The VA Streamline Refinance, officially known as the Interest Rate Reduction Refinance Loan (IRRRL), offers veterans and active-duty service members a unique opportunity to refinance their existing VA loans with minimal hassle. This program is designed to lower monthly mortgage payments or stabilize interest rates, making it a popular choice among eligible borrowers. However, like any financial product, it comes with its own set of advantages and disadvantages that potential applicants should carefully consider.

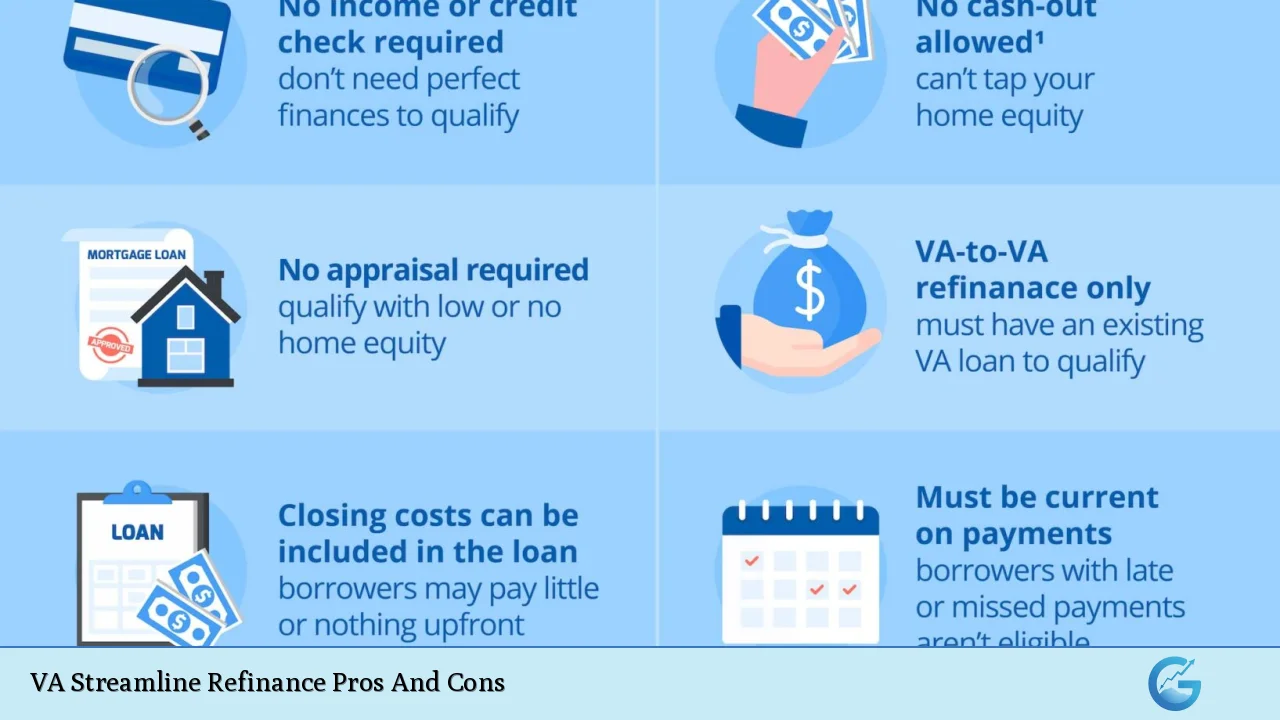

| Pros | Cons |

|---|---|

| Potential for lower mortgage payments | Cannot cash out equity |

| No appraisal required | Must wait for interest rates to drop below current rates |

| No credit check necessary | Closing costs must still be paid |

| Fast closing process | Limited to existing VA loan holders |

| Lower VA funding fee compared to other loans | Requires a history of on-time payments on the current loan |

| Ability to roll closing costs into the new loan | Not available for investment properties unless previously occupied as primary residence |

| Potential to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage | May not benefit those with low current rates or high existing equity needs |

| Streamlined documentation process reduces paperwork burden | Limited eligibility criteria can exclude some veterans and service members |

Potential for Lower Mortgage Payments

One of the most significant advantages of the VA Streamline Refinance is the potential for lower monthly mortgage payments. By refinancing at a lower interest rate, borrowers can significantly reduce their financial burden.

- Lower Interest Rates: The program allows veterans to secure rates that are typically lower than those available through conventional refinancing options.

- Long-term Savings: Over the life of the loan, even a small reduction in interest rate can lead to substantial savings.

No Appraisal Required

Another appealing feature of the VA Streamline Refinance is that it eliminates the need for an appraisal. This can expedite the refinancing process and reduce costs.

- Faster Processing Times: Without the need for an appraisal, lenders can close loans more quickly, often within 30 days.

- Cost Savings: Borrowers save on appraisal fees, which can range from several hundred to over a thousand dollars.

No Credit Check Necessary

The VA Streamline Refinance does not require a credit check in most cases, which is beneficial for borrowers who may have experienced credit issues.

- Accessibility: This feature makes refinancing accessible to more veterans who might otherwise be disqualified due to low credit scores.

- Simplified Process: The lack of credit scrutiny simplifies the application process, allowing borrowers to focus on securing better terms rather than worrying about their credit history.

Fast Closing Process

Due to its streamlined nature, this refinancing option typically results in a fast closing process.

- Efficiency: Borrowers can expect quicker turnaround times compared to traditional refinancing methods.

- Less Stress: A faster closing means less time spent in uncertainty, which can be particularly advantageous in fluctuating interest rate environments.

Lower VA Funding Fee Compared to Other Loans

The funding fee associated with VA Streamline Refinances is generally lower than that for other types of VA loans.

- Cost-effective Financing: This reduced fee helps make refinancing more affordable.

- Rolling Fees into Loan Amount: Borrowers have the option to roll this fee into their new loan balance, minimizing upfront costs.

Ability to Roll Closing Costs into the New Loan

Borrowers can roll their closing costs into the new loan amount with a VA Streamline Refinance.

- Reduced Out-of-Pocket Expenses: This feature allows borrowers to refinance without needing significant cash reserves at closing.

- Improved Cash Flow: By avoiding large upfront payments, borrowers can maintain better cash flow for other expenses.

Potential Drawbacks

While there are numerous benefits associated with the VA Streamline Refinance, several disadvantages warrant consideration.

Cannot Cash Out Equity

A significant limitation of this refinancing option is that it does not allow borrowers to cash out equity from their homes.

- No Access to Funds: Homeowners looking to tap into their home equity for renovations or debt consolidation will find this option unsuitable.

- Alternative Options Required: Those needing cash may have to explore other refinancing avenues, such as a cash-out refinance.

Must Wait for Interest Rates to Drop Below Current Rates

To qualify for a VA Streamline Refinance, borrowers must wait until interest rates drop below their current mortgage rate unless switching from an ARM.

- Timing Issues: This requirement may delay refinancing opportunities for some borrowers who are eager to take advantage of lower rates.

- Market Dependency: Borrowers must be vigilant and responsive to market changes, which can be challenging in volatile economic climates.

Closing Costs Must Still Be Paid

Despite some costs being rolled into the loan amount, closing costs remain an essential consideration.

- Financial Burden: Borrowers must still prepare for these expenses, which can range from 2% to 6% of the new loan amount.

- Impact on Savings: If not calculated properly, these costs could offset potential savings from lower monthly payments.

Limited to Existing VA Loan Holders

Eligibility for the VA Streamline Refinance is restricted solely to those who already hold a VA loan.

- Inaccessibility for New Borrowers: Veterans looking to refinance non-VA loans cannot take advantage of this program.

- Specific Property Requirements: The property must also be the borrower’s primary residence at some point during ownership.

Requires a History of On-Time Payments on Current Loan

To qualify for this refinance option, borrowers must demonstrate a history of timely payments on their existing VA loan.

- Strict Eligibility Criteria: A record of at least six consecutive on-time payments is necessary; otherwise, applicants may be disqualified.

- Excludes Those in Financial Distress: This requirement may exclude veterans facing financial difficulties despite having existing loans.

Not Available for Investment Properties Unless Previously Occupied as Primary Residence

The VA Streamline Refinance is primarily intended for properties that have been used as primary residences.

- Limitations on Investment Opportunities: Veterans seeking refinancing options for investment properties will find this program unsuitable unless they meet specific conditions.

- Potential Loss of Benefits: This restriction may limit financial strategies that involve leveraging home equity through refinances.

Conclusion

The VA Streamline Refinance presents veterans and active-duty service members with an opportunity to reduce their mortgage payments and streamline their refinancing process. However, it is crucial for potential applicants to weigh both the advantages and disadvantages carefully.

While benefits such as lower monthly payments, no appraisal requirements, and simplified documentation make this option attractive, limitations like inability to cash out equity and strict eligibility criteria could impact financial planning.

In navigating these pros and cons, borrowers should assess their individual financial situations and consider consulting with a knowledgeable lender or financial advisor before proceeding with a refinance application.

Frequently Asked Questions About VA Streamline Refinance

- What is a VA Streamline Refinance?

A VA Streamline Refinance allows eligible veterans and active-duty service members to refinance their existing VA loans with fewer requirements and potentially lower interest rates. - Can I cash out equity with a VA Streamline Refinance?

No, the VA Streamline Refinance does not permit cash-out options; it strictly focuses on lowering interest rates or changing loan terms. - How long does it take to close on a VA Streamline Refinance?

The closing process typically takes around 30 days due to streamlined requirements such as no appraisal needed. - What are the eligibility requirements?

Borrowers must already have an existing VA loan and demonstrate a history of timely payments on that loan. - Are there any income verification requirements?

No income verification is required unless there is an increase in monthly payment by 20% or more. - What happens if I have late payments on my current loan?

If you have more than one late payment in the past year or missed payments recently, you may not qualify for a streamline refinance. - Can I refinance if I previously lived in my home?

You may still qualify if you used to live in your home but currently rent it out; however, you must certify prior occupancy. - Is there a limit on how many times I can use this refinance option?

No limit exists; however, you must wait at least 210 days since your last loan closing before applying again.