Variable annuities are complex financial products that offer a unique blend of investment opportunity and insurance protection. These versatile instruments have gained popularity among investors seeking long-term growth potential coupled with guaranteed income features. However, like any financial product, variable annuities come with their own set of advantages and disadvantages that warrant careful consideration.

| Pros | Cons |

|---|---|

| Tax-deferred growth potential | High fees and expenses |

| Lifetime income options | Market risk exposure |

| Death benefit protection | Complexity and lack of liquidity |

| Investment flexibility | Surrender charges |

| No contribution limits | Tax implications on withdrawals |

| Optional living benefit riders | Potential for underperformance |

Tax-Deferred Growth Potential

One of the most significant advantages of variable annuities is the opportunity for tax-deferred growth. This feature allows investors to potentially accumulate wealth more rapidly compared to taxable investment accounts.

- Earnings grow tax-free until withdrawal

- Compound growth can be more substantial over time

- Flexibility to manage tax liability in retirement

Investors should be aware that while tax-deferral can be beneficial, withdrawals from variable annuities are taxed as ordinary income, which may be higher than capital gains rates applicable to other investments.

High Fees and Expenses

The most significant drawback of variable annuities is their cost structure. These products typically carry higher fees compared to other investment vehicles, which can erode returns over time.

- Mortality and expense risk charges (M&E fees)

- Administrative fees

- Underlying fund expenses

- Optional rider costs

It’s crucial for investors to carefully review the fee structure of any variable annuity contract, as total annual expenses can range from 2% to 3% or more, significantly impacting long-term performance.

Lifetime Income Options

Variable annuities offer the unique benefit of providing a guaranteed income stream that can last for the remainder of the annuitant’s life, addressing longevity risk.

- Annuitization options for consistent payments

- Guaranteed minimum income benefit (GMIB) riders

- Flexibility in payout options (e.g., joint and survivor benefits)

The security of lifetime income can be particularly valuable for retirees concerned about outliving their savings, especially in an era of increasing life expectancies.

Market Risk Exposure

Unlike fixed annuities, variable annuities expose investors to market volatility, which can lead to significant fluctuations in account value.

- Account value tied to performance of underlying investments

- Potential for losses during market downturns

- Risk of reduced income if market performance is poor

While variable annuities offer growth potential, they do not provide the same level of principal protection as fixed annuities, making them less suitable for risk-averse investors.

Death Benefit Protection

Variable annuities typically include a death benefit feature, which can provide a financial safety net for beneficiaries.

- Guaranteed minimum death benefit

- Step-up options to lock in market gains

- Enhanced death benefit riders available

The death benefit can ensure that beneficiaries receive at least the amount of premiums paid, even if the account value has declined due to poor market performance.

Complexity and Lack of Liquidity

Variable annuities are intricate financial instruments that can be challenging for many investors to fully understand. Additionally, they often come with restrictions on access to funds.

- Complex contract terms and conditions

- Limited withdrawal options without penalties

- Potential impact on means-tested benefits

The complexity of variable annuities necessitates thorough research and possibly professional guidance to ensure they align with an investor’s financial goals and risk tolerance.

Investment Flexibility

One of the key advantages of variable annuities is the ability to choose from a range of investment options, allowing for customization based on risk tolerance and financial objectives.

- Diverse selection of subaccounts

- Ability to reallocate investments

- Dollar-cost averaging options

The investment flexibility of variable annuities can be particularly appealing to investors who want to maintain control over their asset allocation while benefiting from the annuity structure.

Surrender Charges

Most variable annuity contracts impose surrender charges for early withdrawals, which can significantly impact returns if funds are needed prematurely.

- Typically apply for 6-8 years after purchase

- Can range from 1% to 10% of the withdrawal amount

- Gradually decrease over time

Investors should carefully consider their liquidity needs before committing to a variable annuity, as accessing funds during the surrender period can result in substantial penalties.

No Contribution Limits

Unlike qualified retirement accounts such as 401(k)s and IRAs, variable annuities do not have annual contribution limits set by the IRS.

- Opportunity for high-income earners to save more

- Potential for larger tax-deferred growth

- Useful for those who have maxed out other retirement accounts

The absence of contribution limits makes variable annuities an attractive option for individuals looking to supplement their retirement savings beyond traditional tax-advantaged accounts.

Tax Implications on Withdrawals

While the tax-deferred growth of variable annuities is advantageous, withdrawals are subject to specific tax rules that can be less favorable than other investment vehicles.

- Withdrawals taxed as ordinary income

- 10% early withdrawal penalty before age 59½

- Last-in, first-out (LIFO) taxation method

The tax treatment of variable annuity withdrawals can result in higher tax liabilities compared to investments that qualify for long-term capital gains rates, particularly for high-income individuals.

Optional Living Benefit Riders

Variable annuities often offer additional features through living benefit riders, which can provide enhanced guarantees and protection.

- Guaranteed minimum withdrawal benefits (GMWB)

- Guaranteed lifetime withdrawal benefits (GLWB)

- Guaranteed minimum accumulation benefits (GMAB)

While these riders can offer valuable protections, they come at an additional cost that must be weighed against the potential benefits they provide.

Potential for Underperformance

Despite the potential for market-linked growth, variable annuities may underperform direct investments in similar assets due to their fee structure and insurance components.

- Higher expenses can drag down returns

- Limited investment options compared to open market

- Insurance features may cap upside potential

Investors should carefully compare the projected performance of variable annuities against other investment options, considering both the potential returns and the impact of fees over time.

In conclusion, variable annuities offer a unique combination of investment potential and insurance features that can be attractive for certain investors, particularly those seeking tax-deferred growth and guaranteed income in retirement. However, the high costs, complexity, and potential drawbacks make them unsuitable for everyone. It’s essential for investors to thoroughly evaluate their financial situation, goals, and risk tolerance before considering a variable annuity, and to seek professional advice to ensure it aligns with their overall financial strategy.

Frequently Asked Questions About Variable Annuities Pros And Cons

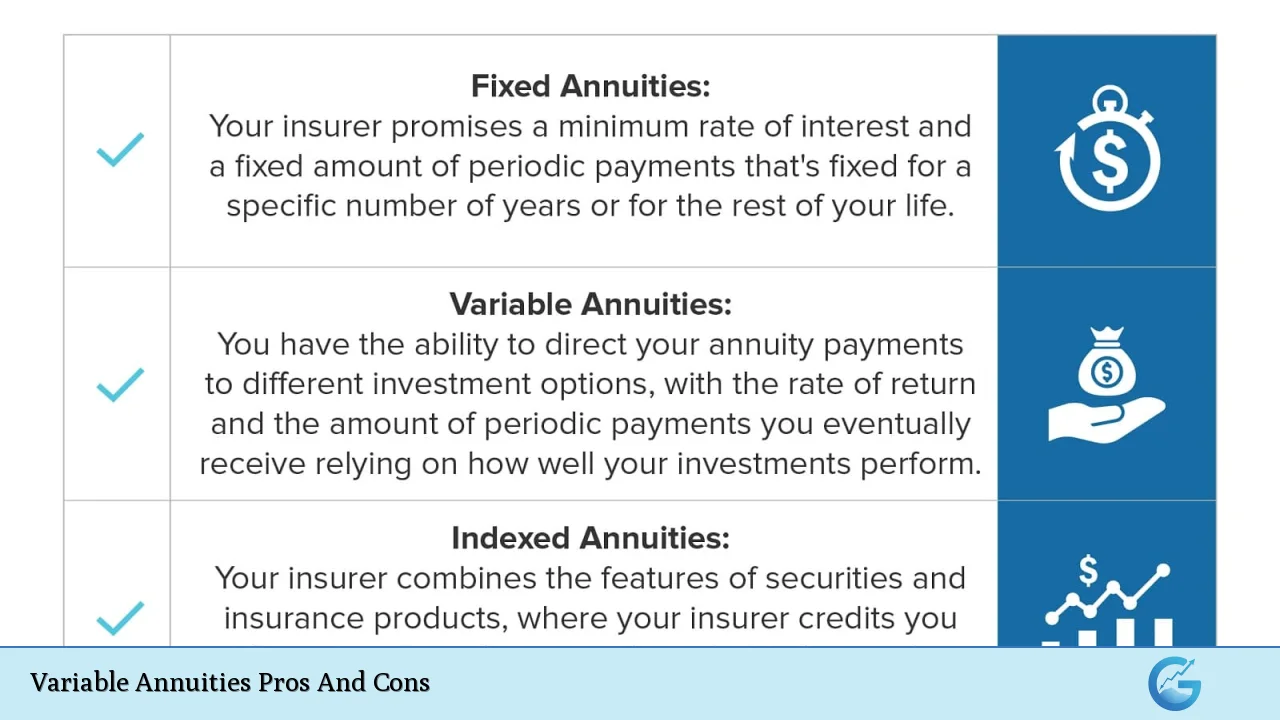

- How do variable annuities differ from fixed annuities?

Variable annuities offer market-linked returns and potential growth, while fixed annuities provide guaranteed interest rates. Variable annuities carry more risk but higher growth potential, whereas fixed annuities offer more stability but potentially lower returns. - Can I lose money in a variable annuity?

Yes, you can lose money in a variable annuity. The account value fluctuates based on the performance of the underlying investments, which means it can decrease during market downturns. - Are variable annuities a good choice for retirees?

Variable annuities can be suitable for some retirees, particularly those seeking growth potential and lifetime income. However, they may not be appropriate for risk-averse individuals or those needing immediate access to their funds. - How do fees impact the performance of variable annuities?

Fees can significantly impact performance over time. High annual expenses can reduce returns, potentially causing variable annuities to underperform compared to lower-cost investment options. - Can I withdraw money from a variable annuity without penalty?

Most variable annuities allow for limited withdrawals (typically 10% annually) without surrender charges. However, withdrawals before age 59½ may incur a 10% IRS penalty in addition to ordinary income taxes. - How are variable annuities taxed?

Earnings in variable annuities grow tax-deferred. Upon withdrawal, gains are taxed as ordinary income. The entire withdrawal may be taxable if made from an annuity funded with pre-tax dollars. - What happens to my variable annuity if I die?

Most variable annuities include a death benefit that pays out to your beneficiaries. This is typically at least the amount of premiums paid or the current account value, whichever is higher. - Can I exchange my variable annuity for a different investment?

Yes, you can exchange a variable annuity for another annuity through a 1035 exchange without triggering immediate taxes. However, this may reset surrender charge periods and should be carefully considered.