Betterment’s High Yield Savings, officially known as the Cash Reserve account, is a modern financial product designed to offer competitive interest rates while providing the flexibility of a cash management account. As a product from a leading robo-advisor, it combines elements of traditional savings accounts with the convenience of digital banking.

This account is particularly appealing to those who are already using Betterment’s investment services or are looking for a high-yield option with additional features beyond what typical savings accounts offer.

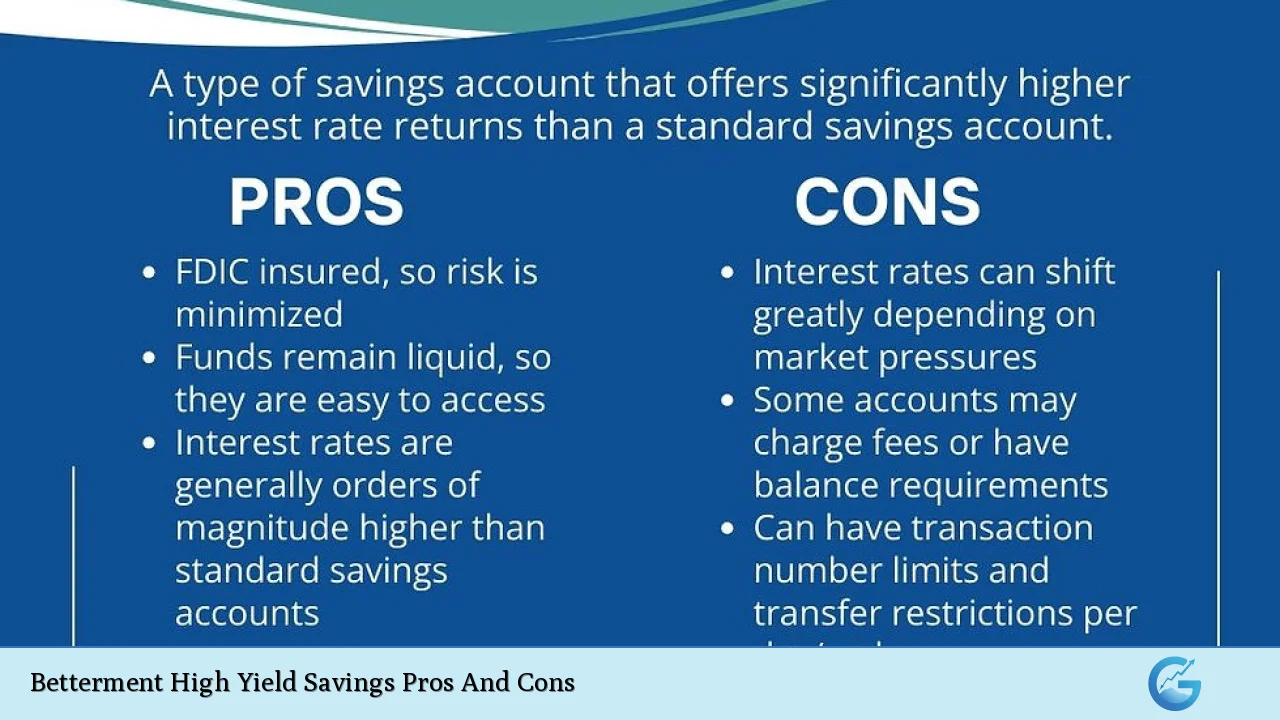

| Pros | Cons |

|---|---|

| High Annual Percentage Yield (APY) | Not a traditional savings account |

| No minimum balance requirements | Limited cash deposit options |

| No monthly fees | No physical branch access |

| FDIC insurance up to $4 million | Requires Betterment account |

| Unlimited transactions | APY can fluctuate without notice |

| Goal-based savings features | Mobile check deposit limitations |

| Two-way sweep automation | Not ideal for long-term savings |

| Integration with Betterment’s investing platform | Potential for yield chasing |

High Annual Percentage Yield (APY)

One of the most significant advantages of Betterment’s Cash Reserve account is its competitive Annual Percentage Yield (APY). As of December 2024, the account offers:

- A base APY of 4.25%

- An introductory boost of 0.50% for new customers, bringing the total to 4.75% for the first three months

This rate significantly outperforms the national average for savings accounts, which typically hovers around 0.43%.

The high APY makes Betterment’s Cash Reserve an attractive option for individuals looking to maximize their short-term savings growth.

However, it’s crucial to note that:

- APYs are variable and subject to change without notice

- The introductory rate boost is temporary and only applies to new customers

- Market conditions and Federal Reserve policies can impact the APY

No Minimum Balance Requirements and No Monthly Fees

Betterment’s Cash Reserve account stands out for its accessibility and cost-effectiveness:

- No minimum balance requirement to open or maintain the account

- $10 minimum deposit to start earning interest

- Zero monthly maintenance fees

These features make the account particularly appealing for:

- New savers just starting to build their financial cushion

- Those who prefer to keep their savings fluid and accessible

- Individuals wary of fee structures that eat into their earnings

The absence of fees and low entry barrier allows savers to retain more of their money and earn interest on their entire balance, regardless of the amount.

FDIC Insurance Up to $4 Million

A standout feature of Betterment’s Cash Reserve is its extensive FDIC insurance coverage:

- Up to $2 million for individual accounts

- Up to $4 million for joint accounts

This is achieved through Betterment’s partnership with multiple program banks. The coverage far exceeds the standard $250,000 FDIC insurance limit offered by most traditional banks.

This enhanced protection provides peace of mind for high-net-worth individuals or those looking to safeguard larger cash reserves.

However, it’s important to understand:

- The funds are distributed across multiple banks to achieve this coverage

- The actual banks holding your money may change without notice

- This level of coverage is unnecessary for most average savers

Unlimited Transactions and Flexibility

Unlike traditional savings accounts that often limit withdrawals, Betterment’s Cash Reserve offers:

- Unlimited withdrawals and transfers

- No penalties for frequent transactions

This flexibility is particularly beneficial for:

- Those who need regular access to their savings

- Individuals using the account as a hybrid checking/savings solution

- Savers who want to avoid transaction limits and associated fees

The absence of transaction limits aligns the Cash Reserve more closely with a cash management account than a traditional savings account, offering greater liquidity and convenience.

Goal-Based Savings Features

Betterment’s Cash Reserve account incorporates goal-setting tools that can enhance the saving experience:

- Ability to create multiple savings buckets within one account

- Set specific targets for different financial goals

- Visual tracking of progress towards each goal

These features are particularly useful for:

- Organizing savings for various short-term objectives (e.g., vacation, emergency fund, major purchase)

- Motivating consistent saving behavior

- Providing a clear overview of financial progress

The goal-based approach can help users stay focused on their financial objectives and make more informed decisions about their savings allocations.

Two-Way Sweep Automation

Betterment offers a unique “two-way sweep” feature that automates the movement of funds between checking and savings:

- Automatically moves excess funds from checking to Cash Reserve

- Transfers money back to checking if the balance falls below a set threshold

- Helps optimize the balance between liquidity and earning potential

Benefits of this feature include:

- Maximizing interest earned on idle cash

- Reducing the risk of overdrafts in the linked checking account

- Minimizing manual fund management

This automation can be particularly valuable for those who struggle with consistent saving habits or tend to keep excess cash in low-yield checking accounts.

Integration with Betterment’s Investing Platform

For users already invested in Betterment’s ecosystem, the Cash Reserve account offers seamless integration:

- Easy transfers between savings and investment accounts

- Holistic view of finances within one platform

- Potential for more cohesive financial planning

This integration can be advantageous for:

- Those looking to simplify their financial management

- Investors who frequently move money between cash and investments

- Users who appreciate a comprehensive financial dashboard

However, this integration might also encourage users to keep more in cash than necessary, potentially missing out on long-term investment growth opportunities.

Not a Traditional Savings Account

It’s crucial to understand that Betterment’s Cash Reserve is not a traditional savings account:

- It’s a cash management account offered through Betterment’s brokerage

- Funds are swept to program banks, not held directly by Betterment

- The account doesn’t have its own routing number for direct deposits

Implications of this structure include:

- Potential confusion when linking to external accounts or setting up direct deposits

- Different regulatory oversight compared to traditional bank accounts

- Possible limitations on certain banking features

While functionally similar to a high-yield savings account, the Cash Reserve’s structure may require users to adapt their banking habits and expectations.

Limited Cash Deposit Options

One significant drawback of Betterment’s Cash Reserve is the limitation on cash deposits:

- No option for direct cash deposits

- Lack of ATM deposit functionality

- Absence of physical locations for deposits

This can be problematic for:

- Those who frequently deal with cash transactions

- Small business owners or freelancers who receive cash payments

- Individuals who prefer to deposit cash savings regularly

Users relying on cash deposits may need to maintain a separate traditional bank account, which could complicate their financial management.

No Physical Branch Access

As an online-only platform, Betterment does not offer physical branch access:

- All transactions and account management are conducted online or via mobile app

- No in-person customer service or account assistance

- Limited options for immediate cash withdrawals

This lack of physical presence can be challenging for:

- Those who prefer face-to-face banking interactions

- Individuals uncomfortable with digital-only financial services

- Situations requiring immediate access to large amounts of cash

While online banking is increasingly common, the absence of physical branches may be a significant drawback for some users, particularly in complex financial situations or emergencies.

APY Fluctuations and Market Sensitivity

While Betterment’s Cash Reserve offers a high APY, it’s subject to market fluctuations:

- Rates can change without prior notice

- APY is closely tied to broader market conditions and Federal Reserve policies

- Promotional rates may create unrealistic long-term expectations

This variability can lead to:

- Uncertainty in short-term savings planning

- Potential for yield chasing behavior

- Disappointment if rates decrease significantly

Users should be prepared for rate changes and avoid basing long-term financial decisions solely on current high yields.

Mobile Check Deposit Limitations

Betterment’s Cash Reserve account has restrictions on mobile check deposits:

- Limited to customers who have been with Betterment for at least 30 days

- Requires at least $500 in direct deposits in the previous month

- Daily deposit limit of $1,500 for paper checks

These limitations can be problematic for:

- New customers needing to deposit checks immediately

- Those who receive large or frequent check payments

- Users without consistent direct deposits

The restrictions on mobile check deposits may necessitate maintaining an additional bank account for check-cashing purposes, potentially complicating financial management.

In conclusion, Betterment’s High Yield Savings (Cash Reserve) account offers a compelling blend of high interest rates, flexibility, and modern banking features. It’s particularly well-suited for digitally-savvy savers who prioritize yield and integration with investment services. However, the lack of traditional banking features and physical presence may be drawbacks for some users.

As with any financial product, potential users should carefully weigh the pros and cons against their personal financial needs and habits before committing to this innovative savings solution.

Frequently Asked Questions About Betterment High Yield Savings Pros And Cons

- How does Betterment’s Cash Reserve APY compare to traditional banks?

Betterment’s Cash Reserve typically offers a significantly higher APY compared to traditional banks, often 10 times or more the national average. However, rates are variable and subject to change based on market conditions. - Is my money safe in Betterment’s Cash Reserve account?

Yes, funds in the Cash Reserve account are FDIC insured up to $4 million for joint accounts ($2 million for individual accounts) through Betterment’s partner banks. This is substantially higher than the standard $250,000 FDIC coverage at most banks. - Can I use Betterment’s Cash Reserve as my primary savings account?

While it can function as a primary savings account for many users, it lacks some features of traditional savings accounts like cash deposits. It’s best suited for those comfortable with digital banking and who don’t need frequent cash transactions. - Are there any fees associated with Betterment’s Cash Reserve account?

Betterment does not charge any monthly maintenance fees or require a minimum balance for the Cash Reserve account. However, users should be aware of any potential fees for specific transactions or services. - How quickly can I access my money in the Cash Reserve account?

Transfers from Cash Reserve to a linked checking account typically take 1-2 business days. While there are no withdrawal limits, the lack of ATM access means immediate cash withdrawals are not possible. - Can I open a Cash Reserve account if I’m not using Betterment’s investment services?

Yes, you can open a Cash Reserve account without using Betterment’s investment services. However, having both may provide additional benefits and easier fund management within the Betterment platform. - How does the two-way sweep feature work?

The two-way sweep automatically moves excess money from your checking account to Cash Reserve to earn higher interest, and moves it back if your checking balance falls below a set threshold. This helps optimize your cash management automatically. - Is Betterment’s Cash Reserve suitable for long-term savings goals?

While it can be used for long-term savings, Cash Reserve is primarily designed for short to medium-term goals. For long-term objectives, Betterment’s investment accounts might be more appropriate due to potential for higher returns.