Whole life insurance is a type of permanent life insurance that provides coverage for the insured’s entire lifetime, as long as premiums are paid. It is designed to offer both a death benefit and a cash value component, which grows over time. This dual benefit makes whole life insurance a popular choice among individuals seeking long-term financial security for their families. However, like any financial product, it comes with its own set of advantages and disadvantages. This article explores the pros and cons of whole life insurance policies in detail, providing insights for those interested in finance, investing, and wealth management.

| Pros | Cons |

|---|---|

| Lifelong coverage guarantees | Higher premiums compared to term life insurance |

| Fixed premiums that do not increase | Complex product that may require additional understanding |

| Cash value accumulation over time | Slower growth of cash value compared to other investments |

| Potential for dividends from the insurer | Loans against cash value can reduce death benefits |

| Tax advantages on cash value growth | Lack of flexibility in adjusting coverage amounts |

| Can serve as a financial asset in estate planning | May not provide sufficient coverage for younger individuals with limited budgets |

Lifelong Coverage Guarantees

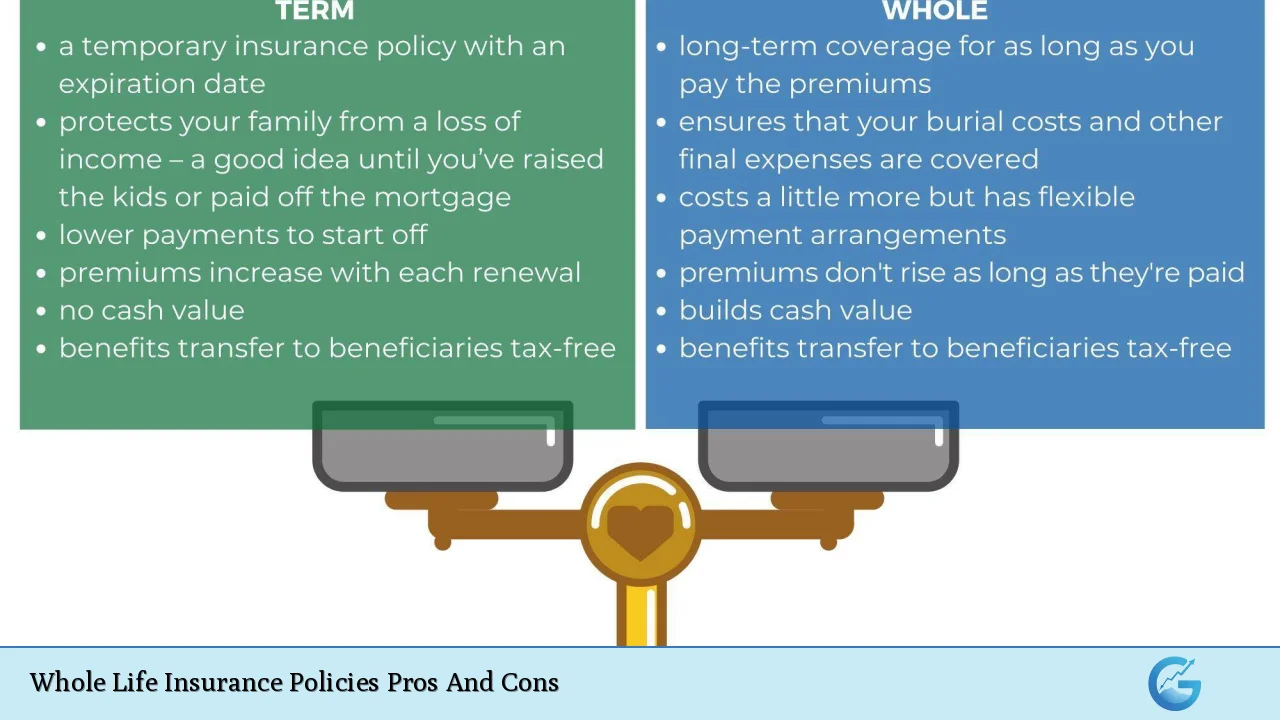

One of the most significant advantages of whole life insurance is its promise of lifelong coverage. Unlike term life insurance, which expires after a set period, whole life insurance remains in effect as long as premiums are paid. This means that beneficiaries are guaranteed a death benefit regardless of when the insured passes away.

- Peace of Mind: Knowing that your loved ones will receive financial support no matter when you die can provide immense peace of mind.

- Permanent Protection: This policy is ideal for individuals who want to ensure their family’s financial security over the long term.

Fixed Premiums That Do Not Increase

Whole life insurance policies typically feature fixed premiums that remain constant throughout the policyholder’s life. This predictability allows for better financial planning.

- Budgeting Ease: With fixed premiums, policyholders can budget their finances without worrying about sudden increases in premium costs.

- Protection Against Inflation: As inflation rises, having a fixed premium can protect policyholders from increasing costs associated with other types of insurance.

Cash Value Accumulation Over Time

Another key advantage of whole life insurance is the cash value component that accumulates over time. A portion of each premium payment goes towards building this cash value.

- Financial Asset: The cash value can be accessed through loans or withdrawals, providing a source of funds for emergencies or major expenses.

- Long-Term Growth: The cash value grows at a guaranteed rate, offering a stable investment option compared to more volatile investments.

Potential for Dividends from the Insurer

Many whole life policies are eligible for dividends based on the insurer’s financial performance. These dividends can be reinvested into the policy or taken as cash.

- Additional Income: Dividends can provide an additional income stream or help pay premiums.

- Increased Cash Value: Reinvesting dividends can significantly enhance the policy’s cash value over time.

Tax Advantages on Cash Value Growth

The growth of cash value in whole life insurance policies is tax-deferred, meaning policyholders do not pay taxes on the gains until they withdraw funds.

- Estate Planning Benefits: This feature makes whole life insurance an attractive option for estate planning, allowing individuals to pass on wealth without incurring immediate tax liabilities.

- Tax-Free Death Benefit: The death benefit is generally paid out tax-free to beneficiaries, providing them with full financial support.

Can Serve as a Financial Asset in Estate Planning

Whole life insurance can play a crucial role in estate planning strategies. It provides liquidity to cover estate taxes and other expenses upon death.

- Ensures Financial Stability: Having a whole life policy can ensure that heirs have access to funds when needed most.

- Equalizes Inheritances: It can be used to equalize inheritances among heirs by providing cash benefits to those who may not inherit physical assets.

Higher Premiums Compared to Term Life Insurance

One of the main drawbacks of whole life insurance is its higher premium costs compared to term life policies.

- Budget Constraints: The higher cost may strain budgets, especially for younger individuals or families with limited income.

- Affordability Issues: Some may find it challenging to maintain premium payments over time due to financial changes.

Complex Product That May Require Additional Understanding

Whole life insurance policies can be complex and may require careful consideration and understanding before purchasing.

- Need for Education: Potential buyers should educate themselves about how these policies work and their long-term implications.

- Consultation Recommended: Consulting with an insurance professional can help clarify any questions and ensure informed decisions are made.

Slower Growth of Cash Value Compared to Other Investments

While whole life policies do accumulate cash value, this growth is often slower than that seen in traditional investment vehicles like stocks or mutual funds.

- Opportunity Cost: Individuals may miss out on potentially higher returns available through other investment options.

- Long-Term Commitment Required: The benefits of cash value accumulation usually manifest over many years, requiring patience from policyholders.

Loans Against Cash Value Can Reduce Death Benefits

If policyholders take loans against their cash value and do not repay them, the outstanding amount will reduce the death benefit payable to beneficiaries.

- Risk of Reduced Coverage: This could leave loved ones with less financial support than anticipated.

- Careful Management Needed: Policyholders must manage loans carefully to avoid negatively impacting their beneficiaries’ financial security.

Lack of Flexibility in Adjusting Coverage Amounts

Whole life insurance policies generally lack flexibility regarding coverage amounts once established.

- Limited Adjustments: Unlike some other types of insurance where coverage can be adjusted based on changing needs, whole life policies are more rigid.

- Potential Misalignment with Needs: As personal circumstances change (e.g., marriage, children), policyholders may find their coverage no longer aligns with their needs.

May Not Provide Sufficient Coverage for Younger Individuals with Limited Budgets

For younger individuals starting their careers or families, the cost associated with whole life insurance may not provide adequate coverage relative to their financial situation.

- Term Life as an Alternative: Many young people opt for term life insurance due to its affordability and higher initial coverage amounts.

- Long-Term Financial Planning Considerations: Those considering whole life should evaluate whether they can sustain payments throughout their lifetime without compromising other financial goals.

In conclusion, while whole life insurance offers numerous advantages such as lifelong coverage, fixed premiums, and cash value accumulation, it also presents several drawbacks including higher costs and complexity. Individuals considering this type of insurance should weigh these factors carefully against their financial goals and circumstances. Consulting with a qualified financial advisor or insurance professional is advisable to ensure that they make informed decisions tailored to their unique situations.

Frequently Asked Questions About Whole Life Insurance Policies Pros And Cons

- What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and includes a cash value component that grows over time. - What are the main advantages of whole life insurance?

The main advantages include lifelong coverage guarantees, fixed premiums, cash value accumulation, potential dividends, and tax benefits. - What are the disadvantages of whole life insurance?

The disadvantages include higher premiums compared to term policies, complexity in understanding the product, slower growth rates for cash value, and reduced flexibility. - How does cash value accumulation work?

A portion of each premium payment contributes to building cash value within the policy that grows at a guaranteed rate. - Are dividends guaranteed with whole life policies?

No, dividends are not guaranteed; they depend on the insurer’s performance but can provide additional income or enhance cash value. - Can I borrow against my whole life policy?

Yes, you can borrow against your policy’s cash value; however, unpaid loans will reduce your death benefit. - Is whole life insurance suitable for everyone?

No, it may not be suitable for younger individuals or those on tight budgets; assessing personal financial situations is crucial. - How does whole life compare to term life insurance?

Whole life offers permanent coverage and builds cash value while term life provides temporary coverage at lower costs but does not accumulate any cash value.