Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which covers a specific period, whole life insurance offers lifelong protection along with a cash value component that grows over time. This comprehensive policy has become a popular choice for those seeking long-term financial security and estate planning benefits.

| Pros | Cons |

|---|---|

| Lifelong coverage | Higher premiums |

| Fixed premiums | Complexity |

| Cash value accumulation | Lower initial returns |

| Tax advantages | Less flexibility |

| Potential dividends | Opportunity cost |

| Estate planning tool | Cash surrender charges |

| Loan options | Long-term commitment |

| Guaranteed death benefit | Insurance company dependency |

Advantages of Whole Life Insurance

Lifelong Coverage

Whole life insurance provides protection that lasts for your entire lifetime, ensuring your beneficiaries receive a death benefit regardless of when you pass away.

This permanent coverage offers peace of mind, knowing that your loved ones will be financially protected no matter how long you live. Unlike term life insurance, which expires after a set period, whole life insurance remains in force as long as premiums are paid, making it an excellent option for long-term financial planning.

Fixed Premiums

One of the most attractive features of whole life insurance is the stability of its premiums. Once you purchase a policy, your premium payments remain the same throughout the life of the policy, regardless of changes in your health or age. This predictability allows for easier budgeting and financial planning, as you won’t face unexpected increases in your insurance costs over time.

Cash Value Accumulation

Whole life insurance policies include a savings component known as cash value. A portion of your premium payments goes towards building this cash value, which grows tax-deferred over time. The growth rate is typically guaranteed by the insurance company, providing a stable and predictable increase in your policy’s value. This cash value can be accessed through policy loans or withdrawals, offering a source of funds for various financial needs such as:

- Supplementing retirement income

- Funding education expenses

- Covering emergency costs

- Investing in business opportunities

Tax Advantages

Whole life insurance offers several tax benefits that make it an attractive option for wealth management and estate planning:

- Tax-deferred growth: The cash value in your policy grows tax-deferred, meaning you won’t pay taxes on the gains as long as the policy remains in force.

- Tax-free death benefit: The death benefit paid to your beneficiaries is generally income tax-free, providing them with the full amount of the coverage.

- Tax-free access to cash value: Policy loans and certain withdrawals can be taken tax-free, as long as the policy remains in force and is not a Modified Endowment Contract (MEC).

Potential Dividends

Many whole life insurance policies are “participating,” meaning they have the potential to earn dividends. While not guaranteed, dividends can provide additional value to your policy. These dividends can be used in several ways:

- Paid out in cash

- Applied to reduce premium payments

- Used to purchase additional coverage

- Left to accumulate interest within the policy

Estate Planning Tool

Whole life insurance can be an effective tool for estate planning, helping to ensure a smooth transfer of wealth to your heirs. Some key benefits include:

- Providing liquidity to pay estate taxes

- Equalizing inheritances among beneficiaries

- Funding trusts for long-term care or special needs dependents

- Preserving wealth for future generations

Loan Options

The cash value component of whole life insurance can serve as a source of low-interest loans. Policy loans allow you to borrow against your cash value without credit checks or loan applications. These loans typically offer competitive interest rates and flexible repayment terms. However, it’s important to note that unpaid loans will reduce the death benefit and may have tax implications if the policy lapses.

Guaranteed Death Benefit

Whole life insurance provides a guaranteed death benefit, ensuring that your beneficiaries will receive the full face value of the policy upon your death, regardless of market conditions or the performance of the insurance company’s investments.

This guarantee offers peace of mind and financial security for your loved ones, making whole life insurance a reliable tool for legacy planning and income replacement.

Disadvantages of Whole Life Insurance

Higher Premiums

One of the most significant drawbacks of whole life insurance is its cost. Premiums for whole life policies are typically much higher than those for term life insurance, often 5 to 15 times more expensive for the same death benefit amount. This higher cost is due to the permanent nature of the coverage and the cash value component. The increased expense can make it challenging for some individuals to afford adequate coverage, potentially leading to underinsurance.

Complexity

Whole life insurance policies are more complex than term life insurance, combining insurance protection with a savings component. This complexity can make it difficult for policyholders to fully understand the terms, conditions, and potential returns of their policy. Key aspects that may be confusing include:

- Cash value growth rates

- Dividend calculations and options

- Policy loan terms and consequences

- Surrender charges and fees

Lower Initial Returns

While the cash value component of whole life insurance grows tax-deferred, the rate of return, especially in the early years of the policy, may be lower than other investment options. The guaranteed growth rate is typically modest, and it may take several years before the cash value accumulates significantly. This opportunity cost means that policyholders might miss out on potentially higher returns from alternative investments such as stocks, bonds, or real estate.

Less Flexibility

Compared to other types of permanent life insurance, such as universal life, whole life insurance offers less flexibility in terms of premium payments and death benefit adjustments. Once the policy is in force, it can be challenging to modify coverage amounts or premium payment schedules without surrendering the policy and purchasing a new one. This lack of flexibility can be problematic if your financial situation or insurance needs change over time.

Opportunity Cost

The higher premiums associated with whole life insurance represent a significant opportunity cost. The extra money spent on premiums could potentially be invested in other financial instruments that may offer higher returns. For example:

- Contributing to tax-advantaged retirement accounts like 401(k)s or IRAs

- Investing in diversified stock market index funds

- Purchasing income-producing real estate

- Starting or expanding a business

Cash Surrender Charges

If you decide to surrender your whole life policy, especially in the early years, you may face substantial surrender charges. These fees can significantly reduce the amount of cash value you receive upon cancellation. The surrender period typically lasts for several years, and the charges decrease over time. However, this can make it costly to exit a policy if your financial situation changes or if you find a more suitable insurance option.

Long-term Commitment

Whole life insurance requires a long-term financial commitment. To maintain the policy and benefit from its features, you must continue paying premiums for many years, often decades. This long-term obligation can be challenging if:

- Your income fluctuates or decreases

- You face unexpected financial hardships

- Your insurance needs change significantly

- You find better investment opportunities elsewhere

Failing to maintain premium payments can result in the policy lapsing, potentially leading to a loss of coverage and forfeiture of accumulated cash value.

Insurance Company Dependency

The performance of your whole life insurance policy, particularly in terms of dividends and overall financial stability, is closely tied to the insurance company’s financial health and management. While many insurers have long histories of stability, there’s always a risk of company failure or underperformance. This dependency means that the long-term value of your policy is not entirely under your control, and poor company performance could impact your policy’s returns and potentially its guarantees.

In conclusion, whole life insurance offers a unique combination of lifelong coverage, guaranteed death benefits, and tax-advantaged cash value accumulation. These features make it an attractive option for individuals seeking long-term financial security and estate planning tools. However, the higher costs, complexity, and reduced flexibility compared to other insurance and investment options require careful consideration. Potential policyholders should thoroughly assess their financial situation, long-term goals, and risk tolerance before committing to a whole life insurance policy. Consulting with a qualified financial advisor can help in making an informed decision that aligns with your overall financial strategy.

Frequently Asked Questions About Whole Life Insurance Pros and Cons

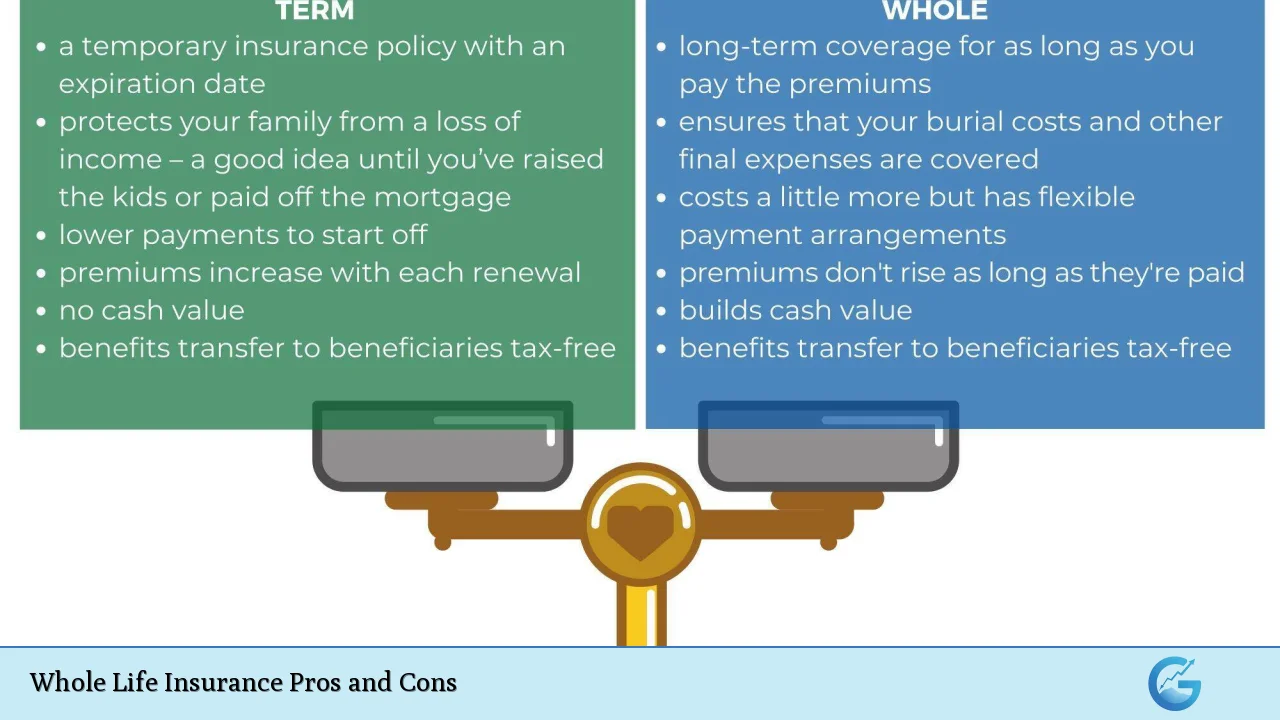

- How does whole life insurance differ from term life insurance?

Whole life insurance provides lifelong coverage with a cash value component, while term life insurance offers coverage for a specific period without cash value. Whole life has fixed premiums and a guaranteed death benefit, whereas term life is typically less expensive but expires after the term ends. - Can I access the cash value of my whole life insurance policy?

Yes, you can access the cash value through policy loans or withdrawals. However, this may reduce the death benefit and could have tax implications if not managed properly. - Are the dividends on whole life insurance policies guaranteed?

No, dividends are not guaranteed and depend on the insurance company’s financial performance. While many established insurers have a history of paying dividends, they are not contractually obligated to do so. - Is whole life insurance a good investment vehicle?

Whole life insurance can be part of a diversified financial strategy, offering tax advantages and guaranteed growth. However, it generally provides lower returns compared to traditional investments and should not be considered a primary investment vehicle. - What happens if I stop paying premiums on my whole life insurance policy?

If you stop paying premiums, you may have options such as using the cash value to pay premiums, reducing the death benefit, or surrendering the policy for its cash value. However, letting the policy lapse can result in loss of coverage and potential tax consequences. - Can I convert my term life insurance to whole life insurance?

Many term life insurance policies offer a conversion option to whole life insurance without requiring a new medical exam. The terms and availability of conversion vary by insurer and policy. - How long does it take for a whole life insurance policy to build significant cash value?

It typically takes 10 to 15 years for a whole life policy to accumulate substantial cash value. The growth rate depends on factors such as the policy design, premium payments, and dividend performance. - Is whole life insurance suitable for everyone?

Whole life insurance is not suitable for everyone. It’s best for individuals who need lifelong coverage, have maxed out other tax-advantaged savings options, or have complex estate planning needs. Those with temporary insurance needs or limited budgets may find term life insurance more appropriate.