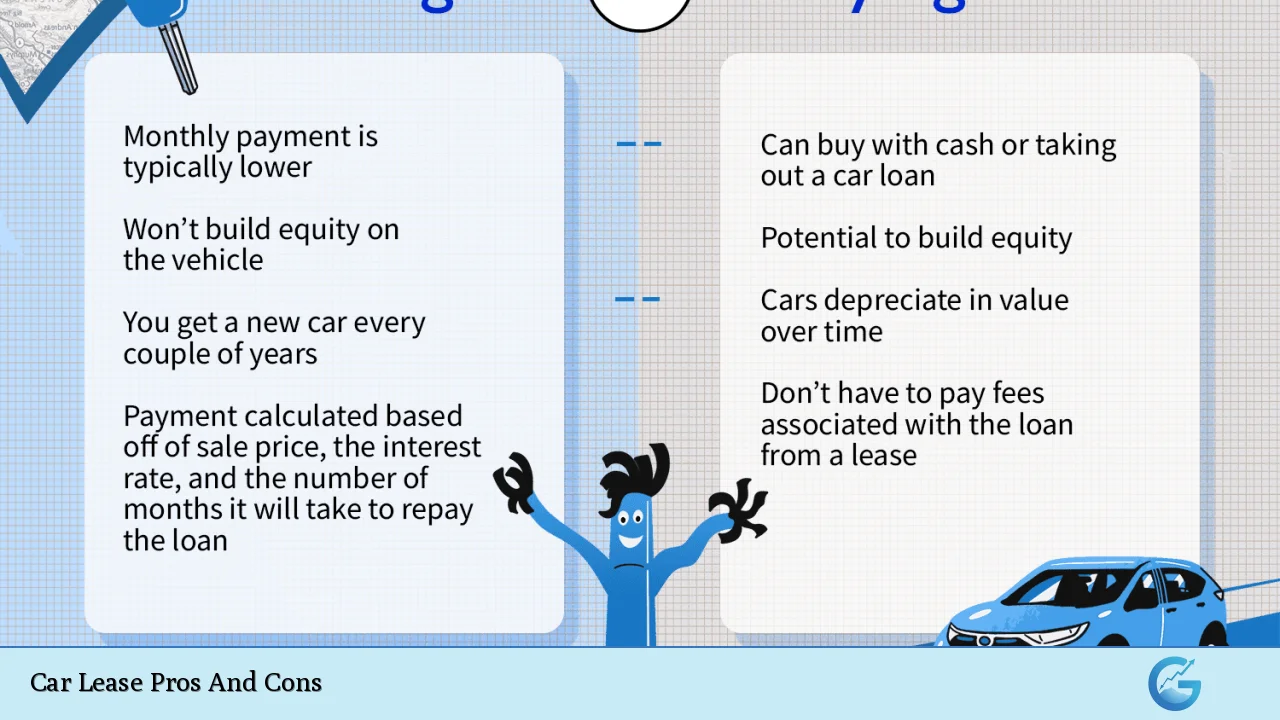

Leasing a car has become an increasingly popular alternative to purchasing a vehicle outright. This financing option allows individuals to drive new vehicles with potentially lower monthly payments compared to traditional auto loans. However, like any financial decision, car leasing comes with its own set of advantages and disadvantages that need to be carefully considered.

| Pros | Cons |

|---|---|

| Lower monthly payments | No ownership equity |

| Drive newer vehicles more frequently | Mileage restrictions |

| Reduced maintenance costs | Potential fees for excess wear and tear |

| Lower upfront costs | Long-term cost may be higher |

| Potential tax benefits for businesses | Early termination penalties |

| Warranty coverage for lease duration | Customization limitations |

| Simplified end-of-term process | Continuous monthly payments |

| Opportunity to drive luxury vehicles | Credit score impact |

Lower Monthly Payments

One of the most attractive aspects of leasing a car is the potential for lower monthly payments compared to purchasing a vehicle with an auto loan.

This is because lease payments are based on the vehicle’s depreciation during the lease term rather than its full purchase price. For investors and finance-savvy individuals, this can free up capital for other investment opportunities or financial goals.

- Payments typically 20-30% lower than loan payments for the same vehicle

- Allows for better cash flow management

- Opportunity to allocate funds to potentially higher-yielding investments

Drive Newer Vehicles More Frequently

Leasing provides the opportunity to drive a new car every few years, typically every 24 to 48 months. This aspect is particularly appealing to those who enjoy having access to the latest automotive technology and safety features.

- Regular access to new models with updated features

- Reduced risk of major mechanical issues associated with older vehicles

- Ability to adapt vehicle choice to changing lifestyle needs

Reduced Maintenance Costs

Most leased vehicles are covered by the manufacturer’s warranty for the duration of the lease term, potentially resulting in significant savings on maintenance and repair costs.

This can be especially beneficial for those who prioritize predictable monthly expenses and want to avoid unexpected repair bills.

- Warranty coverage typically includes routine maintenance

- Lower risk of costly out-of-warranty repairs

- Simplified budgeting for vehicle-related expenses

Lower Upfront Costs

Leasing often requires a lower initial outlay compared to purchasing a vehicle. This can be advantageous for individuals looking to conserve cash or invest in other financial instruments.

- Down payments are often lower or sometimes not required

- Reduced initial cash commitment

- Opportunity to redirect upfront savings to other investments

Potential Tax Benefits for Businesses

For entrepreneurs and business owners, leasing a vehicle can offer tax advantages. The IRS allows businesses to deduct lease payments as operating expenses, which can lead to significant tax savings.

- Lease payments may be fully deductible as business expenses

- Simplified record-keeping for tax purposes

- Potential for accelerated depreciation benefits

Warranty Coverage for Lease Duration

Most leased vehicles come with comprehensive warranty coverage that lasts for the entire lease term. This provides peace of mind and protection against unexpected repair costs.

- Full manufacturer’s warranty typically included

- Reduced risk of costly repairs

- Predictable vehicle operating costs

Simplified End-of-Term Process

At the end of a lease, the process of returning the vehicle is generally straightforward. This eliminates the hassle of selling or trading in a vehicle, which can be time-consuming and potentially costly.

- No need to negotiate trade-in values or find a buyer

- Avoid depreciation risks associated with ownership

- Seamless transition to a new vehicle

Opportunity to Drive Luxury Vehicles

Leasing can make luxury vehicles more accessible, allowing individuals to drive high-end cars that might be out of reach if purchased outright.

- Access to premium brands at lower monthly costs

- Experience latest luxury features and technologies

- Potential image benefits for business professionals

Disadvantages of Car Leasing

No Ownership Equity

Perhaps the most significant drawback of leasing is that you don’t build any equity in the vehicle.

At the end of the lease term, you have no asset to show for your payments, unlike when you purchase a vehicle.

- Payments do not contribute to vehicle ownership

- No trade-in value at the end of the lease

- Potential opportunity cost compared to building equity through ownership

Mileage Restrictions

Lease agreements typically come with annual mileage limits, usually ranging from 10,000 to 15,000 miles per year. Exceeding these limits can result in substantial fees.

- Overage charges can be expensive (often $0.10 to $0.25 per mile)

- May restrict travel flexibility

- Potential for unexpected costs at lease-end

Potential Fees for Excess Wear and Tear

Lessees are responsible for returning the vehicle in good condition, adhering to the lessor’s standards of “normal wear and tear.” Excessive damage or wear can lead to additional charges at the end of the lease.

- Subjective assessment of vehicle condition

- Potential for unexpected fees at lease-end

- May require more careful vehicle maintenance and use

Long-Term Cost May Be Higher

While monthly payments are often lower, leasing can be more expensive in the long run compared to buying and keeping a vehicle for an extended period.

- Continuous payments without building equity

- No potential for a payment-free period after loan payoff

- Cumulative cost of multiple leases may exceed long-term ownership costs

Early Termination Penalties

Ending a lease before the agreed-upon term can result in significant financial penalties.

This lack of flexibility can be problematic if your financial situation or vehicle needs change unexpectedly.

- Early termination fees can be substantial

- Reduced financial flexibility

- Potential for being “locked in” to payments

Customization Limitations

Lease agreements often restrict vehicle modifications, which can be frustrating for those who enjoy personalizing their vehicles.

- Aftermarket modifications may violate lease terms

- Limited ability to adapt the vehicle to specific needs

- Potential charges for returning a modified vehicle

Continuous Monthly Payments

Unlike buying a car, where payments eventually stop once the loan is paid off, leasing means you’ll always have a car payment as long as you continue to lease.

- No opportunity for payment-free vehicle use

- Ongoing impact on monthly budget

- Potential opportunity cost of continuous payments

Credit Score Impact

Leasing a vehicle typically requires a good to excellent credit score. Additionally, the lease itself can impact your credit utilization ratio and overall credit profile.

- May be difficult to qualify with lower credit scores

- Potential for negative credit impact if payments are missed

- Lease obligations factor into debt-to-income ratios for future credit applications

In conclusion, car leasing offers a unique set of advantages and disadvantages that must be carefully weighed against an individual’s financial goals, lifestyle needs, and personal preferences. For those prioritizing lower monthly payments, access to newer vehicles, and simplified maintenance, leasing can be an attractive option. However, individuals seeking long-term cost efficiency, vehicle ownership, and the flexibility to modify their vehicles may find purchasing a more suitable choice.

It’s crucial for potential lessees to thoroughly review lease terms, understand their driving habits, and consider their long-term financial objectives before committing to a lease agreement.

As with any significant financial decision, consulting with a financial advisor or automotive finance specialist can provide valuable insights tailored to your specific situation.

Frequently Asked Questions About Car Lease Pros And Cons

- Is leasing a car cheaper than buying?

Leasing often has lower monthly payments than buying, but it may be more expensive long-term. The total cost depends on factors like lease duration, mileage, and vehicle depreciation. - Can you negotiate a car lease?

Yes, many aspects of a car lease are negotiable. This includes the capitalized cost (vehicle price), money factor (interest rate), and sometimes even mileage allowances. - What happens if I exceed the mileage limit on my lease?

If you exceed the mileage limit, you’ll be charged an overage fee per mile. These fees typically range from $0.10 to $0.25 per mile and can add up quickly. - Is it possible to purchase the car at the end of the lease?

Most lease agreements include a purchase option at the end of the term. The purchase price is typically the residual value stated in your lease contract plus any applicable fees. - How does leasing affect my credit score?

Leasing can affect your credit similar to an auto loan. Timely payments can positively impact your score, while missed payments can have a negative effect. - Are maintenance costs included in a car lease?

Basic maintenance is often covered under the vehicle’s warranty during the lease term. However, you’re typically responsible for routine maintenance like oil changes and tire rotations. - Can I terminate my car lease early?

Early termination is possible but often comes with significant penalties. Options may include paying a lump sum, transferring the lease, or trading in the vehicle. - How does leasing compare to subscription services?

Car subscriptions often offer more flexibility than traditional leases, with shorter terms and the ability to switch vehicles. However, they typically come at a premium price compared to standard leases.