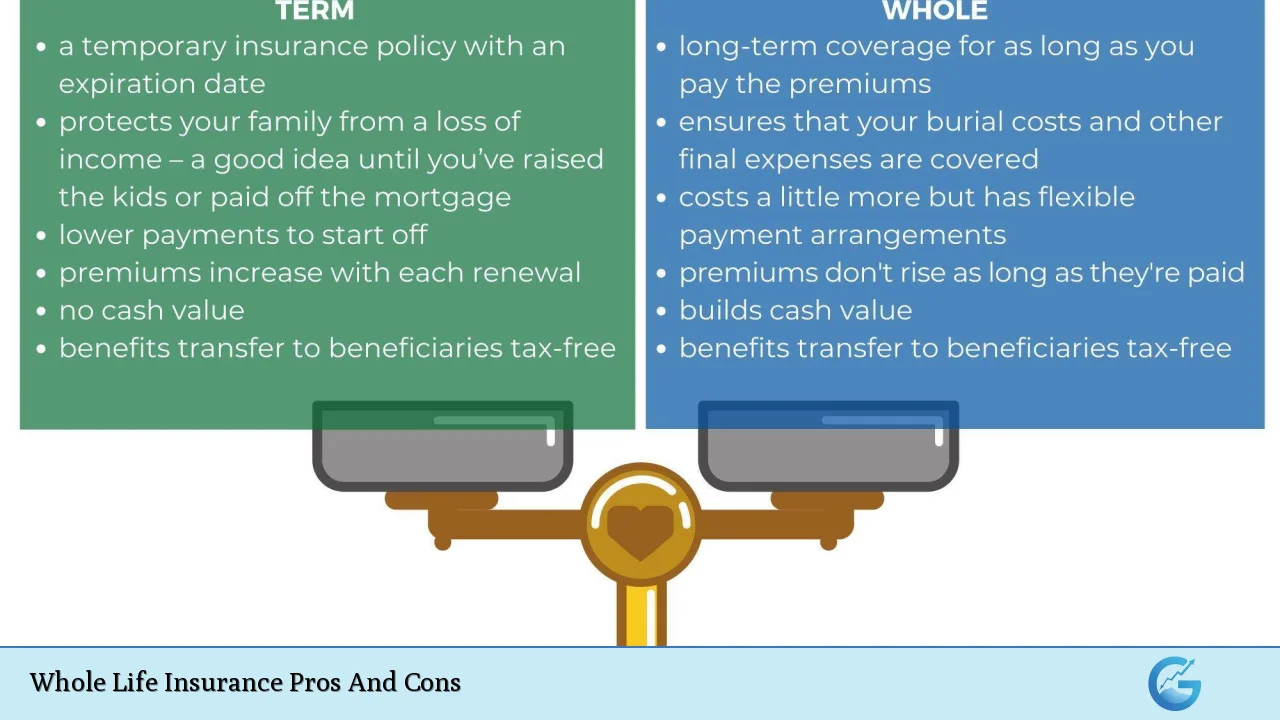

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. Unlike term life insurance, which covers a specific period, whole life insurance offers lifelong protection along with a cash value component that grows over time. This comprehensive policy has garnered attention from investors and financial planners due to its dual nature as both an insurance product and an investment vehicle.

| Pros | Cons |

|---|---|

| Lifelong coverage | Higher premiums |

| Fixed premiums | Lower initial death benefit |

| Cash value accumulation | Complexity |

| Tax-deferred growth | Lower returns compared to other investments |

| Dividend potential | Inflexibility |

| Estate planning benefits | Opportunity cost |

| Loan options | Surrender charges |

| Guaranteed death benefit | Limited investment options |

Advantages of Whole Life Insurance

Lifelong Coverage

Whole life insurance provides protection that lasts for your entire lifetime, ensuring that your beneficiaries will receive a death benefit regardless of when you pass away.

This feature is particularly valuable for individuals with long-term financial obligations or those who want to leave a legacy for their heirs. Unlike term life insurance, which expires after a set period, whole life insurance offers peace of mind knowing that your coverage will not lapse as long as premiums are paid.

- Guaranteed protection until death

- No need to renew or requalify for coverage

- Ideal for estate planning and legacy creation

Fixed Premiums

One of the most attractive features of whole life insurance is the stability of its premium payments.

Once you purchase a policy, your premium amount remains constant throughout the life of the policy, regardless of changes in your health or age.

This predictability allows for easier budgeting and financial planning, especially for those on fixed incomes or approaching retirement.

- Premiums never increase

- Easier to budget for long-term financial planning

- Protection against future insurability issues

Cash Value Accumulation

Whole life insurance policies include a savings component known as cash value.

A portion of each premium payment is allocated to this cash value account, which grows tax-deferred over time.

The growth rate is typically guaranteed by the insurance company, providing a stable and predictable increase in value. This feature sets whole life insurance apart from term life policies and can be an attractive option for those looking to combine insurance protection with long-term savings.

- Tax-deferred growth

- Guaranteed minimum growth rate

- Potential for dividends to increase cash value

Tax Benefits

The tax advantages of whole life insurance are significant and multifaceted.

The cash value grows on a tax-deferred basis, meaning you don’t pay taxes on the gains as long as the policy remains in force.

Additionally, the death benefit is generally paid out tax-free to beneficiaries. These tax benefits make whole life insurance an attractive tool for wealth transfer and estate planning.

- Tax-deferred growth of cash value

- Tax-free death benefit for beneficiaries

- Potential for tax-free policy loans

Dividend Potential

Many whole life insurance policies are “participating,” meaning they have the potential to earn dividends.

While not guaranteed, dividends can significantly enhance the value of a policy over time.

Policyholders can choose to receive dividends in cash, use them to reduce premium payments, or reinvest them to purchase additional coverage, further increasing the policy’s death benefit and cash value.

- Opportunity for additional returns

- Flexible options for dividend use

- Potential to increase policy value over time

Disadvantages of Whole Life Insurance

Higher Premiums

The most significant drawback of whole life insurance is its cost.

Premiums for whole life policies are substantially higher than those for term life insurance with the same death benefit. This higher cost is due to the permanent nature of the coverage and the cash value component. For younger individuals or those on tight budgets, the expense of whole life insurance can be prohibitive and may limit the amount of coverage they can afford.

- Significantly more expensive than term life insurance

- May limit the amount of coverage affordable

- Can strain monthly budgets, especially for younger policyholders

Lower Initial Death Benefit

Due to the higher premiums and the allocation of funds to the cash value component, whole life insurance typically offers a lower initial death benefit compared to term life insurance for the same premium amount.

This means that individuals may need to choose between adequate coverage and the benefits of a whole life policy.

For those with high coverage needs, such as young families with mortgages and future education expenses, this can be a significant disadvantage.

- Less coverage per dollar of premium

- May not meet high coverage needs for young families

- Potential need to supplement with additional term insurance

Complexity

Whole life insurance policies are inherently more complex than term life insurance.

The combination of lifelong coverage, cash value accumulation, and potential dividends can make these policies difficult to understand fully.

This complexity can lead to misunderstandings about policy performance and features, potentially resulting in disappointment or unmet expectations. It’s crucial for policyholders to thoroughly understand the terms and conditions of their policy.

- More difficult to understand than simpler insurance products

- Requires more time and effort to manage effectively

- Potential for misunderstandings about policy features and performance

Lower Returns Compared to Other Investments

While the cash value component of whole life insurance does grow over time, the rate of return is often lower than what could be achieved through other investment vehicles.

The conservative nature of the investments made by insurance companies typically results in modest returns, which may not keep pace with inflation or more aggressive investment strategies.

For individuals focused on maximizing investment returns, the cash value growth of whole life insurance may be disappointing.

- Generally lower returns than stock market investments

- May not keep pace with inflation over long periods

- Opportunity cost compared to other investment options

Inflexibility

Once established, whole life insurance policies offer limited flexibility.

The fixed premiums and death benefit can be disadvantageous if your financial situation or insurance needs change over time.

Unlike some other types of permanent life insurance, such as universal life, whole life policies do not allow for adjustments to premium payments or death benefits without significant changes to the policy.

- Difficult to adjust coverage or premiums

- May not adapt well to changing financial circumstances

- Limited options for policy modifications

Frequently Asked Questions About Whole Life Insurance Pros And Cons

- Is whole life insurance a good investment?

Whole life insurance can be a good investment for those seeking guaranteed lifelong coverage and tax-deferred savings. However, it may not be suitable for those prioritizing high investment returns or needing maximum coverage at lower costs. - How does whole life insurance compare to term life insurance?

Whole life insurance offers lifelong coverage and cash value accumulation but at higher premiums. Term life insurance provides temporary coverage at lower costs but without cash value or permanence. - Can I access the cash value of my whole life insurance policy?

Yes, you can access the cash value through policy loans or withdrawals. However, this may reduce the death benefit and could have tax implications if not managed properly. - Are the premiums for whole life insurance tax-deductible?

Generally, premiums paid for personal whole life insurance are not tax-deductible. However, the cash value grows tax-deferred, and the death benefit is typically paid out tax-free to beneficiaries. - What happens if I stop paying premiums on my whole life insurance policy?

If you stop paying premiums, the policy may lapse, or the cash value may be used to keep the policy in force for a period. Some policies offer non-forfeiture options like reduced paid-up insurance. - Can I convert my term life insurance to whole life insurance?

Many term life policies offer a conversion option to whole life insurance. This can be beneficial if your insurability has decreased, but conversion typically must occur within a specified timeframe. - How long does it take for a whole life insurance policy to build cash value?

Cash value begins to accumulate from the first premium payment, but it may take several years to build significant value. The growth rate depends on the policy terms and any dividends earned. - Is whole life insurance suitable for estate planning?

Whole life insurance can be an effective estate planning tool, providing liquidity for estate taxes and ensuring a tax-free inheritance for beneficiaries. It’s particularly useful for high-net-worth individuals with complex estate needs.

In conclusion, whole life insurance offers a unique combination of lifelong protection and financial benefits that can be advantageous for certain individuals and financial strategies. Its guaranteed death benefit, fixed premiums, and cash value accumulation provide stability and potential for long-term financial planning. However, the higher costs, complexity, and potentially lower investment returns compared to alternative options make it crucial for individuals to carefully consider their financial goals and circumstances before committing to a whole life insurance policy. As with any significant financial decision, it’s advisable to consult with a qualified financial advisor to determine if whole life insurance aligns with your overall financial strategy and objectives.