Biweekly mortgage payments have gained popularity among homeowners seeking to optimize their mortgage repayment strategy. This approach involves making half of your monthly mortgage payment every two weeks, resulting in 26 half-payments annually, equivalent to 13 full monthly payments. This method can potentially lead to significant savings and faster loan payoff, but it’s essential to understand both its advantages and drawbacks before committing to this payment schedule.

| Pros | Cons |

|---|---|

| Faster loan payoff | Potential fees and administrative hassles |

| Reduced interest payments | Less payment flexibility |

| Accelerated equity building | Opportunity cost of alternative investments |

| Alignment with biweekly pay schedules | Not universally offered by lenders |

| Psychological benefit of more frequent payments | Potential for misapplied payments |

Advantages of Biweekly Mortgage Payments

Faster Loan Payoff

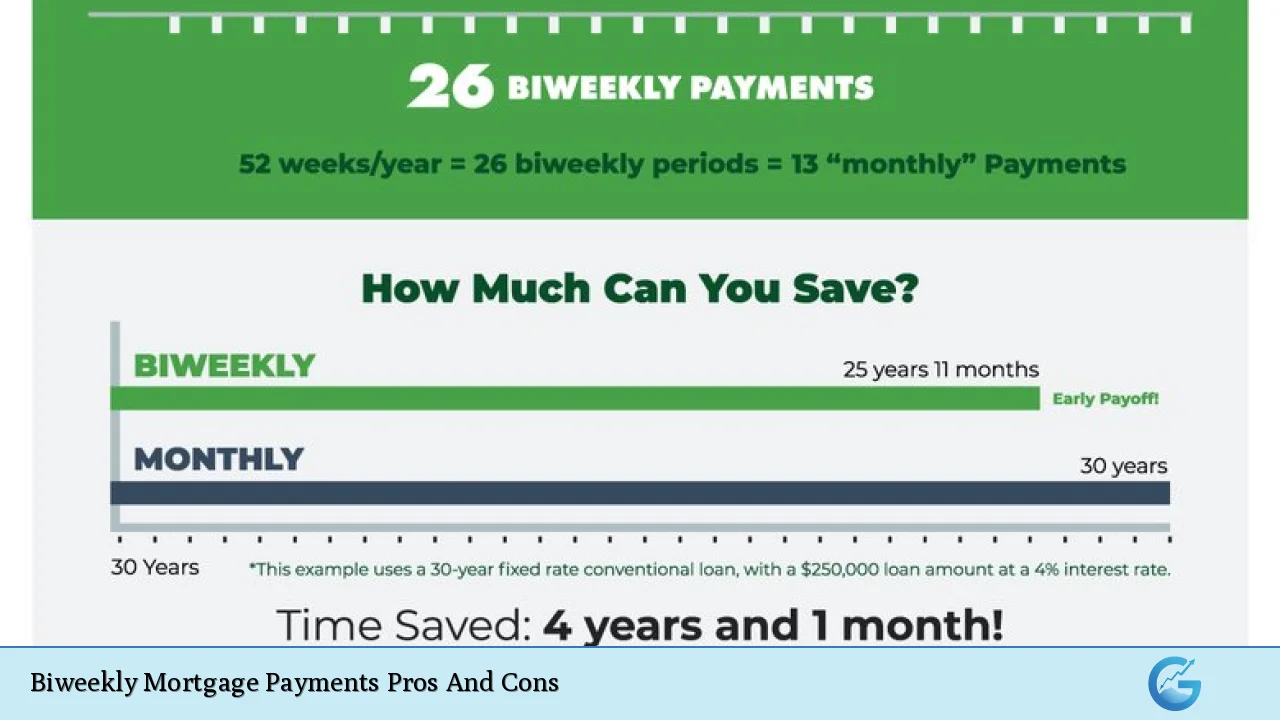

Biweekly payments can significantly reduce the time it takes to pay off your mortgage. By making 26 half-payments annually, you effectively make one extra full payment each year compared to the traditional monthly payment schedule. This extra payment goes directly towards reducing the principal balance, accelerating the loan payoff process.

- A 30-year mortgage could be paid off in approximately 25-26 years

- Shorter loan term means less time paying interest

- Earlier mortgage freedom allows for pursuit of other financial goals

Reduced Interest Payments

One of the most compelling reasons to consider biweekly payments is the potential for substantial interest savings over the life of the loan. By reducing the principal balance more quickly, less interest accrues on the remaining balance.

- Interest is calculated on a lower principal balance more frequently

- The cumulative effect can result in tens of thousands of dollars saved

- Particularly beneficial for long-term mortgages with higher interest rates

Accelerated Equity Building

Biweekly payments contribute to faster equity accumulation in your home. As you chip away at the principal balance more aggressively, your ownership stake in the property increases at an accelerated rate.

- Higher equity provides greater financial flexibility

- Improved loan-to-value ratio can lead to better refinancing options

- Increased home equity can be leveraged for other financial needs

Alignment with Biweekly Pay Schedules

For many homeowners, biweekly mortgage payments align well with their income schedule. If you receive paychecks every two weeks, this payment structure can simplify budgeting and ensure timely mortgage payments.

- Synchronization with income can improve cash flow management

- Reduces the risk of missing payments

- Can make the mortgage payment feel less burdensome

Psychological Benefit of More Frequent Payments

Some borrowers find that making smaller, more frequent payments is psychologically easier than facing a larger monthly payment. This can lead to better overall financial discipline and reduced stress related to mortgage obligations.

- Smaller payments may feel more manageable

- Creates a habit of regular financial commitment

- Can foster a sense of progress and accomplishment

Disadvantages of Biweekly Mortgage Payments

Potential Fees and Administrative Hassles

While the concept of biweekly payments is straightforward, implementation can sometimes be complicated. Some lenders charge fees for setting up and maintaining a biweekly payment plan, which can offset the potential savings.

- Setup fees can range from $0 to several hundred dollars

- Some servicers charge per-transaction fees

- Administrative costs may negate a portion of the interest savings

Less Payment Flexibility

Committing to a biweekly payment schedule means less flexibility in your monthly budget. This rigid structure may not be suitable for everyone, especially those with variable incomes or unpredictable expenses.

- Less adaptable to financial emergencies or income fluctuations

- May create cash flow challenges during months with extra expenses

- Difficult to revert to monthly payments if financial situations change

Opportunity Cost of Alternative Investments

While paying down your mortgage faster can save on interest, it’s important to consider the potential returns from alternative investments. In a low-interest-rate environment, the money used for extra mortgage payments might yield higher returns if invested elsewhere.

- Stock market historically outperforms mortgage interest rates

- Retirement accounts may offer tax advantages and employer matching

- Emergency funds and high-yield savings accounts provide liquidity

Not Universally Offered by Lenders

Not all mortgage lenders offer official biweekly payment programs. This can limit your options if you’re committed to this payment structure and may require you to manage the process manually.

- May need to switch lenders or refinance to access a biweekly program

- Self-managed biweekly payments require discipline and organization

- Some lenders may not apply extra payments as intended without explicit instructions

Potential for Misapplied Payments

When implementing a biweekly payment strategy, there’s a risk that payments may not be applied correctly, especially if you’re managing the process yourself or if your lender’s system isn’t optimized for this payment structure.

- Extra payments might be held in suspense accounts instead of applied to principal

- Incorrect application can result in less interest savings than anticipated

- Regular monitoring of your mortgage statement is crucial to ensure proper crediting

Implementing Biweekly Mortgage Payments Effectively

To maximize the benefits of biweekly mortgage payments while minimizing potential drawbacks, consider the following steps:

- Consult with your lender about their biweekly payment options and any associated fees.

- Confirm that extra payments will be applied directly to the principal balance.

- Verify that there are no prepayment penalties on your mortgage.

- If self-managing, set up automatic transfers to ensure consistency.

- Regularly review your mortgage statements to confirm proper payment application.

- Consider the impact on your overall financial strategy, including other investments and savings goals.

It’s crucial to weigh the pros and cons of biweekly mortgage payments in the context of your personal financial situation and goals. While the potential for interest savings and faster loan payoff is attractive, the rigidity of the payment structure and possible fees should be carefully considered. For some homeowners, a hybrid approach—making monthly payments with occasional extra principal payments—might offer a balance between accelerated payoff and financial flexibility.

Biweekly Payments in the Context of Broader Financial Markets

When considering biweekly mortgage payments, it’s important to view this strategy within the larger financial landscape. The decision to accelerate mortgage payments should be balanced against other investment opportunities in various markets:

- Forex (Foreign Exchange) Market: Currency fluctuations can offer potentially higher returns, but with increased risk.

- Cryptocurrency: The volatile nature of crypto assets might provide substantial gains, but also carries significant risk.

- Stock Market: Historically, stock market returns have outpaced mortgage interest rates over the long term.

- Bond Market: Government and corporate bonds can offer steady, albeit typically lower, returns compared to mortgage interest savings.

The opportunity cost of allocating extra funds to mortgage payments instead of these markets should be carefully evaluated based on your risk tolerance and financial goals.

Regional Considerations for Biweekly Payments in the US

The effectiveness and availability of biweekly payment programs can vary across different regions of the United States:

- In states with higher property values and mortgage amounts, such as California or New York, the interest savings from biweekly payments can be more substantial.

- Some states have specific regulations regarding mortgage servicing that may affect how biweekly payments are processed.

- Regional economic conditions and real estate markets can influence the decision to accelerate mortgage payments versus investing in local opportunities.

It’s advisable to consult with local financial advisors or real estate professionals to understand how biweekly payments might fit into your regional economic context.

Frequently Asked Questions About Biweekly Mortgage Payments

- How much can I save with biweekly mortgage payments?

Savings vary based on your loan terms, but you could potentially save tens of thousands in interest and pay off your mortgage years earlier. On a $300,000 30-year mortgage at 4% interest, you might save over $30,000 and pay off the loan 4 years early. - Can I set up biweekly payments myself without going through my lender?

Yes, you can manually make half-payments every two weeks or set up automatic transfers. However, ensure your lender applies the extra payments correctly to the principal balance and doesn’t charge prepayment penalties. - Are there any risks to making biweekly mortgage payments?

The main risks include potential fees, less financial flexibility, and the opportunity cost of not investing that money elsewhere. Additionally, if payments are not applied correctly, you may not realize the full benefits of the strategy. - How do biweekly payments affect my taxes and mortgage interest deduction?

Biweekly payments can reduce your total interest paid, potentially lowering your mortgage interest deduction. However, the overall financial benefit usually outweighs this tax consideration. - Can I switch back to monthly payments if I start a biweekly plan?

Most lenders allow you to switch back to monthly payments, but there may be administrative processes or fees involved. Check with your lender for specific policies. - Do all types of mortgages qualify for biweekly payments?

While most fixed-rate mortgages are suitable for biweekly payments, adjustable-rate mortgages (ARMs) may be more complicated due to changing interest rates and payments. Consult your lender for eligibility. - How does a biweekly payment plan affect refinancing options?

Biweekly payments can help build equity faster, potentially improving your refinancing options. However, ensure any new loan doesn’t negate the progress you’ve made with accelerated payments. - Is it better to make biweekly payments or one extra payment annually?

Biweekly payments can save slightly more interest due to more frequent principal reduction. However, making one extra payment annually is simpler and can still provide significant benefits if you prefer more flexibility.

In conclusion, biweekly mortgage payments offer a structured approach to accelerating your mortgage payoff and reducing overall interest costs. While the benefits can be substantial, it’s crucial to consider your entire financial picture, including investment opportunities in various markets and regional economic factors. By carefully weighing the pros and cons and understanding how this strategy fits into your broader financial goals, you can make an informed decision about whether biweekly mortgage payments are the right choice for your situation.