Velocity banking is a financial strategy that aims to accelerate debt repayment, particularly for mortgages. It leverages a Home Equity Line of Credit (HELOC) or a Personal Line of Credit (PLOC) to make large lump-sum payments against a primary mortgage. By doing so, the strategy seeks to reduce the overall interest paid over time and shorten the duration of the loan. While velocity banking has gained popularity among those seeking rapid debt elimination, it is essential to understand both its advantages and disadvantages, especially for individuals actively engaged in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Accelerated Debt Repayment | Complexity and Learning Curve |

| Reduced Interest Payments | Requires Positive Cash Flow |

| Improved Cash Flow Management | Potential for Increased Debt |

| Utilizes Home Equity Effectively | Variable Interest Rate Risks |

| Focus on Financial Discipline | Narrowed Focus on Mortgage Payoff |

| Liquidity in Emergencies | Potential Scams and Misleading Information |

| Flexibility in Payment Strategies | Not Suitable for Everyone |

| Opportunity for Wealth Building | Emotional Stress and Anxiety Management |

Accelerated Debt Repayment

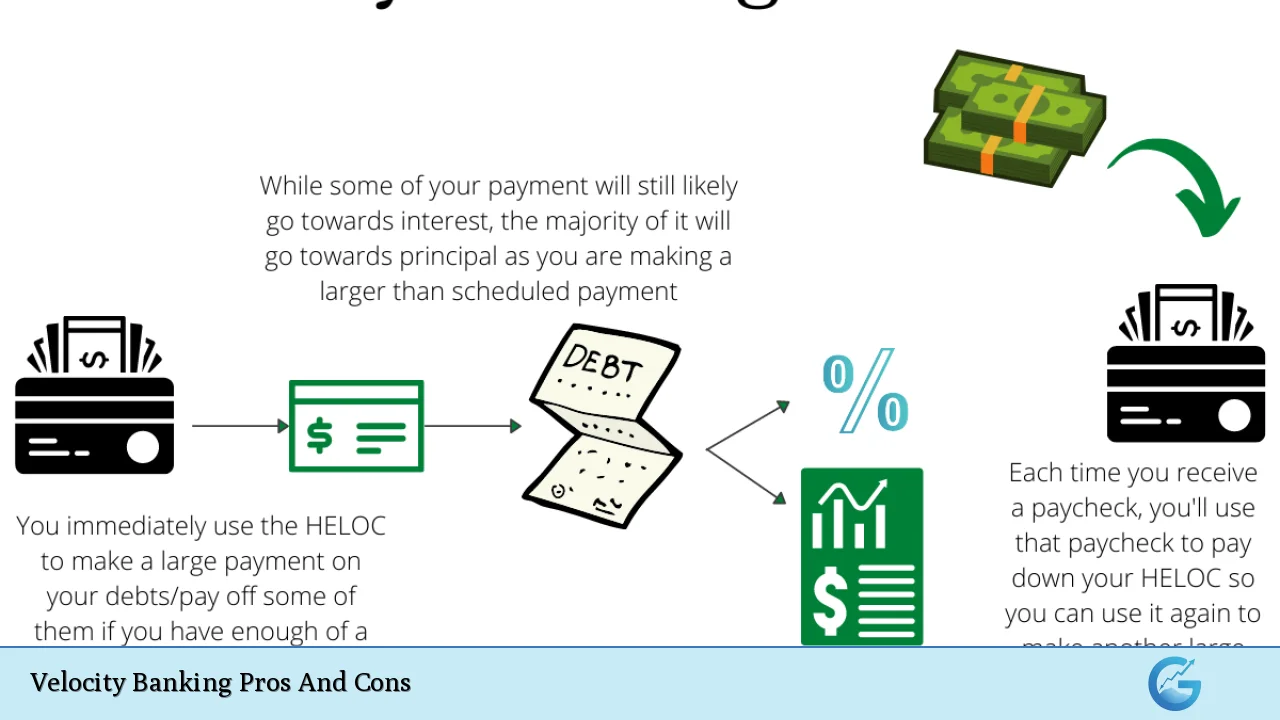

One of the most significant advantages of velocity banking is its ability to expedite the repayment of debts, particularly mortgages. By making larger payments from a HELOC or PLOC, borrowers can significantly reduce their principal balance more quickly than through traditional payment methods.

- Chunk Payments: This strategy allows homeowners to make substantial lump-sum payments towards their mortgage, which can lead to paying off loans in a fraction of the time compared to standard monthly payments.

- Faster Path to Freedom: Many users report being able to pay off their mortgages in as little as 5–7 years instead of the typical 30-year term.

Reduced Interest Payments

Velocity banking can lead to substantial savings on interest payments over time.

- Interest Calculation: Mortgages often charge interest on the remaining balance; by reducing this balance quickly through lump-sum payments, borrowers minimize the total interest paid.

- Lower Overall Costs: This method can save thousands of dollars in interest costs compared to traditional amortized loans.

Improved Cash Flow Management

This strategy encourages better management of cash flow.

- Paycheck Parking: By depositing income directly into the HELOC, borrowers can reduce their average daily balance, thus lowering interest charges.

- Expense Management: Using credit cards for everyday purchases and paying them off with the HELOC can optimize cash flow and delay interest accrual.

Utilizes Home Equity Effectively

Velocity banking allows homeowners to tap into their home equity strategically.

- Access to Funds: A HELOC provides access to cash that can be used not only for mortgage repayment but also for other investments or emergencies.

- Equity Growth: As debts are paid down faster, homeowners can build equity more rapidly.

Focus on Financial Discipline

Implementing velocity banking requires a high degree of financial discipline.

- Commitment to Strategy: Users must be dedicated to following the plan consistently, which can foster better financial habits.

- Goal-Oriented Approach: This focus on debt repayment can motivate individuals to prioritize their financial goals.

Liquidity in Emergencies

A notable benefit of using a HELOC is maintaining liquidity.

- Emergency Access: Unlike traditional savings accounts, funds in a HELOC can be accessed quickly in case of emergencies without incurring penalties.

- Financial Flexibility: This accessibility allows borrowers to manage unexpected expenses without derailing their debt repayment plans.

Flexibility in Payment Strategies

Velocity banking offers various strategies for managing debt repayment.

- Customizable Plans: Borrowers can adjust their payment strategies based on changing financial situations or goals.

- Integration with Other Financial Tools: This method can be combined with other strategies like investing or saving for retirement.

Opportunity for Wealth Building

By accelerating debt repayment, velocity banking may free up cash flow for investments.

- Reinvestment Potential: Once debts are reduced, individuals may have more disposable income to invest in stocks, real estate, or other opportunities.

- Long-Term Financial Growth: This reinvestment can lead to wealth accumulation over time.

Complexity and Learning Curve

Despite its advantages, velocity banking is not without challenges.

- Understanding the Mechanics: The strategy involves complex calculations and financial planning that may be overwhelming for some individuals.

- Time Investment: Mastering this approach requires significant time and effort to learn and implement effectively.

Requires Positive Cash Flow

Velocity banking necessitates a consistent positive cash flow for it to work effectively.

- Financial Stability Needed: Individuals must have sufficient income after expenses to make lump-sum payments towards their debts.

- Risk of Insufficient Funds: Without adequate cash flow, borrowers may struggle to maintain the velocity banking strategy, leading to potential financial strain.

Potential for Increased Debt

Using lines of credit carries inherent risks.

- Debt Accumulation Risk: If not managed carefully, borrowers may find themselves accumulating more debt than they intended.

- Spending Temptations: The ease of accessing credit might encourage overspending or poor financial decisions.

Variable Interest Rate Risks

HELOCs often come with variable interest rates that can fluctuate over time.

- Interest Rate Increases: Rising rates could increase monthly payments unexpectedly and extend the timeline for debt repayment.

- Uncertain Financial Planning: This variability makes it challenging to predict long-term costs accurately.

Narrowed Focus on Mortgage Payoff

While focusing on mortgage repayment can be beneficial, it may also lead to neglecting other financial goals.

- Limited Savings Growth: Prioritizing mortgage payoff might hinder contributions toward retirement accounts or emergency funds.

- Potential Opportunity Costs: Funds used solely for debt repayment could have been invested elsewhere with potentially higher returns.

Potential Scams and Misleading Information

The rise in popularity of velocity banking has also led to misinformation and scams.

- Caution Needed: Individuals should be wary of services promising guaranteed results or requiring payment for “expert” advice on implementing velocity banking.

- Self-Education Recommended: It’s crucial for potential users to thoroughly research and understand the strategy before committing financially.

Not Suitable for Everyone

Velocity banking is not universally applicable; it requires specific conditions to be effective.

- Eligibility Criteria: Homeowners need good credit scores and sufficient home equity to access HELOCs effectively.

- Individual Financial Situations Vary: Those with unstable incomes or high existing debts may find this strategy unsuitable or risky.

Emotional Stress and Anxiety Management

The demands of managing multiple debts through velocity banking can lead to emotional strain.

- Financial Pressure: Constantly monitoring balances and payments may cause anxiety about meeting obligations.

- Impact on Decision-Making: Stress may lead individuals to make hasty financial decisions that could jeopardize their overall financial health.

In conclusion, while velocity banking presents an innovative approach for accelerating debt repayment and improving cash flow management, it comes with significant risks and complexities. Individuals interested in this strategy must weigh its pros against its cons carefully. Understanding one’s financial situation and maintaining discipline are crucial components for success. As always, consulting with a financial advisor before embarking on such strategies is advisable.

Frequently Asked Questions About Velocity Banking

- What is velocity banking?

Velocity banking is a debt repayment strategy that uses lines of credit like HELOCs or PLOCs to make large lump-sum payments towards mortgages or other debts. - How does velocity banking save money?

This method reduces overall interest paid by lowering the principal balance quickly through substantial payments. - Is velocity banking suitable for everyone?

No, it requires specific conditions such as good credit and positive cash flow; not all individuals will benefit from this approach. - What are the risks involved in velocity banking?

The main risks include variable interest rates on HELOCs, potential increased debt accumulation, and emotional stress from managing multiple debts. - Can I use credit cards with velocity banking?

Yes, using credit cards strategically can help manage cash flow while leveraging the benefits of velocity banking. - How quickly can I pay off my mortgage using this method?

Some individuals report being able to pay off their mortgages within 5–7 years using velocity banking effectively. - What should I do if my cash flow decreases?

If your cash flow decreases significantly, it may be wise to reassess your use of velocity banking as it relies heavily on consistent income. - Are there alternatives to velocity banking?

Yes, alternatives include traditional extra mortgage payments or refinancing options that might suit different financial situations better.