USDA loans, backed by the United States Department of Agriculture, are designed to promote homeownership in rural and suburban areas. These loans offer unique benefits to eligible borrowers, making homeownership more accessible for those with limited financial resources. However, like any financial product, USDA loans come with both advantages and disadvantages that potential borrowers should carefully consider.

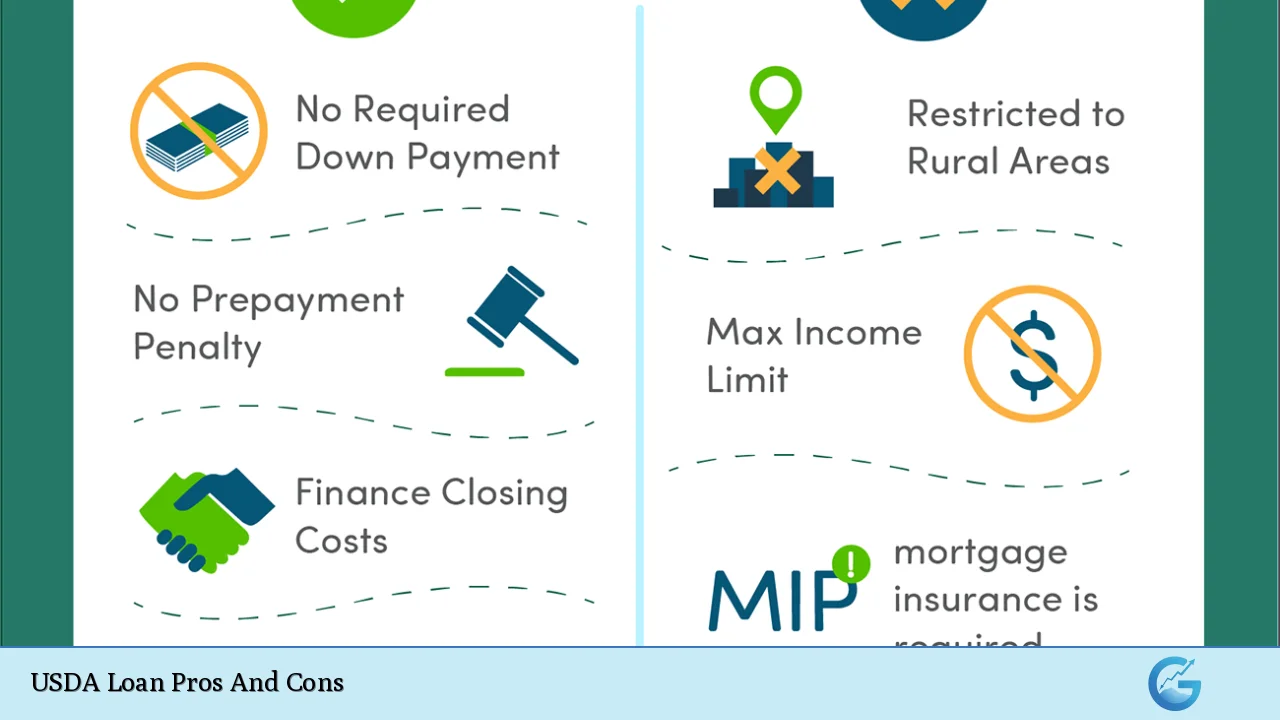

| Pros | Cons |

|---|---|

| No down payment required | Geographic restrictions |

| Competitive interest rates | Income limits |

| Flexible credit requirements | Property use limitations |

| Lower mortgage insurance fees | Longer processing times |

| Ability to finance closing costs | Upfront and annual fees |

| No maximum loan amount | Stricter property requirements |

Advantages of USDA Loans

No Down Payment Required

One of the most significant benefits of USDA loans is the ability to finance 100% of the home’s purchase price.

This feature sets USDA loans apart from conventional mortgages and even FHA loans, which typically require down payments. For many potential homebuyers, especially first-time buyers or those with limited savings, the zero-down-payment option can be a game-changer, making homeownership a reality much sooner than they might have thought possible.

Benefits of no down payment:

- Reduces the upfront cost of homeownership

- Allows buyers to preserve savings for other expenses or emergencies

- Makes it easier for renters to transition to homeownership

- Can potentially lead to faster home purchases

Competitive Interest Rates

USDA loans often come with interest rates that are lower than those of conventional mortgages and comparable to or even better than FHA loan rates.

The government backing of USDA loans allows lenders to offer these favorable rates, as the risk to the lender is reduced.

Lower interest rates translate to lower monthly payments and significant savings over the life of the loan.

Factors contributing to competitive rates:

- Government guarantee reduces lender risk

- Targeted program for rural development

- Focus on moderate to low-income borrowers

Flexible Credit Requirements

While USDA loans do consider credit scores, they are generally more forgiving than conventional loans when it comes to credit requirements.

Borrowers with credit scores as low as 640 may qualify for streamlined processing, and those with lower scores may still be eligible with additional documentation.

This flexibility opens up homeownership opportunities to a broader range of borrowers who might struggle to qualify for other types of mortgages.

Credit-related benefits:

- Consideration of alternative credit histories

- Potential for manual underwriting for borderline cases

- Opportunity for credit counseling to improve eligibility

Lower Mortgage Insurance Fees

USDA loans require mortgage insurance, similar to FHA and conventional loans with less than 20% down. However,

the USDA’s annual mortgage insurance premium is typically lower than that of FHA loans and many conventional loans with private mortgage insurance (PMI).

This can result in lower monthly payments for USDA borrowers compared to other low-down-payment options.

USDA mortgage insurance structure:

- Upfront guarantee fee: 1% of the loan amount

- Annual fee: 0.35% of the outstanding loan balance

Ability to Finance Closing Costs

Another advantage of USDA loans is the potential to finance closing costs into the loan, subject to the property appraising for more than the purchase price.

This feature can further reduce the out-of-pocket expenses for borrowers at closing, making homeownership even more accessible.

Additionally, sellers are allowed to contribute up to 6% of the sale price towards the buyer’s closing costs, which can provide additional financial relief.

Options for handling closing costs:

- Rolling costs into the loan (subject to appraisal)

- Seller contributions

- Gifts from family members or approved sources

No Maximum Loan Amount

Unlike some other government-backed loan programs, USDA loans do not have a predetermined maximum loan amount. Instead,

the loan amount is determined by the borrower’s ability to repay the loan, as well as the property’s appraised value.

This flexibility allows borrowers in higher-cost areas to still take advantage of the USDA loan program, provided they meet income and property eligibility requirements.

Factors influencing loan amounts:

- Borrower’s debt-to-income ratio

- Property appraisal

- Local income limits

- Area loan limits (which can be quite generous)

Disadvantages of USDA Loans

Geographic Restrictions

One of the primary limitations of USDA loans is the geographic restriction on eligible properties.

To qualify for a USDA loan, the property must be located in an area designated as “rural” by the USDA.

However, the definition of rural is broader than many people realize and includes many suburban areas. Nonetheless, this requirement excludes properties in urban areas and some densely populated suburban locations.

Considerations regarding location:

- USDA eligibility maps are updated periodically

- Some areas may lose eligibility over time due to population growth

- Buyers must verify property eligibility before proceeding with a USDA loan

Income Limits

USDA loans are designed to assist low to moderate-income households, which means there are income limits for eligibility.

These limits vary by location and household size but generally cannot exceed 115% of the area’s median income.

While this ensures the program serves its intended audience, it can disqualify some potential borrowers who exceed the income thresholds.

Income limit considerations:

- Limits are based on total household income, not just the borrower’s income

- Adjustments are made for dependents and certain expenses

- Income from all adult household members is considered, even if they’re not on the loan

Property Use Limitations

USDA loans are intended for primary residences only.

This restriction means that investment properties, vacation homes, or second homes are not eligible for USDA financing.

Additionally, the property cannot be designed for income-producing activities, which may limit options for those looking to combine their home with a business venture.

Property restrictions:

- Must be owner-occupied

- Cannot have income-producing features (like excessive acreage for farming)

- Must meet USDA’s definition of a “modest” home for the area

Longer Processing Times

Due to the government backing and additional eligibility checks required, USDA loans can take longer to process than conventional mortgages.

This extended timeline can be a disadvantage in competitive real estate markets where quick closings are often preferred by sellers.

Borrowers should be prepared for potentially longer wait times and should communicate this to sellers when making offers.

Factors contributing to longer processing:

- USDA review and approval process

- Property eligibility verification

- Income and employment documentation requirements

Upfront and Annual Fees

While USDA loans offer competitive interest rates and lower mortgage insurance premiums, they do come with both an upfront guarantee fee and an annual fee.

The upfront fee is 1% of the loan amount and can be financed into the loan, while the annual fee is 0.35% of the outstanding loan balance, paid monthly.

Although these fees are generally lower than those associated with FHA loans, they still represent an additional cost that borrowers must consider.

Fee structure:

- Upfront guarantee fee: 1% of the loan amount (can be financed)

- Annual fee: 0.35% of the outstanding balance (paid monthly)

Stricter Property Requirements

USDA loans have specific property requirements that must be met for the loan to be approved.

These requirements are designed to ensure that the property is safe, sanitary, and functionally sound, but they can sometimes be more stringent than those for conventional loans.

This can limit the pool of eligible properties and may require repairs or improvements to be made before the loan can close.

Property requirement considerations:

- Must meet USDA’s minimum property standards

- May require additional inspections or appraisals

- Repairs might need to be completed before closing

In conclusion, USDA loans offer a unique opportunity for eligible borrowers to achieve homeownership with significant financial advantages. The no-down-payment option, competitive rates, and flexible credit requirements make these loans an attractive option for many rural and suburban homebuyers. However, the geographic restrictions, income limits, and property use limitations mean that USDA loans are not suitable for everyone. Potential borrowers should carefully weigh these pros and cons against their personal financial situation and homeownership goals to determine if a USDA loan is the right choice for them.

Frequently Asked Questions About USDA Loan Pros And Cons

- Who is eligible for a USDA loan?

Eligible borrowers must have U.S. citizenship or permanent residency, meet income requirements, and purchase a property in a USDA-designated rural area. Credit and employment history are also considered in the application process. - Can I use a USDA loan to purchase any type of property?

USDA loans are primarily for single-family homes that will be used as the borrower’s primary residence. Certain condos, townhouses, and manufactured homes may also be eligible if they meet USDA requirements. - How do USDA loan interest rates compare to conventional mortgages?

USDA loan interest rates are often lower than those of conventional mortgages due to the government backing. Rates can vary by lender and borrower qualifications, so it’s best to shop around for the most competitive offer. - Is mortgage insurance required for USDA loans?

Yes, USDA loans require both an upfront guarantee fee and an annual fee, which function similarly to mortgage insurance. However, these fees are typically lower than the mortgage insurance premiums for FHA loans or private mortgage insurance for conventional loans with low down payments. - Can I refinance a USDA loan?

Yes, the USDA offers refinancing options including the Streamlined Assist Refinance program, which can help borrowers lower their interest rates or monthly payments. Refinancing to a non-USDA loan is also possible if the borrower no longer meets USDA eligibility criteria. - Are there limits on how much I can borrow with a USDA loan?

There is no set maximum loan amount for USDA loans. The loan amount is determined by the borrower’s ability to repay, the property’s appraised value, and local income limits. However, the property must still be considered “modest” for the area. - How long does the USDA loan process typically take?

The USDA loan process can take longer than conventional loans, often 30 to 60 days from application to closing. Factors such as property eligibility verification and USDA approval can extend the timeline. - Can I make home improvements with a USDA loan?

Yes, USDA loans can be used for home improvements in certain situations. The Section 504 Home Repair program offers loans and grants for repairs and improvements to make homes safer and more accessible.