Zero-Based Budgeting (ZBB) is a budgeting approach that requires organizations to start from a “zero base” at the beginning of each budgeting cycle, meaning every expense must be justified for each new period. Unlike traditional budgeting methods, which often carry over previous budgets with incremental adjustments, ZBB compels managers to evaluate all expenditures based on current needs and priorities. This method has gained popularity in various sectors, including finance, government, and corporate environments, due to its potential for enhancing cost efficiency and strategic alignment.

In this article, we will explore the pros and cons of zero-based budgeting in detail, providing insights into its advantages and disadvantages for organizations looking to optimize their financial management strategies.

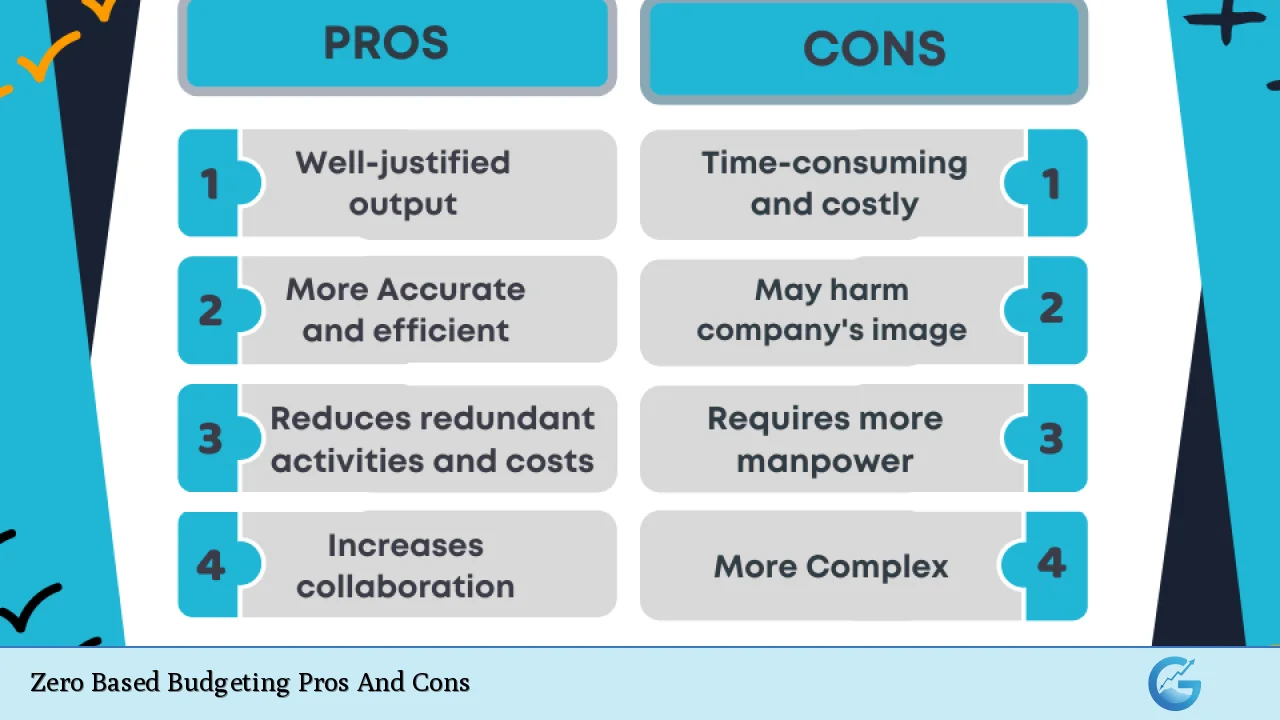

| Pros | Cons |

|---|---|

| Enhanced cost control | Time-consuming implementation |

| Alignment with strategic goals | Potential for short-term focus |

| Increased accountability | Resource-intensive process |

| Encourages efficient resource allocation | Resistance to change from stakeholders |

| Improved communication across departments | Complexity in execution |

| Identification of unnecessary expenses | Requires cultural shift in budgeting mindset |

| Flexibility to adapt to changing conditions | May overlook long-term investments |

| Encourages thorough analysis of expenditures | Risk of budget manipulation by savvy managers |

Enhanced Cost Control

One of the primary advantages of zero-based budgeting is its ability to enhance cost control. By requiring every department to justify their expenses from scratch, organizations can eliminate unnecessary costs and ensure that funds are allocated only to essential activities. This rigorous scrutiny helps prevent the carryover of outdated or irrelevant expenditures from previous budgets.

- Prevents wasteful spending: ZBB forces managers to critically assess each expense.

- Promotes financial discipline: Departments are held accountable for their spending decisions.

Alignment with Strategic Goals

Zero-based budgeting ensures that every dollar spent aligns with the organization’s current strategic objectives. This alignment fosters a more focused approach to resource allocation, allowing organizations to prioritize initiatives that directly contribute to their goals.

- Supports strategic initiatives: Funds are directed towards projects that drive growth.

- Facilitates agile decision-making: Organizations can quickly adapt their budgets in response to changing priorities.

Increased Accountability

ZBB enhances accountability within organizations by requiring managers to justify their budget requests. This process encourages ownership over financial decisions and promotes a culture of transparency.

- Empowers managers: Individuals are responsible for defending their budget requests.

- Encourages performance monitoring: Regular reviews ensure departments stay aligned with their financial commitments.

Encourages Efficient Resource Allocation

By starting from zero, organizations can allocate resources more effectively. ZBB enables a comprehensive evaluation of all expenditures, ensuring that funds are directed towards high-impact activities rather than being spread thinly across numerous low-value initiatives.

- Eliminates redundant activities: Resources can be redirected towards more productive areas.

- Enhances operational efficiency: Departments are incentivized to optimize their operations.

Improved Communication Across Departments

The zero-based budgeting process necessitates collaboration among various departments. This requirement fosters better communication and understanding of organizational priorities, leading to more cohesive financial planning.

- Breaks down silos: Departments work together to create a unified budget.

- Enhances team dynamics: Collaborative discussions lead to improved relationships among teams.

Identification of Unnecessary Expenses

ZBB’s rigorous approach helps identify and eliminate unnecessary expenses that may have been overlooked in traditional budgeting methods. By scrutinizing every line item, organizations can uncover areas where costs can be reduced without sacrificing quality or performance.

- Promotes continuous improvement: Ongoing assessment leads to better cost management.

- Encourages innovation: Departments are motivated to find creative solutions for funding needs.

Flexibility to Adapt to Changing Conditions

Zero-based budgeting allows organizations to remain flexible in their financial planning. As market conditions change or new opportunities arise, ZBB enables quick adjustments to the budget based on current realities rather than historical data.

- Responsive budgeting: Organizations can pivot quickly in response to new information.

- Supports dynamic environments: Ideal for industries facing rapid changes.

Thorough Analysis of Expenditures

ZBB encourages a detailed analysis of all expenditures, fostering a culture of critical thinking among managers. This thorough examination helps ensure that every dollar spent is justified and aligned with organizational goals.

- Enhances decision-making quality: Managers make informed choices based on data.

- Drives performance improvement: Continuous evaluation leads to better outcomes.

Time-Consuming Implementation

Despite its advantages, zero-based budgeting can be time-consuming to implement. The process requires significant effort from all departments as they must justify every expense anew each budget cycle. This extensive preparation can strain resources, particularly in larger organizations.

- Initial investment in time: The first implementation may take longer than expected.

- Ongoing commitment required: Continuous justification can be burdensome over time.

Potential for Short-Term Focus

One significant drawback of ZBB is its tendency to promote short-term thinking among managers. In an effort to justify immediate expenses, managers may prioritize initiatives that yield quick results over those that contribute to long-term growth and sustainability.

- Neglects long-term investments: Critical projects may receive inadequate funding.

- Encourages reactive decision-making: Focus shifts towards immediate gains rather than strategic development.

Resource-Intensive Process

The zero-based budgeting process can be resource-intensive, requiring substantial input from various departments. Organizations may need additional personnel or tools to manage the increased workload associated with justifying every expense.

- Increased administrative burden: More resources may be needed for effective implementation.

- Potential for burnout among staff: Continuous justification can lead to fatigue among employees involved in the process.

Resistance to Change from Stakeholders

Implementing zero-based budgeting often encounters resistance from stakeholders who are accustomed to traditional budgeting methods. Change management strategies must be employed to gain buy-in from all levels of management and staff involved in the budgeting process.

- Cultural shift required: Organizations must foster an environment open to change.

- Need for effective communication: Clear messaging about the benefits is essential for acceptance.

Complexity in Execution

The execution of zero-based budgeting can be complex due to its detailed nature. Organizations must develop clear guidelines and processes for evaluating expenses, which can vary significantly across different departments or business units.

- Requires robust systems and processes: Effective tracking mechanisms must be established.

- Potential for inconsistencies: Different interpretations of guidelines may lead to uneven application across departments.

Requires Cultural Shift in Budgeting Mindset

For zero-based budgeting to be successful, organizations must undergo a cultural shift in how they approach budgeting. This shift involves moving away from entitlement-based funding towards a more analytical and justification-focused mindset.

- Challenges existing norms: Traditional practices may need reevaluation.

- Encourages proactive engagement with finances: A cultural change promotes deeper financial literacy among staff.

May Overlook Long-Term Investments

While ZBB focuses on current needs and efficiencies, it may inadvertently overlook essential long-term investments such as research and development or employee training programs that do not provide immediate returns but are vital for future success.

- Short-sighted funding decisions: Critical areas may suffer due to lack of immediate justification.

- Risk of stifling innovation: Long-term growth initiatives could be deprioritized in favor of short-term gains.

Risk of Budget Manipulation by Savvy Managers

In some cases, experienced managers may manipulate the zero-based budgeting process by strategically justifying only certain expenses while neglecting others. This manipulation undermines the integrity of the ZBB approach and can lead to inequitable resource distribution within the organization.

- Potential for bias in justifications: Managers might prioritize personal agendas over organizational needs.

- Challenges in maintaining fairness: Ensuring equitable treatment across departments becomes difficult without oversight.

In conclusion, zero-based budgeting offers several advantages such as enhanced cost control, alignment with strategic goals, increased accountability, and improved communication across departments. However, it also presents challenges including time-intensive implementation, potential short-term focus, resource intensity, resistance from stakeholders, complexity in execution, and risks associated with budget manipulation.

Organizations considering this approach should weigh these pros and cons carefully against their specific circumstances and financial objectives before making a commitment. Ultimately, successful implementation hinges on effective change management strategies and a willingness among all stakeholders to embrace a new way of thinking about budgeting processes.

Frequently Asked Questions About Zero Based Budgeting

- What is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) is a method where every expense must be justified anew during each budget cycle rather than relying on previous budgets. - What are the main benefits of Zero-Based Budgeting?

The primary benefits include enhanced cost control, alignment with strategic goals, increased accountability among departments, and improved communication. - What challenges does Zero-Based Budgeting present?

ZBB can be time-consuming and resource-intensive; it may also encourage short-term thinking at the expense of long-term investments. - How does Zero-Based Budgeting differ from traditional budgeting?

Unlike traditional budgeting which often carries over previous budgets with minor adjustments, ZBB starts from scratch each period requiring justification for all expenses. - Is Zero-Based Budgeting suitable for all organizations?

ZBB can benefit many organizations but may not suit those with stable budgets or less variable income streams. - Can Zero-Based Budgeting lead to conflicts within an organization?

The process may foster competition among departments for funding which could result in conflicts if not managed properly. - How can an organization successfully implement Zero-Based Budgeting?

A successful implementation involves clear communication about its benefits, stakeholder buy-in at all levels, and robust systems for tracking justifications. - What industries benefit most from Zero-Based Budgeting?

ZBB is particularly effective in industries facing rapid changes or those with fluctuating revenues as it allows flexible financial planning.