USDA mortgage loans are a unique financing option designed to promote homeownership in rural areas of the United States. Backed by the U.S. Department of Agriculture, these loans provide an opportunity for low to moderate-income families to purchase homes without the burden of a down payment. While they offer significant advantages, such as lower interest rates and reduced mortgage insurance costs, they also come with specific limitations and requirements that potential borrowers must consider. This article explores the pros and cons of USDA mortgage loans in detail, helping prospective homebuyers make informed decisions.

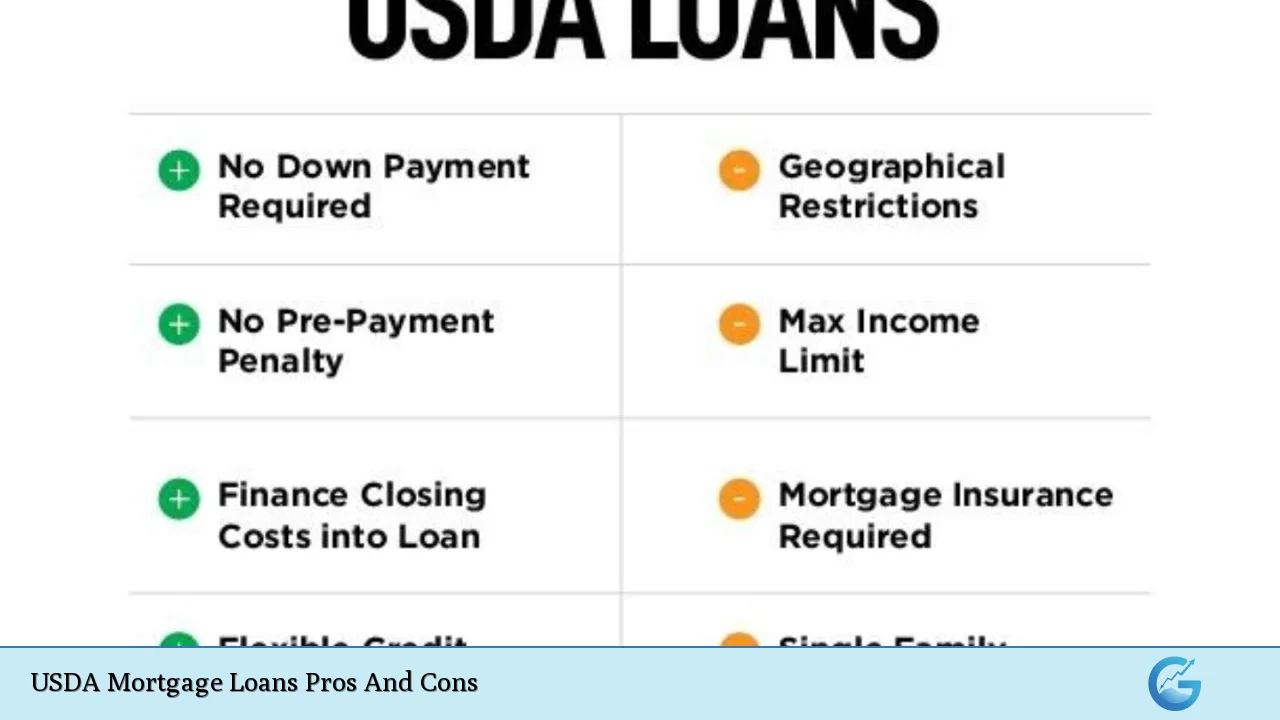

| Pros | Cons |

|---|---|

| No down payment required | Geographical restrictions on property location |

| Lower mortgage insurance premiums | Income limits based on household size and location |

| Competitive interest rates | Property must be used as a primary residence |

| Ability to finance closing costs | Longer underwriting process compared to other loans |

| No minimum credit score requirement for some applicants | Lifetime mortgage insurance premiums apply |

| Streamlined refinancing options available | Limited to specific loan amounts based on area limits |

| Seller can pay closing costs on behalf of the buyer | Requires completion of homeownership education course for first-time buyers |

No Down Payment Required

One of the most significant advantages of USDA loans is that they allow eligible borrowers to purchase a home without making a down payment. This feature is particularly beneficial for first-time homebuyers who may struggle to save for a traditional down payment.

- Zero upfront costs: Borrowers can finance 100% of the home’s value, which means they can allocate funds toward other expenses such as closing costs or moving expenses.

- Access for low-income families: This no-down-payment requirement opens doors for families who might not have sufficient savings but possess stable income.

Lower Mortgage Insurance Premiums

USDA loans typically come with lower mortgage insurance costs compared to FHA or conventional loans.

- Affordable insurance rates: While USDA loans do include an upfront guarantee fee and an annual fee, these rates are generally lower than those associated with FHA loans.

- Financing options: Borrowers can finance these fees into their loan amount, further reducing the initial cash required at closing.

Competitive Interest Rates

Because USDA loans are backed by the government, lenders can offer competitive interest rates that are often lower than those found in conventional mortgages.

- Lower monthly payments: The reduced interest rates translate into lower monthly mortgage payments, making homeownership more affordable over time.

- Long-term savings: Borrowers save significantly on total interest paid over the life of the loan due to these lower rates.

Ability to Finance Closing Costs

Another advantage of USDA loans is that they allow borrowers to include closing costs in the loan amount.

- Reduced out-of-pocket expenses: This feature can help buyers manage their finances better by minimizing upfront costs associated with purchasing a home.

- Gift funds allowed: Buyers can also use gift funds from family members to cover closing costs, making it easier to secure financing.

No Minimum Credit Score Requirement

USDA loans do not impose strict credit score requirements, making them accessible to a broader range of applicants.

- Flexibility for borrowers: While some lenders may prefer scores above 640 for automated underwriting, those with lower scores may still qualify through manual underwriting processes.

- Consideration of alternative credit histories: Applicants without established credit histories may use alternative sources like rent or utility payments to demonstrate creditworthiness.

Streamlined Refinancing Options Available

For current USDA loan holders, refinancing options are available that simplify the process compared to traditional refinancing methods.

- Quick turnaround: The streamlined assist refinance program allows borrowers to refinance without needing extensive documentation like credit reports or appraisals.

- Lower barriers to refinancing: This makes it easier for borrowers to take advantage of lower interest rates or better financial situations over time.

Seller Can Pay Closing Costs on Behalf of the Buyer

In many cases, sellers can contribute towards closing costs when a buyer uses a USDA loan.

- Increased negotiation power: This provision can make offers more attractive in competitive markets where buyers may struggle with upfront costs.

- Financial relief for buyers: It alleviates some financial burdens from buyers, allowing them to focus on other aspects of homeownership.

Geographical Restrictions on Property Location

Despite their numerous benefits, USDA loans come with geographical limitations that potential borrowers must consider.

- Eligible rural areas only: Properties must be located in designated rural areas as defined by the USDA. While this definition includes many suburban regions, it excludes urban properties.

- Potential limitations on choices: Buyers looking for homes in urban settings may need to explore other financing options if they do not meet this criterion.

Income Limits Based on Household Size and Location

USDA loans have specific income limits that vary based on household size and geographic location.

- Eligibility constraints: Borrowers must demonstrate that their income falls within certain thresholds established by the USDA, which ensures that assistance goes primarily to low and moderate-income families.

- Impact on larger households: Families with more members may have higher income limits but could still find themselves ineligible if their combined income exceeds local thresholds.

Property Must Be Used as a Primary Residence

USDA loans are strictly intended for primary residences only; investment properties or vacation homes do not qualify.

- Limitations for investors: This restriction means that individuals looking to purchase rental properties will need to seek alternative financing solutions.

- Focus on owner occupancy: The program aims to promote stable communities by ensuring that homes are occupied by their owners rather than being used solely as investment properties.

Longer Underwriting Process Compared to Other Loans

The underwriting process for USDA loans can take longer than conventional or FHA loans due to additional requirements imposed by the USDA itself.

- Increased processing time: While lenders can approve FHA and VA loans independently, USDA requires its review after lender approval, potentially delaying closings by several weeks.

- Planning ahead necessary: Borrowers should factor this extended timeline into their home buying plans, especially if they have tight deadlines for moving or selling another property.

Lifetime Mortgage Insurance Premiums Apply

While USDA loans have lower mortgage insurance premiums than other options, these premiums last for the life of the loan unless refinanced into a conventional mortgage with at least 20% equity.

- Ongoing cost consideration: Borrowers must budget for these ongoing premiums throughout their loan duration, which could affect long-term financial planning.

- Limited options for removal: The inability to eliminate mortgage insurance without refinancing can be seen as a downside compared to other loan types where private mortgage insurance (PMI) drops off once sufficient equity is achieved.

Limited To Specific Loan Amounts Based On Area Limits

USDA loans have maximum loan amounts determined by geographic area limits set by the agency.

- Potential borrowing limitations: These caps might restrict eligible buyers from purchasing higher-value homes in desirable areas even if they meet income qualifications.

- Regional variations exist: Borrowers should check local limits as they vary significantly across different regions and could impact their purchasing power in competitive markets.

Requires Completion of Homeownership Education Course for First-Time Buyers

First-time homebuyers using USDA loans must complete an approved homeownership education course before closing on their new home.

- Preparation for ownership responsibilities: These courses equip buyers with essential knowledge about managing finances and maintaining their new homes effectively.

- Additional step in the process: While beneficial, this requirement adds another layer of complexity and time commitment for first-time buyers navigating the home buying process.

In conclusion, USDA mortgage loans present a compelling option for eligible buyers seeking affordable housing solutions in rural areas. With no down payment requirement and competitive interest rates, they cater specifically to low-to-moderate-income families striving for homeownership. However, potential borrowers must weigh these benefits against geographical restrictions, income limits, and other specific requirements inherent in this program. Understanding both the advantages and disadvantages will empower prospective homeowners to make informed decisions aligned with their financial goals and lifestyle needs.

Frequently Asked Questions About USDA Mortgage Loans

- What is a USDA loan?

A USDA loan is a government-backed mortgage option designed primarily for low-to-moderate-income individuals looking to purchase homes in eligible rural areas. - Do I need a down payment?

No, one of the key benefits of a USDA loan is that it requires no down payment from eligible borrowers. - Are there income limits?

Yes, eligibility is determined based on household size and location; applicants must meet specific income thresholds set by the USDA. - Can I use a USDA loan for an investment property?

No, USDA loans are intended solely for primary residences; investment properties do not qualify. - What are the credit requirements?

While there is no minimum credit score mandated by the USDA, many lenders prefer scores above 640 for automated underwriting. - How long does it take to close a USDA loan?

The closing process may take longer than traditional mortgages due to additional reviews required by the USDA after lender approval. - Can I refinance my USDA loan?

Yes, there are streamlined refinancing options available that simplify the process compared to conventional refinancing methods. - What happens if I sell my house?

If you sell your house before paying off your USDA loan, you will need to pay off any remaining balance from the sale proceeds.