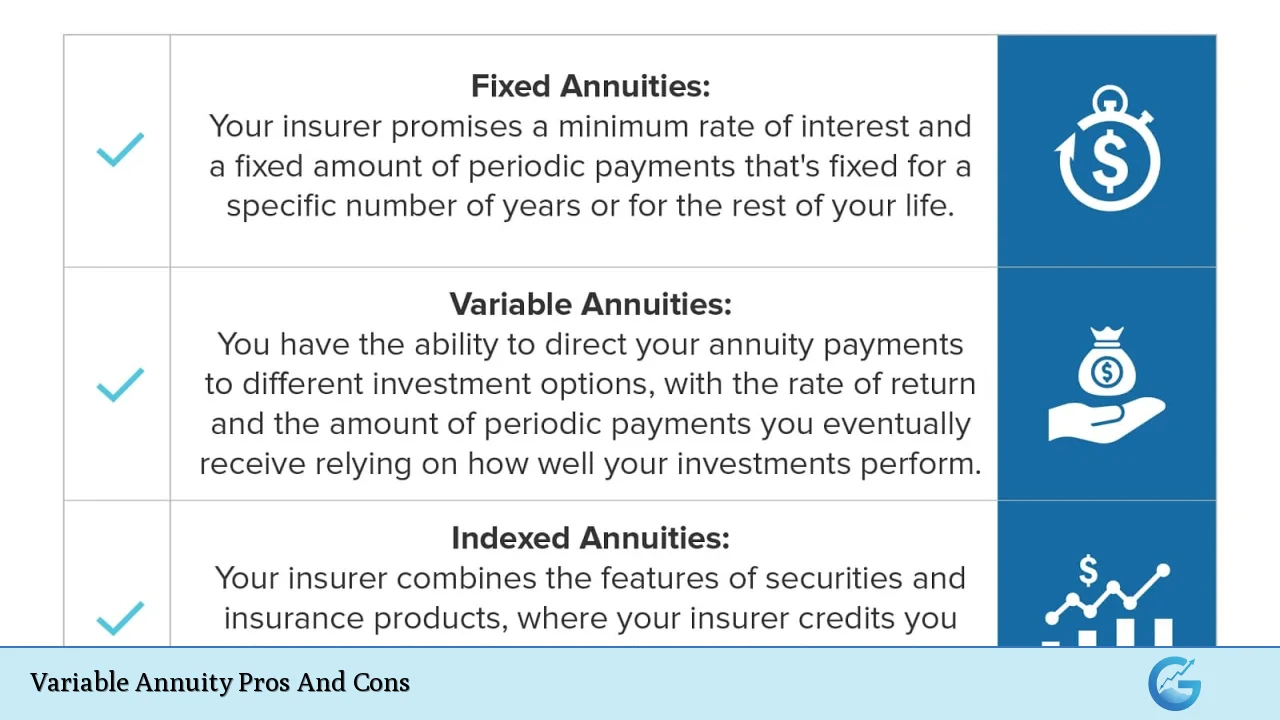

Variable annuities are complex financial products that combine elements of insurance and investment, offering potential growth and income in retirement. These versatile instruments have gained popularity among investors seeking a balance between market participation and guaranteed benefits. However, like any financial product, variable annuities come with their own set of advantages and disadvantages that warrant careful consideration.

| Pros | Cons |

|---|---|

| Tax-deferred growth | High fees and expenses |

| Potential for higher returns | Market risk and volatility |

| Lifetime income options | Complexity and lack of liquidity |

| Death benefit protection | Surrender charges |

| Investment flexibility | Less favorable tax treatment on withdrawals |

| No contribution limits | Potential for lower returns compared to direct investments |

| Creditor protection in some states | Commission-driven sales practices |

| Professional fund management | Opportunity cost of locked-up capital |

Advantages of Variable Annuities

Tax-Deferred Growth

One of the most significant benefits of variable annuities is the tax-deferred growth they offer.

Similar to traditional IRAs and 401(k)s, the earnings within a variable annuity are not taxed until withdrawal. This tax deferral can lead to potentially higher compounded growth over time, as the money that would have been paid in taxes remains invested and can generate additional returns.

- Allows for more efficient wealth accumulation

- Particularly beneficial for high-income earners in higher tax brackets

- Provides flexibility in managing taxable income during retirement

Potential for Higher Returns

Variable annuities offer the opportunity to invest in a variety of sub-accounts, which are similar to mutual funds. These sub-accounts can include stocks, bonds, and other securities, potentially providing higher returns compared to fixed annuities or other conservative investments.

- Access to a range of investment options

- Ability to adjust investment strategy over time

- Potential to outpace inflation through equity exposure

Lifetime Income Options

A key feature of variable annuities is the option to convert the accumulated value into a guaranteed stream of income that can last for life.

This annuitization option can provide peace of mind for retirees concerned about outliving their savings.

- Guaranteed income regardless of market performance

- Options for joint and survivor benefits for couples

- Potential for increasing income through certain riders

Death Benefit Protection

Variable annuities typically include a death benefit that ensures beneficiaries receive at least the amount invested or a guaranteed minimum, even if the account value has declined due to poor market performance.

- Protection for heirs against market downturns

- Options for enhanced death benefits through additional riders

- Bypass of probate process for faster distribution to beneficiaries

Investment Flexibility

Investors in variable annuities can choose from a variety of sub-accounts and often have the ability to reallocate their investments without incurring immediate tax consequences.

- Diversification across multiple asset classes

- Ability to adjust risk exposure over time

- Automatic rebalancing options to maintain desired asset allocation

No Contribution Limits

Unlike IRAs and 401(k)s, variable annuities do not have annual contribution limits set by the IRS. This makes them attractive to high-income earners who have maxed out other tax-advantaged retirement accounts.

- Ability to invest large lump sums

- Suitable for catch-up savings strategies

- Potential for significant tax-deferred growth on substantial investments

Creditor Protection

In many states, assets held in annuities are protected from creditors, which can be valuable for individuals in high-liability professions or those concerned about potential lawsuits.

- Varies by state, with some offering unlimited protection

- Can be part of a comprehensive asset protection strategy

- May provide security in the event of bankruptcy or legal judgments

Professional Fund Management

Variable annuities offer access to professionally managed investment options, which can be beneficial for investors who prefer not to manage their portfolios actively.

- Expertise of experienced fund managers

- Regular portfolio rebalancing and monitoring

- Access to institutional-quality investment strategies

Disadvantages of Variable Annuities

High Fees and Expenses

One of the most significant drawbacks of variable annuities is their high cost structure.

These products often come with multiple layers of fees that can significantly impact overall returns.

- Mortality and expense (M&E) charges, typically 1-1.5% annually

- Administrative fees for account maintenance and record-keeping

- Investment management fees for the underlying sub-accounts

- Optional rider fees for additional benefits, which can be substantial

Market Risk and Volatility

Unlike fixed annuities, variable annuities expose the investor to market risk. The value of the annuity can fluctuate based on the performance of the chosen sub-accounts.

- Potential for loss of principal in down markets

- Sequence of returns risk, especially near or during retirement

- Psychological stress from market volatility

Complexity and Lack of Liquidity

Variable annuities are complex financial instruments with many moving parts, making them difficult for some investors to fully understand. Additionally, they typically have limited liquidity.

- Complicated contract terms and conditions

- Restrictions on withdrawals, especially in early years

- Potential tax penalties for withdrawals before age 59½

Surrender Charges

Most variable annuities impose surrender charges if the contract is terminated or if withdrawals exceed certain limits within the first several years, typically 5-7 years but sometimes longer.

- Can be as high as 7-10% in the first year, declining over time

- May limit financial flexibility in case of unexpected needs

- Can make it costly to switch to a more suitable investment

Less Favorable Tax Treatment on Withdrawals

While growth is tax-deferred, withdrawals from variable annuities are taxed as ordinary income rather than at potentially lower capital gains rates.

- No preferential tax treatment for long-term capital gains

- Can push retirees into higher tax brackets

- May result in higher overall tax liability compared to other investment vehicles

Potential for Lower Returns Compared to Direct Investments

The high fees associated with variable annuities can erode returns over time, potentially resulting in lower overall performance compared to direct investments in similar assets.

- Impact of compounding fees over long holding periods

- Opportunity cost of not investing in lower-cost alternatives

- Reduced benefit from tax deferral due to fee drag

Commission-Driven Sales Practices

Variable annuities often come with high commissions for the agents selling them, which can lead to conflicts of interest and potentially unsuitable recommendations.

- Risk of being sold a product that’s not in the investor’s best interest

- Complexity can obscure true costs and benefits

- Pressure tactics from commission-motivated salespeople

Opportunity Cost of Locked-up Capital

The long-term nature of variable annuities and their surrender charge periods can result in significant opportunity costs if better investment options become available.

- Limited ability to take advantage of changing market conditions

- Reduced financial flexibility for other investment opportunities

- Potential for being stuck in an underperforming or overpriced product

In conclusion, variable annuities offer a unique combination of potential growth, tax deferral, and guaranteed benefits that can be attractive to certain investors.

However, their high costs, complexity, and potential drawbacks make them unsuitable for many. Careful consideration of individual financial goals, risk tolerance, and alternatives is crucial before investing in a variable annuity. As with any significant financial decision, consulting with a fiduciary financial advisor can help ensure that a variable annuity aligns with your overall retirement strategy and financial objectives.

Frequently Asked Questions About Variable Annuity Pros And Cons

- What is the primary advantage of a variable annuity over other investment options?

The primary advantage is the combination of tax-deferred growth potential with the option for guaranteed lifetime income. This unique feature can provide both investment opportunity and retirement security. - How do the fees in a variable annuity compare to those of mutual funds?

Variable annuity fees are typically higher than those of mutual funds. They often include mortality and expense charges, administrative fees, and fund expenses, which can total 2-3% annually or more, compared to average mutual fund expense ratios of around 0.5-1%. - Can I lose money in a variable annuity?

Yes, you can lose money in a variable annuity. The value of your investment fluctuates based on the performance of the underlying sub-accounts, which are subject to market risk. - Are variable annuities suitable for young investors?

Generally, variable annuities are more suitable for investors closer to retirement. Young investors typically have a longer time horizon and may benefit more from lower-cost investment options with greater liquidity. - How does the death benefit in a variable annuity work?

The basic death benefit typically guarantees that your beneficiaries will receive at least the amount you’ve invested, even if the account value has declined. Enhanced death benefits may offer greater guarantees for an additional cost. - Can I withdraw money from my variable annuity without penalties?

Most variable annuities allow for limited withdrawals (often 10% annually) without surrender charges. However, withdrawals before age 59½ may incur a 10% IRS penalty in addition to ordinary income taxes. - How do variable annuities perform in high-inflation environments?

Variable annuities have the potential to outperform fixed annuities during high inflation due to their equity exposure. However, this depends on market performance and is not guaranteed. - Are the gains in a variable annuity taxed differently than those in a mutual fund?

Yes, all gains withdrawn from a variable annuity are taxed as ordinary income, whereas long-term capital gains from mutual funds held outside of retirement accounts may be taxed at lower capital gains rates.