Universal life insurance is a type of permanent life insurance that combines a death benefit with a savings component, offering policyholders flexibility in premium payments and death benefit amounts. This innovative financial product has gained popularity among investors and individuals seeking long-term financial security. However, like any insurance product, it comes with its own set of advantages and disadvantages that warrant careful consideration.

| Pros | Cons |

|---|---|

| Flexible premium payments | Complex policy structure |

| Adjustable death benefit | Market-sensitive returns |

| Cash value accumulation | Potential for policy lapse |

| Tax-deferred growth | Higher fees compared to term life insurance |

| Lifetime coverage | Requires active management |

| Loan options against cash value | Surrender charges |

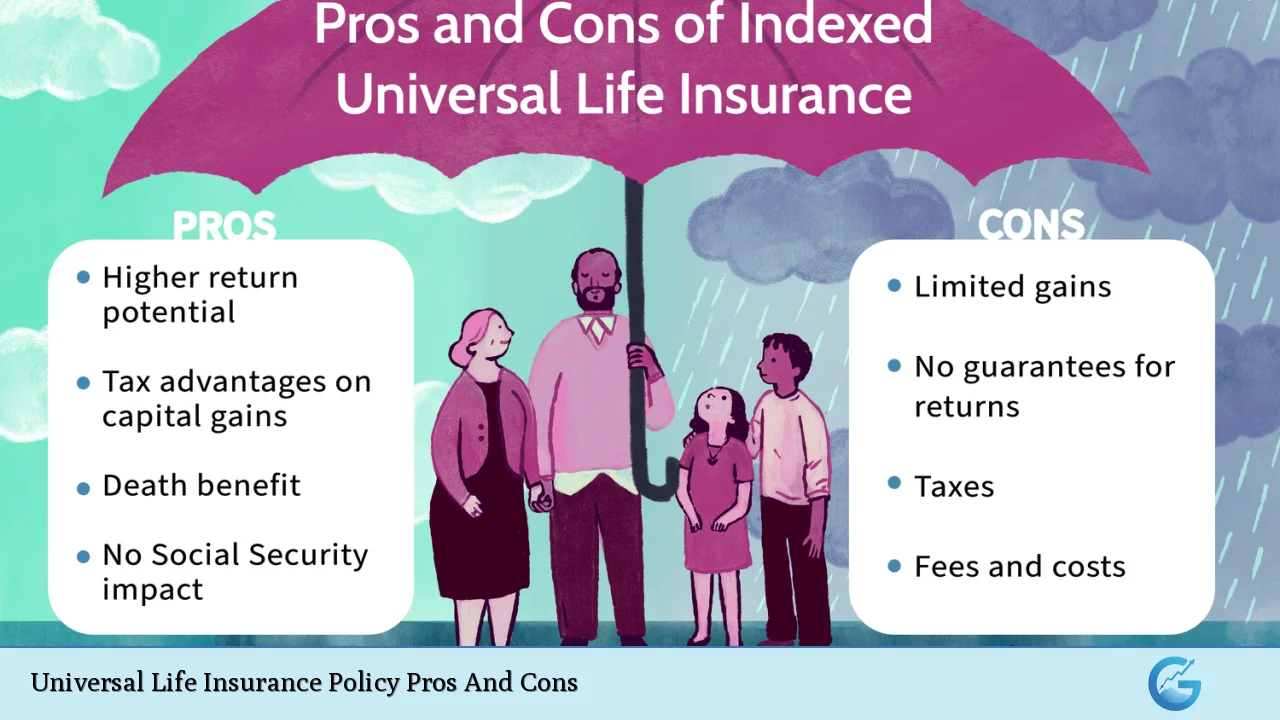

Advantages of Universal Life Insurance Policies

Flexible Premium Payments

One of the most significant advantages of universal life insurance is the flexibility it offers in premium payments. Unlike traditional whole life insurance policies that require fixed premium payments, universal life allows policyholders to adjust their premium amounts within certain limits. This feature can be particularly beneficial for individuals with fluctuating incomes or those who want to align their insurance costs with their financial situation.

- Ability to increase or decrease premium payments

- Option to use accumulated cash value to cover premiums

- Potential to skip payments if sufficient cash value is available

It’s important to note that while premium flexibility is advantageous, policyholders must ensure that the policy remains adequately funded to prevent lapse.

Adjustable Death Benefit

Universal life insurance policies offer the unique advantage of an adjustable death benefit. This feature allows policyholders to increase or decrease the amount of coverage based on their changing needs and financial circumstances. For instance, a policyholder might choose to increase their death benefit after starting a family or decrease it as they approach retirement and have fewer financial obligations.

- Option to increase coverage (subject to underwriting)

- Ability to decrease coverage to reduce premiums

- Tailored protection that evolves with life stages

Cash Value Accumulation

A key feature of universal life insurance is the cash value component, which grows over time based on the premiums paid and the interest credited by the insurance company. This cash value accumulation serves as a savings vehicle within the policy, offering potential for growth and financial flexibility.

- Tax-deferred growth of cash value

- Potential for higher returns compared to traditional savings accounts

- Option to access cash value through withdrawals or loans

The cash value in a universal life policy can be a valuable asset for supplementing retirement income or addressing unexpected financial needs.

Tax-Deferred Growth

One of the most attractive aspects of universal life insurance for investors is the tax-deferred growth of the cash value component. This means that the policyholder does not pay taxes on the interest or earnings as they accumulate within the policy. This tax advantage can lead to significant long-term growth potential, especially for those in higher tax brackets.

- No annual taxes on cash value growth

- Potential for compounded growth over time

- Tax-free death benefit for beneficiaries

Lifetime Coverage

Universal life insurance provides lifetime coverage, ensuring that beneficiaries will receive a death benefit regardless of when the policyholder passes away, as long as the policy remains in force. This permanent coverage can be particularly valuable for estate planning purposes or for individuals with long-term financial obligations.

- Guaranteed protection for life

- Peace of mind for policyholders and beneficiaries

- Potential for legacy planning and wealth transfer

Loan Options Against Cash Value

The accumulated cash value in a universal life policy can serve as a source of liquidity through policy loans. Policyholders can borrow against their cash value, often at competitive interest rates, without the need for credit checks or loan applications. This feature provides financial flexibility and can be a valuable resource in times of need.

- Access to funds without traditional loan requirements

- Typically lower interest rates compared to personal loans

- No fixed repayment schedule (though unpaid loans may reduce the death benefit)

While policy loans offer financial flexibility, it’s crucial to understand that unpaid loans can reduce the death benefit and potentially lead to policy lapse if not managed properly.

Disadvantages of Universal Life Insurance Policies

Complex Policy Structure

Universal life insurance policies are inherently more complex than traditional term or whole life insurance. The combination of insurance coverage and investment components, along with flexible premiums and adjustable benefits, can make these policies challenging to understand and manage effectively.

- Requires a higher level of financial literacy

- Potential for misunderstanding policy terms and conditions

- May necessitate professional guidance for optimal management

Market-Sensitive Returns

The cash value component of universal life insurance is often tied to market performance or interest rates set by the insurance company. This means that the growth of the cash value can be unpredictable and may underperform during periods of low interest rates or market downturns.

- Potential for lower-than-expected cash value growth

- Risk of not meeting long-term financial goals

- Necessity to monitor and adjust the policy based on market conditions

Policyholders should be prepared for fluctuations in cash value growth and understand that past performance does not guarantee future results.

Potential for Policy Lapse

One of the most significant risks associated with universal life insurance is the potential for policy lapse if the cash value becomes insufficient to cover the cost of insurance and policy fees. This risk is particularly acute during periods of poor market performance or if the policyholder has reduced or skipped premium payments.

- Risk of losing coverage if cash value is depleted

- Potential need for increased premium payments to maintain coverage

- Complexity in managing the policy to prevent lapse

Higher Fees Compared to Term Life Insurance

Universal life insurance typically comes with higher fees and expenses compared to simpler term life insurance policies. These fees can include administrative charges, mortality and expense risk charges, and costs associated with the investment component of the policy.

- Higher overall cost of insurance

- Potential erosion of cash value due to fees

- Need for careful consideration of cost-benefit ratio

Requires Active Management

To maximize the benefits and minimize the risks of a universal life policy, policyholders must actively manage their coverage. This includes regularly reviewing the policy performance, adjusting premiums as needed, and potentially modifying the death benefit to ensure the policy remains aligned with financial goals.

- Time-consuming policy maintenance

- Necessity for ongoing financial education

- Potential for suboptimal results without proper management

Regular policy reviews and consultations with financial professionals are essential to ensure that the universal life policy continues to meet the policyholder’s needs and objectives.

Surrender Charges

Universal life insurance policies often come with surrender charges, which are fees imposed if the policyholder cancels the policy or withdraws a significant portion of the cash value within a specified period (typically the first 10-15 years of the policy). These charges can substantially reduce the amount of cash value available to the policyholder if they need to access funds early in the policy’s life.

- Reduced liquidity in the early years of the policy

- Potential financial penalties for early policy termination

- Need for long-term commitment to maximize policy benefits

In conclusion, universal life insurance policies offer a unique combination of flexibility, potential for cash value growth, and lifetime coverage. However, these benefits come with increased complexity, market sensitivity, and the need for active management. Prospective policyholders should carefully weigh the advantages and disadvantages, considering their long-term financial goals, risk tolerance, and ability to manage a complex financial product. Consulting with a qualified financial advisor can help individuals determine whether a universal life insurance policy aligns with their overall financial strategy and insurance needs.

Frequently Asked Questions About Universal Life Insurance Policy Pros And Cons

- How does universal life insurance differ from whole life insurance?

Universal life offers more flexibility in premiums and death benefits, while whole life has fixed premiums and guaranteed cash value growth. Universal life’s cash value is more sensitive to market conditions, potentially offering higher returns but with more risk. - Can I use the cash value in my universal life policy for retirement income?

Yes, you can access the cash value through withdrawals or loans for retirement income. However, this may reduce the death benefit and could lead to policy lapse if not managed carefully. - What happens if I can’t pay the premiums on my universal life policy?

If you have sufficient cash value, it can be used to cover premium payments. If not, the policy may lapse, losing both the death benefit and accumulated cash value. - Are the returns on universal life insurance policies guaranteed?

No, returns are not guaranteed and can fluctuate based on market conditions or the insurance company’s declared interest rates. Many policies offer a minimum guaranteed interest rate, but actual returns may be higher or lower. - How does the cost of universal life insurance compare to term life insurance?

Universal life is typically more expensive than term life due to its permanent coverage and cash value component. However, it offers lifelong protection and potential for cash value growth, which term policies do not provide. - Can I increase or decrease my coverage with a universal life policy?

Yes, most universal life policies allow you to adjust your death benefit. Increasing coverage may require additional underwriting, while decreasing coverage can lower your premiums. - What are the tax implications of a universal life insurance policy?

Cash value grows tax-deferred, and death benefits are generally tax-free to beneficiaries. However, surrendering the policy or taking loans may have tax consequences, so consult a tax professional for specific advice. - Is universal life insurance a good investment vehicle?

While universal life offers potential for cash value growth, it’s primarily an insurance product. For pure investment purposes, there may be more efficient options available. Consider your overall financial goals and consult a financial advisor before using it as an investment strategy.