USDA loans, backed by the U.S. Department of Agriculture, are designed to promote homeownership in rural areas by providing affordable financing options. These loans offer several benefits, such as no down payment and competitive interest rates, making them an attractive choice for eligible borrowers. However, they also come with certain restrictions and requirements that potential buyers should carefully consider. This article will explore the advantages and disadvantages of USDA loans to help you make an informed decision.

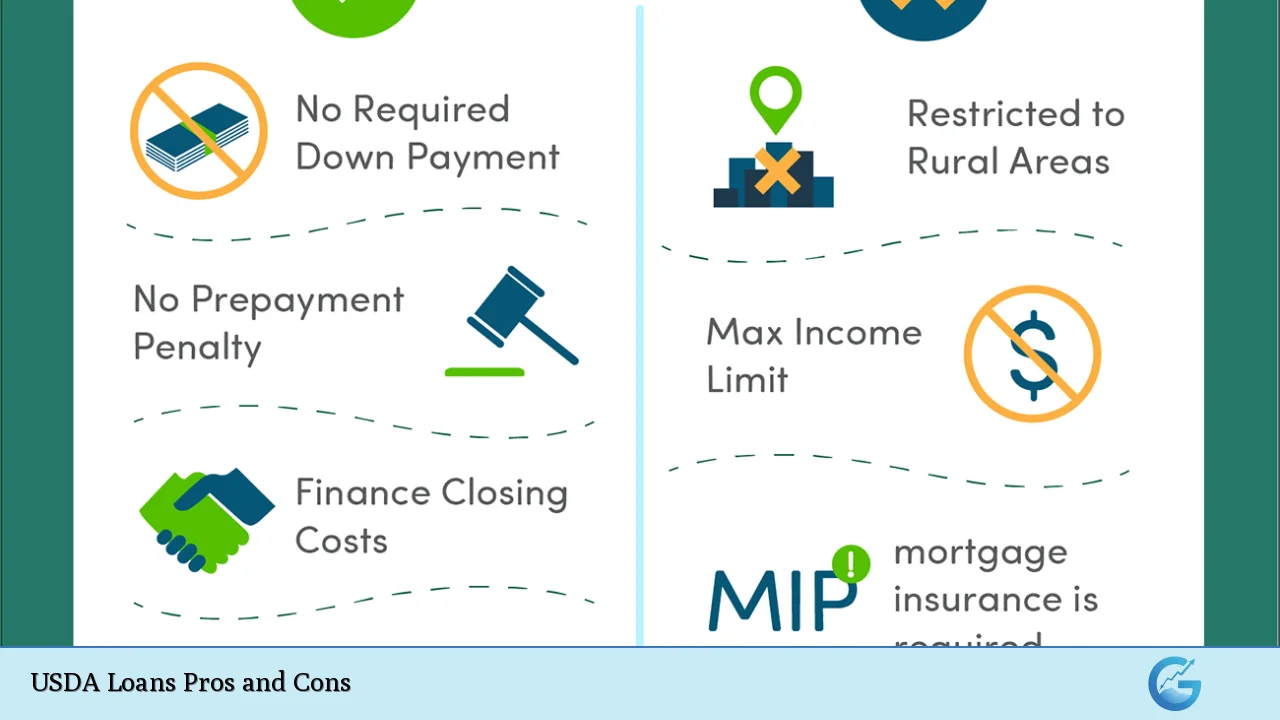

| Pros | Cons |

|---|---|

| No down payment required | Income limits apply |

| Competitive interest rates | Property must be in designated rural areas |

| Relaxed credit requirements | Occupancy restrictions (primary residence only) |

| No private mortgage insurance (PMI) required | USDA program fees can add to costs |

| Penalty-free repayment options | Longer underwriting process compared to conventional loans |

| Ability to finance closing costs into the loan | Limited loan amounts based on local median income |

| Available for both purchase and refinancing | Potential for limited property types (e.g., no income-producing properties) |

No Down Payment Required

One of the most significant advantages of USDA loans is that they do not require a down payment. This feature makes homeownership accessible for individuals and families who may not have substantial savings.

- Affordability: Eliminating the down payment can save borrowers thousands of dollars upfront.

- Increased Buying Power: Without the need for a down payment, buyers can allocate their funds toward other expenses such as closing costs or home improvements.

Competitive Interest Rates

USDA loans typically offer lower interest rates compared to conventional loans. This is primarily due to the government backing, which reduces lender risk.

- Lower Monthly Payments: Lower interest rates can lead to reduced monthly mortgage payments, making homeownership more affordable over time.

- Long-Term Savings: Borrowers can save significantly on interest payments throughout the life of the loan.

Relaxed Credit Requirements

USDA loans generally have more lenient credit requirements than conventional loans, making them accessible to a broader range of borrowers.

- Flexible Credit Scores: Many lenders accept credit scores as low as 640, allowing those with less-than-perfect credit to qualify.

- Consideration of Non-Traditional Credit: For borrowers without a traditional credit history, some lenders may consider alternative credit sources.

No Private Mortgage Insurance (PMI) Required

Unlike many conventional loans that require PMI when the down payment is less than 20%, USDA loans do not require this additional cost.

- Cost Savings: Eliminating PMI can result in significant savings on monthly payments.

- Lower Overall Loan Costs: The absence of PMI makes USDA loans more financially attractive compared to other loan types that impose this requirement.

Penalty-Free Repayment Options

USDA loans offer flexibility in repayment without penalties for early payoff.

- Financial Freedom: Borrowers can pay off their loans early without incurring additional fees, allowing them to save on interest costs.

- Encouragement of Responsible Borrowing: This feature promotes responsible financial management among borrowers.

Ability to Finance Closing Costs into the Loan

USDA loans allow borrowers to include closing costs in their financing, which can alleviate immediate financial burdens.

- Reduced Upfront Costs: This feature enables buyers to manage their finances better by minimizing out-of-pocket expenses at closing.

- Easier Budgeting: Including closing costs in the loan simplifies budgeting for new homeowners.

Available for Both Purchase and Refinancing

USDA loans are versatile in that they can be used not only for purchasing homes but also for refinancing existing mortgages.

- Refinancing Options: Homeowners with existing USDA loans can refinance for better terms or lower rates without needing a new down payment.

- Support for Rural Development: This flexibility encourages investment in rural communities by making it easier for residents to improve their housing situations.

Income Limits Apply

While USDA loans have many advantages, they also come with income limits that may restrict eligibility.

- Targeted Assistance: The income limits are set at 115% of the median income for the area, ensuring that assistance is directed toward low-to-moderate-income households.

- Potential Exclusion for Higher Earners: Borrowers with incomes above this threshold will not qualify, which can limit access for some potential buyers.

Property Must Be in Designated Rural Areas

Another significant drawback is that properties must be located in designated rural areas as defined by the USDA.

- Geographic Limitations: Buyers looking in urban or suburban settings may find it challenging to locate eligible properties.

- Rural Definition Variability: The USDA defines “rural” based on population density and other factors, which may vary widely across different regions.

Occupancy Restrictions (Primary Residence Only)

USDA loans are strictly intended for primary residences and cannot be used for investment properties or vacation homes.

- Limitations on Investment Opportunities: This restriction may deter investors looking to purchase rental properties or second homes in rural areas.

- Focus on Homeownership: The program aims to promote homeownership rather than investment, aligning with its mission to support rural communities.

USDA Program Fees Can Add to Costs

While USDA loans do not require PMI, they do involve certain fees that can impact overall loan costs.

- Guarantee Fees: USDA loans include an upfront guarantee fee (typically 1% of the loan amount) and an annual fee (currently 0.35%), which are added costs that need consideration during budgeting.

- Impact on Loan Affordability: Although these fees are lower than typical PMI costs, they still represent an additional financial burden that borrowers should factor into their decision-making process.

Longer Underwriting Process Compared to Conventional Loans

The approval process for USDA loans can be more time-consuming than conventional loan processes due to additional requirements and documentation needed.

- Extended Waiting Periods: Borrowers may experience longer wait times for approval and funding, which could delay home purchases.

- Increased Documentation Requirements: The need for extensive documentation can complicate and prolong the application process compared to conventional lending options.

Limited Loan Amounts Based on Local Median Income

USDA loan amounts are typically limited based on local median income levels, which can restrict borrowing capacity for some applicants.

- Affordability Constraints: Borrowers seeking higher-priced homes may find themselves unable to secure adequate financing through USDA programs due to these limits.

- Regional Variability: Loan limits vary significantly across different regions, impacting potential buyers differently depending on their location.

Potential for Limited Property Types

Certain property types may not qualify under USDA guidelines, further narrowing options for potential buyers.

- Restrictions on Income-Producing Properties: Properties intended for rental or business purposes do not qualify under USDA guidelines, limiting investment opportunities in rural areas.

- Eligible Property Types Defined by USDA: Buyers must ensure their chosen property meets specific criteria set forth by the USDA regarding safety and suitability before applying for a loan.

In conclusion, while USDA loans present numerous advantages such as no down payment requirements and competitive interest rates, they also come with notable disadvantages including geographic restrictions and income limits. Potential borrowers should weigh these pros and cons carefully against their financial situation and housing needs. By understanding both sides of this financing option, individuals can make informed decisions about whether a USDA loan is right for them in their pursuit of homeownership in rural America.

Frequently Asked Questions About USDA Loans

- What are USDA loans?

USDA loans are government-backed mortgages aimed at promoting homeownership in rural areas without requiring a down payment. - Who qualifies for a USDA loan?

To qualify, borrowers must meet specific income limits based on local median income levels and choose properties located in designated rural areas. - Are there any fees associated with USDA loans?

Yes, there are upfront guarantee fees and annual fees associated with USDA loans that borrowers should consider. - Can I use a USDA loan to buy an investment property?

No, USDA loans are only available for primary residences; investment properties do not qualify. - How long does it take to get approved for a USDA loan?

The approval process can take longer than conventional loans due to additional documentation requirements. - Is there a minimum credit score requirement for USDA loans?

The typical minimum credit score accepted is around 640; however, some lenders may have more flexible criteria. - Can I refinance my existing mortgage with a USDA loan?

Yes, existing homeowners with eligible properties can refinance through various USDA refinancing programs. - What types of properties qualify under the USDA loan program?

Eligible properties include single-family homes located in designated rural areas but exclude income-producing properties.