The Illinois 529 Plan, particularly the Bright Start College Savings Program, is a popular tool for families aiming to save for higher education expenses. This tax-advantaged savings plan allows individuals to invest money that can grow over time, providing a financial cushion for college costs. However, like any financial product, it comes with its own set of advantages and disadvantages. Understanding these can help potential investors make informed decisions about whether this savings vehicle aligns with their financial goals.

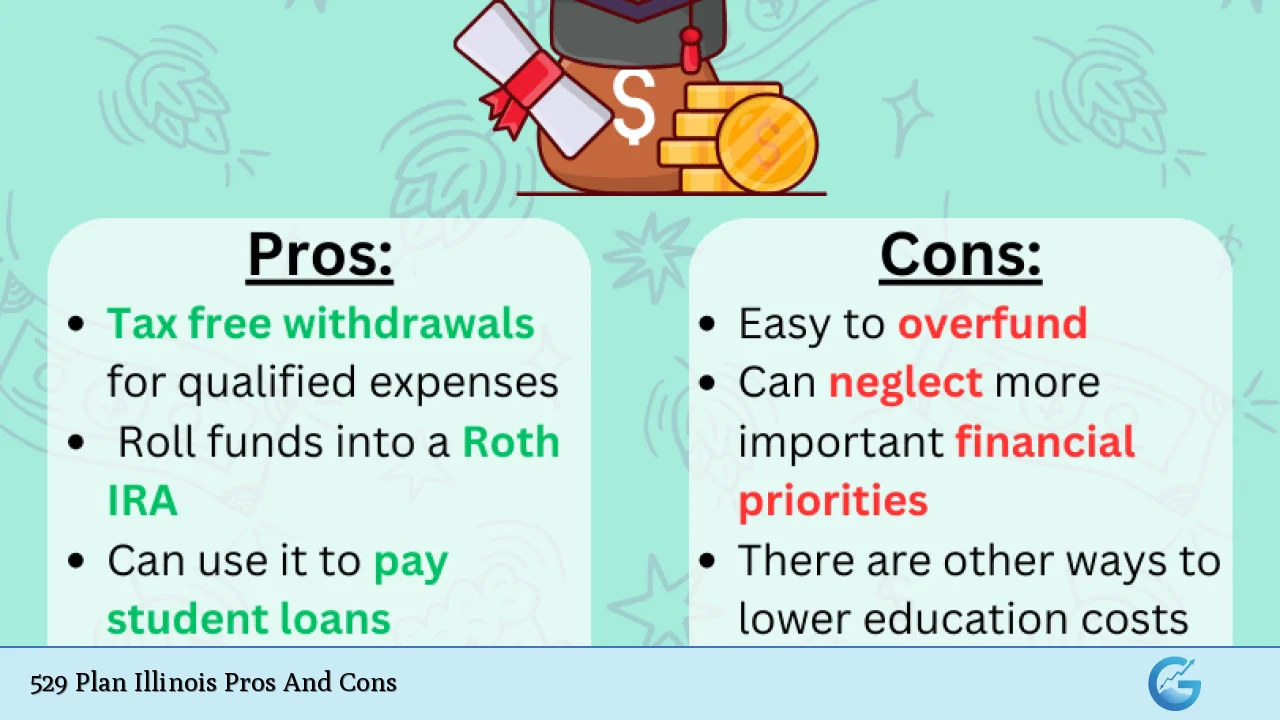

| Pros | Cons |

|---|---|

| Tax deductions for Illinois residents | Funds must be used for qualified education expenses only |

| High contribution limits | Potential penalties for non-qualified withdrawals |

| Diverse investment options | Limited control over investment choices |

| Flexibility in usage across states and institutions | State-specific tax implications on rollovers and withdrawals |

| No income restrictions on account ownership | Fees can vary based on the plan chosen |

| Encourages saving for education | Impact on financial aid eligibility |

| Ability to change beneficiaries without penalty | Complex rules and regulations to navigate |

| Options for student loan repayment and K-12 expenses (up to limits) | No guarantees on investment performance |

Tax Deductions for Illinois Residents

One of the most significant advantages of the Illinois 529 Plan is the state tax deduction available to residents.

- Illinois taxpayers can deduct contributions up to $10,000 annually ($20,000 for married couples filing jointly) from their state taxable income. This deduction can lead to substantial tax savings, especially for those contributing regularly.

- The tax benefits extend beyond just deductions; earnings in the account grow on a tax-deferred basis. When funds are withdrawn for qualified education expenses, they are not subject to federal or state income taxes.

High Contribution Limits

The Illinois 529 Plan offers generous contribution limits that allow families to save adequately for future educational costs.

- The maximum aggregate balance limit is $500,000 per beneficiary, which is significantly higher than many other states’ plans. This allows families to save more without worrying about hitting a cap too soon.

- Additionally, there are no annual contribution limits, enabling families to contribute as much as they wish within the overall cap.

Diverse Investment Options

Another notable advantage of the Illinois 529 Plan is its range of investment choices.

- Participants can select from various portfolios based on their risk tolerance, including conservative, moderate, and aggressive options. This flexibility allows savers to tailor their investments according to their financial goals and market conditions.

- The plan also includes age-based portfolios that automatically adjust the investment strategy as the beneficiary approaches college age, reducing risk over time.

Flexibility in Usage Across States and Institutions

Funds from an Illinois 529 Plan can be used at eligible educational institutions nationwide and even some abroad.

- This flexibility means that if a beneficiary decides to attend college out of state or even overseas, the funds can still be utilized without penalty.

- Moreover, beneficiaries do not need to attend an Illinois institution, making this plan attractive for families considering various educational paths.

No Income Restrictions on Account Ownership

Unlike many investment accounts that may have income restrictions or eligibility criteria, anyone can open an Illinois 529 Plan account regardless of income level.

- This inclusivity allows all families, regardless of their financial situation, to take advantage of the benefits offered by the plan.

- Additionally, there are no minimum contributions required to open an account, making it accessible even for those who may only be able to contribute small amounts initially.

Encourages Saving for Education

The structure of the 529 Plan inherently promotes saving for education.

- Research indicates that children with dedicated college savings accounts are significantly more likely to attend college compared to those without such accounts.

- The psychological benefit of having a designated fund can motivate both parents and children to prioritize education savings early on.

Ability to Change Beneficiaries Without Penalty

If circumstances change—such as a beneficiary deciding not to pursue higher education—the funds in a 529 account are not lost.

- Account owners can change the beneficiary to another qualifying family member without incurring penalties, allowing families greater flexibility in managing their educational savings.

- This feature is particularly beneficial in families with multiple children or when considering future educational needs that may arise unexpectedly.

Options for Student Loan Repayment and K-12 Expenses (Up To Limits)

Recent changes in legislation have expanded the uses of 529 funds beyond just college expenses.

- Account holders can now withdraw up to $10,000 per individual lifetime limit for student loan repayments, which provides additional utility for those who have already graduated but still face debt burdens.

- Furthermore, funds can also be used for K-12 tuition expenses up to $10,000 annually per student. This flexibility allows families more options in how they allocate their educational savings.

Funds Must Be Used for Qualified Education Expenses Only

While there are many benefits associated with the Illinois 529 Plan, one significant drawback is that funds must be used strictly for qualified education expenses.

- If withdrawals are made for non-qualified purposes—such as personal expenses or unrelated investments—those distributions will incur federal income tax as well as a 10% penalty on earnings.

- This restriction can limit flexibility if financial circumstances change or if plans shift regarding education paths.

Potential Penalties for Non-Qualified Withdrawals

As mentioned earlier, withdrawing funds from a 529 Plan for non-qualified purposes can lead to significant penalties.

- The 10% additional federal tax on earnings serves as a deterrent against using these funds outside of educational contexts.

- Additionally, any state tax deductions previously claimed may need to be recaptured if funds are withdrawn improperly.

Limited Control Over Investment Choices

While there are diverse investment options available within the Illinois 529 Plan, account owners do not have complete control over how those investments are managed.

- Most plans limit changes in investment options to once per year. This restriction can be frustrating if market conditions shift dramatically or if personal financial situations necessitate immediate adjustments.

- Furthermore, some plans may require investors to choose from pre-selected portfolios rather than allowing them full autonomy over individual investments.

State-Specific Tax Implications on Rollovers and Withdrawals

When considering rolling over funds into another state’s 529 Plan or making withdrawals, it’s crucial to understand state-specific tax rules.

- Illinois imposes certain tax implications that could affect how much money you ultimately keep after moving funds or withdrawing them improperly.

- For instance, rolling over funds may trigger recapture of previously claimed state tax deductions which could diminish potential savings from switching plans.

Fees Can Vary Based on the Plan Chosen

While many 529 Plans offer low fees compared to other investment vehicles, it’s essential to review fee structures carefully before committing.

- Different plans within Illinois may have varying management fees or expense ratios which could impact overall returns on investment over time.

- It’s advisable for potential investors to compare these fees against expected returns and consider how they fit into long-term financial strategies.

Impact on Financial Aid Eligibility

Contributions made into a 529 Plan can affect a student’s eligibility for financial aid when applying for college.

- Since assets in a 529 account are counted as parental assets during financial aid calculations (which typically have a lower impact than student assets), they may reduce the amount of aid available compared with other savings forms.

- Understanding how these assets will be treated during financial aid assessments is crucial when planning educational financing strategies.

Complex Rules and Regulations To Navigate

Finally, navigating the rules and regulations surrounding 529 Plans can be complex and daunting.

- Investors must familiarize themselves with various guidelines regarding contributions, withdrawals, penalties, and tax implications which can vary significantly by state and individual circumstances.

- Consulting with financial advisors or experts knowledgeable about these plans is often necessary to ensure compliance and optimal usage of these savings vehicles.

Conclusion

The Illinois 529 Plan offers numerous advantages that make it an attractive option for families looking to save for higher education expenses. With significant tax benefits, high contribution limits, diverse investment options, and flexibility in fund usage across institutions and states, it stands out among savings vehicles designed specifically for education funding. However, potential investors should also weigh these benefits against disadvantages such as strict withdrawal rules, potential penalties for non-qualified uses, varying fees among different plans, and impacts on financial aid eligibility. By carefully considering both sides of this equation and seeking professional guidance when necessary, families can make informed decisions about whether an Illinois 529 Plan aligns with their long-term educational financing goals.

Frequently Asked Questions About 529 Plan Illinois Pros And Cons

- What is a 529 plan?

A 529 plan is a tax-advantaged savings plan designed specifically for funding qualified education expenses. - Can anyone open an Illinois 529 plan?

Yes! Anyone aged 18 or older with a Social Security Number or ITIN can open an account. - What are qualified expenses under a 529 plan?

Qualified expenses include tuition fees, books, supplies needed for enrollment at eligible institutions. - Are contributions tax-deductible?

Illinois residents can deduct contributions up to $10,000 annually ($20,000 if married filing jointly) from their state taxable income. - What happens if I withdraw money for non-qualified purposes?

If you withdraw funds not used for qualified expenses, you will incur taxes on earnings plus a potential 10% penalty. - Can I change beneficiaries on my account?

Yes! You can change beneficiaries without penalty as long as they are qualifying family members. - How does this affect my child’s financial aid eligibility?

The assets in a 529 plan count toward parental assets during financial aid calculations but typically have less impact than student assets. - What happens if I move out of Illinois?

You can maintain your Illinois 529 account regardless of your residency status; however state-specific benefits may change.