A balloon mortgage is a type of home loan that offers lower initial payments for a specified term, typically ranging from five to seven years, followed by a larger lump sum payment, known as the balloon payment, at the end of the loan term. This structure can be appealing for borrowers who anticipate selling or refinancing before the balloon payment is due. However, it carries significant risks and benefits that potential borrowers should carefully consider. This article explores the advantages and disadvantages of balloon mortgages, providing a comprehensive overview for individuals interested in finance, investment, and real estate.

| Pros | Cons |

|---|---|

| Lower initial monthly payments | Risk of large balloon payment at maturity |

| Potential for lower interest rates | Uncertainty in refinancing options |

| Shorter loan terms can be beneficial for certain buyers | Potential for negative equity |

| Flexibility in financial planning for short-term ownership | Limited equity accumulation during the loan term |

| Can be advantageous for investors or house flippers | Higher risk of foreclosure if unable to pay balloon payment |

Lower Initial Monthly Payments

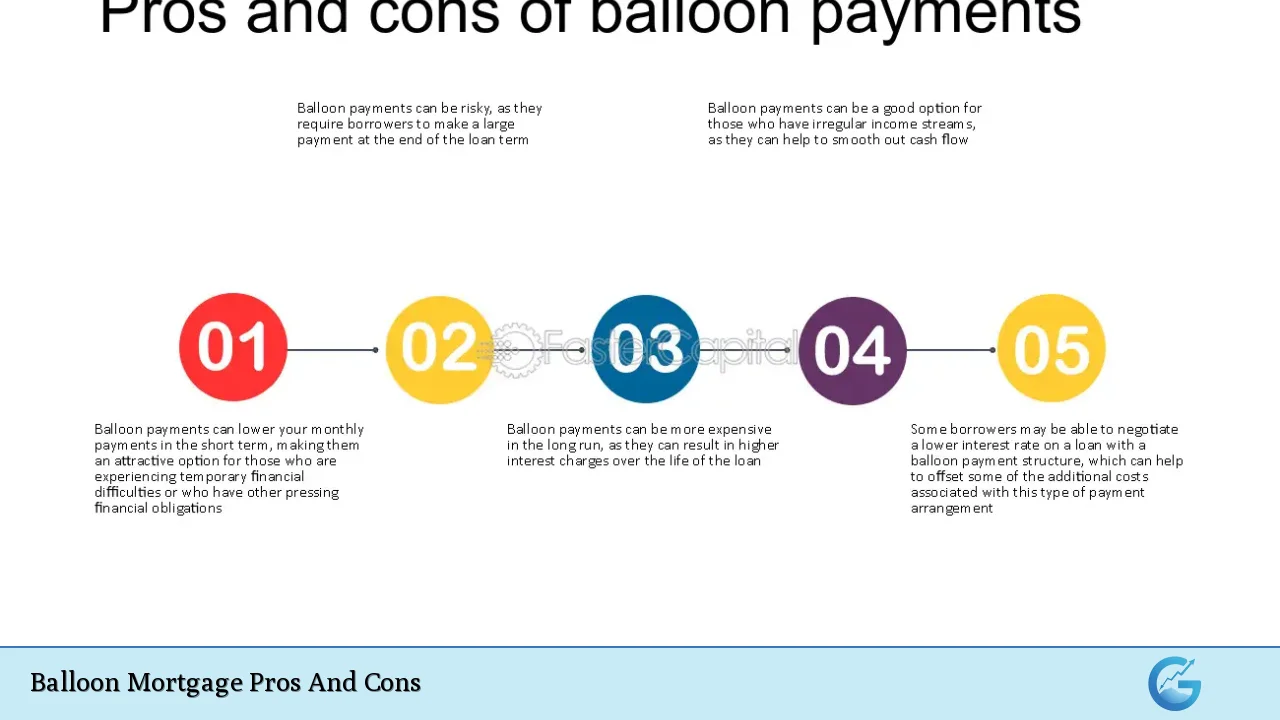

One of the most attractive features of a balloon mortgage is its lower initial monthly payments compared to traditional fixed-rate mortgages. This is particularly beneficial for borrowers who are looking to minimize their expenses in the short term.

- Affordability: Lower payments can make homeownership more accessible.

- Cash Flow Management: Borrowers can allocate funds to other investments or savings during the initial period.

Risk of Large Balloon Payment at Maturity

Despite the appeal of lower payments, the most significant downside is the risk associated with the large balloon payment that becomes due at the end of the loan term.

- Financial Burden: The lump sum can be substantial, often exceeding twice the monthly payment amount.

- Planning Challenges: Borrowers must have a clear plan on how to manage this payment when it comes due.

Potential for Lower Interest Rates

Balloon mortgages often come with lower interest rates than traditional loans during the initial phase. This can lead to substantial savings over time if managed correctly.

- Cost Savings: Lower rates can reduce overall borrowing costs if refinancing or selling before the balloon payment is due.

- Market Timing: Borrowers may benefit from favorable interest rates at the time of securing their mortgage.

Uncertainty in Refinancing Options

A critical disadvantage of balloon mortgages is the uncertainty surrounding refinancing options as the balloon payment approaches.

- Market Conditions: Economic fluctuations may affect interest rates and lending criteria, making refinancing difficult.

- Personal Financial Changes: Changes in a borrower’s financial situation could hinder their ability to refinance or sell before maturity.

Shorter Loan Terms Can Be Beneficial for Certain Buyers

Balloon mortgages typically feature shorter loan terms, which can be advantageous for specific buyers who plan on moving or selling their property within a few years.

- Strategic Financial Planning: Buyers anticipating a change in financial circumstances may find this structure appealing.

- Investment Opportunities: Investors may use balloon mortgages to quickly acquire properties without long-term commitments.

Potential for Negative Equity

The risk of negative equity is heightened with balloon mortgages, particularly if property values decline during the loan term.

- Market Vulnerability: If home values drop, borrowers may owe more than their property is worth when it’s time to sell or refinance.

- Limited Options: Negative equity can restrict refinancing opportunities and complicate selling efforts.

Flexibility in Financial Planning for Short-Term Ownership

Balloon mortgages provide flexibility that can be beneficial for individuals looking to own a home temporarily or invest in real estate without long-term commitments.

- Short-Term Ownership Strategy: Ideal for those who plan to sell their home within a few years or expect financial changes.

- Investment Leverage: Investors can leverage lower payments to reinvest profits elsewhere while waiting for property appreciation.

Limited Equity Accumulation During the Loan Term

During the life of a balloon mortgage, borrowers may find that they accumulate limited equity in their homes, especially if they only make interest payments initially.

- Equity Growth Constraints: If payments are primarily interest-based, homeowners might not build significant equity until they make substantial payments toward principal.

- Future Financial Planning: Limited equity can complicate future financial decisions regarding home improvement or leveraging equity for other investments.

Can Be Advantageous for Investors or House Flippers

For real estate investors or house flippers, balloon mortgages can serve as an effective financing tool due to their structure and lower initial costs.

- Quick Turnaround Potential: Investors can purchase properties with minimal upfront costs and sell them before incurring large payments.

- Market Adaptability: The flexibility allows investors to adapt quickly to changing market conditions without long-term financial commitments.

Higher Risk of Foreclosure if Unable to Pay Balloon Payment

The most severe consequence associated with balloon mortgages is the risk of foreclosure if borrowers cannot meet their balloon payment obligations at maturity.

- Credit Impact: Defaulting on a balloon mortgage can severely damage credit scores and limit future borrowing capabilities.

- Financial Stress: The pressure of preparing for a large payment can lead to significant stress and financial strain on borrowers.

In conclusion, while balloon mortgages offer several advantages such as lower initial payments and potential cost savings through lower interest rates, they also present substantial risks that must be carefully considered. Borrowers should evaluate their financial situation, market conditions, and long-term goals before opting for this type of mortgage. Consulting with financial professionals and exploring alternative financing options is advisable to ensure that individuals make informed decisions aligned with their financial objectives and risk tolerance.

Frequently Asked Questions About Balloon Mortgage Pros And Cons

- What is a balloon mortgage?

A balloon mortgage is a type of home loan with low initial monthly payments followed by one large final payment at the end of its term. - What are the main advantages of a balloon mortgage?

The primary advantages include lower initial payments, potentially lower interest rates, and shorter loan terms suitable for temporary ownership. - What are some risks associated with balloon mortgages?

The major risks include facing a large lump sum payment at maturity, uncertainty in refinancing options, and potential negative equity. - Who should consider a balloon mortgage?

Individuals planning short-term ownership or real estate investors looking for flexibility may find balloon mortgages appealing. - How does one prepare for a balloon payment?

Borrowers should have clear financial strategies in place, including saving plans or exit strategies such as selling or refinancing. - Can I refinance my balloon mortgage?

Refinancing is possible but depends on market conditions and personal financial circumstances at the time of maturity. - What happens if I can’t make my balloon payment?

If unable to pay, borrowers risk foreclosure on their property and significant damage to their credit scores. - Are there alternatives to balloon mortgages?

Yes, traditional fixed-rate mortgages and adjustable-rate mortgages are common alternatives that do not involve lump sum payments.