When it comes to estate planning, individuals often face the decision of whether to utilize a will or a trust. Both serve crucial roles in managing and distributing assets after death, but they do so in fundamentally different ways. Understanding the advantages and disadvantages of each can help individuals make informed decisions that align with their financial goals and family needs. This article delves into the pros and cons of wills and trusts, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

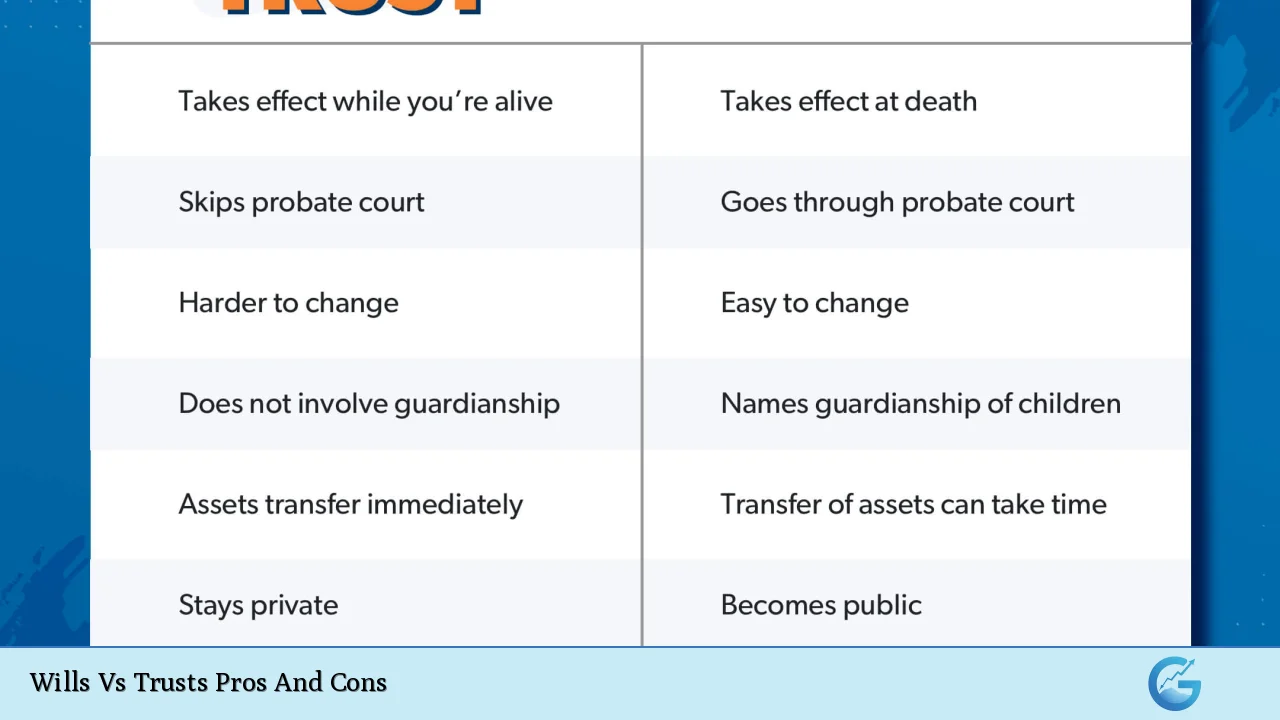

| Pros | Cons |

|---|---|

| Wills are generally simpler and less expensive to create. | Wills must go through probate, which can be time-consuming and costly. |

| Wills allow for guardianship designations for minor children. | Wills become public documents once probated, compromising privacy. |

| Wills can be easily amended or revoked during the testator’s lifetime. | Assets may be subject to creditors during the probate process. |

| Trusts can help avoid probate, expediting asset distribution. | Trusts can be more complex and costly to set up initially. |

| Trusts offer greater control over asset distribution and management. | Once established, irrevocable trusts cannot be easily modified. |

| Trusts provide privacy since they do not go through probate. | Trusts require ongoing management and maintenance costs. |

| Certain trusts can provide tax benefits by minimizing estate taxes. | The complexity of trusts may necessitate professional legal advice. |

Advantages of Wills

Simplicity and Cost-Effectiveness

One of the primary advantages of wills is their simplicity. Drafting a will is generally straightforward, making it an accessible option for many individuals. The costs associated with creating a will are typically lower than those for establishing a trust. This makes wills an attractive choice for those with smaller estates or straightforward asset distributions.

Guardianship Provisions

A significant benefit of wills is the ability to designate guardians for minor children. This is crucial for parents who want to ensure their children are cared for by trusted individuals in the event of their untimely death. Wills allow parents to specify who they wish to raise their children, providing peace of mind.

Flexibility in Amendments

Wills offer flexibility as they can be easily amended or revoked throughout the testator’s lifetime. This adaptability is beneficial as circumstances change—such as marriage, divorce, or the birth of children—allowing individuals to update their wishes accordingly.

Disadvantages of Wills

Probate Process

One major drawback of wills is that they must go through probate upon the testator’s death. This legal process can be lengthy and costly, potentially delaying asset distribution to beneficiaries. Additionally, probate proceedings are public, which means that details about the estate become accessible to anyone.

Public Disclosure

Since wills are filed with the court during probate, they become public documents. This lack of privacy can be concerning for individuals who wish to keep their financial affairs confidential. The public nature of probate can also lead to disputes among heirs.

Vulnerability to Creditors

Assets distributed through a will may be subject to claims from creditors during the probate process. This means that debts owed by the deceased could reduce the amount available for beneficiaries.

Advantages of Trusts

Avoiding Probate

One of the most significant advantages of trusts is that they allow assets to bypass probate. This can result in quicker distribution of assets to beneficiaries without court intervention, saving time and potentially reducing costs associated with probate.

Control Over Asset Distribution

Trusts provide greater control over how and when assets are distributed. Grantors can specify conditions under which beneficiaries receive their inheritance, such as age milestones or achievement of certain goals. This feature is particularly useful when beneficiaries may not be financially responsible or if there are concerns about their ability to manage inherited wealth.

Privacy Protection

Unlike wills, trusts do not become public documents upon death. This privacy allows families to keep their financial matters confidential, safeguarding sensitive information from public scrutiny.

Tax Benefits

Certain types of trusts can offer tax advantages by minimizing estate taxes. For example, irrevocable trusts may remove assets from an individual’s taxable estate, potentially reducing tax liabilities for heirs.

Disadvantages of Trusts

Initial Complexity and Cost

Establishing a trust is often more complex than drafting a will. The process typically requires legal assistance, which can lead to higher initial costs compared to creating a will. Additionally, funding a trust—transferring assets into it—can add another layer of complexity.

Irrevocability Issues

While revocable trusts offer flexibility during the grantor’s lifetime, irrevocable trusts cannot be easily modified once established. This lack of flexibility can be a disadvantage if circumstances change or if the grantor wishes to alter their estate plan.

Ongoing Management Requirements

Trusts require ongoing management and maintenance, which may incur additional costs over time. Trustees must keep accurate records and manage trust assets according to specified terms, necessitating time and effort that some individuals may find burdensome.

Conclusion

Choosing between a will and a trust depends on individual circumstances and preferences. Wills are generally simpler and less expensive, making them suitable for smaller estates or those seeking straightforward asset distribution. In contrast, trusts offer greater control over asset management, privacy protection, and potential tax benefits but come with increased complexity and costs.

Ultimately, consulting with an estate planning professional can help individuals navigate these options effectively and tailor their estate plans according to their unique financial situations and family dynamics.

Frequently Asked Questions About Wills Vs Trusts

- What is a will?

A will is a legal document outlining how an individual’s assets should be distributed after their death. - What is a trust?

A trust is a legal arrangement where one party holds assets for the benefit of another party according to specific terms set by the grantor. - Do I need both a will and a trust?

Many people benefit from having both; a will can cover any assets not included in a trust while providing guardianship provisions for minor children. - Can I change my will after it’s created?

Yes, wills can be amended or revoked at any time during your lifetime as long as you are mentally competent. - Are trusts more expensive than wills?

Yes, establishing a trust typically involves higher initial costs due to its complexity compared to drafting a will. - How does probate affect my estate?

Probate is the legal process that validates your will; it can delay asset distribution and incur additional costs. - Can I name guardians for my children in a trust?

No, only wills allow you to designate guardians for minor children; trusts do not have this provision. - What happens if I die without a will or trust?

If you die intestate (without a will), state laws dictate how your assets are distributed, which may not align with your wishes.