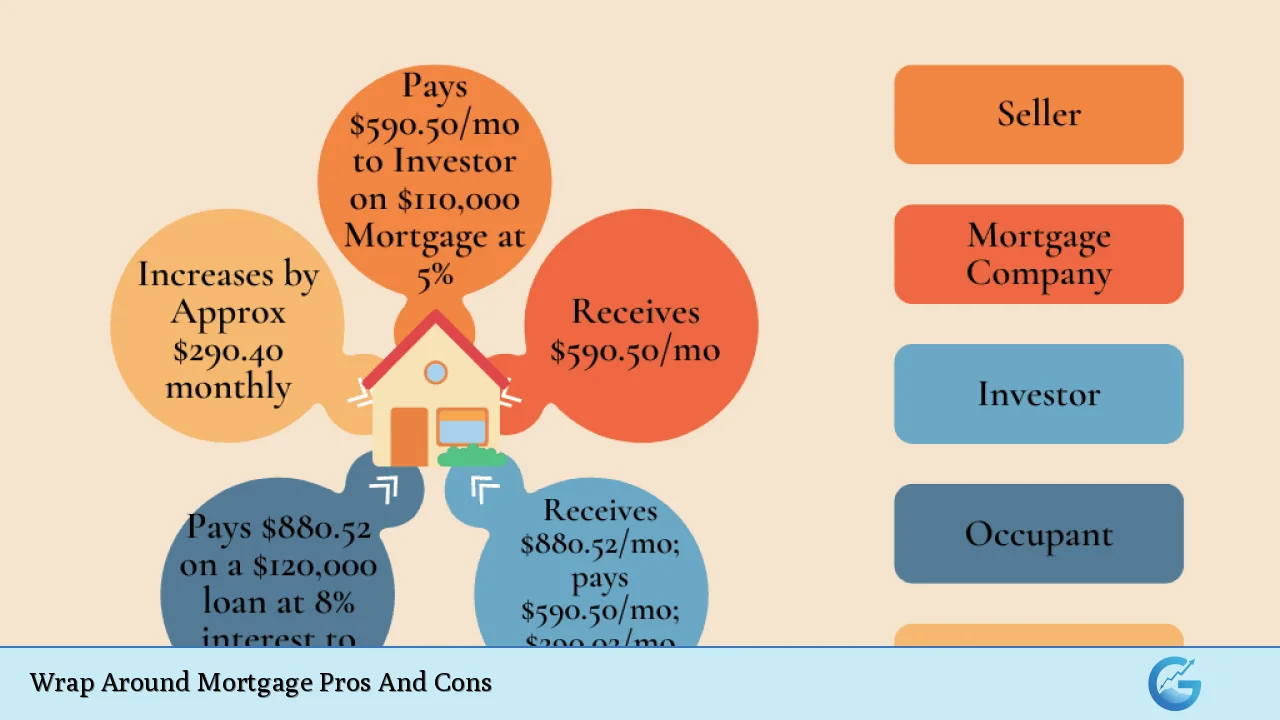

A wraparound mortgage is a unique financing arrangement that allows a seller to maintain their existing mortgage while providing a new loan to the buyer. This type of mortgage “wraps around” the original loan, meaning that the buyer makes payments directly to the seller, who then continues to pay their own mortgage. This arrangement can be beneficial for both parties, particularly in situations where traditional financing options are limited. However, it comes with its own set of risks and complexities that must be understood before entering into such an agreement.

Below is a table summarizing the pros and cons of wraparound mortgages:

| Pros | Cons |

|---|---|

| Flexible financing options for buyers | Higher interest rates compared to traditional mortgages |

| Lower closing costs | Risk of default on both mortgages |

| Faster closing process | Potential legal complications with existing lenders |

| Continuous income stream for sellers | Uncertain property ownership rights for buyers |

| Less stringent qualification requirements for buyers | Due-on-sale clause risks for sellers |

Flexible Financing Options for Buyers

One of the primary advantages of a wraparound mortgage is the flexibility it offers to buyers. Traditional mortgage applications often require extensive documentation, credit checks, and income verification. In contrast, wraparound mortgages typically have more lenient qualification criteria, allowing individuals who may not qualify for conventional loans to purchase a home.

- Easier qualification: Buyers can often secure financing without meeting strict credit requirements.

- Negotiable terms: The buyer and seller can negotiate terms directly, allowing for customized payment schedules and interest rates.

- Access to properties: This arrangement can enable buyers to access properties they might not otherwise be able to afford through traditional financing.

Lower Closing Costs

Wraparound mortgages can significantly reduce closing costs associated with home purchases. Since these transactions do not involve traditional banks or lenders, many of the fees typically charged during a conventional loan process are eliminated.

- Reduced fees: Buyers may avoid appraisal fees, origination fees, and other costs associated with traditional lending.

- Direct transactions: The direct nature of the transaction between buyer and seller streamlines the process and minimizes additional costs.

Faster Closing Process

The speed at which a wraparound mortgage can be executed is another significant advantage. Traditional real estate transactions often involve lengthy approval processes from banks, which can delay closing dates.

- Quick agreements: Without needing lender approval, transactions can close much faster.

- Immediate ownership: Buyers can gain ownership of the property sooner than they would through conventional means.

Continuous Income Stream for Sellers

For sellers, wraparound mortgages provide an opportunity to generate continuous income. By acting as the lender, sellers receive monthly payments from buyers while still maintaining their existing mortgage.

- Profit from interest: Sellers can charge a higher interest rate than their original mortgage, creating a profit margin.

- Steady cash flow: Monthly payments from buyers provide a reliable income stream that can help cover existing mortgage payments or other expenses.

Less Stringent Qualification Requirements for Buyers

Wraparound mortgages often come with fewer qualifications than traditional loans. This accessibility makes them particularly appealing in markets where lending standards are tightening.

- Flexibility in terms: Sellers may be more willing to negotiate terms based on personal circumstances rather than rigid bank policies.

- Opportunity for non-traditional buyers: Individuals with less-than-perfect credit or unstable income streams may find this option viable.

Higher Interest Rates Compared to Traditional Mortgages

While wraparound mortgages offer many benefits, one significant drawback is that they often come with higher interest rates than conventional loans.

- Increased monthly payments: Buyers may face larger monthly payments due to elevated interest rates, which could strain their finances over time.

- Long-term costs: The total cost of borrowing could be significantly higher when compared to traditional financing options.

Risk of Default on Both Mortgages

Both buyers and sellers face risks associated with defaults on either mortgage involved in a wraparound agreement.

- Dual foreclosure risk: If the buyer defaults on their payments, it could jeopardize the seller’s ability to pay their original mortgage, leading to potential foreclosure on both loans.

- Financial instability: Both parties must maintain financial stability to avoid defaulting on their respective obligations.

Potential Legal Complications with Existing Lenders

Wraparound mortgages can introduce legal complexities due to existing mortgage agreements.

- Due-on-sale clauses: Many original mortgages contain clauses that require full repayment if the property is sold or transferred. If a seller does not obtain permission from their lender before entering into a wraparound agreement, they risk triggering this clause.

- Legal disputes: Misunderstandings regarding the terms of the agreement or failure to disclose information could lead to legal disputes between parties involved in the transaction.

Uncertain Property Ownership Rights for Buyers

Buyers entering into a wraparound mortgage may face uncertainties regarding their ownership rights.

- Title issues: Because the seller retains their original mortgage, there may be complications regarding title transfer if issues arise with either party’s financial obligations.

- Potential loss of investment: If the seller defaults on their original loan, buyers could lose their investment despite making regular payments on the wraparound mortgage.

Due-on-Sale Clause Risks for Sellers

Sellers must also consider the implications of due-on-sale clauses when engaging in wraparound mortgages.

- Immediate repayment demands: If lenders discover that a property has been sold under a wraparound agreement without notification, they may demand immediate repayment of the entire outstanding balance on the original loan.

- Increased liability: Sellers could face significant financial liability if they fail to comply with their existing loan terms while attempting to facilitate a wraparound mortgage.

In conclusion, while wraparound mortgages present unique opportunities for both buyers and sellers in real estate transactions, they come with inherent risks and complexities that must be thoroughly understood. Both parties should engage legal counsel and conduct due diligence before entering into such agreements. Understanding these pros and cons will help potential investors make informed decisions aligned with their financial goals and risk tolerance levels.

Frequently Asked Questions About Wrap Around Mortgages

- What is a wraparound mortgage?

A wraparound mortgage is a type of seller financing where the buyer makes payments directly to the seller instead of obtaining a new loan from a bank. - Who benefits most from a wraparound mortgage?

Both buyers who have difficulty qualifying for traditional loans and sellers looking for steady income streams benefit from this arrangement. - Are there risks involved in wraparound mortgages?

Yes, risks include higher interest rates, potential defaults on either mortgage, and legal complications related to existing loans. - How do I know if a wraparound mortgage is right for me?

This depends on your financial situation; consult with real estate professionals and attorneys before proceeding. - Can I lose my home if I enter into a wraparound mortgage?

If either party defaults on their obligations, it could lead to foreclosure and loss of property. - What should I do if my lender has a due-on-sale clause?

You should seek permission from your lender before entering into any wraparound agreement. - How quickly can I close on a property using a wraparound mortgage?

The process is typically faster than traditional methods since it eliminates many lender requirements. - Is it necessary to hire an attorney for a wraparound mortgage?

Yes, hiring an attorney is advisable to navigate legal complexities and ensure all agreements are properly documented.