treasury. They are designed to raise funds for government spending and are considered one of the safest investments available due to their backing by the full faith and credit of the U.S. government. T-bonds have maturities ranging from 20 to 30 years and pay interest every six months. While they offer a reliable source of income, they also come with certain risks and limitations. This article delves into the advantages and disadvantages of investing in Treasury bonds, providing a comprehensive overview for potential investors.

| Pros | Cons |

|---|---|

| Steady income stream through fixed interest payments | Lower returns compared to other investment options |

| Considered a risk-free investment backed by the U.S. government | Inflation risk can erode purchasing power |

| High liquidity allows for easy buying and selling in secondary markets | Interest rate risk can lead to capital losses if sold before maturity |

| Tax advantages, as interest is exempt from state and local taxes | Potentially lower yield in a rising interest rate environment |

| Diversification benefits for an investment portfolio | Long maturity can tie up capital for extended periods |

Steady Income Stream Through Fixed Interest Payments

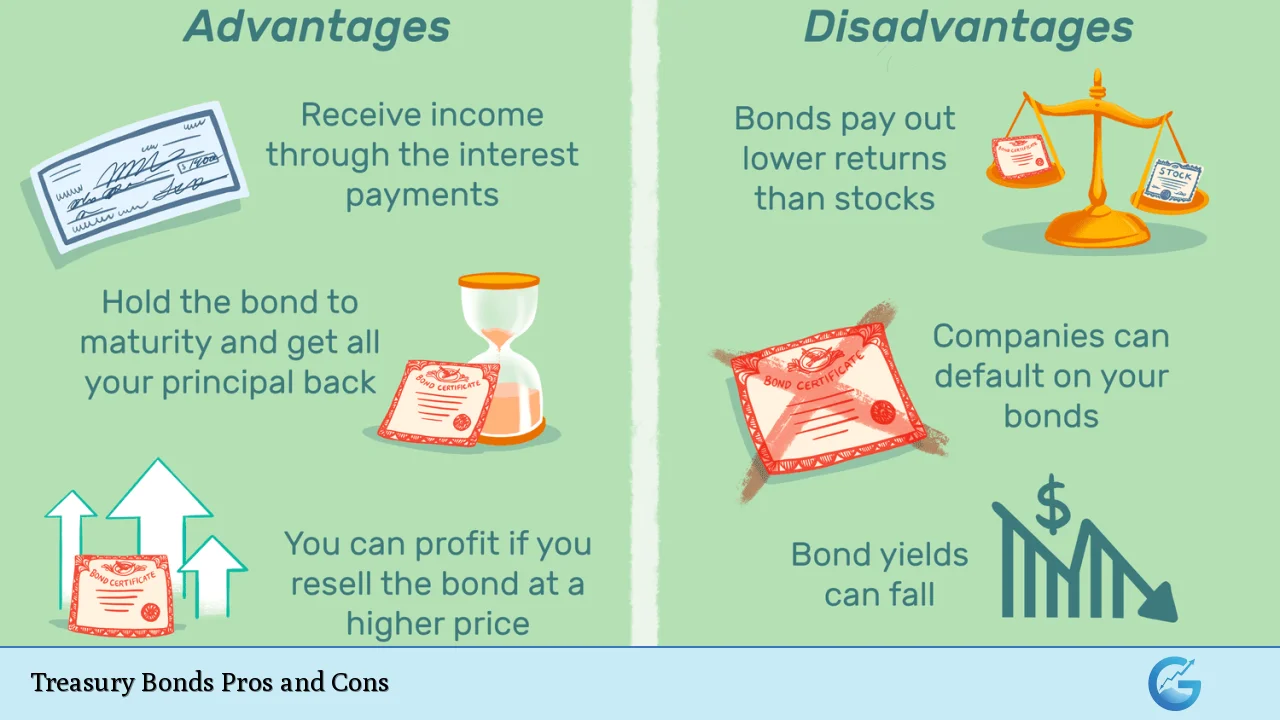

One of the primary advantages of Treasury bonds is their ability to provide a steady income stream. Investors receive fixed interest payments every six months until maturity, which can be particularly appealing for those seeking predictable cash flow.

- Regular Income: T-bonds pay interest semiannually, allowing investors to plan their finances effectively.

- Long-Term Security: The fixed nature of these payments provides assurance against market volatility, making them suitable for conservative investors.

Considered a Risk-Free Investment Backed by the U.S. Government

Treasury bonds are often labeled as “risk-free” investments because they are backed by the U.S. government. This backing significantly reduces the likelihood of default.

- Government Guarantee: Investors are assured that they will receive their principal back at maturity, assuming they hold the bond until then.

- Creditworthiness: The U.S. government’s strong credit rating enhances investor confidence in T-bonds.

High Liquidity Allows for Easy Buying and Selling in Secondary Markets

Another significant advantage is the liquidity of Treasury bonds. They can be easily bought or sold in secondary markets, providing flexibility to investors.

- Market Accessibility: Investors can quickly liquidate their holdings if needed without facing significant barriers.

- Active Trading: The robust market for T-bonds ensures that there are usually buyers available, which helps maintain liquidity.

Tax Advantages

Investing in Treasury bonds comes with certain tax benefits that can enhance overall returns.

- State and Local Tax Exemption: Interest earned on T-bonds is exempt from state and local taxes, which can be beneficial for investors residing in high-tax jurisdictions.

- Federal Taxation: While interest is subject to federal income tax, this exemption from state taxes provides a net advantage.

Diversification Benefits for an Investment Portfolio

Incorporating Treasury bonds into an investment portfolio can help mitigate risk through diversification.

- Risk Management: T-bonds typically have low correlation with equities, which can reduce overall portfolio volatility.

- Balance Against Riskier Assets: Including T-bonds allows investors to balance higher-risk investments with stable returns.

Lower Returns Compared to Other Investment Options

Despite their many benefits, one of the main drawbacks of Treasury bonds is their relatively low returns when compared to other investment vehicles such as stocks or corporate bonds.

- Opportunity Cost: Investors may miss out on higher yields available from equities or other fixed-income securities.

- Fixed Rates: The fixed interest rates on T-bonds often do not keep pace with inflation or other investment opportunities.

Inflation Risk Can Erode Purchasing Power

Inflation poses a significant risk to investors holding Treasury bonds, as it can diminish the purchasing power of fixed interest payments over time.

- Real Returns: If inflation rates exceed the bond’s interest rate, the real return (adjusted for inflation) could be negative.

- Long-Term Impact: Given the long maturities of T-bonds, inflationary pressures could significantly affect overall returns over time.

Interest Rate Risk Can Lead to Capital Losses if Sold Before Maturity

Interest rate fluctuations present another challenge for Treasury bond investors. If market interest rates rise, existing bonds with lower rates may lose value in secondary markets.

- Market Value Decline: Selling a T-bond before maturity in a rising rate environment could result in capital losses.

- Investment Timing: Investors must carefully consider market conditions when deciding whether to hold or sell their bonds.

Potentially Lower Yield in a Rising Interest Rate Environment

In an environment where interest rates are increasing, new issues of Treasury bonds may offer higher yields than existing ones. This can lead to lower demand for older bonds.

- Yield Curve Dynamics: As newer bonds become more attractive due to higher yields, older bonds may depreciate in value.

- Reinvestment Risk: Investors may face challenges reinvesting proceeds from maturing bonds at comparable rates if rates have risen significantly.

Long Maturity Can Tie Up Capital for Extended Periods

The long-term nature of T-bonds (20 to 30 years) means that investors may have limited access to their capital during this time frame.

- Liquidity Constraints: While T-bonds are liquid, selling them before maturity may not always be favorable due to market conditions.

- Financial Planning Considerations: Investors must consider their financial needs over the long term when committing funds to T-bonds.

In conclusion, Treasury bonds offer a unique combination of safety, steady income, and tax advantages that make them attractive options for conservative investors seeking stability within their portfolios. However, potential buyers should also weigh the downsides such as lower returns compared to other investments, inflation risks, and exposure to interest rate fluctuations. Understanding these pros and cons is essential for making informed investment decisions regarding Treasury bonds.

Frequently Asked Questions About Treasury Bonds

- What are Treasury bonds?

Treasury bonds are long-term debt securities issued by the U.S. government with maturities ranging from 20 to 30 years. - How do Treasury bonds provide income?

Treasury bonds pay fixed interest every six months until maturity. - Are Treasury bonds considered safe investments?

Yes, they are backed by the U.S. government, making them one of the safest investment options available. - What is the tax treatment of Treasury bond interest?

The interest earned is exempt from state and local taxes but subject to federal income tax. - Can I sell my Treasury bonds before they mature?

Yes, Treasury bonds can be sold in secondary markets before maturity. - What risks should I consider when investing in Treasury bonds?

The primary risks include inflation risk and interest rate risk that could affect returns. - How do I purchase Treasury bonds?

You can buy them directly through the U.S. Department of the Treasury’s website or through financial institutions. - What role do Treasury bonds play in an investment portfolio?

Treasury bonds provide stability and predictable income while diversifying an investment portfolio.