529 accounts, also known as 529 plans, are tax-advantaged investment vehicles designed to encourage saving for future education expenses. They are named after Section 529 of the Internal Revenue Code, which governs these plans. The primary purpose of a 529 account is to provide families with a way to save for college or other qualified educational expenses while enjoying certain tax benefits. As education costs continue to rise, understanding the advantages and disadvantages of 529 accounts is crucial for anyone considering this savings option. This article delves into the pros and cons of 529 accounts, providing a comprehensive overview for potential investors.

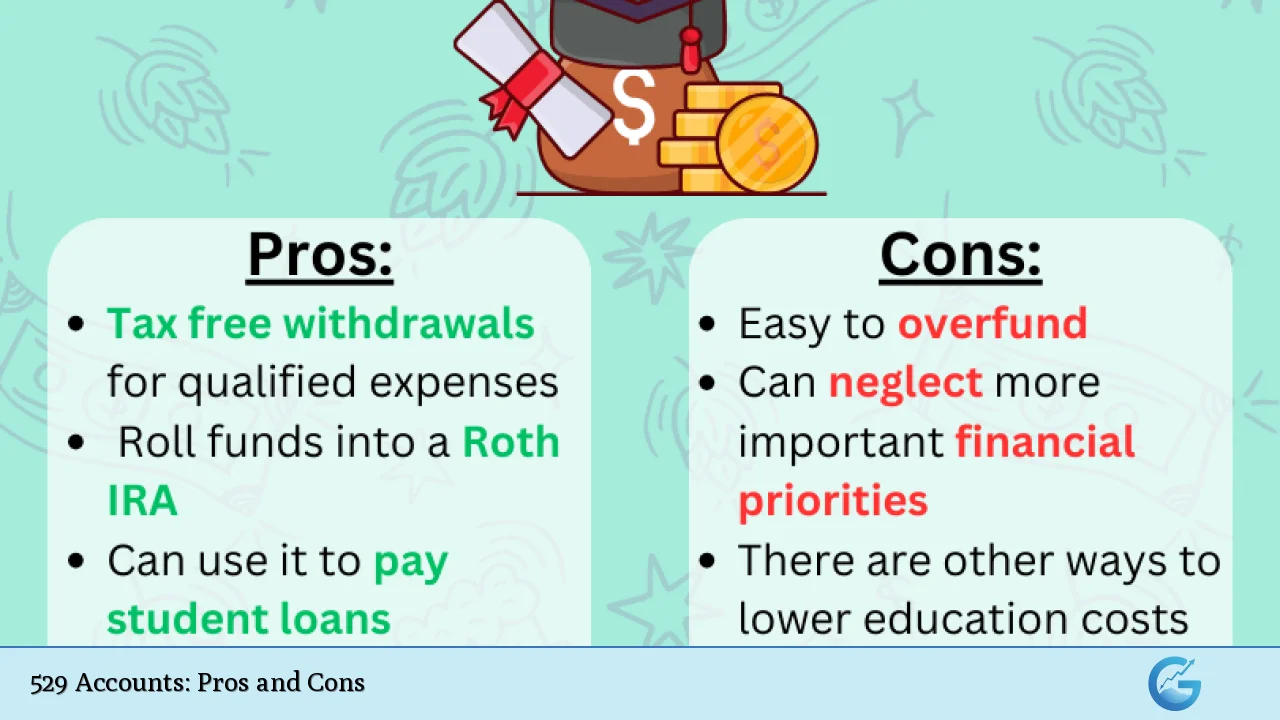

| Pros | Cons |

|---|---|

| Tax-free growth and withdrawals for qualified expenses | Funds must be used for qualified education expenses |

| High contribution limits | Limited investment options |

| Potential state tax deductions or credits | Penalties for non-qualified withdrawals |

| Flexibility in changing beneficiaries | Impact on financial aid calculations |

| Low maintenance required | Fees can vary significantly between plans |

| Ability to use funds for K-12 education expenses | State-specific rules can complicate usage |

| Creditor protection in some states | No federal tax deduction for contributions |

| Option to roll over funds to a Roth IRA (under certain conditions) | Contributions may affect eligibility for financial aid |

Tax-Free Growth and Withdrawals for Qualified Expenses

One of the most significant advantages of a 529 account is that it allows for tax-free growth on investments. Earnings in a 529 plan grow federal income tax-free, and withdrawals made for qualified education expenses are also exempt from federal taxes. This feature can lead to substantial savings over time, especially when considering the compounding effect of investments.

- Tax-free growth: Earnings accumulate without being taxed.

- Tax-free withdrawals: Funds used for tuition, fees, books, and other qualified expenses are not subject to federal income tax.

Funds Must Be Used for Qualified Education Expenses

While the tax benefits are appealing, there is a crucial limitation: funds in a 529 account must be used exclusively for qualified education expenses. If the money is used for non-qualified purposes, it will incur taxes and penalties.

- Qualified expenses include: Tuition, fees, books, room and board.

- Non-qualified withdrawals: Subject to income tax and a 10% penalty on earnings.

High Contribution Limits

Another advantage of 529 accounts is their high contribution limits. Most states allow contributions that can exceed $300,000 per beneficiary, which provides ample opportunity for families to save significant amounts over time.

- Contribution flexibility: Families can contribute large sums without worrying about hitting a limit quickly.

- Superfunding option: Individuals can contribute up to five years’ worth of annual gift tax exclusions in one year.

Limited Investment Options

Despite their benefits, 529 plans often come with limited investment choices compared to other investment vehicles like IRAs or brokerage accounts. Most plans offer a selection of mutual funds or age-based portfolios, which may not suit every investor’s preferences.

- Limited choices: Typically restricted to specific mutual funds selected by the plan.

- Less control: Investors cannot pick individual stocks or bonds.

Potential State Tax Deductions or Credits

Many states offer tax deductions or credits for contributions made to their own state’s 529 plan. This can provide an additional incentive for families to invest in these accounts.

- State-specific benefits: Some states provide significant tax breaks.

- Consideration of state residency: Benefits may vary based on where you live.

Penalties for Non-Qualified Withdrawals

If you withdraw funds from a 529 account for non-qualified expenses, you will incur penalties. The earnings portion of these withdrawals is subject to federal income tax and an additional 10% penalty.

- Strict rules: Withdrawals must be carefully planned to avoid penalties.

- Exceptions exist: Certain circumstances (like scholarships) may exempt you from penalties.

Flexibility in Changing Beneficiaries

A unique feature of 529 accounts is the ability to change the beneficiary without incurring taxes or penalties. This allows families to adapt their savings strategies as educational needs change over time.

- Beneficiary changes allowed: Funds can be transferred among family members.

- Adaptability: Useful if the original beneficiary does not need the funds.

Impact on Financial Aid Calculations

One downside of 529 accounts is their impact on financial aid eligibility. While they are considered parental assets (which have a lower impact on aid calculations than student assets), they can still affect how much aid your child may receive.

- Asset consideration: A portion of the account value may be counted against financial aid eligibility.

- Planning required: Families should consider this when applying for financial aid.

Low Maintenance Required

Once established, 529 accounts require minimal maintenance. Most plans are designed to be user-friendly and do not require frequent management or monitoring.

- Ease of use: Simple setup and management processes.

- Automatic rebalancing options: Many plans offer age-based portfolios that adjust automatically over time.

Fees Can Vary Significantly Between Plans

One important consideration when selecting a 529 plan is the fees associated with it. Fees can vary widely from one plan to another and can significantly impact overall returns.

- Expense ratios matter: Higher fees can eat into your investment returns.

- Comparison shopping recommended: Families should compare fees across different state plans before committing.

Ability to Use Funds for K-12 Education Expenses

In addition to college costs, recent changes in legislation allow families to use up to $10,000 per year from their 529 accounts for K-12 tuition expenses at private or religious schools. This expansion broadens the utility of these accounts beyond just higher education.

- K-12 flexibility: Provides options for younger students as well.

- Wider applicability: Useful for families considering private schooling.

State-Specific Rules Can Complicate Usage

Each state administers its own 529 plan with unique rules and regulations. This variability can lead to confusion regarding contributions, withdrawals, and tax benefits depending on where you live.

- State differences matter: Not all states offer the same benefits or rules.

- Research required: Families must understand their specific state’s regulations before investing.

No Federal Tax Deduction for Contributions

Unlike some retirement accounts that offer federal tax deductions on contributions, 529 plans do not provide this benefit at the federal level. While some states may offer deductions, this is not universal.

- Contribution limitations: Lack of federal deduction might deter some investors.

- State benefits vary widely: Families should check if their state offers any deductions before investing.

Option to Roll Over Funds to a Roth IRA (Under Certain Conditions)

Recent changes in legislation now allow individuals who have maintained their 529 account for at least 15 years to roll over funds into a Roth IRA under specific conditions. This provides an additional avenue for utilizing excess funds if educational needs change over time.

- New flexibility introduced: Rollover options expand potential uses of funds.

- Conditions apply: Specific requirements must be met before rolling over funds.

In conclusion, while 529 accounts offer numerous advantages such as tax-free growth and high contribution limits, they also come with notable disadvantages including limited investment options and strict usage rules. Understanding both sides is essential when considering whether a 529 account aligns with your financial goals and educational funding strategies.

Frequently Asked Questions About 529 Accounts

- What is a 529 account?

A 529 account is a tax-advantaged savings plan designed specifically for funding education costs. - Can I use my 529 funds for non-qualified expenses?

No, using funds for non-qualified expenses will incur taxes and penalties. - What happens if my child does not go to college?

You can change the beneficiary or roll over funds into a Roth IRA under certain conditions. - Are there contribution limits on 529 accounts?

While there are no annual contribution limits set by federal law, each state has its own maximum contribution limits. - Do I get a federal tax deduction for my contributions?

No, there are no federal tax deductions available; however, some states offer deductions. - How do I choose the best 529 plan?

Consider factors such as fees, investment options, state benefits, and your specific educational funding needs. - Can I change my investment options within my 529 plan?

You can typically change your investment options once per year. - What happens if I withdraw money from my 529 account?

If used for qualified expenses, withdrawals are tax-free; otherwise, they incur taxes plus penalties.

Understanding both the pros and cons of 529 accounts will empower families to make informed decisions about saving for education while maximizing potential benefits.