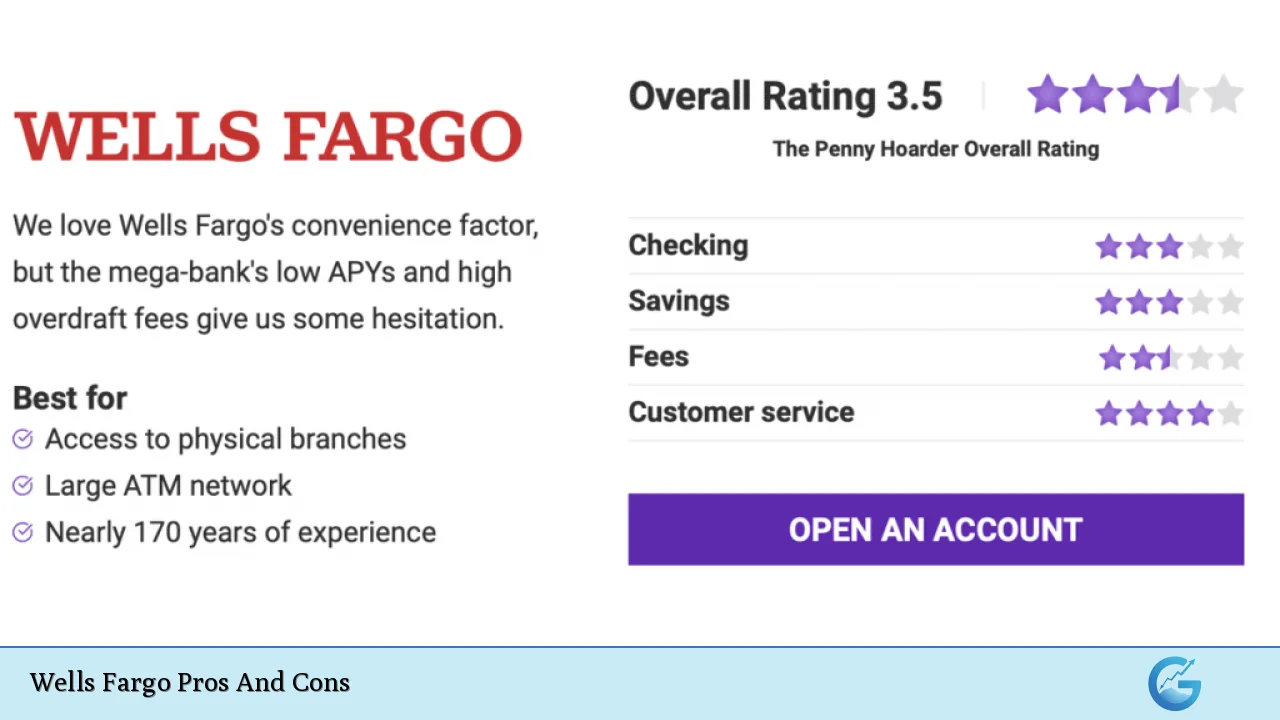

Wells Fargo & Company is one of the largest financial services institutions in the United States, offering a wide range of banking, investment, and mortgage services. With a significant presence across the country, it serves millions of customers through thousands of branches and ATMs. However, the bank has faced scrutiny over the years due to various scandals, including the infamous fake accounts scandal that emerged in 2016. This article will delve into the advantages and disadvantages of banking with Wells Fargo, providing a comprehensive overview for individuals interested in finance, investments, and related markets.

| Pros | Cons |

|---|---|

| Extensive branch and ATM network | Low interest rates on savings accounts |

| Easy fee waivers on accounts | Reputation issues from past scandals |

| Variety of financial products available | High overdraft fees and penalties |

| Strong mobile banking features | Customer service complaints |

| Investment options and wealth management services | Limited competitive rates compared to online banks |

Extensive Branch and ATM Network

One of the most significant advantages of Wells Fargo is its extensive network of branches and ATMs.

- Accessibility: With over 8,000 branches and approximately 13,000 ATMs nationwide, customers can easily access their accounts and conduct transactions without having to travel far.

- Convenience: This widespread presence makes it convenient for customers who prefer in-person banking services or need immediate access to cash.

- 24/7 Customer Support: Wells Fargo offers round-the-clock customer service through various channels, including phone support, which adds to the overall convenience for account holders.

Low Interest Rates on Savings Accounts

Despite its many benefits, Wells Fargo is often criticized for its low interest rates on savings accounts and certificates of deposit (CDs).

- Unattractive APYs: The annual percentage yields (APYs) offered on standard savings accounts are typically below the national average. For example, many savings accounts yield only around 0.01% APY.

- Comparison with Online Banks: In contrast to online banks that often provide significantly higher interest rates due to lower overhead costs, Wells Fargo’s rates may not be appealing for those looking to grow their savings.

Easy Fee Waivers on Accounts

Wells Fargo provides several options for customers to avoid monthly service fees on their checking and savings accounts.

- Account Requirements: Customers can easily waive fees by maintaining a minimum balance or setting up direct deposits.

- Flexibility: This flexibility allows customers to manage their finances without incurring unnecessary charges.

Reputation Issues from Past Scandals

Wells Fargo’s reputation has been marred by several scandals over the years, particularly the fake accounts scandal that came to light in 2016.

- Trust Concerns: The creation of millions of unauthorized accounts led to significant fines and legal repercussions, damaging customer trust.

- Ongoing Scrutiny: Although the bank has made efforts to improve its practices and regain customer confidence, lingering concerns about its ethical practices remain a drawback for potential customers.

Variety of Financial Products Available

Wells Fargo offers a broad range of financial products that cater to various customer needs.

- Comprehensive Offerings: From personal banking products like checking and savings accounts to investment services and mortgages, Wells Fargo provides an extensive suite of options.

- Small Business Services: The bank also offers tailored services for small businesses, including low-fee checking options that can be advantageous for entrepreneurs.

High Overdraft Fees and Penalties

One notable disadvantage of banking with Wells Fargo is its overdraft policies.

- Overdraft Fees: The standard overdraft fee is $35 per occurrence, which can accumulate quickly if multiple transactions are made in a single day.

- Financial Risk: This can pose a risk for customers who occasionally mismanage their funds or have irregular income streams.

Strong Mobile Banking Features

Wells Fargo has invested heavily in its mobile banking capabilities, making it easier for customers to manage their finances on-the-go.

- User-Friendly App: The Wells Fargo Mobile app allows users to check balances, transfer funds, pay bills, and even deposit checks remotely.

- Security Features: The app includes robust security measures such as encryption technology and automatic sign-off to protect customer information.

Customer Service Complaints

Customer service has been a point of contention for many Wells Fargo account holders.

- Mixed Reviews: While some customers report satisfactory experiences, others have expressed frustration with long wait times and unhelpful responses from representatives.

- Impact on Satisfaction: These issues can detract from overall customer satisfaction and may influence potential clients’ decisions when choosing a bank.

Investment Options and Wealth Management Services

Wells Fargo provides various investment options that appeal to both novice investors and seasoned professionals.

- Diverse Investment Products: Customers can access mutual funds, stocks, bonds, retirement accounts, and more through Wells Fargo Advisors.

- Wealth Management Services: The bank also offers personalized wealth management services for high-net-worth individuals seeking tailored financial strategies.

Limited Competitive Rates Compared to Online Banks

While Wells Fargo offers a variety of products and services, its interest rates often lag behind those offered by online-only banks.

- Market Comparison: Many online banks provide higher yields on savings accounts without monthly fees or minimum balance requirements.

- Potential Losses: For customers focused on maximizing their savings growth through interest earnings, choosing an online bank might be more beneficial than opting for Wells Fargo’s offerings.

In conclusion, while Wells Fargo presents numerous advantages such as convenience through its vast branch network, easy fee waivers, diverse financial products, strong mobile banking features, and investment options, it also faces significant disadvantages. These include low interest rates on savings accounts compared to competitors, high overdraft fees that can lead to financial strain, ongoing reputation issues stemming from past scandals, customer service complaints that may hinder user experience, and limited competitive rates compared to online banks.

Ultimately, potential customers should weigh these pros and cons carefully when considering whether Wells Fargo aligns with their financial needs and goals.

Frequently Asked Questions About Wells Fargo Pros And Cons

- What are the main advantages of banking with Wells Fargo?

The main advantages include an extensive branch network for easy access to services, easy fee waivers on accounts through minimum balance requirements or direct deposits, strong mobile banking features for managing finances remotely, and diverse financial products including investment options. - What are the primary disadvantages associated with Wells Fargo?

The primary disadvantages include low interest rates on savings accounts compared to other banks, high overdraft fees that can accumulate quickly if not managed properly, ongoing reputation issues due to past scandals affecting customer trust, and mixed reviews regarding customer service quality. - How does Wells Fargo compare with online banks?

Wells Fargo generally offers lower interest rates on savings compared to many online banks which often provide higher yields without monthly fees. Additionally, online banks typically have fewer overhead costs allowing them to offer better rates. - Are there any specific fees I should be aware of at Wells Fargo?

Customers should be aware of potential overdraft fees ($35 per occurrence), monthly maintenance fees that may apply unless waived by meeting certain criteria (like maintaining a minimum balance), and possible penalties associated with not meeting account requirements. - Has Wells Fargo improved its reputation since the fake account scandal?

Yes, since the scandal emerged in 2016, Wells Fargo has made efforts to improve its practices by implementing new security measures and focusing on customer service improvements. However, trust issues still linger among some consumers. - What types of investment options does Wells Fargo offer?

Wells Fargo offers a variety of investment products including mutual funds, stocks/bonds trading through its brokerage services (Wells Fargo Advisors), retirement accounts like IRAs (Individual Retirement Accounts), and personalized wealth management services. - Is it easy to open an account at Wells Fargo?

Yes! Opening an account at Wells Fargo is relatively straightforward; customers can do so online or visit any branch location. Required documentation typically includes identification such as a driver’s license or passport along with proof of address. - How does customer service at Wells Fargo rate?

Customer service ratings at Wells Fargo vary; while some users report positive experiences with representatives being helpful during inquiries or issues faced while others have expressed dissatisfaction regarding wait times or unhelpful responses.