Estate planning is a critical process that ensures your assets are distributed according to your wishes after your death. Two of the most common tools used in estate planning are wills and trusts. While both serve the purpose of managing how your assets will be handled, they operate differently and come with their unique advantages and disadvantages. Understanding the pros and cons of each can help you make informed decisions about which option is best suited for your financial situation and goals.

| Pros | Cons |

|---|---|

| Wills are straightforward and easy to create. | Wills must go through probate, which can be time-consuming and costly. |

| Wills allow you to appoint guardians for minor children. | Wills become public record once probated, compromising privacy. |

| Trusts can avoid probate, allowing for quicker asset distribution. | Trusts can be more complex and expensive to set up than wills. |

| Trusts can provide ongoing management of assets for beneficiaries. | Trusts require active management and maintenance over time. |

| Trusts can protect assets from creditors in some cases. | Not all trusts provide the same level of protection, and some may have limitations. |

| Trusts allow for more control over how and when assets are distributed. | Creating a trust may involve legal complexities that require professional assistance. |

Wills: Advantages

Simplicity and Cost-Effectiveness

One of the most significant advantages of a will is its simplicity. Wills are generally easier to draft than trusts, making them a more accessible option for many individuals. The legal requirements for creating a will are straightforward, often requiring just a signature and witness. Additionally, wills tend to be less expensive to create compared to trusts, which may involve more complex legal frameworks.

Guardianship of Minor Children

A crucial feature of wills is the ability to designate guardians for minor children. This provision ensures that you can choose someone you trust to care for your children if something happens to you. This aspect is particularly important for parents who want to ensure their children are raised in a safe and supportive environment.

Flexibility

Wills offer flexibility as they can be modified or revoked at any time while you are alive, provided you have the mental capacity to do so. This adaptability allows individuals to update their wills as their circumstances change—such as marriage, divorce, or the birth of new children.

Wills: Disadvantages

Probate Process

One of the main drawbacks of wills is that they must go through probate, a legal process that validates the will and oversees the distribution of assets. Probate can be lengthy and costly, often taking months or even years to complete. During this time, beneficiaries may not receive their inheritance promptly.

Public Record

Once a will is probated, it becomes part of the public record. This transparency means that anyone can access the details of your estate plan, including asset distribution and beneficiaries. For those concerned about privacy, this aspect of wills can be a significant disadvantage.

Limited Control Over Asset Distribution

Wills provide limited control over how assets are distributed after death. They cannot dictate terms for ongoing management or conditions for inheritance, which means beneficiaries receive their share outright without stipulations.

Trusts: Advantages

Avoiding Probate

One of the primary benefits of establishing a trust is that it allows assets to bypass probate entirely. This means that your beneficiaries can receive their inheritance much faster—often within days or weeks—without waiting for court approval. This efficiency can save both time and money.

Privacy Protection

Unlike wills, trusts do not become public records upon death. The terms of a trust remain private, allowing families to keep their financial matters confidential. This aspect is particularly appealing for individuals who wish to protect their family’s privacy.

Ongoing Asset Management

Trusts can provide ongoing management of assets for beneficiaries, which is especially beneficial if those beneficiaries are minors or individuals who may not be financially responsible. A trustee can manage the assets according to specific terms set forth in the trust document.

Control Over Distribution

Trusts allow for greater control over how and when assets are distributed. You can set conditions on distributions—such as age milestones or specific purposes like education—which ensures that funds are used as intended.

Trusts: Disadvantages

Complexity and Cost

Establishing a trust typically involves more complexity than drafting a will. The legal requirements can be intricate, often necessitating professional assistance from an attorney or financial advisor. As a result, setting up a trust may incur higher initial costs compared to creating a will.

Ongoing Management Requirements

Trusts require active management over time. This responsibility falls on the trustee, who must ensure that assets are properly maintained and distributed according to the trust’s terms. Failure to manage a trust adequately can lead to legal complications or financial losses.

Potential Limitations on Protection

While trusts can protect assets from creditors in certain situations, not all trusts offer this benefit equally. Some trusts may have limitations on what types of debts they protect against, so it’s essential to understand these nuances when considering asset protection strategies.

Conclusion

Choosing between a will and a trust requires careful consideration of your individual circumstances, goals, and preferences. Both tools have their distinct advantages and disadvantages; thus, understanding these aspects is crucial in making an informed decision about your estate planning needs.

For many people, combining both tools might provide the best solution—using a will for guardianship provisions while establishing a trust for asset management and distribution. Consulting with an estate planning professional can help tailor an approach that aligns with your financial objectives while addressing any concerns regarding privacy, complexity, or cost.

Frequently Asked Questions About Will Versus Trust

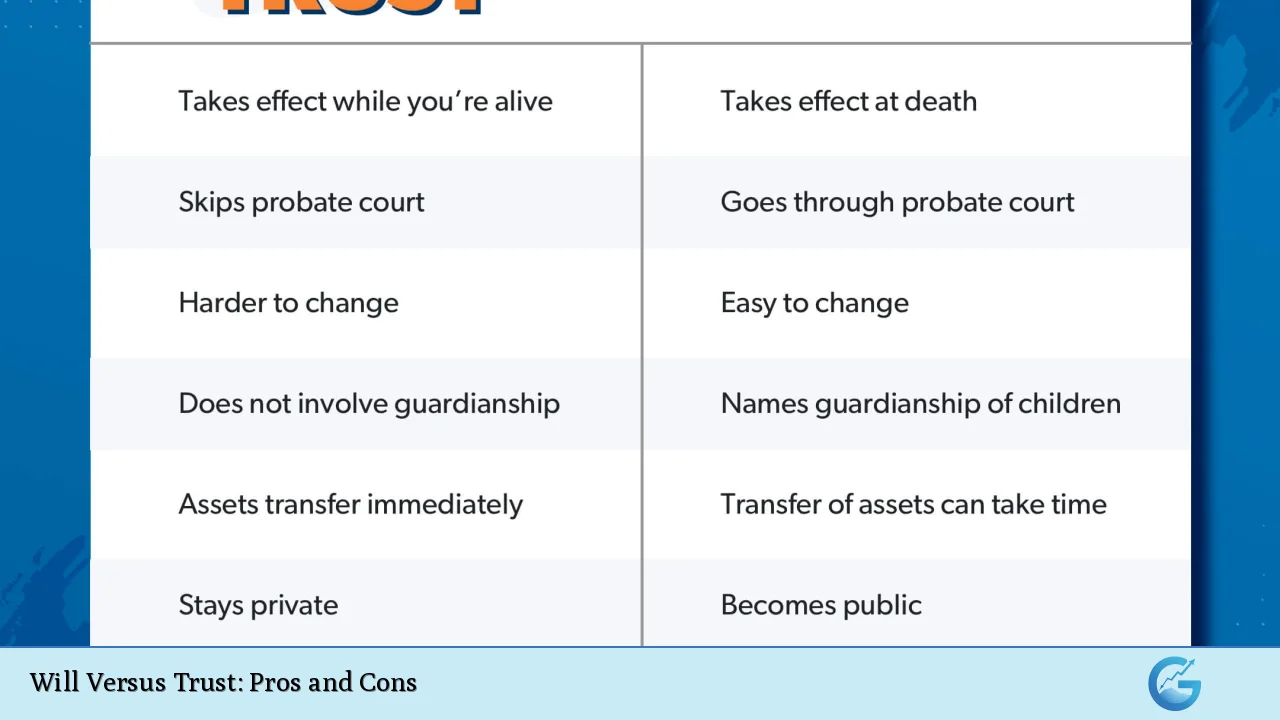

- What is the main difference between a will and a trust?

The primary difference is that a will goes into effect only after death while a trust takes effect immediately upon creation. - Can I change my will after it’s created?

Yes, you can modify or revoke your will at any time while you are alive and mentally competent. - Do trusts avoid probate?

Yes, one significant advantage of trusts is that they allow assets to bypass probate entirely. - Are wills public documents?

Yes, once probated, wills become public records accessible by anyone. - Can I designate guardians for my children in a trust?

No, guardianship designations must be made in a will; trusts do not have this provision. - What happens if I die without either a will or a trust?

If you die intestate (without either), state laws dictate how your assets are distributed. - Are there tax benefits associated with trusts?

Certain types of trusts may offer tax advantages; however, this varies based on individual circumstances. - Can I use both a will and a trust together?

Yes, many people use both tools in conjunction to cover different aspects of their estate planning needs effectively.