Purchasing a HUD (U.S. Department of Housing and Urban Development) home can be an attractive option for many homebuyers, especially those looking for affordable housing solutions. HUD homes are properties that have been foreclosed on and are now owned by the government. They are typically sold at below-market prices, making them appealing to first-time buyers, investors, and those looking for a good deal. However, buying a HUD home comes with its own set of advantages and disadvantages that potential buyers should carefully consider. This article explores the pros and cons of buying HUD homes, providing a detailed analysis to help you make an informed decision.

| Pros | Cons |

|---|---|

| Lower purchase prices compared to market value | Sold “as-is,” potentially requiring significant repairs |

| Less competition from investors during initial bidding | Limited choice of real estate agents (must use HUD-approved brokers) |

| Possibility of closing cost assistance | Bidding process can be competitive and time-sensitive |

| Access to special financing options (e.g., FHA loans) | Potential for long-term vacancy issues affecting property condition |

| Opportunity to improve property value through renovations | Restrictions on purchasing multiple HUD homes within a certain timeframe |

Lower Purchase Prices Compared to Market Value

One of the most significant advantages of purchasing a HUD home is the potential for lower purchase prices.

- Affordability: HUD homes are often listed below their market value, making them an attractive option for first-time buyers or those with limited budgets.

- Investment Potential: Buying at a lower price allows for potential equity growth as property values increase over time.

- First-Time Homebuyer Programs: Many HUD homes qualify for special programs aimed at helping first-time homebuyers secure affordable housing.

Sold “As-Is,” Potentially Requiring Significant Repairs

While the lower purchase price is appealing, it is essential to understand that HUD homes are sold “as-is.”

- No Repairs by Seller: Buyers should be prepared to take on any necessary repairs or renovations after purchase, as HUD does not make any repairs before selling the property.

- Inspection Importance: Conducting a thorough inspection before bidding is crucial to identify any major issues that could lead to additional costs down the line.

- Cost Considerations: Buyers must factor in potential repair costs when determining their budget for purchasing a HUD home.

Less Competition from Investors During Initial Bidding

HUD homes typically offer less competition from real estate investors during the initial bidding period.

- Owner-Occupant Priority: For the first 30 days after a home is listed, only owner-occupants can submit bids. This gives personal buyers a better chance of securing the property without competing against cash offers from investors.

- Market Stability: This policy helps stabilize neighborhoods by encouraging homeownership rather than investment purchases.

Limited Choice of Real Estate Agents

A notable disadvantage of buying a HUD home is that buyers must work with HUD-approved brokers.

- Broker Limitations: This requirement limits your choice of real estate agents, which may affect your overall experience in navigating the purchasing process.

- Agent Expertise: It’s essential to find an experienced broker familiar with HUD properties to ensure you receive proper guidance throughout the transaction.

Possibility of Closing Cost Assistance

HUD often provides assistance with closing costs, which can significantly reduce out-of-pocket expenses for buyers.

- Negotiable Costs: Buyers can negotiate up to 3% of the purchase price in closing cost assistance during the bidding process, making it easier to afford additional expenses associated with buying a home.

- Financial Relief: This support can be particularly beneficial for first-time buyers who may struggle with upfront costs.

Bidding Process Can Be Competitive and Time-Sensitive

The process of purchasing a HUD home involves competitive bidding, which can be stressful for buyers.

- Time Constraints: The 30-day owner-occupant bidding window creates urgency, requiring buyers to act quickly and decisively.

- Market Research: Buyers need to conduct thorough research on comparable properties and market conditions to place competitive bids effectively.

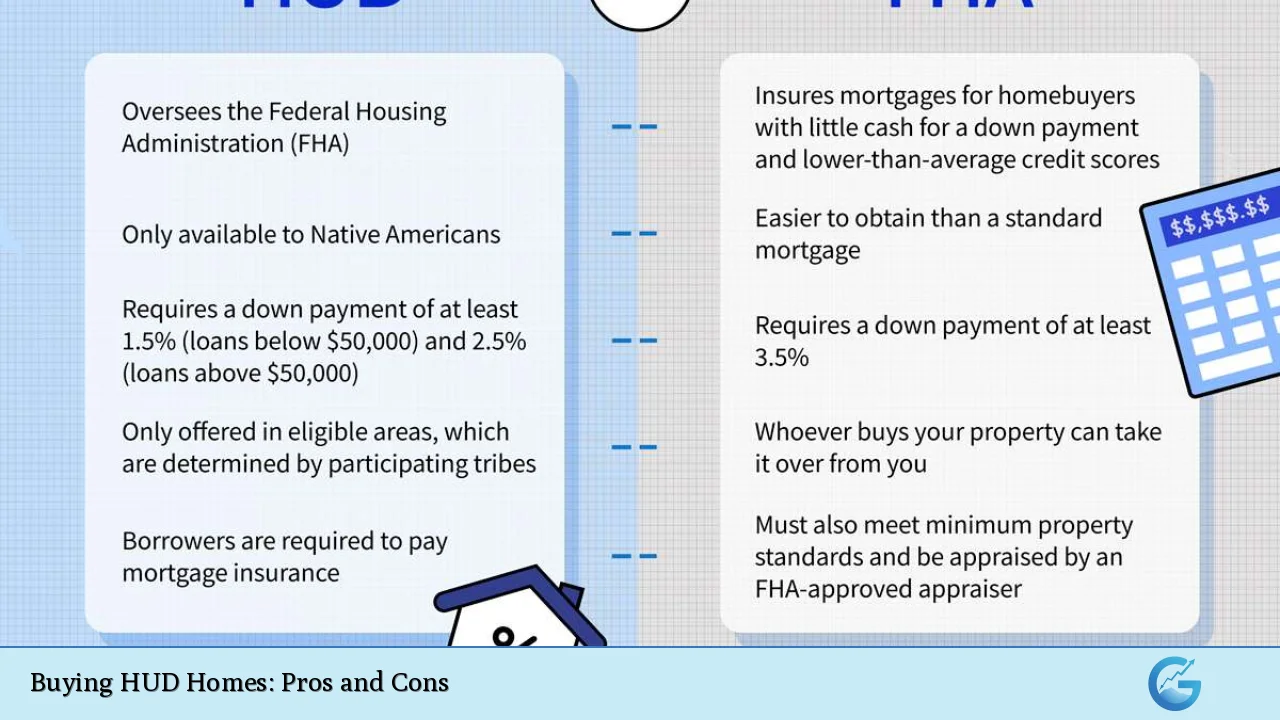

Access to Special Financing Options

HUD homes are eligible for various financing options that can make purchasing easier and more affordable.

- FHA Loans: Many buyers opt for FHA loans when purchasing HUD homes due to their lower down payment requirements and flexible credit score criteria.

- 203(k) Loan Program: This program allows buyers to finance both the purchase price and renovation costs into one mortgage, facilitating improvements on the property without needing separate funding sources.

Potential for Long-Term Vacancy Issues Affecting Property Condition

One downside of buying a HUD home is that many properties may have been vacant for extended periods before being sold.

- Deferred Maintenance: Properties that sit vacant may suffer from maintenance issues such as mold growth or plumbing problems that worsen over time.

- Inspection Necessity: A thorough inspection is critical not only before bidding but also after purchase to assess any ongoing issues that may need immediate attention.

Opportunity to Improve Property Value Through Renovations

Buying a HUD home often presents an opportunity for homeowners to increase their investment through renovations.

- Customization Potential: Buyers can tailor renovations to their preferences, creating a personalized living space while increasing property value simultaneously.

- Equity Building: Investing in improvements can lead to significant equity growth as the home’s value increases post-renovation.

Restrictions on Purchasing Multiple HUD Homes Within a Certain Timeframe

Lastly, there are restrictions regarding how often an individual can purchase HUD homes.

- Owner Occupancy Requirement: Owners must occupy their purchased HUD home for at least one year before being eligible to buy another one. This restriction limits investment opportunities for those looking to acquire multiple properties quickly.

In conclusion, buying a HUD home presents both advantages and disadvantages that potential buyers should carefully weigh. The opportunity for lower prices, reduced competition from investors, and access to special financing options makes these properties appealing. However, the “as-is” sale condition, potential repair costs, and limitations on real estate agent choices must also be considered.

Engaging in thorough research and working with knowledgeable professionals can help navigate these challenges effectively. Ultimately, understanding both sides will empower you as an informed buyer ready to take advantage of what HUD homes have to offer while being aware of the risks involved.

Frequently Asked Questions About Buying HUD Homes

- What is a HUD home?

A HUD home is a property owned by the U.S. Department of Housing and Urban Development after foreclosure on an FHA-insured mortgage. - Can anyone buy a HUD home?

Yes, anyone who qualifies for financing or has cash can purchase a HUD home; there are no income restrictions. - Are there any special financing options available?

Yes, many buyers use FHA loans or 203(k) loans specifically designed for purchasing and renovating HUD homes. - What does “as-is” mean in terms of buying a HUD home?

“As-is” means that the property will not be repaired or improved by the seller (HUD) prior to sale; buyers assume responsibility for any necessary repairs. - How long do I need to live in a HUD home before buying another?

You must live in your purchased HUD home for at least one year before being eligible to buy another one. - Can I get help with closing costs when buying a HUD home?

Yes, you may negotiate up to 3% of the purchase price in closing cost assistance during the bidding process. - Is there competition when bidding on HUD homes?

Yes, while owner-occupants have priority during the first 30 days, there can still be competition from other interested buyers. - What should I do before placing a bid on a HUD home?

You should conduct thorough research on comparable properties and have an inspection done if possible before submitting your bid.