U.S. Bank, one of the largest financial institutions in the United States, offers a wide range of banking services including checking and savings accounts, loans, credit cards, and investment options. With its extensive branch network and digital banking capabilities, it caters to a diverse clientele. However, like any financial institution, U.S. Bank has its strengths and weaknesses. This article provides a comprehensive analysis of the pros and cons of banking with U.S. Bank, particularly for individuals interested in finance, cryptocurrency, forex, and money markets.

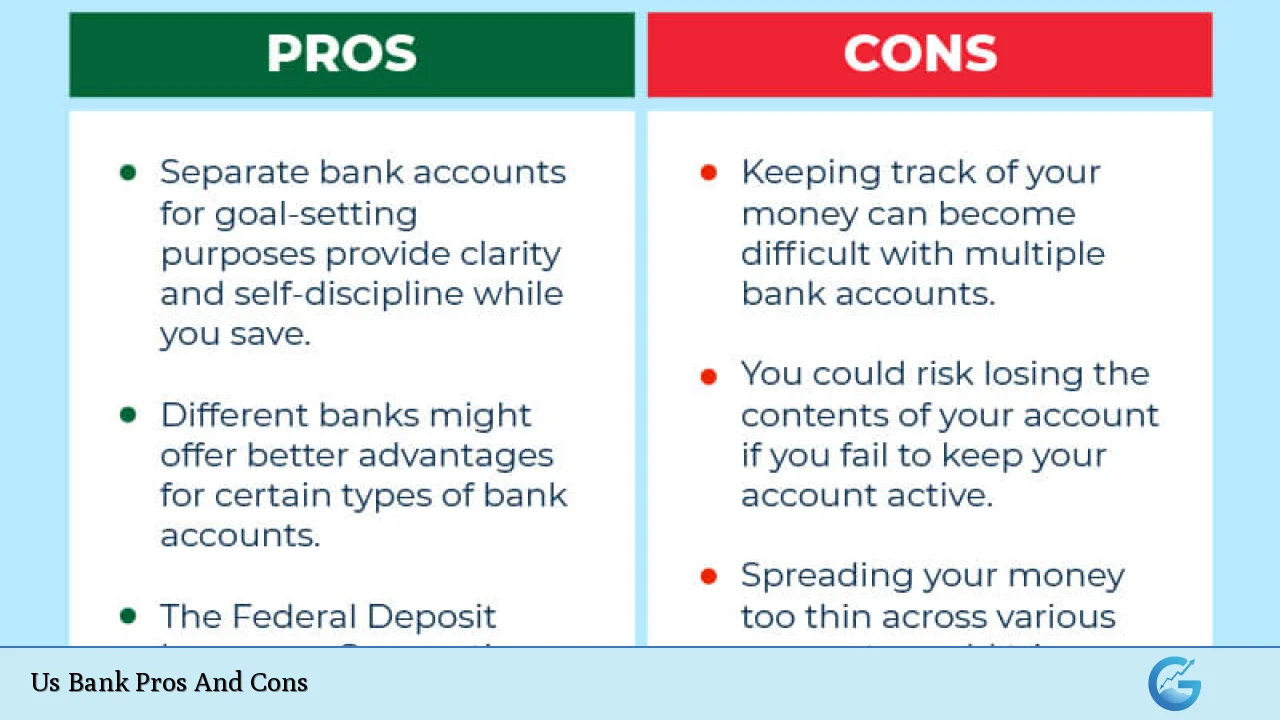

| Pros | Cons |

|---|---|

| Extensive branch and ATM network | High fees for certain services |

| 24/7 customer service availability | Low interest rates on savings accounts |

| Wide range of financial products | Poor online banking experience reported by some users |

| Strong mobile app functionality | Mixed reviews on customer service quality |

| Overdraft protection options available | Regulatory issues leading to fines and penalties |

Extensive Branch and ATM Network

U.S. Bank boasts one of the largest branch networks in the country, with thousands of locations across the Midwest and West regions. This extensive reach allows customers to access banking services conveniently.

- Accessibility: Customers can easily find a branch or ATM nearby.

- In-Person Services: Offers personalized assistance for complex transactions.

However, geographical restrictions may apply to certain accounts, limiting availability in some areas.

24/7 Customer Service Availability

Another significant advantage of U.S. Bank is its commitment to customer service. The bank provides 24/7 support through various channels, including phone and online chat.

- Immediate Assistance: Customers can resolve issues at any time.

- Multiple Contact Options: Various ways to reach customer support enhance convenience.

Despite these advantages, some users report inconsistent experiences with service quality.

Wide Range of Financial Products

U.S. Bank offers a comprehensive suite of financial products tailored to meet diverse customer needs:

- Personal Banking: Checking and savings accounts with various features.

- Loans and Mortgages: Options for personal loans, mortgages, and home equity lines of credit.

- Investment Services: Access to investment accounts and retirement planning tools.

This variety ensures that customers can find suitable products for their financial goals.

Strong Mobile App Functionality

The U.S. Bank mobile app is highly rated for its user-friendly interface and functionality:

- Convenient Transactions: Users can deposit checks, transfer funds, and pay bills easily.

- Financial Management Tools: The app provides insights into spending habits and budgeting tools.

However, while the app receives high ratings, some users have reported issues with online banking experiences that do not meet expectations.

Overdraft Protection Options Available

U.S. Bank offers overdraft protection services that can help customers avoid costly fees when they accidentally overdraw their accounts:

- Buffer Options: Customers can opt for an overdraft buffer that allows small overdrafts without incurring fees.

- Flexible Solutions: Various options are available to suit different financial situations.

This feature can be particularly beneficial for those who occasionally mismanage their funds.

High Fees for Certain Services

One of the notable downsides of banking with U.S. Bank is the high fees associated with certain services:

- Overdraft Fees: While overdraft protection is available, the fees can be steep if not managed properly.

- Monthly Maintenance Fees: Some accounts have monthly fees that can add up unless specific conditions are met.

These costs may deter budget-conscious consumers from choosing U.S. Bank as their primary financial institution.

Low Interest Rates on Savings Accounts

Another disadvantage is the relatively low interest rates offered on savings accounts compared to other banks:

- Limited Growth Potential: Customers may find that their savings do not grow as quickly as they would with other institutions offering higher rates.

- Competitive Market: In a competitive banking environment, lower interest rates can be a significant drawback for savers.

This aspect may discourage individuals looking to maximize their savings returns.

Poor Online Banking Experience Reported by Some Users

While U.S. Bank has invested in digital banking solutions, some customers report dissatisfaction with their online banking experience:

- User Interface Issues: Some users find the website difficult to navigate.

- Technical Glitches: Occasional technical problems have been noted during peak usage times.

These issues can lead to frustration among customers who prefer online banking solutions.

Mixed Reviews on Customer Service Quality

Despite 24/7 availability, customer service quality at U.S. Bank has received mixed reviews:

- Inconsistent Experiences: Some customers report excellent service while others describe long wait times or unhelpful representatives.

- Impact on Satisfaction: Poor service experiences can significantly affect overall customer satisfaction levels.

This inconsistency may lead potential customers to consider other banking options where service quality is more reliable.

Regulatory Issues Leading to Fines and Penalties

U.S. Bank has faced regulatory scrutiny in recent years, resulting in fines for various compliance failures:

- Past Violations: The bank has been fined for issues related to improper handling of customer accounts during critical periods such as the COVID-19 pandemic.

- Trust Concerns: Ongoing regulatory challenges may raise concerns about the bank’s reliability among potential customers.

These issues highlight the importance of considering a bank’s regulatory history when choosing where to bank.

In conclusion, U.S. Bank presents a mix of advantages and disadvantages that potential customers should carefully evaluate. Its extensive branch network, 24/7 customer service availability, diverse financial products, strong mobile app functionality, and overdraft protection options make it an attractive choice for many consumers. However, high fees for certain services, low interest rates on savings accounts, reported online banking issues, mixed customer service reviews, and past regulatory challenges warrant consideration before making a decision.

Frequently Asked Questions About Us Bank

- What types of accounts does U.S. Bank offer?

U.S. Bank offers various accounts including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). - Does U.S. Bank charge monthly fees?

Yes, some accounts come with monthly maintenance fees which can often be waived by meeting certain criteria. - How does U.S. Bank handle overdrafts?

U.S. Bank provides overdraft protection options that allow small overdrafts without incurring fees under certain conditions. - Is there a mobile app for U.S. Bank?

Yes, U.S. Bank has a highly rated mobile app that allows users to perform various banking transactions conveniently. - What are the interest rates like at U.S. Bank?

The interest rates on savings accounts at U.S. Bank tend to be lower compared to many competitors. - How is customer service at U.S. Bank?

Customer service experiences vary; while some users report satisfaction, others have encountered long wait times or unhelpful responses. - Has U.S. Bank faced any regulatory issues?

Yes, U.S. Bank has faced fines related to compliance failures in recent years. - Can I access my account online?

Yes, U.S. Bank offers online banking services that allow customers to manage their accounts digitally.

In summary, understanding both the strengths and weaknesses of U.S. Bank is crucial for anyone considering it as their primary financial institution. Whether you prioritize accessibility through branches or digital convenience via mobile apps will influence your decision significantly.