USDA home loans, backed by the U.S. Department of Agriculture, are designed to promote homeownership in rural areas. They provide an opportunity for low to moderate-income individuals and families to purchase homes without the burden of a down payment. This program is particularly beneficial for those who may struggle to save for a traditional down payment. However, like any financial product, USDA loans come with their own set of advantages and disadvantages. In this article, we will explore the pros and cons of USDA home loans in detail, providing potential borrowers with a comprehensive understanding of what these loans entail.

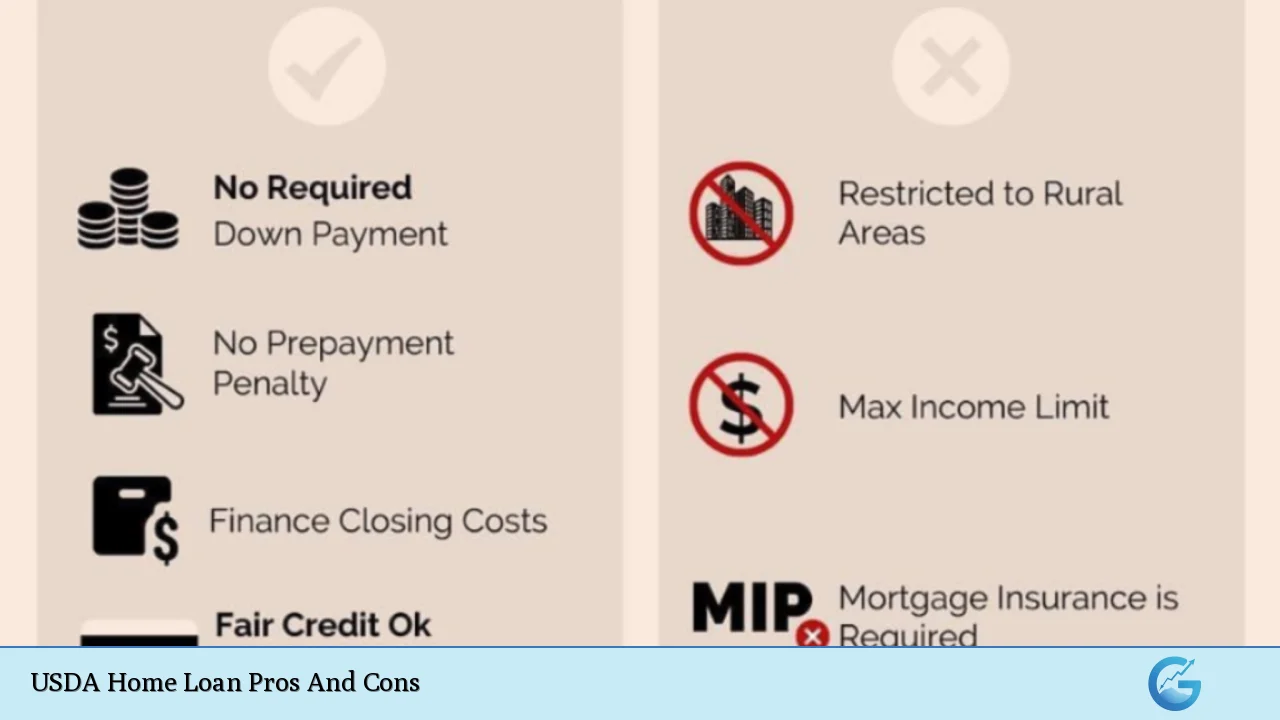

| Pros | Cons |

|---|---|

| No down payment required | Geographic restrictions on property location |

| Competitive interest rates | Income limits for eligibility |

| Flexible credit requirements | Property type limitations |

| No private mortgage insurance (PMI) | Upfront and annual guarantee fees apply |

| No prepayment penalties | Longer underwriting times compared to conventional loans |

| Can finance closing costs into the loan | Must occupy the home as a primary residence |

| Available for both purchasing and refinancing | Strict property standards must be met |

No Down Payment Required

One of the most significant advantages of USDA loans is that they allow qualified borrowers to purchase a home with no down payment. This feature is particularly appealing for first-time homebuyers or those with limited savings. By eliminating the need for a down payment, USDA loans help make homeownership more accessible to individuals who might otherwise struggle to gather enough funds.

- Benefit: Allows buyers to finance 100% of the home’s purchase price.

- Impact: Reduces the initial financial burden on the borrower.

Competitive Interest Rates

USDA loans typically offer lower interest rates compared to conventional loans. This is largely due to the government backing that reduces lender risk, allowing them to offer more favorable terms.

- Benefit: Lower monthly payments and reduced overall interest costs over the life of the loan.

- Impact: Makes homeownership more affordable in the long run.

Flexible Credit Requirements

Another advantage of USDA loans is their flexible credit requirements. While there is no official minimum credit score set by the USDA, many lenders will consider borrowers with scores as low as 600.

- Benefit: Provides opportunities for individuals with less-than-perfect credit histories.

- Impact: Increases access to home financing for a broader range of applicants.

No Private Mortgage Insurance (PMI)

Unlike many other loan types that require private mortgage insurance when the down payment is less than 20%, USDA loans do not require PMI. Instead, they have a guarantee fee which is generally lower than PMI premiums.

- Benefit: Saves borrowers money on monthly payments.

- Impact: Reduces overall loan costs compared to conventional financing options.

No Prepayment Penalties

USDA loans do not impose penalties for paying off the loan early. This flexibility allows borrowers to refinance or sell their homes without incurring additional costs.

- Benefit: Encourages financial freedom and flexibility.

- Impact: Allows borrowers to take advantage of lower interest rates or better financial situations without penalty.

Can Finance Closing Costs Into the Loan

USDA loans allow borrowers to include closing costs in their loan amount, which can further ease the financial burden associated with purchasing a home.

- Benefit: Reduces upfront cash needed at closing.

- Impact: Facilitates home purchases for those who may not have sufficient cash reserves.

Available for Both Purchasing and Refinancing

USDA loans can be used not only for purchasing homes but also for refinancing existing mortgages. This makes them versatile options for homeowners looking to lower their interest rates or change their loan terms.

- Benefit: Offers flexibility in financing options.

- Impact: Helps current homeowners take advantage of favorable market conditions.

Geographic Restrictions on Property Location

While USDA loans offer many benefits, one significant disadvantage is that they are limited to properties located in designated rural areas. This means that buyers seeking homes in urban or suburban locations may not qualify.

- Challenge: Limits potential property choices for buyers.

- Impact: May restrict buyers who prefer urban living or need proximity to city amenities.

Income Limits for Eligibility

USDA loans have specific income limits based on household size and location. Borrowers must have an income that does not exceed 115% of the area median income (AMI).

- Challenge: Potential borrowers may earn too much to qualify.

- Impact: Excludes higher-income individuals from accessing these beneficial loan options.

Property Type Limitations

USDA loans are intended solely for primary residences and cannot be used to purchase investment properties or vacation homes. This restriction can limit potential buyers’ options.

- Challenge: Only applicable for owner-occupied homes.

- Impact: May deter investors or those looking for secondary residences from using this financing option.

Upfront and Annual Guarantee Fees Apply

While USDA loans do not require PMI, they do have an upfront guarantee fee (typically 1% of the loan amount) and an annual fee (around 0.35%). These fees can add significant costs over time.

- Challenge: Increases overall loan costs.

- Impact: May negate some financial benefits associated with lower interest rates.

Longer Underwriting Times Compared to Conventional Loans

The underwriting process for USDA loans can take longer than conventional loans due to additional requirements and government oversight. This can delay closing times, which may be inconvenient for some buyers.

- Challenge: Potentially longer wait times before closing.

- Impact: May frustrate buyers eager to finalize their home purchase quickly.

Must Occupy the Home as a Primary Residence

To qualify for a USDA loan, borrowers must agree to occupy the purchased property as their primary residence. This requirement eliminates any potential investment opportunities through rental properties or vacation homes.

- Challenge: Restricts flexibility in property use.

- Impact: Limits options for buyers who may want investment properties or second homes.

Strict Property Standards Must Be Met

Properties financed through USDA loans must meet specific safety and quality standards set by HUD. This requirement ensures that homes are safe but can complicate transactions if properties do not meet these standards.

- Challenge: Properties must pass inspections and meet criteria.

- Impact: May result in additional costs or delays if renovations are needed before closing.

In conclusion, USDA home loans present a unique opportunity for eligible borrowers seeking affordable housing options in rural areas. The absence of a down payment requirement, competitive interest rates, and flexible credit criteria make these loans attractive choices for many potential homeowners. However, it is essential to consider the geographic restrictions, income limits, and property type limitations associated with these loans before proceeding. By weighing these pros and cons carefully, prospective buyers can make informed decisions about whether a USDA loan aligns with their financial goals and housing needs.

Frequently Asked Questions About USDA Home Loans

- What is a USDA loan?

A USDA loan is a government-backed mortgage designed to assist low-to-moderate-income individuals in purchasing homes in eligible rural areas. - Do I need a down payment for a USDA loan?

No, one of the main advantages of USDA loans is that they require no down payment. - What are the income limits for USDA loans?

The income limits vary by region but generally cannot exceed 115% of the area median income. - Can I buy an investment property with a USDA loan?

No, USDA loans are only available for primary residences. - Are there any fees associated with USDA loans?

Yes, there are upfront guarantee fees and annual fees that apply. - How long does it take to process a USDA loan?

The processing time can vary but typically takes longer than conventional loans due to additional requirements. - What types of properties qualify for USDA loans?

The property must be located in an eligible rural area and meet specific safety standards. - Can I refinance my existing mortgage with a USDA loan?

Yes, USDA loans can be used for refinancing existing mortgages as well.