The debate surrounding the cancellation of student debt has gained significant traction in recent years, particularly as the burden of student loans has reached staggering levels in the United States. With approximately 43 million borrowers collectively owing over $1.7 trillion, the implications of student debt cancellation extend beyond individual finances to encompass broader economic concerns. Advocates argue that forgiving student debt could stimulate the economy and alleviate financial stress for millions, while critics contend that it fails to address the root causes of rising education costs and may even exacerbate existing inequalities. This article explores the advantages and disadvantages of canceling student debt, providing a comprehensive overview for those interested in finance, economics, and policy.

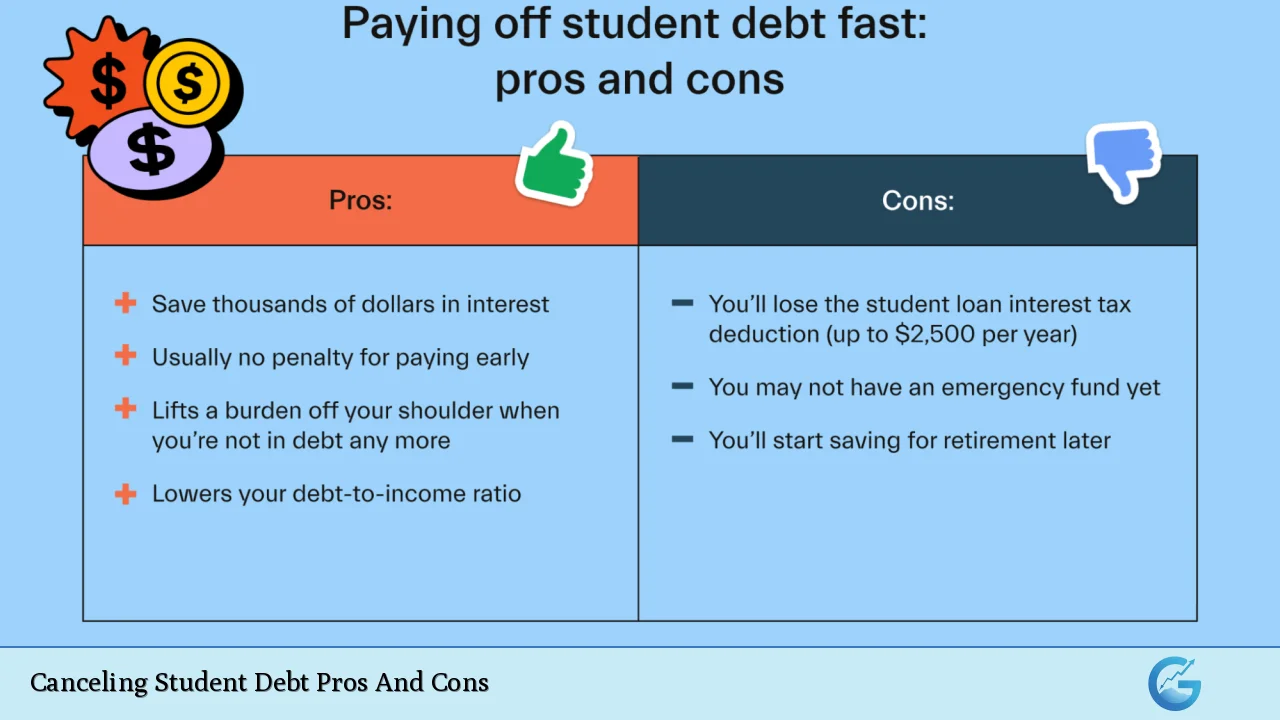

| Pros | Cons |

|---|---|

| Stimulates economic growth by increasing disposable income. | Does not address the underlying issue of high college tuition costs. |

| Reduces financial stress for millions of borrowers. | May lead to inflationary pressures on the economy. |

| Encourages home ownership and entrepreneurship. | Potentially regressive, benefiting higher-income individuals disproportionately. |

| Improves mental health and financial stability for borrowers. | Could create a moral hazard, encouraging future borrowing without accountability. |

| Reduces racial and socioeconomic disparities in education access. | Administrative challenges and costs associated with implementing forgiveness programs. |

Stimulates Economic Growth by Increasing Disposable Income

One of the most significant advantages of canceling student debt is its potential to stimulate economic growth. When borrowers are relieved of their loan obligations, they often redirect their funds toward essential expenses such as housing, healthcare, and consumer goods. This increased spending can lead to a ripple effect throughout the economy.

- Increased consumer spending: With more disposable income, borrowers are likely to spend on goods and services, which can boost local businesses and create jobs.

- Economic multiplier effect: The infusion of cash into the economy can lead to further economic activity, potentially adding billions to the GDP over time.

- Long-term growth potential: By alleviating debt burdens, individuals may invest in education or start businesses, contributing to sustained economic expansion.

Does Not Address the Underlying Issue of High College Tuition Costs

While canceling student debt may provide immediate relief for borrowers, it does not tackle the root cause of the crisis: soaring college tuition costs. Critics argue that without systemic changes in higher education funding and pricing structures, future generations will continue to face similar challenges.

- Temporary solution: Debt cancellation may be viewed as a “Band-Aid” approach that fails to provide a long-term solution to rising educational expenses.

- Increased college pricing power: If students believe future debts will be forgiven, colleges may feel less pressure to keep tuition costs manageable.

- Potential for more low-value degrees: Increased borrowing could lead students to pursue degrees that do not offer a strong return on investment.

Reduces Financial Stress for Millions of Borrowers

For many individuals burdened by student loans, cancellation can significantly reduce financial stress. This relief can enhance overall well-being and improve quality of life.

- Mental health benefits: The alleviation of debt can lead to improved mental health outcomes for borrowers who previously faced anxiety related to their financial obligations.

- Increased financial stability: With fewer monthly payments, borrowers may find it easier to manage their finances and save for future goals.

- Empowerment through education: Debt cancellation can empower individuals to pursue further education or career changes without fear of overwhelming debt.

May Lead to Inflationary Pressures on the Economy

One potential downside of widespread student debt cancellation is its impact on inflation. Economists warn that injecting significant amounts of money into the economy could exacerbate existing inflationary trends.

- Increased demand: As borrowers gain access to more disposable income, demand for goods and services may outpace supply, leading to higher prices.

- Federal Reserve response: To combat inflationary pressures, the Federal Reserve may need to raise interest rates, which could slow economic growth and increase borrowing costs for everyone.

- Short-term versus long-term effects: While initial spending may boost the economy, sustained inflation could undermine these benefits over time.

Encourages Home Ownership and Entrepreneurship

Another advantage of canceling student debt is its potential to facilitate home ownership and entrepreneurship. By reducing financial burdens, individuals may find it easier to make significant investments in their futures.

- Improved credit scores: Debt cancellation can enhance credit scores by lowering overall debt-to-income ratios, making it easier for borrowers to qualify for mortgages or business loans.

- Increased home ownership rates: With fewer financial obstacles, more individuals may pursue home ownership, contributing positively to housing markets.

- Entrepreneurial opportunities: Freed from significant monthly payments, individuals might be more inclined to start businesses or invest in innovative ventures.

Potentially Regressive, Benefiting Higher-Income Individuals Disproportionately

Critics argue that student debt cancellation could disproportionately benefit higher-income individuals who have attended prestigious institutions. This raises concerns about equity and fairness in public policy.

- Wealthier graduates benefit more: Those with larger debts often come from higher-income backgrounds or attended expensive universities; thus, they stand to gain significantly from cancellation policies.

- Inequitable distribution of benefits: Lower-income individuals who did not attend college or who have already paid off their loans may feel overlooked by such policies.

- Alternative solutions needed: Advocates suggest focusing on targeted relief measures that prioritize lower-income borrowers rather than blanket forgiveness programs.

Improves Mental Health and Financial Stability for Borrowers

The psychological impact of student debt cannot be understated. Canceling loans can lead to improved mental health outcomes and greater financial stability for many individuals.

- Reduction in anxiety: The burden of student loans often leads to chronic stress; cancellation can alleviate this pressure significantly.

- Better decision-making: With reduced financial stress, individuals are more likely to make informed decisions regarding investments in their future—be it further education or home purchases.

- Enhanced quality of life: Overall well-being improves when individuals are no longer weighed down by unmanageable debt levels.

Could Create a Moral Hazard

While relieving current borrowers is beneficial, there are concerns about creating a moral hazard where future students might take on excessive debt with the expectation that it will eventually be forgiven.

- Encouragement of irresponsible borrowing: If students believe that debts will be canceled regularly, they may take on larger loans than necessary without considering repayment implications.

- Pressure on educational institutions: Colleges might increase tuition rates knowing that students are willing to borrow more under the assumption that debts will not need repayment in full.

- Long-term sustainability issues: This cycle could perpetuate a system where educational costs continue rising unchecked due to perceived safety nets like loan forgiveness programs.

Administrative Challenges and Costs Associated with Implementing Forgiveness Programs

Implementing widespread student loan forgiveness presents logistical challenges that could complicate execution and incur significant administrative costs.

- Complexity of eligibility criteria: Determining who qualifies for forgiveness can be cumbersome and requires extensive verification processes that strain resources.

- Potential legal challenges: Past attempts at broad loan forgiveness have faced legal hurdles that could delay or derail implementation efforts altogether.

- Funding concerns: The cost associated with canceling substantial amounts of student debt must be carefully considered within broader fiscal policy frameworks; this includes potential impacts on taxpayers and government budgets.

In conclusion, while canceling student debt presents several compelling advantages—such as stimulating economic growth and reducing financial stress—it also poses significant challenges. These include failing to address underlying issues in higher education financing and potential inflationary impacts. As policymakers grapple with these complexities, it is crucial for stakeholders in finance and economics to weigh both sides carefully before advocating for sweeping changes in student loan policy.

Frequently Asked Questions About Canceling Student Debt

- What is student loan cancellation?

Student loan cancellation refers to forgiving some or all federal student loan debts owed by borrowers. - Who would benefit from canceling student debt?

Approximately 43 million Americans with federal student loans would benefit from some level of forgiveness. - What are the economic implications of canceling student debt?

Cancelling debt could stimulate economic growth by increasing consumer spending but may also lead to inflationary pressures. - How does student debt cancellation affect racial disparities?

Debt cancellation could help reduce racial disparities by alleviating burdens disproportionately affecting minority communities. - What are alternative solutions besides blanket forgiveness?

Targeted relief measures focusing on low-income borrowers or reforms aimed at reducing college tuition costs are potential alternatives. - Will canceling student debt affect my credit score?

Cancelling student loans generally improves credit scores by reducing overall debt levels. - Is there a risk of moral hazard with loan forgiveness?

The expectation of future cancellations could encourage irresponsible borrowing among students. - What administrative challenges exist with implementing forgiveness?

The complexity of determining eligibility and verifying borrower information poses significant administrative hurdles.