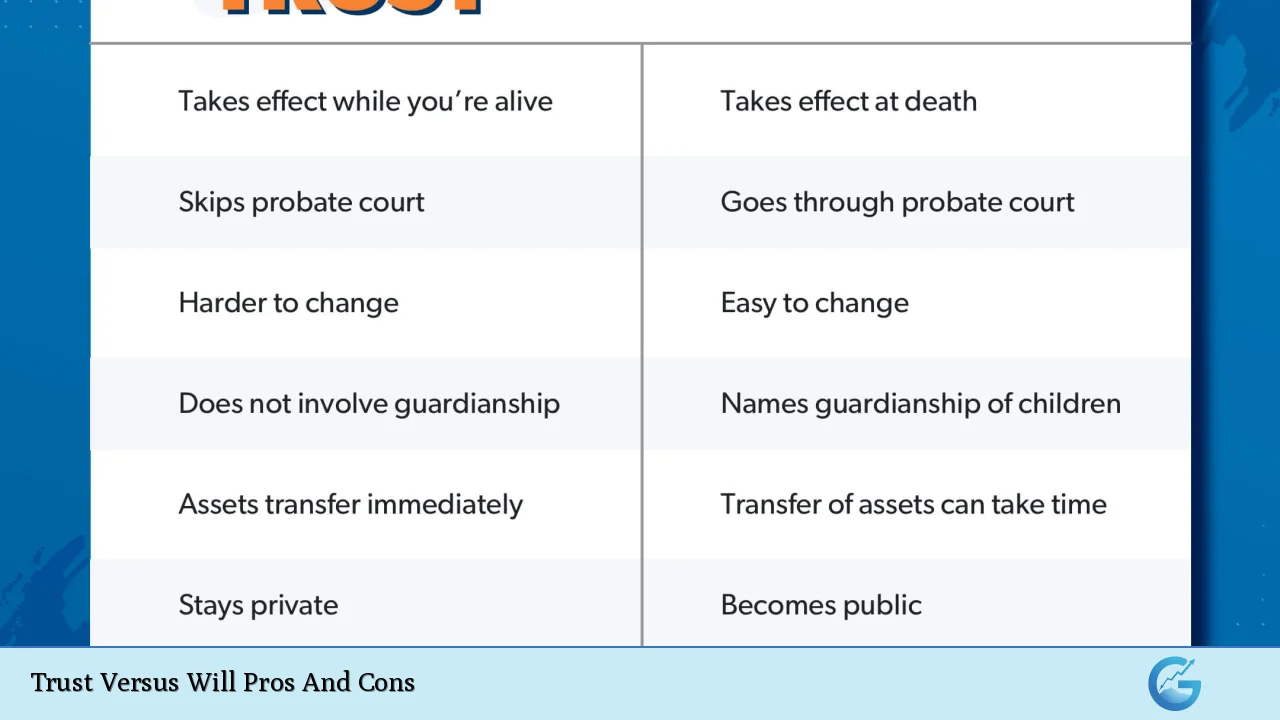

Estate planning is a crucial aspect of financial management that often gets overlooked until it’s too late. Two of the most common tools used in estate planning are trusts and wills. While both serve the purpose of distributing assets after death, they have distinct characteristics that make them suitable for different situations. This comprehensive guide will delve into the advantages and disadvantages of trusts and wills, helping you make an informed decision about which option might be best for your unique circumstances.

| Pros | Cons |

|---|---|

| Avoids probate process | More complex to set up |

| Offers privacy | Higher initial costs |

| Provides more control over asset distribution | Requires ongoing management |

| Can reduce estate taxes | May complicate property ownership |

| Allows for incapacity planning | Potential for trustee misconduct |

| Flexibility in asset management | Limited protection from creditors (for revocable trusts) |

| Can provide for minor children or dependents | May require professional assistance to manage |

| Potential for smoother asset transfer | Possible loss of control over assets (for irrevocable trusts) |

Advantages of Trusts

Avoidance of Probate

One of the most significant benefits of a trust is its ability to bypass the probate process. Probate is the legal procedure through which a will is validated and assets are distributed under court supervision. This process can be time-consuming, expensive, and public. By placing assets in a trust, you ensure that they pass directly to your beneficiaries without court intervention, potentially saving time and money.

- Faster distribution of assets to beneficiaries

- Reduced legal fees and court costs

- Avoidance of potential delays in asset transfer

Enhanced Privacy

Unlike wills, which become public records once they enter probate, trusts maintain privacy regarding the distribution of your assets. This confidentiality can be particularly valuable for high-net-worth individuals or those concerned about potential challenges to their estate plans.

- Keeps family financial matters private

- Reduces the risk of unwanted publicity

- Protects beneficiaries from potential harassment

Greater Control Over Asset Distribution

Trusts offer more flexibility and control over how and when your assets are distributed. You can set specific conditions for beneficiaries to receive their inheritance, such as reaching a certain age or achieving particular milestones.

- Ability to stagger distributions over time

- Can protect assets from beneficiaries’ potential creditors or divorcing spouses

- Allows for continued support of charitable causes

Potential Tax Benefits

Certain types of trusts, particularly irrevocable trusts, can offer significant tax advantages. By removing assets from your estate, you may be able to reduce estate taxes, gift taxes, and even income taxes in some cases.

- Possible reduction in estate tax liability

- Opportunity for generation-skipping transfer tax planning

- Potential income tax benefits through charitable remainder trusts

Incapacity Planning

A living trust can provide for the management of your assets if you become incapacitated. This feature can help avoid the need for a court-appointed conservatorship and ensure that your financial affairs are handled according to your wishes.

- Seamless transition of asset management in case of incapacity

- Avoids potential family conflicts over financial decisions

- Ensures continuity in financial management

Disadvantages of Trusts

Complexity and Initial Costs

Setting up a trust can be more complex and initially more expensive than creating a will. The process often requires the assistance of an attorney and may involve transferring property titles and other assets into the trust’s name.

- Higher upfront legal fees

- Time-consuming process of transferring assets into the trust

- May require ongoing professional assistance

Ongoing Management Requirements

Trusts require active management throughout your lifetime. This includes keeping accurate records, filing tax returns for the trust, and potentially making investment decisions.

- Need for regular review and potential updates

- Possible trustee fees for management

- Responsibility for maintaining separate financial records

Potential for Trustee Misconduct

The effectiveness of a trust largely depends on the trustee’s ability to manage it properly. There is always a risk of trustee misconduct or mismanagement, which can have serious consequences for beneficiaries.

- Possibility of embezzlement or misuse of trust funds

- Challenges in removing or replacing an incompetent trustee

- Potential for family conflicts if a family member is chosen as trustee

Limited Asset Protection in Revocable Trusts

While irrevocable trusts can offer asset protection, revocable living trusts generally do not protect assets from creditors during the grantor’s lifetime.

- Assets remain vulnerable to creditors’ claims

- May not provide protection in case of lawsuits

- Limited usefulness in Medicaid planning

Advantages of Wills

Simplicity and Lower Initial Costs

Wills are generally simpler to create and less expensive to set up than trusts. For individuals with straightforward estates, a will may be sufficient to meet their needs.

- Can be created without extensive legal assistance

- Lower upfront costs compared to trusts

- Easier to understand for most people

Flexibility to Change

Wills can be easily modified or revoked during the testator’s lifetime. This flexibility allows for changes in circumstances, such as births, deaths, or changes in financial situation.

- Simple process for making amendments (codicils)

- Can be completely rewritten if necessary

- Allows for adaptation to changing family dynamics

Court Oversight

While probate can be seen as a disadvantage, it does provide court supervision of the estate settlement process. This oversight can be beneficial in ensuring that the will is properly executed and assets are distributed correctly.

- Reduces the risk of executor misconduct

- Provides a formal process for resolving disputes

- Ensures proper notification of beneficiaries and creditors

Naming Guardians for Minor Children

Wills allow you to designate guardians for minor children, which is a crucial consideration for parents. While trusts can provide for the financial care of children, they cannot legally appoint guardians.

- Clear designation of who will care for minor children

- Can specify alternate guardians if first choice is unavailable

- Provides peace of mind for parents

Disadvantages of Wills

Probate Process

The primary disadvantage of a will is that it must go through probate. This process can be time-consuming, expensive, and public.

- Potential delays in asset distribution

- Higher legal and court fees

- Loss of privacy due to public nature of probate

Limited Control After Death

Once a will goes into effect, you have limited control over how assets are used by beneficiaries. Unlike trusts, wills cannot easily impose conditions on inheritances or provide long-term asset management.

- Cannot protect assets from beneficiaries’ poor financial decisions

- Limited ability to provide for long-term care of dependents

- Less effective for complex family situations or large estates

Potential for Challenges

Wills are more susceptible to legal challenges than trusts. Disgruntled heirs may contest the will in court, potentially leading to lengthy and expensive legal battles.

- Risk of “will contests” by dissatisfied family members

- Potential for invalidation if not properly executed

- May cause family conflicts and disputes

Lack of Incapacity Planning

Unlike living trusts, wills do not provide for management of your assets if you become incapacitated. This may necessitate a court-appointed conservatorship to manage your affairs.

- No provision for asset management during incapacity

- Potential for court intervention in financial decisions

- May result in decisions contrary to your wishes

In conclusion, the choice between a trust and a will depends on your individual circumstances, including the size and complexity of your estate, your family situation, and your long-term goals. While trusts offer more control and privacy, they come with higher costs and management requirements. Wills, on the other hand, are simpler and less expensive but provide less control and privacy. Many estate plans benefit from using both a trust and a will to cover all bases. It’s crucial to consult with a qualified estate planning attorney to determine the best approach for your specific needs.

Frequently Asked Questions About Trust Versus Will Pros And Cons

- Can I have both a trust and a will?

Yes, many people use both a trust and a will in their estate plan. A will can serve as a backup for assets not transferred to the trust and can name guardians for minor children. - Are trusts only for wealthy individuals?

No, trusts can be beneficial for people with various levels of wealth. They’re particularly useful for those who want to avoid probate, maintain privacy, or have complex family situations. - How much does it cost to set up a trust compared to a will?

Generally, setting up a trust is more expensive than creating a will. Trusts can cost several thousand dollars, while a simple will might cost a few hundred dollars. - Can a trust help reduce estate taxes?

Certain types of trusts, particularly irrevocable trusts, can help reduce estate taxes by removing assets from your taxable estate. However, this depends on the size of your estate and current tax laws. - Is a living trust the same as a living will?

No, these are different documents. A living trust manages your assets, while a living will specifies your healthcare wishes if you become incapacitated. - Can I change my trust or will after it’s created?

Wills and revocable trusts can be changed during your lifetime. Irrevocable trusts, as the name suggests, generally cannot be changed without the beneficiaries’ consent. - Do I need an attorney to create a trust or will?

While it’s possible to create a simple will without an attorney, it’s highly recommended to consult with a legal professional, especially for trusts or more complex estates. - What happens if I die without a will or trust?

If you die without a will or trust (intestate), your assets will be distributed according to state law, which may not align with your wishes. This process can be time-consuming and may cause family disputes.