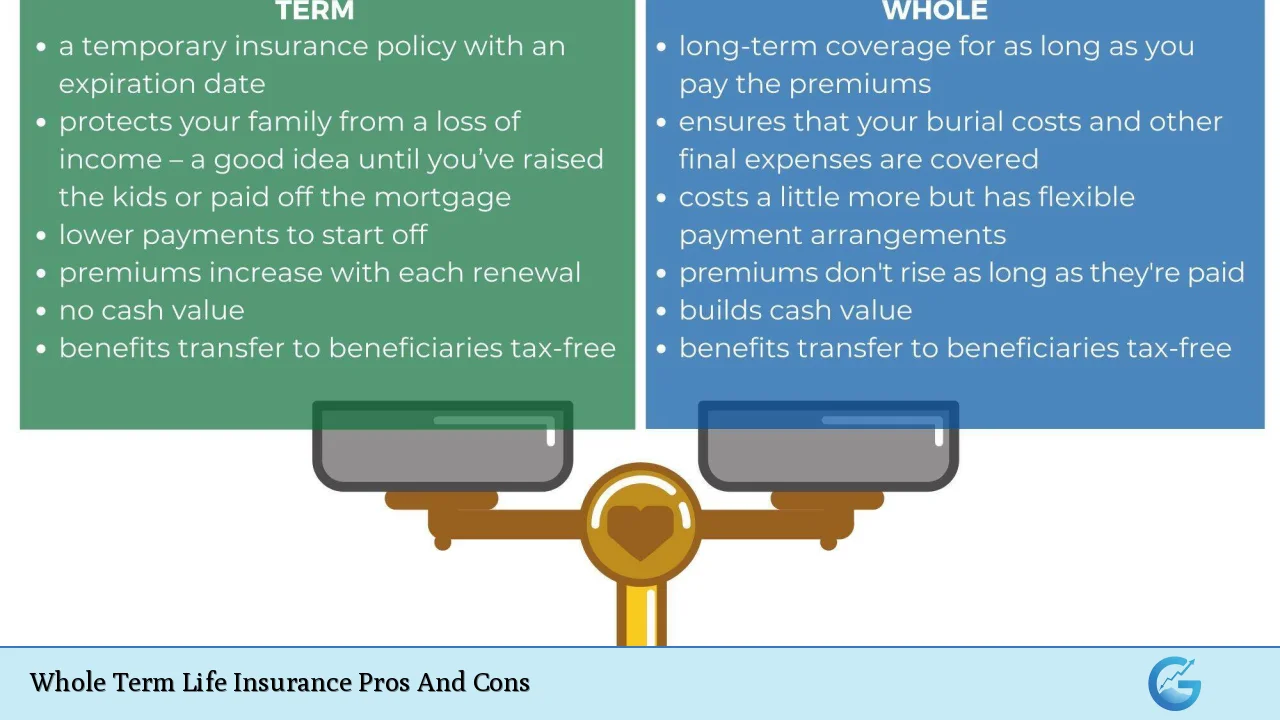

Whole life insurance, often referred to as permanent life insurance, is a financial product that provides coverage for the entire lifetime of the insured as long as premiums are paid. Unlike term life insurance, which offers coverage for a specific period, whole life insurance combines a death benefit with a cash value component that grows over time. This dual nature makes it an appealing option for individuals seeking both protection and an investment vehicle. However, like any financial product, whole life insurance comes with its own set of advantages and disadvantages that potential policyholders should carefully consider.

| Pros | Cons |

|---|---|

| Guaranteed lifelong coverage | Higher premiums compared to term life insurance |

| Fixed premiums that do not increase | Complexity in understanding policy terms |

| Cash value accumulation over time | Slower growth of cash value compared to other investments |

| Potential dividends from mutual insurers | Loans against the policy can reduce death benefits |

| Tax-deferred growth of cash value | Less flexibility in adjusting coverage as needs change |

| Provides financial security for beneficiaries | May not be suitable for all financial situations or goals |

| Can be used as collateral for loans | Possible penalties for early withdrawal of cash value |

| Estate planning benefits, including tax advantages | Limited investment control compared to other vehicles |

Guaranteed Lifelong Coverage

One of the primary advantages of whole life insurance is its guarantee of lifelong coverage. As long as the policyholder continues to pay the premiums, their beneficiaries will receive a death benefit upon their passing. This feature provides peace of mind, knowing that loved ones will be financially protected regardless of when the insured dies.

- Lifelong protection: The policy remains active throughout the insured’s life.

- Death benefit assurance: Beneficiaries are guaranteed a payout, which can help cover expenses such as funeral costs or outstanding debts.

Fixed Premiums That Do Not Increase

Whole life insurance policies typically feature fixed premiums that remain constant throughout the life of the policy. This predictability allows policyholders to budget effectively without worrying about rising costs.

- Budget-friendly: Knowing the exact premium amount aids in long-term financial planning.

- No surprises: Unlike some term policies that may increase premiums upon renewal, whole life premiums are stable.

Cash Value Accumulation Over Time

Another significant advantage is the cash value component that builds over time. A portion of each premium payment contributes to this cash value, which grows at a guaranteed rate.

- Savings component: The cash value can serve as a savings vehicle, providing funds for emergencies or major expenses.

- Loan option: Policyholders can borrow against their cash value without undergoing credit checks.

Potential Dividends from Mutual Insurers

Some whole life policies are issued by mutual insurance companies, which may pay dividends to policyholders based on company performance. While dividends are not guaranteed, they can provide additional financial benefits.

- Extra income: Dividends can be taken in cash, used to reduce premiums, or reinvested into the policy to increase cash value and death benefits.

- Performance-related benefits: Dividends reflect the insurer’s profitability and can enhance overall returns on the policy.

Tax-Deferred Growth of Cash Value

The cash value in whole life insurance grows on a tax-deferred basis. This means that policyholders do not pay taxes on the growth until they withdraw funds or surrender the policy.

- Tax efficiency: This feature allows for potentially greater accumulation of wealth within the policy compared to taxable investment accounts.

- Estate planning advantages: The death benefit is generally paid out tax-free to beneficiaries, providing further financial security.

Provides Financial Security for Beneficiaries

Whole life insurance ensures that beneficiaries receive a financial safety net upon the insured’s death. This can be especially important for families with dependents or significant financial obligations.

- Debt coverage: The death benefit can help cover mortgages, loans, and other debts, preventing financial strain on surviving family members.

- Income replacement: For families relying on one income source, the payout can replace lost income and maintain living standards.

Can Be Used as Collateral for Loans

The accumulated cash value in a whole life insurance policy can be used as collateral for loans. This provides an additional layer of financial flexibility for policyholders who may need access to funds without liquidating investments.

- Access to liquidity: Policyholders can borrow against their cash value while keeping their investments intact.

- No credit checks required: Loans secured by cash value do not require traditional credit evaluations.

Higher Premiums Compared to Term Life Insurance

One of the most significant drawbacks of whole life insurance is its higher cost compared to term life policies. Premiums can be five to fifteen times greater due to the lifelong coverage and cash value component.

- Budget strain: Higher premiums may limit disposable income or lead to financial stress if not adequately planned for.

- Opportunity cost: Funds allocated toward higher premiums could potentially yield better returns if invested elsewhere.

Complexity in Understanding Policy Terms

Whole life insurance policies can be complex and difficult to navigate due to various terms and conditions. Understanding how premiums are allocated between coverage and cash value can be challenging for many consumers.

- Need for education: Potential buyers must invest time in understanding how whole life policies work before committing.

- Potential pitfalls: Misunderstanding policy details could lead to dissatisfaction or unexpected costs later on.

Slower Growth of Cash Value Compared to Other Investments

While whole life policies accumulate cash value over time, this growth is often slower than what might be achieved through traditional investment vehicles like stocks or mutual funds.

- Lower returns: The conservative growth rate may not meet aggressive investment goals or expectations for wealth accumulation.

- Risk aversion trade-off: Individuals seeking stability may sacrifice higher potential returns available through market investments.

Loans Against the Policy Can Reduce Death Benefits

Borrowing against the cash value of a whole life insurance policy comes with risks. Any outstanding loans plus interest will reduce the death benefit payable to beneficiaries if not repaid before the insured’s passing.

- Impact on legacy: Families may receive less than expected if loans are not managed properly.

- Interest costs: Borrowing incurs interest charges, which must be considered when accessing funds from the policy’s cash value.

Less Flexibility in Adjusting Coverage as Needs Change

Whole life insurance policies are less flexible than term policies regarding adjustments in coverage amounts. Once established, changing benefits often requires additional underwriting or new policies altogether.

- Inability to adapt easily: Life changes such as marriage or having children may necessitate increased coverage that could require new applications and higher costs.

- Potentially outdated coverage: Policies may not align with current financial needs without significant adjustments or additional purchases.

May Not Be Suitable for All Financial Situations or Goals

While whole life insurance offers numerous benefits, it may not align with every individual’s financial situation or objectives. Those prioritizing short-term protection or lower costs might find better options in term life insurance or other investment vehicles.

- Individual assessment required: Prospective buyers should evaluate their long-term goals and current financial status before committing to a whole life policy.

- Not universally ideal: Whole life might work well for some but could be impractical or overly expensive for others based on their unique circumstances.

In conclusion, whole life insurance presents a blend of advantages and disadvantages that potential buyers must carefully weigh. Its ability to provide lifelong coverage and accumulate cash value makes it an attractive option for many individuals seeking both protection and an investment vehicle. However, its higher costs and complexity cannot be overlooked.

When considering whether whole life insurance aligns with your financial goals and needs, it is crucial to conduct thorough research and possibly consult with a financial advisor who understands your unique situation. By doing so, you can make an informed decision that best supports your long-term financial security and peace of mind.

Frequently Asked Questions About Whole Term Life Insurance

- What is whole term life insurance?

Whole term life insurance is often confused with whole life insurance; however, it typically refers to permanent coverage that lasts throughout your lifetime. - How do premiums compare between whole and term life insurance?

Whole life insurance generally has significantly higher premiums than term life due to its lifelong coverage and cash accumulation features. - Can I borrow against my whole life policy?

Yes, you can borrow against your whole life policy’s cash value; however, any unpaid loans will reduce your death benefit. - Are there tax implications with whole life insurance?

The growth of cash value is tax-deferred until withdrawal; however, beneficiaries typically receive death benefits tax-free. - What happens if I stop paying my premiums?

If you stop paying your premiums, your policy may lapse unless there is sufficient cash value available to cover costs. - Is whole life insurance suitable for everyone?

No, it may not be suitable for everyone; individuals should assess their specific financial situations and goals before purchasing. - What are dividends in whole life insurance?

Dividends are payments made by mutual insurers based on company performance; they can enhance your overall returns but are not guaranteed. - How does cash value grow in a whole life policy?

Cash value grows at a guaranteed rate set by the insurer; however, this growth is typically slower than traditional investments.