Bring Chicago Home is a proposed initiative in Chicago aimed at addressing homelessness by restructuring the city’s real estate transfer tax. This measure would create a graduated tax system for property sales, with increased rates for high-value properties and reduced rates for lower-value ones. The primary goal is to generate an estimated $100 million annually to fund programs and services for the homeless population in Chicago.

| Pros | Cons |

|---|---|

| Dedicated funding for homelessness | Potential negative impact on real estate market |

| Progressive tax structure | Lack of detailed implementation plan |

| Tax reduction for most property sales | Possible burden on commercial properties |

| Addressing a critical social issue | Uncertainty in revenue projections |

| Potential to improve city’s overall quality of life | Risk of capital flight |

Advantages of Bring Chicago Home

Dedicated Funding for Homelessness

The primary advantage of Bring Chicago Home is its potential to create a stable, dedicated funding source for addressing homelessness in Chicago.

This initiative aims to generate approximately $100 million annually, which would be specifically earmarked for programs and services to combat homelessness. In a city where resources for the homeless have historically been limited compared to other major metropolitan areas, this influx of funds could make a significant impact.

- Consistent funding for long-term planning and implementation of homelessness solutions

- Ability to expand existing programs and create new initiatives

- Potential to reduce the overall number of homeless individuals and families in Chicago

Progressive Tax Structure

Bring Chicago Home introduces a progressive tax structure to Chicago’s real estate transfer tax system. This approach aligns with principles of economic equity by placing a higher tax burden on those purchasing more expensive properties.

- Graduated tax rates based on property value

- Higher rates for properties over $1 million and $1.5 million

- Lower rate for properties under $1 million, benefiting most homebuyers

Tax Reduction for Most Property Sales

An often-overlooked benefit of Bring Chicago Home is that it would actually reduce the transfer tax for the majority of property sales in Chicago.

This aspect of the proposal could make homeownership more accessible for many Chicagoans.

- Tax rate reduction from 0.75% to 0.60% for properties under $1 million

- Potential savings for 93% of home buyers in Chicago

- Improved affordability for first-time homebuyers and middle-class families

Addressing a Critical Social Issue

Homelessness is a pressing issue in Chicago, affecting tens of thousands of individuals and families. Bring Chicago Home represents a proactive approach to tackling this complex problem.

- Potential to provide housing and support services to a significant number of homeless individuals

- Addressing root causes of homelessness through comprehensive programs

- Opportunity to implement evidence-based solutions on a larger scale

Potential to Improve City’s Overall Quality of Life

By focusing on reducing homelessness, Bring Chicago Home could have far-reaching positive effects on the city as a whole.

- Potential reduction in visible homelessness in public spaces

- Improved public health outcomes

- Possible decrease in associated costs for emergency services and healthcare

Disadvantages of Bring Chicago Home

Potential Negative Impact on Real Estate Market

One of the primary concerns surrounding Bring Chicago Home is its potential to disrupt Chicago’s real estate market, particularly in the high-end segment.

Critics argue that the increased tax rates for properties over $1 million could deter investment and slow market activity.

- Possible reduction in high-value property transactions

- Risk of depressing property values in luxury markets

- Potential for decreased overall real estate investment in Chicago

Lack of Detailed Implementation Plan

While Bring Chicago Home outlines a funding mechanism, it has been criticized for not providing a comprehensive plan for how the generated funds would be used to address homelessness effectively.

- Absence of specific programmatic details

- Uncertainty about the allocation of funds across different initiatives

- Concerns about the efficiency and effectiveness of fund utilization

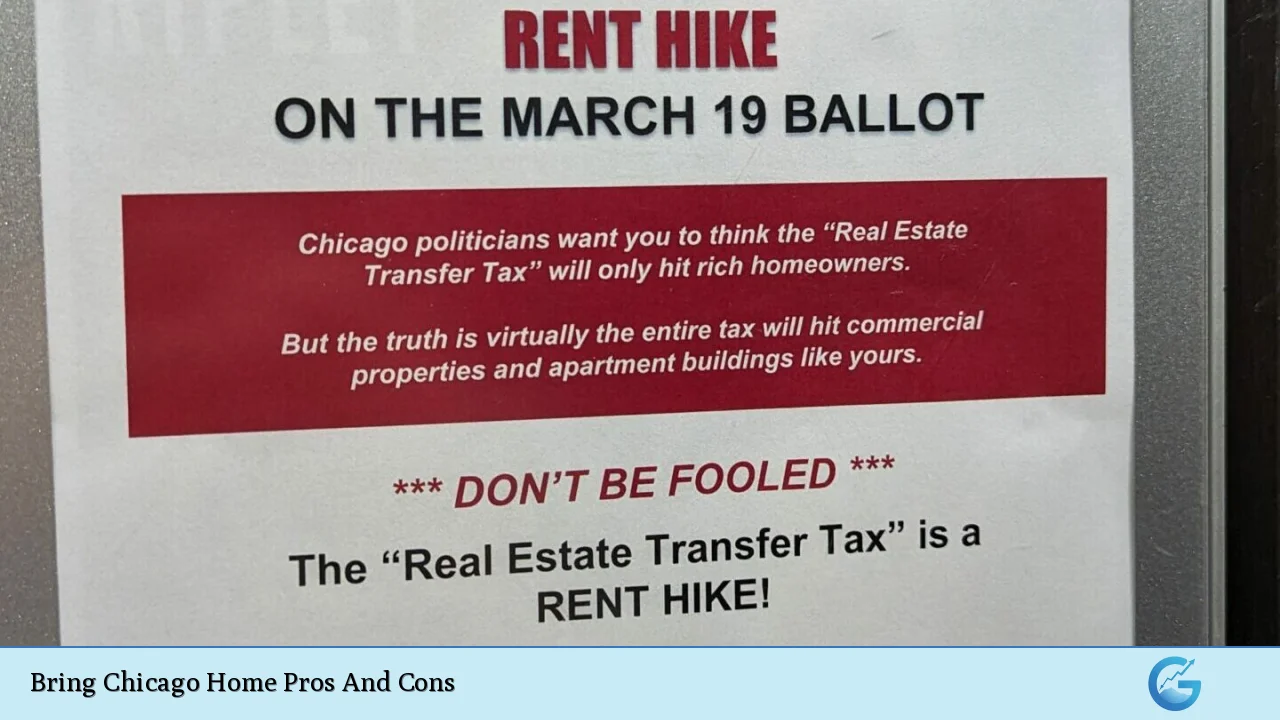

Possible Burden on Commercial Properties

The proposal’s impact on commercial real estate transactions has raised concerns among business owners and investors.

The higher tax rates could disproportionately affect commercial properties, potentially influencing business decisions and economic development in Chicago.

- Increased costs for businesses purchasing or selling commercial properties

- Potential to discourage new businesses from establishing in Chicago

- Risk of passing increased costs to tenants or consumers

Uncertainty in Revenue Projections

The $100 million annual revenue projection for Bring Chicago Home has been questioned by some analysts and opponents. There are concerns about the accuracy of these estimates and the potential for shortfalls.

- Possible overestimation of revenue from high-value property sales

- Risk of not meeting funding goals for homelessness programs

- Uncertainty about market reactions and their impact on revenue generation

Risk of Capital Flight

Some critics argue that the increased tax rates for high-value properties could lead to capital flight, with wealthy individuals and businesses choosing to invest in other cities or suburbs with lower tax burdens.

- Potential loss of high-net-worth residents and investors

- Risk of decreased overall tax revenue for the city

- Possible negative impact on Chicago’s competitiveness in attracting businesses and talent

Conclusion

Bring Chicago Home represents a bold attempt to address the critical issue of homelessness in Chicago through a restructuring of the city’s real estate transfer tax. While it offers the potential for dedicated funding and a more progressive tax structure, it also raises concerns about its impact on the real estate market and overall economic development. As with any significant policy proposal, the success of Bring Chicago Home would depend on careful implementation, ongoing evaluation, and the ability to adapt to unforeseen challenges.

For investors and financial professionals, understanding the implications of such initiatives is crucial. Whether Bring Chicago Home ultimately proves to be a net positive or negative for Chicago’s economy and real estate market remains to be seen. However, its potential to reshape the city’s approach to homelessness and its tax structure makes it a significant development to watch in the realm of urban policy and finance.

Frequently Asked Questions About Bring Chicago Home Pros And Cons

- How would Bring Chicago Home affect the average homebuyer in Chicago?

Most homebuyers would see a reduction in their transfer tax, as the rate for properties under $1 million would decrease from 0.75% to 0.60%. This could make homeownership more affordable for many Chicagoans. - What types of programs for the homeless could be funded by Bring Chicago Home?

While specific details are not fully outlined, potential programs could include affordable housing construction, rental assistance, mental health services, job training, and other supportive services for the homeless population. - How might Bring Chicago Home impact commercial real estate in the city?

Commercial properties, which often sell for over $1 million, could face significantly higher transfer taxes. This might affect investment decisions and potentially increase costs for businesses operating in Chicago. - Could Bring Chicago Home lead to a decrease in high-end property values?

There is concern that the increased tax on high-value properties could potentially depress prices in the luxury market. However, the actual impact would depend on various market factors and buyer behavior. - How does Bring Chicago Home compare to similar initiatives in other cities?

Other cities, such as Los Angeles, have implemented similar “mansion taxes.” Results have been mixed, with some cities falling short of revenue projections and experiencing market disruptions. - What safeguards are in place to ensure the funds are used effectively for homelessness?

The proposal stipulates that funds must be used “for the sole purpose of combating homelessness.” However, detailed oversight mechanisms and specific program allocations have not been fully outlined. - How might Bring Chicago Home affect Chicago’s overall competitiveness as a business destination?

Critics argue it could make Chicago less attractive for high-end real estate investment and business relocation. Supporters contend that addressing homelessness could improve the city’s overall quality of life and attractiveness. - What alternatives to Bring Chicago Home have been proposed to address homelessness in Chicago?

Other proposed solutions include increasing general fund allocations, seeking more federal and state funding, and exploring public-private partnerships for affordable housing development.