Venmo has revolutionized the way people transfer money, becoming a household name in the realm of peer-to-peer payment applications. This digital wallet, owned by PayPal, has gained immense popularity, particularly among younger generations, for its user-friendly interface and social features. As with any financial tool, it’s crucial to understand both its advantages and disadvantages before integrating it into your financial ecosystem.

| Pros | Cons |

|---|---|

| Easy and quick money transfers | Limited to U.S. users only |

| Social features for splitting bills | Privacy concerns due to public transactions |

| No fees for basic transactions | Potential for scams and fraud |

| Integration with bank accounts and cards | Transaction limits for unverified users |

| Venmo debit and credit card options | Fees for instant transfers and credit card usage |

| Cryptocurrency trading feature | No interest earned on Venmo balance |

| Business profile options for merchants | Lack of buyer and seller protection |

| Early direct deposit feature | Potential for overspending due to ease of use |

Advantages of Venmo

Seamless Money Transfers

Venmo’s primary strength lies in its ability to facilitate quick and easy money transfers between individuals.

This feature has made it an indispensable tool for splitting bills, paying rent, or sharing costs for group activities. The app’s interface is intuitive, allowing users to send money with just a few taps on their smartphone.

- Instant transfers to friends and family

- Option to add notes or emojis to payments, making the experience more personal

- Ability to request money from multiple people simultaneously

Social Integration

One of Venmo’s unique selling points is its social feed, which allows users to see their friends’ transactions (minus the amount). This feature has transformed the app into a social platform of sorts, making financial transactions more engaging and interactive.

- Users can like and comment on friends’ transactions

- Option to share payments publicly, privately, or with friends only

- Facilitates group dynamics and social connections through financial interactions

Cost-Effective Basic Services

For standard transactions, Venmo offers a cost-effective solution with no fees for basic services.

This makes it an attractive option for frequent, small-value transfers that might otherwise incur bank charges.

- Free to send money from Venmo balance, bank account, or debit card

- No fees for receiving money or transferring to a bank account (standard transfer)

- No monthly maintenance fees or minimum balance requirements

Versatile Payment Options

Venmo provides users with multiple ways to fund their accounts and make payments, offering flexibility in how they manage their finances.

- Link multiple bank accounts and debit cards

- Option to use credit cards (with a fee)

- Venmo balance can be used for future transactions

Venmo Cards

The platform has expanded its offerings to include both debit and credit card options, providing users with more traditional banking features.

- Venmo Debit Card: Use Venmo balance for in-store purchases and ATM withdrawals

- Venmo Credit Card: Earn cashback on purchases in your top spend categories

- Both cards can be managed directly through the Venmo app

Cryptocurrency Integration

In a move to stay relevant in the evolving financial landscape, Venmo has introduced cryptocurrency trading features.

- Buy, sell, and hold popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin

- Educational content provided to help users understand crypto markets

- Ability to share crypto transactions on the Venmo social feed

Business Profiles

Venmo has expanded its services to cater to small businesses and sole proprietors, offering a platform for commercial transactions.

- Separate business profile linked to personal account

- Accept payments using QR codes or payment links

- Increased visibility through the Venmo social feed

Early Direct Deposit

Venmo offers an early direct deposit feature, allowing users to receive their paychecks up to two days earlier than traditional banks.

- Potential to access funds faster

- No additional fee for this service

- Helps with cash flow management for users living paycheck to paycheck

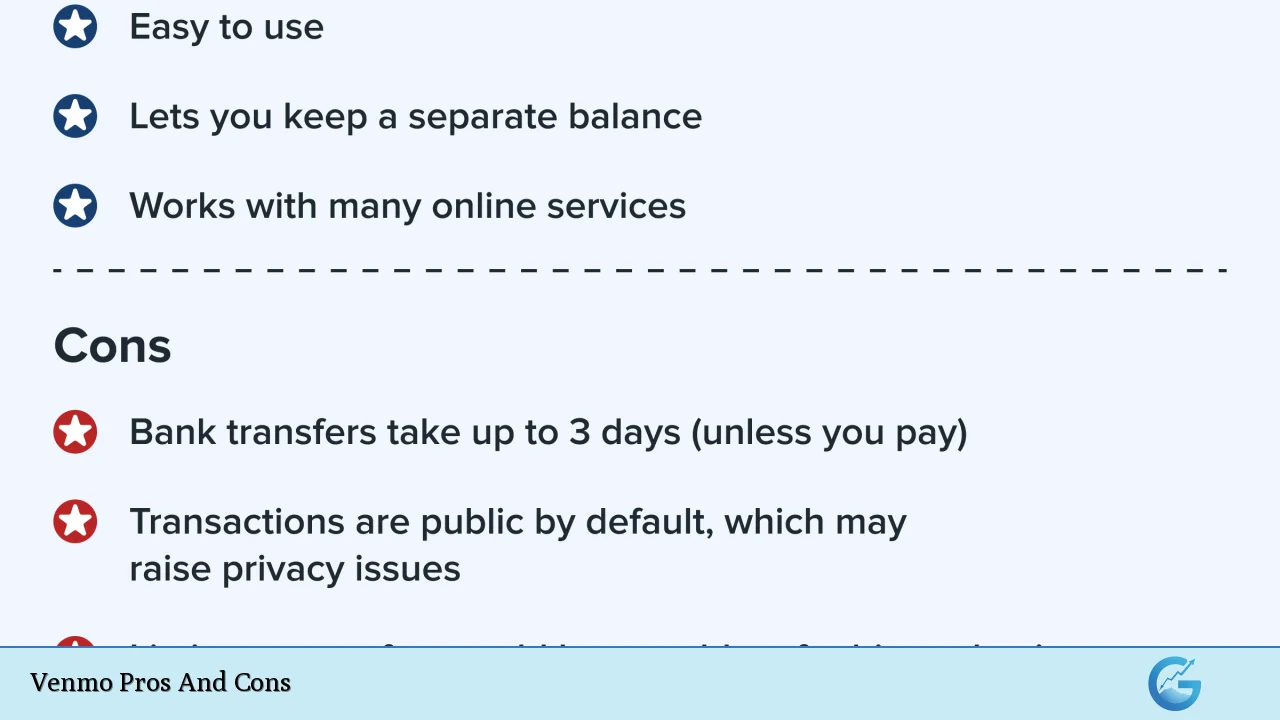

Disadvantages of Venmo

Geographic Limitations

One of the most significant drawbacks of Venmo is its limitation to the United States market.

This restriction can be problematic for users who need to make international transactions or for those traveling abroad.

- Only available to U.S. residents with U.S. bank accounts

- Cannot be used for international money transfers

- Limits its utility in an increasingly global economy

Privacy Concerns

The social aspect of Venmo, while appealing to some, raises serious privacy concerns for others. The default setting for transactions is public, which can lead to unintended sharing of financial information.

- Public transaction history can be viewed by anyone unless settings are changed

- Potential for stalking or monitoring of spending habits

- Users may inadvertently reveal sensitive information through transaction descriptions

Security Risks

While Venmo employs security measures, the platform is not immune to scams and fraudulent activities. The ease of use that makes Venmo attractive also makes it a target for cybercriminals.

- Potential for phishing scams and account takeovers

- Risk of sending money to the wrong person due to similar usernames

- Limited recourse for users who fall victim to scams

Transaction Limits

Venmo imposes transaction limits, which can be restrictive for users who need to transfer larger sums of money. These limits are particularly stringent for unverified accounts.

- Weekly sending limit of $299.99 for unverified users

- Even verified accounts have limits that may be lower than traditional bank transfers

- Limits can be inconvenient for high-value transactions or frequent users

Fee Structure for Premium Services

While basic services are free, Venmo does charge fees for certain premium features and transactions.

- 3% fee for credit card transactions

- 1.75% fee for instant transfers to a bank account

- Fees for purchasing and selling cryptocurrency

No Interest on Balance

Unlike traditional bank accounts, Venmo does not offer interest on the balance held in the app. This means that large balances in Venmo are not working to earn additional income for the user.

- Opportunity cost of holding money in a non-interest-bearing account

- Potential for users to keep more money in Venmo than necessary

- Lack of FDIC insurance for balances not from direct deposits or mobile check capture

Limited Buyer and Seller Protection

Venmo’s protection policies for buyers and sellers are not as comprehensive as those offered by its parent company, PayPal, or traditional credit card companies.

- Limited recourse for unauthorized transactions or disputes

- No built-in escrow service for large purchases

- Increased risk for high-value or complex transactions

Potential for Overspending

The ease of use and social nature of Venmo can lead to impulsive spending and difficulty in budgeting.

- Quick transactions may lead to less thoughtful spending decisions

- Social pressure to participate in group expenses

- Lack of robust budgeting tools within the app

In conclusion, Venmo offers a convenient and socially engaging platform for peer-to-peer transactions, with additional features like cryptocurrency trading and business profiles expanding its utility. However, users must weigh these benefits against the potential risks, including privacy concerns, security vulnerabilities, and geographic limitations. As with any financial tool, it’s crucial to use Venmo responsibly and in conjunction with a broader financial strategy. By understanding both the strengths and weaknesses of this popular payment app, users can make informed decisions about how to integrate Venmo into their financial lives while mitigating potential drawbacks.

Frequently Asked Questions About Venmo Pros And Cons

- Is Venmo safe to use for everyday transactions?

Venmo employs encryption and security measures, making it generally safe for everyday use. However, users should enable additional security features like PIN protection and two-factor authentication to enhance account security. - Can I use Venmo for business transactions?

Yes, Venmo offers business profiles for merchants to accept payments. However, it’s important to note that business transactions have different fee structures and may lack the protections offered by more traditional payment processors. - How does Venmo compare to traditional bank transfers?

Venmo offers faster, more convenient transfers for small amounts between individuals. However, it may have lower transaction limits and fewer protections compared to traditional bank transfers, especially for large sums. - Are there any alternatives to Venmo for international transfers?

For international transfers, services like PayPal, Wise (formerly TransferWise), or traditional bank wire transfers are more suitable alternatives. These platforms offer global reach that Venmo currently lacks. - How does Venmo make money if basic transfers are free?

Venmo generates revenue through fees on instant transfers, credit card transactions, and cryptocurrency trades. They also earn from interchange fees when users make purchases with Venmo debit or credit cards. - Is it safe to keep a large balance in my Venmo account?

While Venmo is secure, it’s generally not recommended to keep large balances in the app. Funds from direct deposits are FDIC insured, but other balances are not, and the account doesn’t earn interest. - Can Venmo be used for investing or trading stocks?

Currently, Venmo does not offer stock trading capabilities. Its investment features are limited to buying and selling a select few cryptocurrencies within the app. - How does Venmo’s social feed impact user privacy?

Venmo’s social feed can potentially expose users’ spending habits and social connections. Users can adjust privacy settings to limit visibility, but by default, transactions are public, which may raise privacy concerns for some users.