Wealthfront is a leading robo-advisor that has gained popularity for its automated investment management services. Launched in 2011, it offers a range of financial products designed to help individuals manage their investments, save for the future, and optimize their tax liabilities. With a focus on low fees and diversified portfolios, Wealthfront appeals to both novice and experienced investors. However, like any financial service, it has its strengths and weaknesses. This article explores the pros and cons of using Wealthfront as an investment platform.

| Pros | Cons |

|---|---|

| Low management fees (0.25%) | No access to human financial advisors |

| Automated tax-loss harvesting | Higher minimum investment requirement ($500) |

| Diverse investment options including cryptocurrency | Limited customization for smaller accounts |

| High-yield cash account with competitive APY | Overemphasis on conservative asset classes for some users |

| User-friendly platform with strong mobile app support | Poor customer service ratings from some users |

| Advanced financial planning tools available | Limited options for retirement accounts (no custodial accounts) |

Low Management Fees

One of the most significant advantages of Wealthfront is its low management fee structure. The platform charges a 0.25% annual fee, which is competitive compared to many traditional financial advisors and other robo-advisors. This low fee allows investors to keep more of their returns over time, making it an attractive option for those looking to maximize their investment growth without incurring high costs.

- Cost-effective: Compared to traditional advisors who may charge 1% or more, Wealthfront’s fee structure is appealing.

- Transparent pricing: There are no hidden fees, allowing investors to understand exactly what they will pay.

Automated Tax-Loss Harvesting

Wealthfront offers automated tax-loss harvesting, a feature that can significantly enhance after-tax returns. This process involves selling investments that have declined in value to offset gains from other investments, thus reducing overall tax liability.

- Maximizes tax efficiency: By automatically harvesting losses, investors can lower their taxable income.

- Continuous monitoring: Wealthfront’s software constantly monitors portfolios for opportunities to harvest losses, ensuring that clients benefit from this strategy without needing to actively manage their investments.

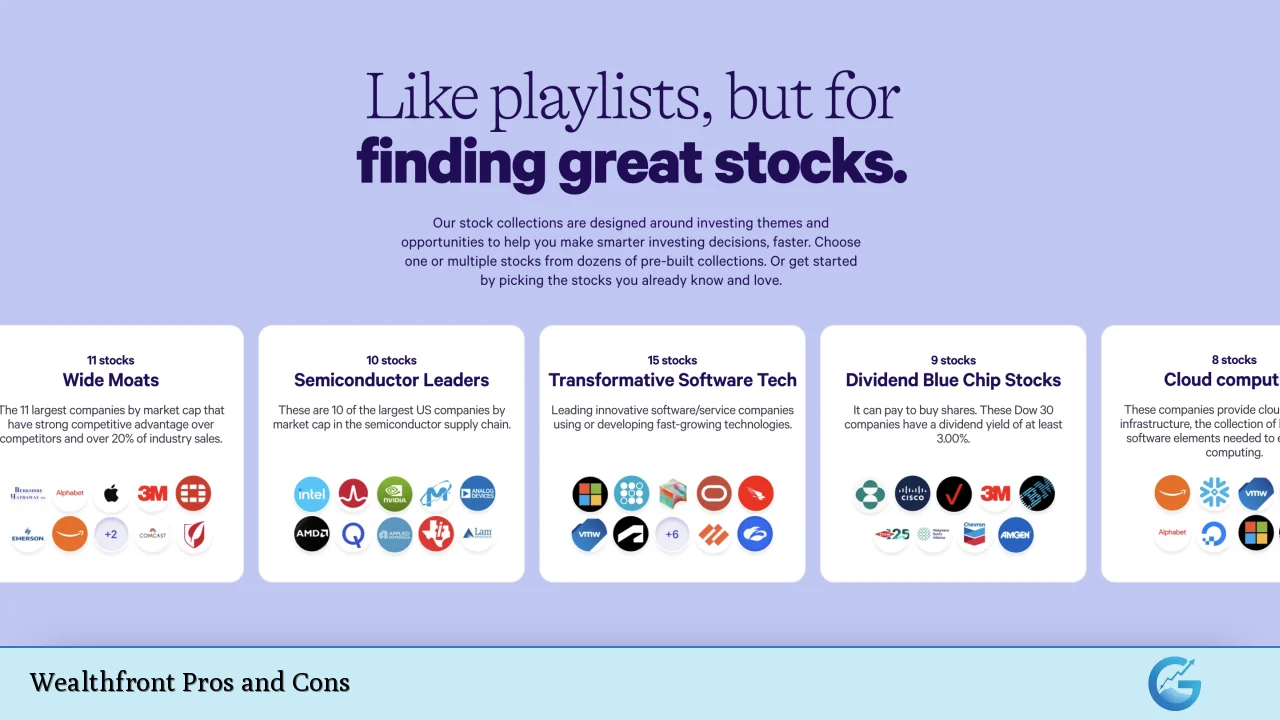

Diverse Investment Options

Wealthfront provides access to a wide range of investment options, including:

- Exchange-Traded Funds (ETFs): Clients can invest in over 200 ETFs across various asset classes.

- Cryptocurrency: Wealthfront allows limited exposure to cryptocurrencies through trusts for Bitcoin and Ethereum, catering to those interested in digital assets.

- Socially Responsible Investments (SRI): Investors can choose from ESG-focused funds, aligning their investments with personal values.

High-Yield Cash Account

The platform features a high-yield cash account that offers an annual percentage yield (APY) significantly higher than traditional savings accounts. As of late 2024, the APY is around 5%, which is over ten times the national average.

- FDIC insurance: Wealthfront partners with multiple banks to provide FDIC insurance up to $8 million per account, ensuring safety for client funds.

- Flexible access: Users can easily manage their cash with features like free ATM withdrawals and bill payments.

User-Friendly Platform

Wealthfront’s platform is designed for ease of use, making it accessible even for those new to investing. The interface is intuitive, and the mobile app has received high ratings from users.

- Comprehensive tools: The platform includes various tools for budgeting and financial planning, helping users make informed decisions about their finances.

- Educational resources: Wealthfront provides articles and guides that help users understand investing concepts better.

No Access to Human Financial Advisors

One of the primary drawbacks of using Wealthfront is the lack of access to human financial advisors. This can be a significant disadvantage for investors who prefer personalized advice or have complex financial situations.

- Limited support: While there is customer service available via phone during business hours, there are no live chat options or in-person consultations.

- Potentially isolating experience: Some users may feel uncomfortable managing their investments without direct human interaction or guidance.

Higher Minimum Investment Requirement

Wealthfront requires a minimum investment of $500, which may be higher than some competing platforms that allow smaller initial deposits. This could be a barrier for new investors or those with limited capital.

- Accessibility concerns: The minimum requirement may deter younger or less affluent individuals from starting their investment journey.

Limited Customization for Smaller Accounts

While Wealthfront offers some degree of portfolio customization, this feature is primarily available for clients with larger accounts (typically over $100,000). For smaller accounts, customization options are limited.

- Standardized portfolios: Investors with less capital may receive more generic investment strategies that do not fully align with their specific goals or risk tolerance.

Overemphasis on Conservative Asset Classes

Some users have noted that Wealthfront tends toward conservative asset allocations, which may not suit all investors’ risk profiles or long-term growth objectives.

- Potentially lower returns: A conservative approach might limit growth potential during bull markets when aggressive strategies could yield higher returns.

- Risk tolerance mismatch: Investors seeking higher risk/reward profiles may find Wealthfront’s allocations too cautious.

Poor Customer Service Ratings

Customer service experiences vary widely among users, with some reporting dissatisfaction regarding response times and support quality.

- Limited direct contact options: The absence of live chat support can lead to frustration for clients needing immediate assistance.

- Mixed reviews on responsiveness: Some users have reported long wait times when contacting customer support by phone.

Limited Options for Retirement Accounts

Wealthfront does not offer certain retirement account types like custodial accounts or Solo 401(k)s. This limitation may affect self-employed individuals or those seeking specific retirement savings strategies.

- Narrow retirement offerings: Investors looking for comprehensive retirement planning solutions might need to explore other platforms alongside Wealthfront.

- Focus on taxable accounts: Most services are geared towards taxable investment accounts rather than specialized retirement vehicles.

In conclusion, Wealthfront presents a compelling option for many investors due to its low fees, automated features like tax-loss harvesting, diverse investment choices, and user-friendly platform. However, potential users should consider the limitations regarding human support, minimum investment requirements, and customization options before deciding if this robo-advisor aligns with their financial goals and preferences.

Frequently Asked Questions About Wealthfront

- What types of investments does Wealthfront offer?

Wealthfront offers a range of investments including ETFs across various asset classes and limited cryptocurrency options through trusts. - Is there an account minimum required to open a Wealthfront account?

Yes, Wealthfront requires a minimum initial investment of $500. - Does Wealthfront provide access to human financial advisors?

No, Wealthfront operates as a robo-advisor without direct access to human financial advisors. - What is tax-loss harvesting?

Tax-loss harvesting involves selling securities at a loss to offset capital gains taxes on other investments. - How does Wealthfront’s high-yield cash account work?

Wealthfront’s cash account offers competitive interest rates and FDIC insurance through partner banks. - Can I customize my portfolio on Wealthfront?

Customization options are available but primarily for accounts over $100,000; smaller accounts have limited flexibility. - What fees does Wealthfront charge?

Wealthfront charges an annual management fee of 0.25% on invested assets. - Is Wealthfront suitable for beginners?

Yes, Wealthfront’s user-friendly platform and automated features make it suitable for novice investors.

Overall, while there are notable disadvantages associated with using Wealthfront—such as limited human interaction and higher minimums—the advantages often outweigh these concerns for many investors seeking a straightforward way to manage their portfolios effectively.