A 401(k) loan is a unique financial instrument that allows individuals to borrow money from their retirement savings account. This option can be appealing for those facing financial challenges or seeking to fund significant expenses. However, it’s crucial to understand both the advantages and potential drawbacks before deciding to tap into your retirement funds.

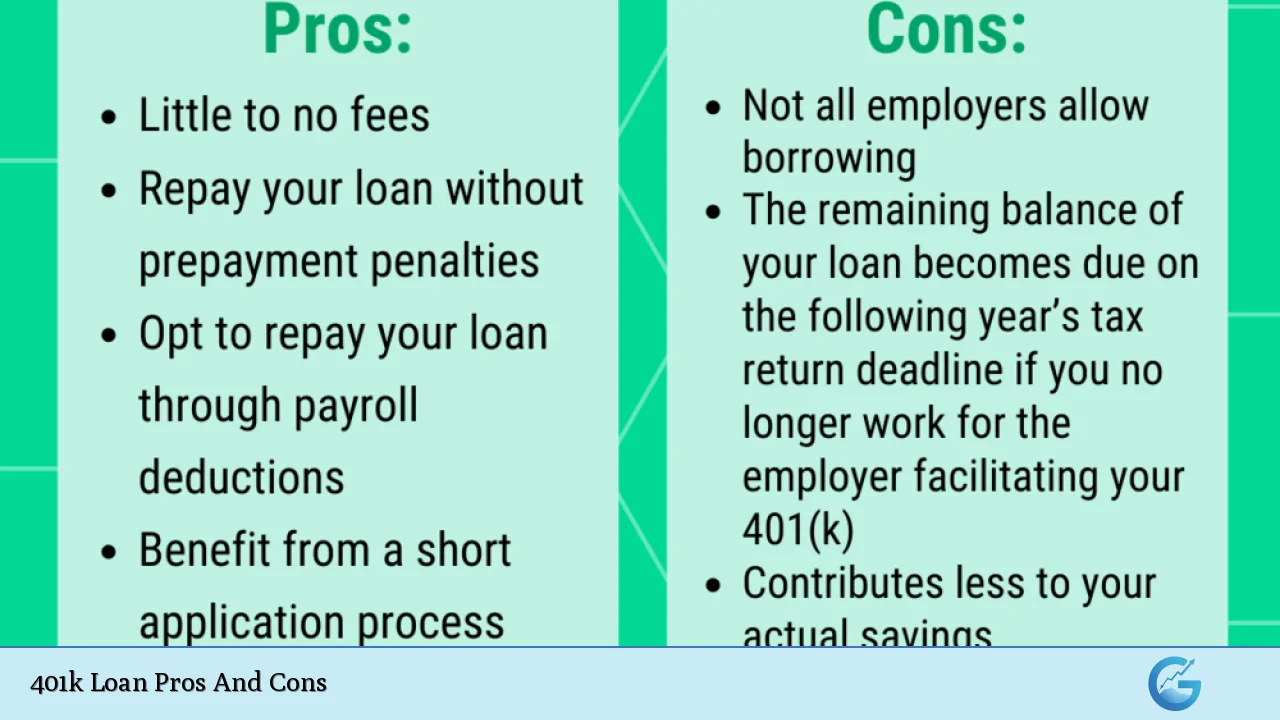

| Pros | Cons |

|---|---|

| Easy access to funds | Reduced retirement savings |

| No credit check required | Double taxation on interest |

| Lower interest rates | Repayment risks |

| Interest paid to yourself | Opportunity cost of lost growth |

| No early withdrawal penalties | Limited borrowing amount |

| Flexible repayment options | Potential for default |

Advantages of 401(k) Loans

Easy Access to Funds

One of the most significant benefits of a 401(k) loan is the ease of access to your funds. Unlike traditional loans that require extensive paperwork and approval processes, 401(k) loans are relatively straightforward to obtain.

Most plans allow you to request a loan online or with a simple phone call, making it a quick solution for immediate financial needs.

- No lengthy application process

- Funds typically available within a few days

- No need to explain the purpose of the loan (in most cases)

No Credit Check Required

For individuals with less-than-stellar credit scores, a 401(k) loan can be particularly attractive. Since you’re essentially borrowing from yourself, there’s no need for a credit check. This feature makes 401(k) loans accessible to those who might struggle to secure traditional loans due to credit issues.

- Ideal for those with poor or limited credit history

- No impact on your credit score when borrowing

- Helps avoid high-interest loans from predatory lenders

Lower Interest Rates

Compared to many other forms of borrowing, 401(k) loans often come with lower interest rates.

The interest rate is typically set at prime rate plus 1%, which is generally lower than rates for personal loans or credit cards.

This can result in significant savings over the life of the loan, especially for larger amounts.

- Rates often lower than credit cards or personal loans

- Potential for substantial interest savings

- Fixed interest rate for the duration of the loan

Interest Paid to Yourself

In a unique twist, the interest you pay on a 401(k) loan goes back into your own retirement account. This means that instead of paying interest to a bank or financial institution, you’re essentially paying it to yourself. While this doesn’t negate the opportunity cost of borrowing from your retirement savings, it does soften the blow somewhat.

- Interest payments increase your 401(k) balance

- Helps mitigate some of the negative impacts of borrowing

- Can be seen as a forced savings mechanism

No Early Withdrawal Penalties

When you take a 401(k) loan, you avoid the early withdrawal penalties that would typically apply if you simply cashed out part of your 401(k) before retirement age.

As long as you repay the loan according to the terms, you won’t incur the 10% early withdrawal penalty or immediate income taxes on the borrowed amount.

- Avoids 10% early withdrawal penalty

- No immediate income tax on borrowed amount

- Preserves tax-deferred status of funds if repaid on time

Flexible Repayment Options

Most 401(k) loans offer flexible repayment terms, typically allowing up to five years for repayment (longer for home purchases). Repayments are usually made through automatic payroll deductions, making it convenient to stay on track. Additionally, many plans allow you to repay the loan early without penalties.

- Up to five years for general repayment (longer for home loans)

- Automatic payroll deductions for easy repayment

- Option to repay early without penalties

Disadvantages of 401(k) Loans

Reduced Retirement Savings

The most significant drawback of a 401(k) loan is the potential impact on your long-term retirement savings.

When you borrow from your 401(k), that money is no longer invested in the market, potentially missing out on significant growth during bull markets.

This opportunity cost can be substantial, especially for younger borrowers with a longer time horizon until retirement.

- Loss of compound interest on borrowed funds

- Potential for significant reduction in retirement nest egg

- May require increased contributions later to catch up

Double Taxation on Interest

While the interest you pay on a 401(k) loan goes back into your account, it’s important to note that you’ll face double taxation on this interest. You repay the loan with after-tax dollars, and when you eventually withdraw the funds in retirement, you’ll pay taxes on that money again.

- Interest repaid with after-tax dollars

- Interest taxed again upon withdrawal in retirement

- Reduces the overall tax efficiency of your retirement savings

Repayment Risks

One of the most significant risks of a 401(k) loan is what happens if you leave your job, either voluntarily or involuntarily.

In most cases, if you separate from your employer, you’ll need to repay the entire loan balance within a short period, typically 60 to 90 days.

Failure to do so results in the loan being treated as a distribution, subject to taxes and penalties.

- Full repayment often required if you leave your job

- Short repayment window (usually 60-90 days) upon job loss

- Risk of default and associated penalties

Opportunity Cost of Lost Growth

When you take money out of your 401(k), you’re not just losing the principal amount; you’re also missing out on potential market gains. During periods of strong market performance, this opportunity cost can be substantial. Even if you repay the loan with interest, you may still end up with less money than if you had left the funds invested.

- Missed potential for market gains

- Impact can be significant in bull markets

- Difficult to make up for lost growth, even with interest payments

Limited Borrowing Amount

401(k) loans come with strict borrowing limits set by the IRS.

You can typically borrow up to 50% of your vested account balance or $50,000, whichever is less.

This limit may be insufficient for major expenses or debt consolidation, forcing you to seek additional sources of funding.

- Maximum loan of $50,000 or 50% of vested balance

- May not be enough for large expenses

- Could necessitate additional borrowing from other sources

Potential for Default

If you’re unable to repay your 401(k) loan according to the terms, it will be treated as a distribution. This means you’ll owe income taxes on the outstanding balance, plus a 10% early withdrawal penalty if you’re under 59½. Defaulting on a 401(k) loan can have severe consequences for your retirement savings and current tax situation.

- Unpaid loans treated as taxable distributions

- 10% early withdrawal penalty if under 59½

- Can significantly impact your tax liability and retirement savings

In conclusion, while 401(k) loans can provide a convenient source of funds in times of need, they come with significant risks and potential drawbacks.

It’s crucial to carefully consider all options and consult with a financial advisor before deciding to borrow from your retirement savings.

Remember that your 401(k) is designed to provide for your future retirement, and any decision to borrow from it should be made with careful consideration of both the short-term benefits and long-term consequences.

Frequently Asked Questions About 401k Loan Pros And Cons

- How much can I borrow from my 401(k)?

You can typically borrow up to 50% of your vested account balance or $50,000, whichever is less. Some plans may have lower limits or additional restrictions. - What is the interest rate on a 401(k) loan?

Interest rates are usually set at prime rate plus 1-2%. This rate is often lower than rates for personal loans or credit cards. - How long do I have to repay a 401(k) loan?

Generally, you have up to five years to repay a 401(k) loan. However, if the loan is used to purchase a primary residence, the repayment term may be extended up to 15 years. - What happens if I can’t repay my 401(k) loan?

If you default on your loan, the outstanding balance is treated as a distribution. You’ll owe income taxes on this amount and potentially a 10% early withdrawal penalty if you’re under 59½. - Can I still contribute to my 401(k) while repaying a loan?

Yes, most plans allow you to continue making contributions while repaying a loan. However, some employers may suspend matching contributions during the repayment period. - Will taking a 401(k) loan affect my credit score?

No, 401(k) loans are not reported to credit bureaus and do not impact your credit score. However, if you default on the loan, it could indirectly affect your finances and ability to borrow in the future. - Can I take multiple 401(k) loans?

Some plans allow multiple loans, while others restrict you to one loan at a time. Check with your plan administrator for specific rules regarding multiple loans. - Is interest on a 401(k) loan tax-deductible?

No, unlike mortgage interest, the interest paid on a 401(k) loan is not tax-deductible. This is because you’re borrowing your own money, not from a financial institution.