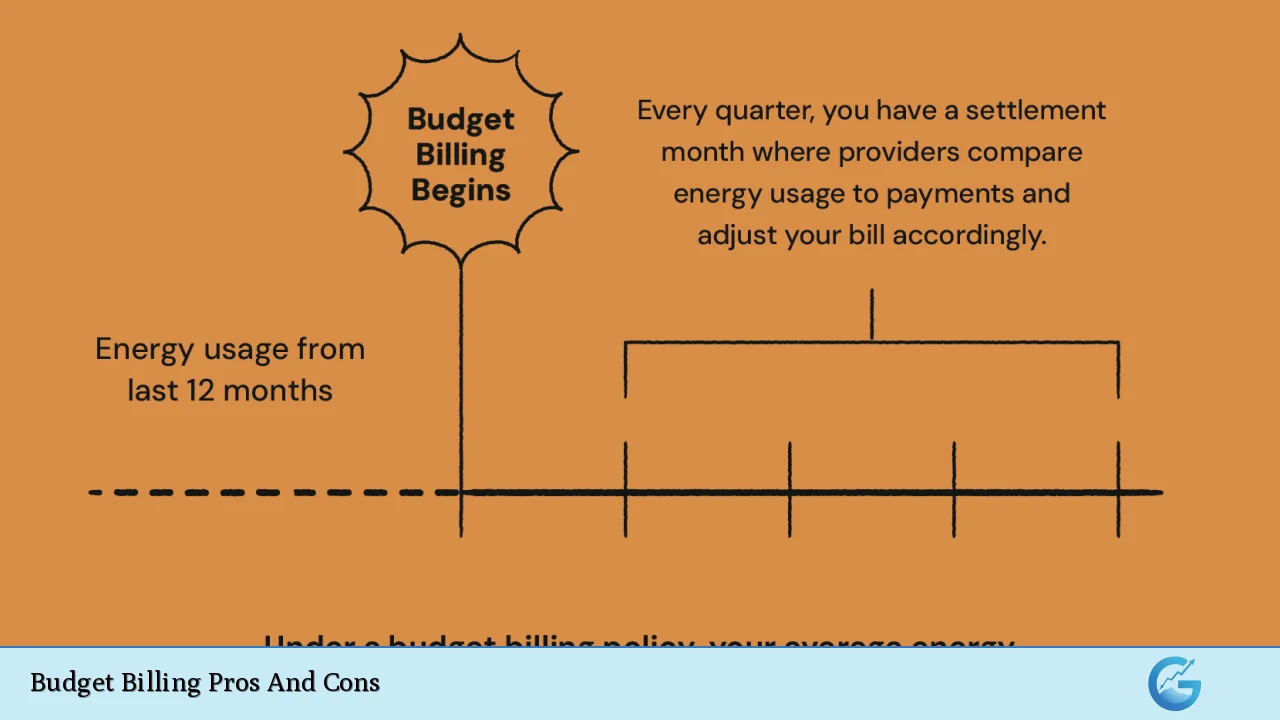

Budget billing is a payment plan offered by utility companies that allows customers to pay a fixed amount each month for their energy usage, rather than fluctuating bills based on actual consumption. This system aims to simplify budgeting for households and businesses by smoothing out the highs and lows of monthly utility costs, especially during seasons of extreme weather. However, while budget billing can provide predictability and ease financial planning, it also comes with its own set of challenges and potential drawbacks.

| Pros | Cons |

|---|---|

| Predictable monthly payments | No savings on overall utility costs |

| Reduced financial stress | Potential for increased energy consumption |

| Avoidance of seasonal spikes in bills | Year-end true-up can lead to large bills |

| Easier budgeting and financial planning | Possible additional fees or penalties |

| Helps avoid late payment penalties | Requires consistent monitoring of energy usage |

| Encourages regular payment habits | May not be suitable for all households or businesses |

Predictable Monthly Payments

One of the primary advantages of budget billing is the predictability it offers. Customers pay a fixed amount each month, which is calculated based on their average energy usage over a specified period, typically the previous year. This consistency helps individuals and families manage their finances more effectively, as they can anticipate their utility expenses without the stress of fluctuating bills.

- Fixed payments allow for easier financial planning.

- Avoids surprises during months with high energy use.

- Stabilizes cash flow, making it easier to allocate funds for other expenses.

Reduced Financial Stress

Budget billing can significantly alleviate the anxiety associated with variable utility bills. Knowing exactly how much will be owed each month helps customers avoid the worry of unexpected spikes in their bills, particularly during extreme weather conditions when energy consumption tends to rise.

- Less anxiety about potential high bills.

- Peace of mind knowing what to expect each month.

- Easier to manage household budgets without unexpected expenses.

Avoidance of Seasonal Spikes in Bills

In many regions, utility costs can skyrocket during peak seasons—hot summers or cold winters—when heating and cooling demands are at their highest. Budget billing spreads these costs evenly throughout the year, preventing customers from facing exorbitant bills during these months.

- Smooths out seasonal fluctuations, making budgeting easier.

- Helps manage cash flow during peak usage times.

- Prevents financial strain associated with high seasonal bills.

Easier Budgeting and Financial Planning

With a consistent monthly payment, individuals can treat their utility bill as a fixed expense in their budget. This makes it simpler to allocate funds each month and reduces the time spent strategizing how to pay variable bills.

- Simplifies monthly budgeting processes.

- Allows for better allocation of resources to other necessary expenses.

- Reduces time spent managing finances, allowing focus on other priorities.

Helps Avoid Late Payment Penalties

Since budget billing provides a clear monthly amount due, customers are less likely to forget or miscalculate their payments. This helps avoid late fees and potential service interruptions that can occur with variable billing systems.

- Minimizes the risk of late payments, which can incur additional fees.

- Encourages timely payments, fostering good financial habits.

- Provides stability in maintaining utility services without interruption.

Potential for Increased Energy Consumption

While budget billing offers many advantages, one significant drawback is that it may inadvertently encourage higher energy usage. When customers know they will pay the same amount regardless of how much energy they consume, they might be less inclined to conserve energy.

- Risk of complacency regarding energy efficiency.

- Higher overall costs if consumption increases significantly.

- Potential environmental impact due to increased energy use.

No Savings on Overall Utility Costs

It is important to note that budget billing does not reduce the total cost of utilities over time. Customers will still pay for all the energy they use; they are merely spreading those costs over a longer period. This means that while monthly payments may be more manageable, they do not equate to savings.

- No discount or reduced rates offered through budget billing plans.

- Total annual cost remains unchanged, regardless of payment structure.

- Customers may end up paying more if they do not monitor usage closely.

Year-End True-Up Can Lead to Large Bills

At the end of the budget period—often 12 months—utility companies conduct a “true-up” process where they compare what customers paid against their actual usage. If customers consumed more than anticipated, they may face a substantial bill at this time, which can strain finances unexpectedly.

- Potential for large year-end payments if usage exceeds estimates.

- Financial strain during true-up periods, especially if unprepared.

- Need for careful tracking of energy consumption throughout the year.

Possible Additional Fees or Penalties

Some utility companies may impose fees associated with budget billing programs. While many offer this service free of charge, others might charge administrative fees or penalties for missed payments, which could negate some benefits of predictable billing.

- Check for hidden fees before enrolling in budget billing plans.

- Understand potential penalties associated with missed payments or cancellations.

- Evaluate whether fees outweigh benefits, depending on individual circumstances.

Requires Consistent Monitoring of Energy Usage

To maximize the benefits of budget billing, customers must actively monitor their energy consumption. This involves being aware of changes in usage patterns and adjusting habits accordingly to avoid surprises at true-up time.

- Encourages proactive management of energy use.

- Requires discipline to maintain efficient habits throughout the year.

- May necessitate investment in energy-saving practices or technologies.

May Not Be Suitable for All Households or Businesses

Finally, while budget billing can be advantageous for many, it may not be suitable for everyone. Households with highly variable energy needs or those that frequently change occupancy may find that traditional billing methods better suit their circumstances.

- Consider individual usage patterns before enrolling in budget billing.

- Evaluate whether fixed payments align with lifestyle changes, such as moving or renovations.

- Consult with utility providers about alternative plans if necessary.

In conclusion, budget billing offers several compelling advantages for those seeking stability in their monthly utility expenses. Its predictability can significantly ease financial planning and reduce stress associated with fluctuating bills. However, it is essential to weigh these benefits against potential drawbacks such as increased consumption and possible year-end surprises. Understanding both sides will help consumers make informed decisions about whether this payment plan aligns with their financial goals and lifestyle needs.

Frequently Asked Questions About Budget Billing

- What is budget billing?

Budget billing is a payment plan that allows customers to pay a fixed monthly amount based on average energy usage instead of fluctuating bills. - Does budget billing save money?

No, while it provides predictable payments, it does not lower overall utility costs; you still pay for all your actual usage. - What happens at the end of the budget period?

A true-up occurs where your actual usage is compared against what you paid; you may owe additional money if you used more than estimated. - Are there any fees associated with budget billing?

Some utility companies may charge administrative or cancellation fees; it’s important to check before enrolling. - Can I change my mind after enrolling?

You can opt-out at any time; however, any outstanding balance will be added to your next bill. - Is budget billing right for everyone?

No, it may not suit households with highly variable needs or those who frequently move. - How is my monthly payment calculated?

Your payment is typically calculated based on your average usage over the past year divided into equal monthly installments. - Can I monitor my energy usage while on budget billing?

Yes, it’s advisable to keep track of your consumption regularly to avoid surprises during the true-up process.