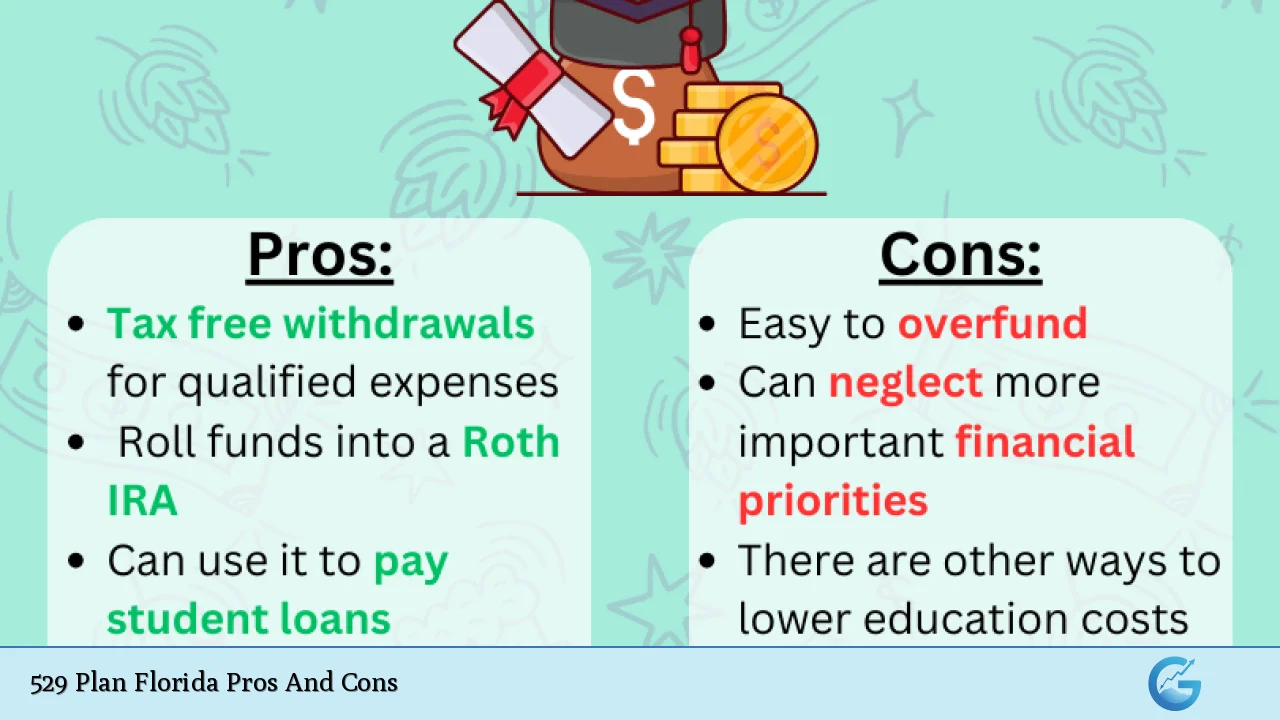

The Florida 529 Plan is a popular college savings option designed to help families save for educational expenses. These plans allow for tax-advantaged growth of funds, making them an attractive choice for parents and guardians looking to secure their children’s educational future. However, like any financial product, they come with both advantages and disadvantages that potential investors should consider carefully. This article will explore the pros and cons of the Florida 529 Plan in detail, providing insights that can help you make informed decisions about your education savings strategy.

| Pros | Cons |

|---|---|

| High contribution limits | Funds must be used for qualified educational expenses |

| Tax-free growth and withdrawals for education | Limited investment options |

| No state income tax on contributions | Potential penalties for non-qualified withdrawals |

| Flexibility in changing beneficiaries | Impact on financial aid eligibility |

| Low maintenance fees compared to other investment accounts | Fees can vary significantly between plans and investments |

| Ability to use funds for K-12 education and apprenticeships | No state tax deductions available in Florida |

| Control over account ownership and investment decisions | Restrictions on how much can be contributed annually without gift tax implications |

| Protection from creditors in some cases | Potential loss of funds if not used for education within a certain timeframe |

High Contribution Limits

One of the most significant advantages of the Florida 529 Plan is its high contribution limit. Families can contribute up to $418,000 per beneficiary, which is among the highest limits in the country. This allows for substantial savings potential, especially important given the rising costs of higher education.

- Flexibility in Contributions: There are no annual contribution limits, allowing families to save aggressively.

- Five-Year Gift Tax Averaging: Contributors can utilize a five-year election to front-load contributions, enabling them to contribute up to $90,000 in one year without incurring gift taxes.

Tax-Free Growth and Withdrawals for Education

The Florida 529 Plan offers significant tax benefits:

- Tax-Deferred Growth: Contributions grow tax-free, meaning you won’t pay taxes on earnings as they accumulate.

- Tax-Free Withdrawals: As long as funds are used for qualified educational expenses, withdrawals are also tax-free at the federal level. This includes tuition, fees, books, and room and board.

No State Income Tax on Contributions

Florida does not impose a state income tax, which means that contributions to the 529 Plan do not benefit from state tax deductions. However, this also means that residents are not subject to state income tax on their earnings or withdrawals.

- National Accessibility: Residents can invest in any state’s 529 plan if they find better options elsewhere.

Flexibility in Changing Beneficiaries

Another advantage of the Florida 529 Plan is the ability to change beneficiaries without incurring penalties. This feature provides families with flexibility in managing their education savings.

- Family Transfers: If one child does not need the funds (e.g., due to scholarships), the account owner can transfer the funds to another family member’s account.

Low Maintenance Fees Compared to Other Investment Accounts

The Florida 529 Plan generally has lower maintenance fees than many other investment accounts. This means more of your money goes toward your child’s education rather than administrative costs.

- Cost Efficiency: Families can save more over time due to lower fees associated with managing their accounts.

Ability to Use Funds for K-12 Education and Apprenticeships

Recent changes have expanded the use of 529 funds beyond just college expenses:

- K-12 Tuition: Up to $10,000 per year can be used for private or religious school tuition at the K-12 level.

- Apprenticeship Programs: The SECURE Act allows funds to be used for certain apprenticeship programs certified by the Department of Labor.

Control Over Account Ownership and Investment Decisions

Account owners maintain control over their 529 plans even after making contributions. This includes decisions about investment options and changing beneficiaries.

- Investment Options: While there are limited choices compared to other investment vehicles, account holders can select from various portfolios based on their risk tolerance.

Protection from Creditors in Some Cases

In certain situations, assets held within a 529 plan may be protected from creditors. This can provide peace of mind for families concerned about financial stability while saving for education.

Funds Must Be Used for Qualified Educational Expenses

A major disadvantage of the Florida 529 Plan is that funds must be used exclusively for qualified educational expenses. If they are not:

- Penalties Apply: Non-qualified withdrawals incur federal income tax on earnings plus a 10% penalty.

- Strict Definitions: Qualified expenses include tuition, fees, books, supplies, and room and board but exclude many other expenses related to education.

Limited Investment Options

While the Florida 529 Plan offers various investment portfolios, these options can be limited compared to other investment accounts:

- Lack of Self-Direction: Investors cannot make individual stock picks or choose alternative investments like real estate or cryptocurrency directly within a 529 plan.

- Potentially High-Cost Funds: Some plans may offer high-cost mutual funds that could diminish overall returns due to higher expense ratios.

Potential Penalties for Non-Qualified Withdrawals

If you withdraw money from a 529 plan for non-qualified expenses:

- Tax Implications: Earnings withdrawn will be subject to federal income tax plus a 10% penalty unless exceptions apply (e.g., scholarship recipients).

Impact on Financial Aid Eligibility

Having a 529 plan can affect your child’s eligibility for financial aid:

- Asset Consideration: A parent-owned 529 account counts as an asset when calculating financial aid eligibility. Generally, it reduces aid by about 5.64% of its value.

- Student-Owned Accounts: If the student owns the account, it could impact aid eligibility even more severely (up to 20%).

Fees Can Vary Significantly Between Plans and Investments

While some plans have low maintenance fees:

- Hidden Costs: It’s essential to review all associated fees carefully as they can vary widely between different investment options within the same plan.

- Expense Ratios Matter: Higher expense ratios on certain funds can significantly erode overall returns over time.

No State Tax Deductions Available in Florida

Unlike many states that offer tax deductions or credits for contributions made to their state’s 529 plan:

- Florida’s Unique Position: Since Florida has no state income tax, residents miss out on additional state-level benefits that could enhance their overall savings strategy.

Restrictions on How Much Can Be Contributed Annually Without Gift Tax Implications

While high contribution limits exist:

- Gift Tax Rules Apply: Contributions exceeding $18,000 per year per beneficiary (or $36,000 for couples) may incur gift taxes unless structured correctly using five-year averaging strategies.

Potential Loss of Funds if Not Used for Education Within a Certain Timeframe

If funds are not utilized within a reasonable timeframe:

- Account Dormancy Risks: Unused funds may face penalties or restrictions if not applied toward qualified educational expenses promptly.

In conclusion, while the Florida 529 Plan offers numerous advantages such as high contribution limits, tax-free growth, and flexibility in beneficiary changes, it also comes with significant disadvantages including restrictions on fund usage and potential impacts on financial aid eligibility. Families considering this option should weigh these factors carefully against their individual financial situations and educational goals.

Frequently Asked Questions About 529 Plan Florida Pros And Cons

- What is a Florida 529 Plan?

A Florida 529 Plan is a tax-advantaged savings plan designed specifically for funding education expenses. - Can I use my Florida 529 Plan at out-of-state colleges?

Yes, funds from a Florida 529 Plan can be used at any accredited college or university nationwide. - Are there penalties for withdrawing money from a 529 Plan?

If funds are withdrawn for non-qualified expenses, earnings are subject to taxes and a potential penalty. - How does a Florida 529 Plan affect financial aid?

A parent-owned Florida 529 account counts against financial aid eligibility but typically has a lower impact than other assets. - What happens if my child receives a scholarship?

If your child receives a scholarship, you can withdraw an amount equal to the scholarship without incurring penalties. - Can I change beneficiaries on my Florida 529 Plan?

You can change beneficiaries without penalties as long as the new beneficiary is a qualified family member. - Is there an age limit for using funds from a Florida 529 Plan?

No age limit exists; however, funds must be used within certain timeframes related to educational expenses. - What types of expenses can I pay with my Florida 529 Plan?

You can use it for tuition, fees, room and board, books, supplies, K-12 tuition up to $10,000 annually, and apprenticeship programs.

This comprehensive overview should assist anyone interested in understanding the intricacies of investing in a Florida 529 Plan while considering both its benefits and drawbacks.