A Thrift Savings Plan (TSP) loan allows federal employees and uniformed service members to borrow against their retirement savings. This financial product has gained popularity due to its relatively low interest rates and flexible borrowing options. However, potential borrowers should be aware of the various advantages and disadvantages associated with TSP loans before making a decision. This article aims to provide a comprehensive overview of the pros and cons of TSP loans, helping individuals understand their implications on personal finance, especially in the context of retirement planning.

| Pros | Cons |

|---|---|

| Low interest rates compared to traditional loans | Potential loss of investment growth in retirement account |

| No credit checks required for approval | Double taxation on repayments |

| Flexible repayment terms | Fees associated with loan processing |

| Interest paid goes back into your TSP account | Limited borrowing amounts based on contributions |

| No collateral required for the loan | Impact on future contributions to TSP |

| Quick access to funds for emergencies or major purchases | Short repayment period if employment is terminated |

| Payments can be deducted directly from payroll | Does not build credit history |

| No penalties for early repayment | Risk of tax consequences if loan defaults |

Low Interest Rates Compared to Traditional Loans

One of the most significant advantages of TSP loans is their low interest rates. TSP loans typically have interest rates that are lower than those offered by commercial lenders. The interest rate is tied to the Government Securities Investment Fund (G Fund) rate, which tends to be more favorable than personal loan rates, especially for those with less-than-perfect credit histories.

- Lower monthly payments: Because of the reduced interest rate, borrowers can enjoy lower monthly payments compared to other types of loans.

- Cost-effective borrowing: For individuals needing funds for significant expenses, such as home purchases or education, the lower cost of borrowing can make a substantial difference in overall financial health.

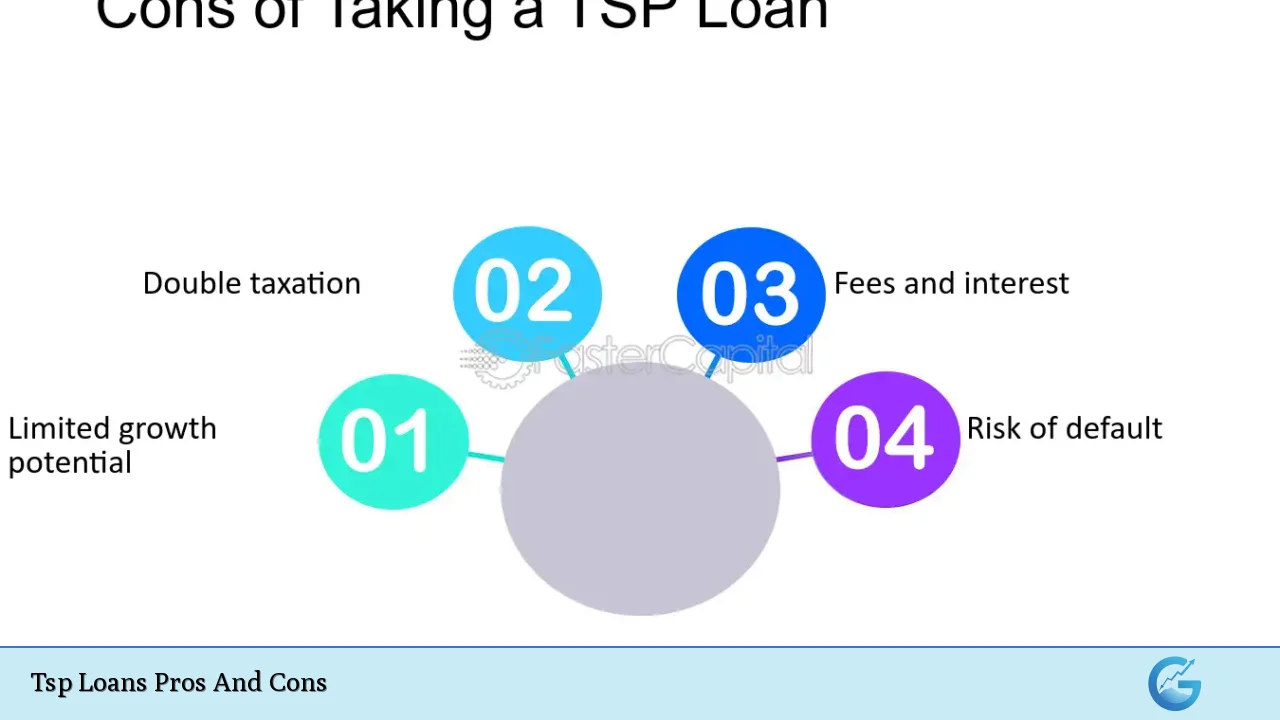

Potential Loss of Investment Growth in Retirement Account

While TSP loans offer immediate financial relief, they come at a cost: the potential loss of investment growth. When funds are withdrawn from a TSP account, they cease to earn returns.

- Opportunity cost: Borrowing from your TSP means that money is no longer invested in potentially high-return assets, which could lead to significant losses over time.

- Long-term impact: Even a short-term loan can have long-lasting effects on retirement savings due to compound interest. For instance, borrowing $10,000 could result in missing out on thousands of dollars in potential earnings over several years.

No Credit Checks Required for Approval

TSP loans do not require credit checks, which makes them accessible for individuals who may struggle with traditional lending criteria.

- Inclusivity: This feature is particularly beneficial for those with poor credit scores or limited borrowing history.

- Simplified application process: The absence of credit checks streamlines the approval process, allowing borrowers to access funds quickly without extensive documentation.

Double Taxation on Repayments

One notable disadvantage of TSP loans is that repayments are made with after-tax dollars. This results in double taxation on the borrowed funds.

- Tax implications: When you repay the loan, you do so with income that has already been taxed. Later, when you withdraw these funds during retirement, they are taxed again.

- Financial burden: This double taxation can lead to an increased financial burden over time and may deter some individuals from taking out a TSP loan.

Flexible Repayment Terms

TSP loans offer flexible repayment terms that can accommodate various financial situations. Borrowers typically have between one and fifteen years to repay their loans, depending on the type (general purpose or residential).

- Customizable payment plans: Borrowers can choose a repayment schedule that aligns with their financial capabilities and goals.

- No prepayment penalties: If circumstances change and borrowers wish to pay off their loans early, they can do so without incurring additional fees.

Fees Associated with Loan Processing

While TSP loans have many benefits, they also come with associated fees. A processing fee is typically charged when taking out a loan.

- Initial costs: The standard fee is around $50 per loan, which may be deducted from the total amount borrowed. This fee can add up if multiple loans are taken out over time.

- Budget considerations: Borrowers should factor this fee into their overall financial planning when considering a TSP loan.

Interest Paid Goes Back Into Your TSP Account

A unique feature of TSP loans is that the interest paid on the loan goes back into the borrower’s TSP account.

- Self-funding mechanism: This means that while borrowers are paying interest on their loans, they are essentially paying themselves back. This can help mitigate some concerns about lost investment growth.

- Encouragement to repay: Knowing that payments contribute back into their retirement savings may motivate borrowers to prioritize timely repayments.

Limited Borrowing Amounts Based on Contributions

The amount one can borrow from a TSP loan is limited by their contributions and earnings within their account.

- Maximum limits: Generally, borrowers can take out up to $50,000 or 50% of their vested balance (whichever is less). This limitation may not suffice for larger financial needs such as purchasing a home outright.

- Potential need for additional financing: Individuals may need to seek other forms of financing if their needs exceed the maximum allowable amount from a TSP loan.

No Collateral Required for the Loan

TSP loans do not require any collateral, making them less risky for borrowers compared to traditional secured loans.

- Easier access: This feature simplifies the borrowing process and allows individuals without significant assets to obtain necessary funds.

- Reduced risk: Borrowers do not risk losing property or assets if they default on the loan since there is no collateral involved.

Impact on Future Contributions to TSP

Taking out a TSP loan can impact future contributions and overall retirement savings strategies.

- Reduced contribution capacity: While repaying a loan, individuals might find it challenging to continue contributing at previous levels due to budget constraints.

- Long-term savings effects: Lower contributions during repayment periods can hinder long-term growth potential within retirement accounts.

Quick Access to Funds for Emergencies or Major Purchases

TSP loans provide quick access to cash when needed most—be it for emergencies or significant purchases like homes or education expenses.

- Timely liquidity: The speed at which funds can be accessed makes TSP loans an attractive option during financial emergencies where immediate cash flow is essential.

- Versatile usage: Borrowers can use these funds for various purposes without stringent restrictions imposed by traditional lenders.

Short Repayment Period if Employment is Terminated

One critical disadvantage arises if an individual leaves federal service before fully repaying their TSP loan.

- 90-day repayment requirement: If employment ends, borrowers must repay their outstanding balance within 90 days; failure to do so will result in tax consequences as it will be treated as taxable income by the IRS.

- Financial pressure during transitions: This requirement may create additional stress during job transitions or unexpected employment changes.

Payments Can Be Deducted Directly from Payroll

TSP loans allow payments to be automatically deducted from payroll, simplifying repayment processes for borrowers.

- Convenience factor: Automatic deductions ensure timely payments without requiring manual intervention each month.

- Budget management: This feature helps individuals manage their budgets more effectively by integrating loan repayments into regular payroll processes.

Does Not Build Credit History

Unlike many traditional loans, payments made on a TSP loan are not reported to credit bureaus.

- No credit benefits: Consequently, borrowers cannot build or improve their credit scores through timely repayments of TSP loans.

- Consideration for future borrowing needs: Individuals planning major purchases requiring good credit may want to consider this aspect before opting for a TSP loan.

Risk of Tax Consequences If Loan Defaults

There are significant risks associated with defaulting on a TSP loan.

- Tax ramifications: If a borrower defaults (typically due to missed payments), the remaining balance will be considered taxable income by the IRS.

- Penalties for early withdrawal: Additionally, individuals under 59½ years old may incur an extra 10% penalty on top of regular income taxes if they default on their loan obligations.

In conclusion, while TSP loans offer several advantages such as low interest rates and quick access to funds without credit checks, they also come with notable disadvantages including potential loss of investment growth and double taxation upon repayment. Individuals considering this option should carefully evaluate their financial situation and long-term goals before proceeding. Understanding both sides will empower them to make informed decisions that align with their overall retirement strategy and financial well-being.

Frequently Asked Questions About Tsp Loans Pros And Cons

- What is a Thrift Savings Plan (TSP) loan?

A TSP loan allows federal employees and uniformed service members to borrow against their own retirement savings within their Thrift Savings Plan account. - Are there any fees associated with taking out a TSP loan?

Yes, there is usually a processing fee around $50 deducted from the total borrowed amount. - Can I take out multiple TSP loans at once?

No, participants are limited to one general purpose loan and one residential loan outstanding at any given time. - What happens if I leave my job before repaying my TSP loan?

If you leave federal service before repaying your loan in full, you must repay it within 90 days; otherwise it will be treated as taxable income. - How does taking out a TSP loan affect my retirement savings?

Taking out a TSP loan reduces your vested balance available for investment growth during the period you have an outstanding balance. - Is there any penalty for repaying my TSP loan early?

No, there are no penalties for early repayment; you can pay off your balance whenever you choose. - Will taking out a TSP loan affect my credit score?

No, repayments on a TSP loan do not get reported to credit bureaus; thus it does not impact your credit score. - What should I consider before taking out a TSP loan?

You should evaluate your current financial situation, potential tax implications, impact on retirement savings growth, and whether you will be able to meet repayment terms.